State Bank of India, Bangladesh Operations - Credit Rating Agency ...

State Bank of India, Bangladesh Operations - Credit Rating Agency ...

State Bank of India, Bangladesh Operations - Credit Rating Agency ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

CRAB <strong>Rating</strong>s<br />

<strong>Bank</strong>s<br />

<strong>Rating</strong> Report [SURVEILLANCE]<br />

<strong>State</strong> <strong>Bank</strong> <strong>of</strong> <strong>India</strong>, <strong>Bangladesh</strong> <strong>Operations</strong><br />

<strong>Rating</strong> Outstanding (26 November 2008)<br />

Long Term : AA 3<br />

Short Term<br />

: ST-1<br />

Validity : 30 June 2009<br />

Previous <strong>Rating</strong> (30 June 2007)<br />

Long Term : AA 1<br />

Short Term<br />

: ST-1<br />

Analyst:<br />

Nur Elahee Molla<br />

7,000<br />

6,000<br />

5,000<br />

4,000<br />

3,000<br />

2,000<br />

1,000<br />

-<br />

Financial Analyst<br />

nur_elahee@crab.com.bd<br />

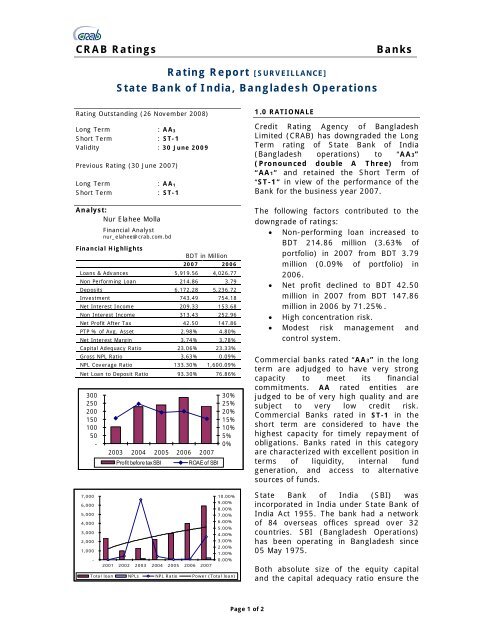

Financial Highlights<br />

BDT in Million<br />

2007 2006<br />

Loans & Advances 5,919.56 4,026.77<br />

Non Performing Loan 214.86 3.79<br />

Deposits 6,172.28 5,236.72<br />

Investment 743.49 754.18<br />

Net Interest Income 209.33 153.68<br />

Non Interest Income 313.43 252.96<br />

Net Pr<strong>of</strong>it After Tax 42.50 147.86<br />

PTP % <strong>of</strong> Avg. Asset 2.98% 4.80%<br />

Net Interest Margin 3.74% 3.78%<br />

Capital Adequacy Ratio 23.06% 23.33%<br />

Gross NPL Ratio 3.63% 0.09%<br />

NPL Coverage Ratio 133.30% 1,600.09%<br />

Net Loan to Deposit Ratio 93.30% 76.86%<br />

300<br />

250<br />

200<br />

150<br />

100<br />

50<br />

-<br />

2003 2004 2005 2006 2007<br />

Pr<strong>of</strong>it before tax SBI<br />

ROAE <strong>of</strong> SBI<br />

2001 2002 2003 2004 2005 2006 2007<br />

30%<br />

25%<br />

20%<br />

15%<br />

10%<br />

5%<br />

0%<br />

10.00%<br />

9.00%<br />

8.00%<br />

7.00%<br />

6.00%<br />

5.00%<br />

4.00%<br />

3.00%<br />

2.00%<br />

1.00%<br />

0.00%<br />

Total loan NPLs NPL Ratio Power (Total loan)<br />

1.0 RATIONALE<br />

<strong>Credit</strong> <strong>Rating</strong> <strong>Agency</strong> <strong>of</strong> <strong>Bangladesh</strong><br />

Limited (CRAB) has downgraded the Long<br />

Term rating <strong>of</strong> <strong>State</strong> <strong>Bank</strong> <strong>of</strong> <strong>India</strong><br />

(<strong>Bangladesh</strong> operations) to “AA3”<br />

(Pronounced double A Three) from<br />

“AA1” and retained the Short Term <strong>of</strong><br />

“ST-1” in view <strong>of</strong> the performance <strong>of</strong> the<br />

<strong>Bank</strong> for the business year 2007.<br />

The following factors contributed to the<br />

downgrade <strong>of</strong> ratings:<br />

Non-performing loan increased to<br />

BDT 214.86 million (3.63% <strong>of</strong><br />

portfolio) in 2007 from BDT 3.79<br />

million (0.09% <strong>of</strong> portfolio) in<br />

2006.<br />

Net pr<strong>of</strong>it declined to BDT 42.50<br />

million in 2007 from BDT 147.86<br />

million in 2006 by 71.25%.<br />

High concentration risk.<br />

Modest risk management and<br />

control system.<br />

Commercial banks rated “AA3” in the long<br />

term are adjudged to have very strong<br />

capacity to meet its financial<br />

commitments. AA rated entities are<br />

judged to be <strong>of</strong> very high quality and are<br />

subject to very low credit risk.<br />

Commercial <strong>Bank</strong>s rated in ST-1 in the<br />

short term are considered to have the<br />

highest capacity for timely repayment <strong>of</strong><br />

obligations. <strong>Bank</strong>s rated in this category<br />

are characterized with excellent position in<br />

terms <strong>of</strong> liquidity, internal fund<br />

generation, and access to alternative<br />

sources <strong>of</strong> funds.<br />

<strong>State</strong> <strong>Bank</strong> <strong>of</strong> <strong>India</strong> (SBI) was<br />

incorporated in <strong>India</strong> under <strong>State</strong> <strong>Bank</strong> <strong>of</strong><br />

