English edition - Pandox

English edition - Pandox

English edition - Pandox

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Pandox</strong><br />

Report on<br />

business<br />

operations<br />

2010<br />

o n e o f t h e l e a d i n g<br />

h o t e l p r o p e r t y c o m p a n i e s i n E u r o p e

The Company<br />

The Business model . . . . . . . . . . . . . . . . . . . 2<br />

The Development . . . . . . . . . . . . . . . . . . . . . 4<br />

Success factors . . . . . . . . . . . . . . . . . . . . . . 6<br />

Strategy. . . . . . . . . . . . . . . . . . . . . . . . . . . . 8<br />

Value-growth . . . . . . . . . . . . . . . . . . . . . . 10<br />

Types of agreements . . . . . . . . . . . . . . . . 10<br />

Business processes . . . . . . . . . . . . . . . . 11<br />

Success stories . . . . . . . . . . . . . . . . . . . . . . 12<br />

Operated by <strong>Pandox</strong> . . . . . . . . . . . . . . . . . . 14<br />

Market communication . . . . . . . . . . . . . . . . 15<br />

Hotel property market . . . . . . . . . . . . . . . . . 16<br />

<strong>Pandox</strong>’ hotels and partners . . . . . . . . . . . . 18<br />

Hotel properties<br />

List of hotel properties . . . . . . . . . . . . . . . . . 40<br />

Other information<br />

CEO commentary 2010 and ahead . . . . . . . 44<br />

Board of Directors and auditors . . . . . . . . . . 48<br />

Senior managers and executives . . . . . . . . 50<br />

Team <strong>Pandox</strong>. . . . . . . . . . . . . . . . . . . . . . . . 52<br />

Finances<br />

Financial overview . . . . . . . . . . . . . . . . . . . 58<br />

Sensitivity analysis . . . . . . . . . . . . . . . . . . . 62<br />

Valuation and fiscal situation . . . . . . . . . . . . 64<br />

Definitions . . . . . . . . . . . . . . . . . . . . . . . . . 65<br />

Ten-year overview . . . . . . . . . . . . . . . . . . . 66<br />

Quarterly data 2009–2010 . . . . . . . . . . . . . 68<br />

Financial statements 2010<br />

Report of the Board of Directors . . . . . . . . . 70<br />

Income statement and comments . . . . . . . . 72<br />

Balance sheet and comments . . . . . . . . . . . 74<br />

Changes in equity . . . . . . . . . . . . . . . . . . . 76<br />

Cash flow statement . . . . . . . . . . . . . . . . . . 77<br />

Accounting principles. . . . . . . . . . . . . . . . . 78<br />

Notes to the accounts . . . . . . . . . . . . . . . . 79<br />

Proposed disposition of earnings . . . . . . . . . 84<br />

Auditors’ report . . . . . . . . . . . . . . . . . . . . . 85

<strong>Pandox</strong> completed<br />

the world’s largest<br />

hotel property transaction in 2010<br />

with the acquisition of Norgani, a portfolio of 73 hotels.<br />

<strong>Pandox</strong> thereby became<br />

one of the leading<br />

hotel property companies in Europe.<br />

<strong>Pandox</strong> strengthened<br />

its position<br />

on the Nordic market.<br />

<strong>Pandox</strong> continued to expand in Brussels and<br />

acquired one of the city’s largest and bestknown<br />

hotels – now called The Hotel.<br />

<strong>Pandox</strong> is also an international<br />

challenger present in ten countries, including<br />

North America with two large hotels in the centre of Montreal.<br />

<strong>Pandox</strong> has unique<br />

collaboration with 19 brands,<br />

creating an extensive network.

The business model<br />

The business model is chosen with<br />

consideration to the local prerequisites in<br />

order to obtain a situationadapted strategy.<br />

The procedure is based on a well-developed methodology with<br />

defined structures, known as the <strong>Pandox</strong> Model, which enables<br />

<strong>Pandox</strong>’ skilful employees to focus on development and the<br />

creative process.<br />

Several models are used in Brussels. Hotel BLOOM! and The<br />

Hotel are independent hotels operated by <strong>Pandox</strong>, and the Crowne<br />

