ANNUAL REPORT 2009 - GAM Holding AG

ANNUAL REPORT 2009 - GAM Holding AG

ANNUAL REPORT 2009 - GAM Holding AG

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Distribution of dividend<br />

In <strong>2009</strong> an ordinary dividend of CHF 103 315 378 has been paid (dividend per share: CHF 0.50). For <strong>2009</strong> no dividend has been proposed.<br />

Distribution of a special dividend<br />

At the Extraordinary General Meeting on 30 June <strong>2009</strong>, it was decided to distribute to the shareholders as follows:<br />

(a) a dividend-in-kind consisting of one registered share of Julius Baer Group Ltd. with a nominal value of CHF 0.02 per registered share of<br />

Julius Baer <strong>Holding</strong> Ltd. entitled to receive a dividend (in total 206 630 756 registered shares of Julius Baer Group Ltd.); plus<br />

(b) a cash dividend in the amount of CHF 0.01076923 per registered share of Julius Baer <strong>Holding</strong> Ltd. entitled to receive a dividend (in total<br />

CHF 2 225 254), which will not be paid to the shareholders, but will be remitted to the Swiss tax authorities by Julius Baer <strong>Holding</strong> Ltd. in<br />

order to satisfy the liability for Swiss withholding tax.<br />

At the Extraordinary General Meeting on 30 June <strong>2009</strong>, a decision was taken that the legal reserves of <strong>GAM</strong> <strong>Holding</strong> Ltd. (formerly Julius Baer<br />

<strong>Holding</strong> Ltd.) be converted in an amount of CHF 4 847 232 563 into free reserves and that therefore the account “general legal reserves”<br />

(capital reserves) be reduced by CHF 4 847 232 563 and the new account “further other reserves” (retained earnings) be credited with the<br />

same amount of CHF 4 847 232 563.<br />

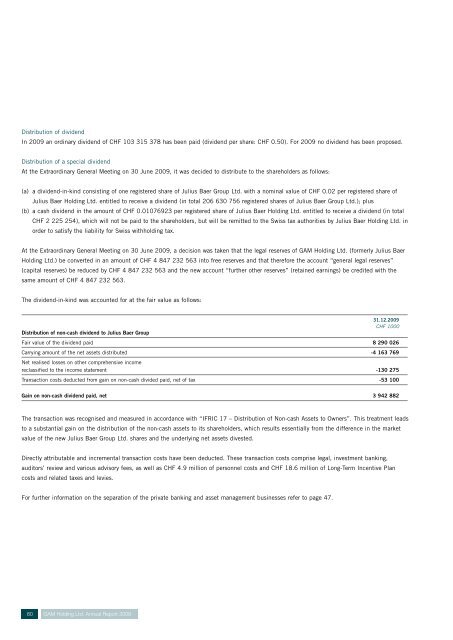

The dividend-in-kind was accounted for at the fair value as follows:<br />

Distribution of non-cash dividend to Julius Baer Group<br />

31.12.<strong>2009</strong><br />

CHF 1000<br />

Fair value of the dividend paid 8 290 026<br />

Carrying amount of the net assets distributed -4 163 769<br />

Net realised losses on other comprehensive income<br />

reclassified to the income statement -130 275<br />

Transaction costs deducted from gain on non-cash divided paid, net of tax -53 100<br />

Gain on non-cash dividend paid, net 3 942 882<br />

The transaction was recognised and measured in accordance with “IFRIC 17 – Distribution of Non-cash Assets to Owners”. This treatment leads<br />

to a substantial gain on the distribution of the non-cash assets to its shareholders, which results essentially from the difference in the market<br />

value of the new Julius Baer Group Ltd. shares and the underlying net assets divested.<br />

Directly attributable and incremental transaction costs have been deducted. These transaction costs comprise legal, investment banking,<br />

auditors’ review and various advisory fees, as well as CHF 4.9 million of personnel costs and CHF 18.6 million of Long-Term Incentive Plan<br />

costs and related taxes and levies.<br />

For further information on the separation of the private banking and asset management businesses refer to page 47.<br />

80 <strong>GAM</strong> <strong>Holding</strong> Ltd. Annual Report <strong>2009</strong>