<strong>India</strong> Act 1955. The bank had a network<br />

<strong>of</strong> 84 overseas <strong>of</strong>fices spread over 32<br />

countries. SBI (<strong>Bangladesh</strong> <strong>Operations</strong>)<br />

has been operating in <strong>Bangladesh</strong> since<br />

05 May 1975.<br />

Both absolute size <strong>of</strong> the equity capital<br />

and the capital adequacy ratio ensure the<br />

Page 1 <strong>of</strong> 2

CRAB <strong>Rating</strong>s<br />

<strong>Bank</strong>s<br />

solid position <strong>of</strong> the <strong>Bank</strong>. The capital <strong>of</strong> the <strong>Bank</strong> in <strong>Bangladesh</strong> stood at BDT<br />

1,468.49 million as on 31 December 2007 against regulatory requirement <strong>of</strong> BDT<br />

2,000.0 million (to be attained by June 2009). It is observed that a sum <strong>of</strong> BDT<br />

487.65 million equivalent US$ 7.20 million has already been received by the <strong>Bank</strong><br />

from the head <strong>of</strong>fice after the balance sheet date (February 2008). As on December<br />

2007 total regulatory capital stood at BDT 1,659.89 million registering a Capital<br />

Adequacy Ratio <strong>of</strong> 23.06% (23.33%in2006).<br />

The deposit <strong>of</strong> SBI stood at BDT 6,172.28 million in 2007, which was BDT 5,236.72<br />

million in 2006, registering a growth rate <strong>of</strong> 17.87%. The growth rate <strong>of</strong> deposit<br />

mobilization in 2007 was the lowest among the last five years due to 22% reduction<br />

<strong>of</strong> deposit base in Dhaka Branch arising from non-renewal <strong>of</strong> a few corporate groups.<br />

However the deposit base was low compared to other FCBs. Although the dependency<br />

in fixed deposit (including term deposit) declined from 84.48% in 2006 to 73.09% in<br />

2007, it is still very high compared to the peer group (55.60%). 71.91% <strong>of</strong> total<br />

deposit will be matured by next twelve months and 28.10% will be matured beyond 1<br />

year but within 5 years. Liquidity position in terms <strong>of</strong> liquid asset ratio i.e.; 40.13% <strong>of</strong><br />

deposit and borrowing is reasonably satisfactory.<br />

Total loans and advances <strong>of</strong> SBI stood at BDT 5,919.56 million in 2007 which was<br />

BDT 4,026.77 million in 2006 registering a growth rate <strong>of</strong> 47% and deposit lent out<br />

ratio <strong>of</strong> 93%. However total loan portfolio <strong>of</strong> the <strong>Bank</strong> to that <strong>of</strong> peer average<br />

remained stable at around 27.50% over the last two years. 54.85% <strong>of</strong> funded<br />

portfolio was involved in short term credit (up to 1 year) in 2007, registering an<br />

average rate <strong>of</strong> 58.64% over the five-year period ended 2007 having standard<br />

deviation <strong>of</strong> 16%. The <strong>Bank</strong> had 21 accounts having more than BDT 10.0 million<br />

outstanding loans and advances amounted to BDT 3,538.32 million, which reveals the<br />

high concentration risk. Total Non-performing loan <strong>of</strong> the <strong>Bank</strong> increased from BDT<br />

3.49 million in 2006 to BDT 214.86 million in 2007 where BDT 128.99 million (60%)<br />

was bad loan. Therefore gross NPL as percentage <strong>of</strong> gross loans largely increased<br />

from 0.09% in 2006 to 3.63% in 2007. Only 10 accounts comprised total NPL <strong>of</strong> BDT<br />

214.86 million, while one obligor accounted for 56.79% <strong>of</strong> total NPL.<br />

Total income form core earning sources (net interest income) stood at BDT 209.33<br />

million in 2007 which was BDT 153.68 million in 2006 registering a growth rate <strong>of</strong><br />

36.21%. However the income from non interest income is still dominating (60% <strong>of</strong><br />

the total operating income) the earning sources due to 50% contribution <strong>of</strong> fees<br />

income. However its Pre-tax pr<strong>of</strong>it (PTP) declined from BDT 284.63 million in 2006 to<br />

BDT 233.42 million in 2007 by 28% and net pr<strong>of</strong>it significantly declined from BDT<br />

147.86 million in 2006 to BDT 42.50 million in 2007 by 71.25% due to deterioration<br />

in asset quality. Therefore PTP as percent <strong>of</strong> average asset and Net pr<strong>of</strong>it as percent<br />

<strong>of</strong> average asset declined from 4.81% and 2.50% in 2006 to 2.98% and 0.54% in<br />

2007 respectively.<br />

The rating also takes into account the reporting system along with policy guidelines<br />

for different banking activities. The bank is yet to comply with the establishment <strong>of</strong><br />

Internal Control and Compliance Division separating in Audit, Inspection and<br />

Monitoring units. The <strong>Bank</strong> uses ‘<strong>Credit</strong> Risk Assessment’ technique along with CRG<br />

model laid down by <strong>Bangladesh</strong> <strong>Bank</strong> to ensure sound credit culture. However the<br />

<strong>Credit</strong> Department is yet to bring separation in <strong>Credit</strong> Appraisal, <strong>Credit</strong> Monitoring<br />

and Recovery units as well as to establish job allocation among RM and CRM to<br />

address the default risk. The rating also takes into consideration the small size <strong>of</strong><br />

operations <strong>of</strong> the <strong>Bank</strong> with 4 Branches.<br />

Page 2 <strong>of</strong> 2