ANNUAL REPORT 2009 - GAM Holding AG

ANNUAL REPORT 2009 - GAM Holding AG

ANNUAL REPORT 2009 - GAM Holding AG

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

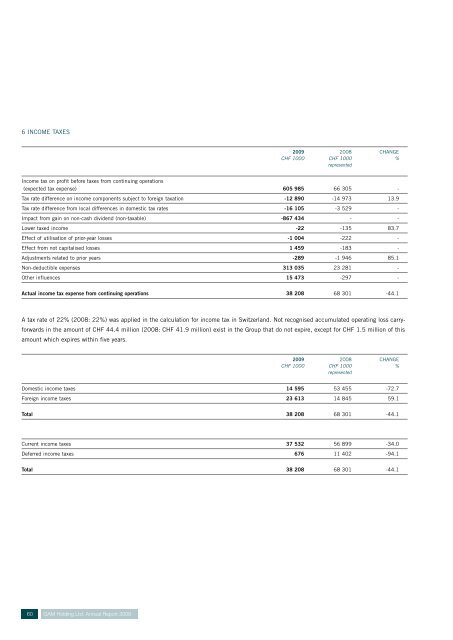

6 INCOME TAXES<br />

<strong>2009</strong> 2008 CHANGE<br />

CHF 1000 CHF 1000 %<br />

represented<br />

Income tax on profit before taxes from continuing operations<br />

(expected tax expense) 605 985 66 305 -<br />

Tax rate difference on income components subject to foreign taxation -12 890 -14 973 13.9<br />

Tax rate difference from local differences in domestic tax rates -16 105 -3 529 -<br />

Impact from gain on non-cash dividend (non-taxable) -867 434 - -<br />

Lower taxed income -22 -135 83.7<br />

Effect of utilisation of prior-year losses -1 004 -222 -<br />

Effect from not capitalised losses 1 459 -183 -<br />

Adjustments related to prior years -289 -1 946 85.1<br />

Non-deductible expenses 313 035 23 281 -<br />

Other influences 15 473 -297 -<br />

Actual income tax expense from continuing operations 38 208 68 301 -44.1<br />

A tax rate of 22% (2008: 22%) was applied in the calculation for income tax in Switzerland. Not recognised accumulated operating loss carryforwards<br />

in the amount of CHF 44.4 million (2008: CHF 41.9 million) exist in the Group that do not expire, except for CHF 1.5 million of this<br />

amount which expires within five years.<br />

<strong>2009</strong> 2008 CHANGE<br />

CHF 1000 CHF 1000 %<br />

represented<br />

Domestic income taxes 14 595 53 455 -72.7<br />

Foreign income taxes 23 613 14 845 59.1<br />

Total 38 208 68 301 -44.1<br />

Current income taxes 37 532 56 899 -34.0<br />

Deferred income taxes 676 11 402 -94.1<br />

Total 38 208 68 301 -44.1<br />

60 <strong>GAM</strong> <strong>Holding</strong> Ltd. Annual Report <strong>2009</strong>