Plaza Brussels City Centre is operated with a franchise agreement,<br />

while the Hilton Brussels City is operated under a management<br />

agreement and the Scandic Grand Place through a lease.<br />

Development<br />

<strong>Pandox</strong> has achieved constant progress in size,<br />

cash flow and value-growth – and consequently<br />

has a stronger market position. The portfolio value<br />

has increased from SEK 800 million to more than<br />

SEK 22 billion, while cash flow has improved by<br />

45 times since the Company was formed in 1995.<br />

4<br />

Read more on page<br />

Success<br />

factors<br />

<strong>Pandox</strong> has developed rapidly since starting in<br />

1995. The success factors are a combination of<br />

the Company’s strategy, expertise, flexible business<br />

model and industrial owners.<br />

2 |<br />

<strong>Pandox</strong> 2010

Knowledge,<br />

network and<br />

individual capital<br />

One of <strong>Pandox</strong>’ most important cornerstones is<br />

to constantly develop the Company’s expertise<br />

and competences. In order to inspire our employees,<br />

an informal leadership style has been devel oped<br />

to give each individual considerable freedom and<br />

development opportunities. The corporate culture<br />

includes an interactive discussion with an extensive<br />

network, which provides valuable input in both<br />

large and small issues.<br />

Consistent<br />

strategy<br />

<strong>Pandox</strong> has a well-defined strategy that is<br />

thoroughly embodied with the Board of<br />

Directors, senior executives and banks – a<br />

strategy that has been consistently followed<br />

since the Company was formed 15 years<br />

ago. The point of departure is to acquire<br />

under-performing large hotels in strong locations,<br />

where the Company’s specialist expertise<br />

can be used to develop the assets. This<br />

in turn creates prerequisites for long-term<br />

value development and a strong company.<br />

Read more on page<br />

6<br />

Read more<br />

on page<br />

8<br />

<strong>Pandox</strong> 2010<br />

| 3

The Development<br />

From financial crisis to successful<br />

hotel property company<br />

When <strong>Pandox</strong> started in 1995, the Company consisted of 18 hotels with 3,000 rooms located in nine<br />

Swedish towns and cities. The business model was new and untried. The Company had weak profita b-<br />

ility and limited capital.<br />

The road to success has since gone via transactions embracing 170 hotel properties to a total value<br />

of SEK 20 billion. With a consistent strategy, <strong>Pandox</strong> has shown durable and profitable growth, along<br />

with a greater geographic spread.<br />

At the end of 2010, <strong>Pandox</strong> had 120 hotels with a total of 24,800 rooms<br />

located in 59 towns and cities in 10 different countries in the Nordic Region,<br />

the rest of Europe, and North America. <strong>Pandox</strong> thereby is one of the<br />

leading hotel property companies in the European market.<br />

266<br />

228<br />

267<br />

272<br />

299<br />

<strong>Pandox</strong>’ development 1995–2010<br />

Number of hotels<br />

Cash flow SEK M<br />

18<br />

12<br />

14<br />

21<br />

20<br />

53<br />

28<br />

97<br />

31<br />

119<br />

46*<br />

*Hotellus förvärvas med 16 hotellfastigheter.<br />

* Acquisition of Hotellus with 16 hotels.<br />

46<br />

44<br />

45<br />

44<br />

1995 1996 1997 1998 1999 2000 2001 2002 2003 2004<br />

1990 – Swedish financial<br />

and property crisis<br />

1999/2000<br />

IT and financial crisis<br />

Acquisitions totalling SEK 20 billion.<br />

Founded in 1995. <strong>Pandox</strong> has its origins in the financial and property crisis<br />

in the beginning of the 1990s. The Company was formed in 1995 by Securum<br />

and Skanska. The mission was to take over and restructure the hotel<br />

portfolio, and prepare it for sale.<br />

The original hotel property portfolio. In the beginning, <strong>Pandox</strong> consisted<br />

of 18 hotel properties and three small operating units. All of the hotels were<br />

in Sweden, and most of them were small with weak locations and in poor<br />

condition.<br />

Stock-exchange listing. <strong>Pandox</strong> was floated on the Stockholm Stock<br />

Exchange in 1997 with a new and untried business concept. The Company’s<br />

portfolio was valued at SEK 1.3 billion and the market capitalisation was SEK<br />

520 million. The listing gave 4,000 new shareholders.<br />

Further to the listing, <strong>Pandox</strong> expanded substantially with acquisitions of<br />

large hotels in strong locations, while smaller hotels were sold.<br />

Internationalisation. In 2000, <strong>Pandox</strong> enlarged its geographical strategy to<br />

northern Europe through the acquisition of Hotellus with 16 hotel properties.<br />

Privatised again in 2004. <strong>Pandox</strong> is bought out from the stock market in<br />

