ABUSE OF STRUCTURED FINANCIAL PRODUCTS- Misusing Basket Options to Avoid Taxes and Leverage Limits MAJORITY AND MINORITY STAFF REPORT

ABUSE OF STRUCTURED FINANCIAL PRODUCTS- Misusing Basket Options to Avoid Taxes and Leverage Limits MAJORITY AND MINORITY STAFF REPORT

ABUSE OF STRUCTURED FINANCIAL PRODUCTS- Misusing Basket Options to Avoid Taxes and Leverage Limits MAJORITY AND MINORITY STAFF REPORT

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

59<br />

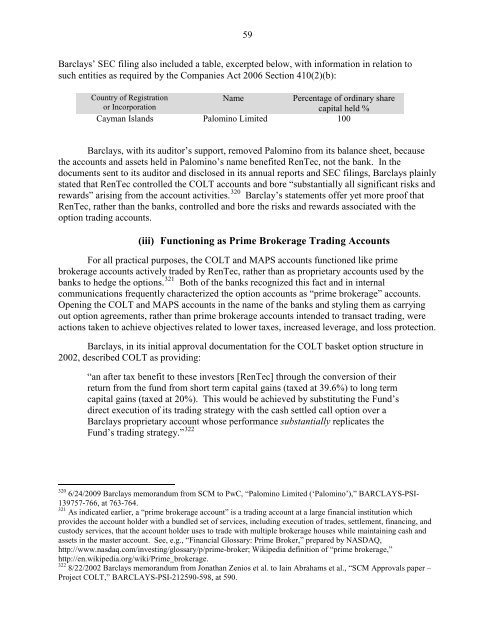

Barclays’ SEC filing also included a table, excerpted below, with information in relation <strong>to</strong><br />

such entities as required by the Companies Act 2006 Section 410(2)(b):<br />

Country of Registration<br />

Name<br />

Percentage of ordinary share<br />

or Incorporation<br />

capital held %<br />

Cayman Isl<strong>and</strong>s Palomino Limited 100<br />

Barclays, with its audi<strong>to</strong>r’s support, removed Palomino from its balance sheet, because<br />

the accounts <strong>and</strong> assets held in Palomino’s name benefited RenTec, not the bank. In the<br />

documents sent <strong>to</strong> its audi<strong>to</strong>r <strong>and</strong> disclosed in its annual reports <strong>and</strong> SEC filings, Barclays plainly<br />

stated that RenTec controlled the COLT accounts <strong>and</strong> bore “substantially all significant risks <strong>and</strong><br />

rewards” arising from the account activities. 320 Barclay’s statements offer yet more proof that<br />

RenTec, rather than the banks, controlled <strong>and</strong> bore the risks <strong>and</strong> rewards associated with the<br />

option trading accounts.<br />

(iii) Functioning as Prime Brokerage Trading Accounts<br />

For all practical purposes, the COLT <strong>and</strong> MAPS accounts functioned like prime<br />

brokerage accounts actively traded by RenTec, rather than as proprietary accounts used by the<br />

banks <strong>to</strong> hedge the options. 321 Both of the banks recognized this fact <strong>and</strong> in internal<br />

communications frequently characterized the option accounts as “prime brokerage” accounts.<br />

Opening the COLT <strong>and</strong> MAPS accounts in the name of the banks <strong>and</strong> styling them as carrying<br />

out option agreements, rather than prime brokerage accounts intended <strong>to</strong> transact trading, were<br />

actions taken <strong>to</strong> achieve objectives related <strong>to</strong> lower taxes, increased leverage, <strong>and</strong> loss protection.<br />

Barclays, in its initial approval documentation for the COLT basket option structure in<br />

2002, described COLT as providing:<br />

“an after tax benefit <strong>to</strong> these inves<strong>to</strong>rs [RenTec] through the conversion of their<br />

return from the fund from short term capital gains (taxed at 39.6%) <strong>to</strong> long term<br />

capital gains (taxed at 20%). This would be achieved by substituting the Fund’s<br />

direct execution of its trading strategy with the cash settled call option over a<br />

Barclays proprietary account whose performance substantially replicates the<br />

Fund’s trading strategy.” 322<br />

320 6/24/2009 Barclays memor<strong>and</strong>um from SCM <strong>to</strong> PwC, “Palomino Limited (‘Palomino’),” BARCLAYS-PSI-<br />

139757-766, at 763-764.<br />

321 As indicated earlier, a “prime brokerage account” is a trading account at a large financial institution which<br />

provides the account holder with a bundled set of services, including execution of trades, settlement, financing, <strong>and</strong><br />

cus<strong>to</strong>dy services, that the account holder uses <strong>to</strong> trade with multiple brokerage houses while maintaining cash <strong>and</strong><br />

assets in the master account. See, e.g., “Financial Glossary: Prime Broker,” prepared by NASDAQ,<br />

http://www.nasdaq.com/investing/glossary/p/prime-broker; Wikipedia definition of “prime brokerage,”<br />

http://en.wikipedia.org/wiki/Prime_brokerage.<br />

322 8/22/2002 Barclays memor<strong>and</strong>um from Jonathan Zenios et al. <strong>to</strong> Iain Abrahams et al., “SCM Approvals paper –<br />

Project COLT,” BARCLAYS-PSI-212590-598, at 590.