2004, with new industrial owners through Eiendomsspar AS and Sundt AS.<br />

4 |<br />

<strong>Pandox</strong> 2010

700<br />

445<br />

446<br />

Average<br />

annual return<br />

19%<br />

389<br />

120 *<br />

301<br />

318<br />

* Acquisition of Norgani with 73 hotels.<br />

36*<br />

* Sale of 12 hotels to Norgani.<br />

39<br />

44 45<br />

46<br />

Key indicators 2010<br />

<strong>Pandox</strong> proforma including Norgani<br />

(before acquisition costs)<br />

Mkr 2010<br />

Number of hotels 120<br />

Number of hotel rooms 24,800<br />

Property revenues, SEK M 1,700<br />

Cash flow, SEK M 700<br />

2005 2006 2007 2008 2009 2010<br />

2007/2008<br />

Global finance crisis<br />

Transactions covering 170 hotels.<br />

Stronger in Europe. The transaction tempo increased further to the privatisation,<br />

and several large hotels were acquired in Berlin, Brussels, Basel,<br />

Copenhagen, Stockholm and Malmö – thus strengthening <strong>Pandox</strong> as one<br />

of the leading hotel property players in Europe.<br />

Expansion to North America. In 2007–2008, <strong>Pandox</strong> continued its international<br />

expansion with two acquisitions in Montreal.<br />

Leading in Europe. In August 2010, <strong>Pandox</strong> announced the acquisition<br />

of Norgani Hotels with a portfolio of 73 hotels in Sweden, Finland, Norway<br />

and Denmark.<br />

Further to the acquisition, <strong>Pandox</strong> became one of the leading pure hotel<br />

property companies in Europe with regard to geographic spread and number<br />

of hotels and brands. Since starting in 1995, <strong>Pandox</strong> has carried out acquisitions<br />

for a total of SEK 20 billion representing transactions of 170 hotels.<br />

The value of the Company’s hotel property portfolio amounts to approximately<br />

SEK 22 billion further to the acquisition of Norgani – which implies<br />

that the value has increased about 20 times. This has been achieved<br />

through a good hotel market, active ownership, sound expertise and<br />

profitable acquisitions.<br />

<strong>Pandox</strong> 2010<br />

| 5

Success factors<br />

Short and rapid<br />

decision-making paths<br />

<strong>Pandox</strong>’ shareholders and Board of Directors possess industrial expertise in the<br />

Company’s three most important areas: hotel operations, properties and business<br />

development. Their knowledge and experience create confidence, which enables<br />

us to take rapid decisions within, for example, different acquisition questions.<br />

This is a competitive advantage in a significantly slower surrounding world.<br />

Clarion Collection Hotel Bastion, Oslo<br />

Well-defined and<br />

consistent strategy<br />

<strong>Pandox</strong> has a well-defined strategy within<br />

geography, types of hotel and yield requirements<br />

that have been consistently followed<br />

since the Company was formed.<br />

Flexible business model<br />

Depending on local prerequisites, <strong>Pandox</strong><br />

is able to choose between four<br />

operational strategies: through leases<br />

with professional operators where <strong>Pandox</strong><br />

remains as a strategic partner; management<br />

agreements where a partner<br />

runs the daily operations on behalf of<br />

<strong>Pandox</strong>; by managing one’s own operations<br />

through a franchise agreement<br />

under a well-known brand or via an independent<br />

distribution system. The business<br />

model provides excellent opportunities<br />

to create a situation-adapted strategy<br />

“asset by asset”.<br />

Expertise and network<br />

International network provides access to unique expertise<br />

<strong>Pandox</strong> has a small management<br />

organisation, and all members are<br />

based at the office in Stockholm. In<br />

addition, one of the Company’s executives<br />

is based in Brussels where the<br />

largest operational activities are<br />

located. The model provides major<br />

benefits with rapid decision-making<br />

paths, a high level of interactivity, and<br />

considerable individual freedom. In<br />

order to maintain all business processes<br />

in motion, the organisation is<br />

supplemented by a national and international<br />

network composed of people<br />

with specialist expertise within market,<br />

management, hotel operations,<br />

property development, brand names,<br />

finance and taxes. <strong>Pandox</strong> works<br />

actively to attract people into the network,<br />

which is a precondition for the<br />

Company’s rapid growth. The model<br />

places demands on both visionary<br />

and operative leadership, as well as<br />

an ability to create forms of collaboration<br />

with individuals with different<br />

backgrounds.<br />

6 |<br />

<strong>Pandox</strong> 2010

Hyatt Regency, Montreal<br />

Corporate culture<br />

<strong>Pandox</strong><br />

Spirit<br />

Acquisition strategy<br />

<strong>Pandox</strong> primarily acquires hotels with a potential that can be<br />

brought out through active measures and where the Company’s<br />

areas of expertise can be utilised.<br />

<strong>Pandox</strong> has established an informal<br />

leadership style where a high level of<br />

expertise is combined with minimum<br />

bureaucracy and effective monitoring<br />

methods. The catchwords are inspiration,<br />

simplicity, rapidity, expertise and<br />

visible leadership.<br />

Portfolio of the highest quality<br />

The hotel property portfolio is of very high quality. The hotels are located in<br />

international and dynamic markets such as London, Brussels, Berlin,<br />

Stockholm, Copenhagen and Montreal as well as locations with a high proportion<br />

of domestic demand, which creates balance in revenues. The hotels<br />

have strong locations and are the right size, which provides a critical mass<br />

as well as being marketed by the sector’s most prominent brand names.<br />

The agreement structure with a combination of leases, management agreements<br />

and own operations provides good potential with limited risk.<br />

Strategic alliances<br />

<strong>Pandox</strong> actively seeks strategic alliances with strong brand names that<br />

have an interest in forming a partnership that creates benefits for both parties.<br />

<strong>Pandox</strong> currently works with 11 partners under 19 brands.<br />

Choice of countries<br />

and locations<br />

<strong>Pandox</strong> is establishing in major hotel markets that<br />

have good potential and stable demand.<br />

<strong>Pandox</strong> 2010<br />

| 7

Strategy<br />

Consistent strategy enables stability<br />

and the spreading of risk<br />

Corner-stones in <strong>Pandox</strong>’ strategy<br />

One type of asset<br />

– hotel properties<br />

Agreement structure<br />

Geographical market<br />

A hotel property has distinctive features<br />

and differs from other types of property,<br />

which demands specialist expertise to be<br />

able to maintain active and successful<br />

ownership. <strong>Pandox</strong> therefore invests in<br />

just one type of asset: hotel properties.<br />

Business position: <strong>Pandox</strong> has<br />

120 hotels with a total of 24,800 rooms.<br />

To maximise value-growth in each hotel<br />

requires a flexible business model that creates<br />

opportunities for a situation-adapted strategy.<br />

Business position: <strong>Pandox</strong> has a structure<br />

that embraces leases, management agreements,<br />

franchise agreements, as well as agreements<br />

with independent players. The largest<br />

portion concerns leases, which cover 87<br />

percent of revenues.<br />

Focusing on one type of asset requires a<br />

broad geographic market so as to create<br />

growth prerequisites and be able to benefit<br />

from changes in the hotel economic cycle.<br />

Business position: <strong>Pandox</strong> is currently<br />

located in ten countries, of which Sweden is<br />

the largest market. Major markets outside the<br />

domestic market are Brussels, Copenhagen,<br />

Helsinki and Montreal. <strong>Pandox</strong> is represented<br />

in 59 locations that have a mix of national and<br />

international demand.<br />

Scandic Kramer, Malmö<br />

Lease structure – Rental revenues<br />

Geographical spread, proportion of hotel rooms<br />

Revenue-based lease, 34%<br />

Revenue-based lease<br />

with guarantee, 52%<br />

Management agreements,<br />

own operation, 4%<br />

Franchise agreement,<br />

own operation, 4%<br />

Own operation, 5%<br />

Other, 1%<br />

Sweden, 51%<br />

International, 49%<br />

8 |<br />

<strong>Pandox</strong> 2010

<strong>Pandox</strong>’ vision is to be one of the world’s leading<br />

hotel property companies with regard to specialist<br />

expertise in both hotel and property operations,<br />

and active ownership.<br />

For the vision to become reality, the Company must retain its<br />

specialist expertise regarding the value-growth chain, and that<br />

the balance between international and national revenues, brand<br />

names and types of hotel are maintained. Another important<br />

aspect is to constantly develop the business model so as to<br />

adapt to each situation and choose the best strategy in relation<br />

to local conditions.<br />

Business concept and strategy<br />

<strong>Pandox</strong>’ business concept, based on expertise within hotel<br />

properties, hotel operations and business development, is to<br />

actively own, develop and lease out hotel properties.<br />

Overall goal<br />

<strong>Pandox</strong>’ overall goal, through specialist expertise within hotels,<br />

hotel properties and business development, is to achieve optimal<br />

yield and value-growth in the hotel property portfolio. Specific<br />

goals are set each year for the operating net, return on investment,<br />

value-growth in the existing hotel property portfolio, and the<br />

equity/assets ratio. The goals are then broken down to each individual<br />

property and act as guidance upon investment decisions.<br />

Location and size<br />

Type of hotel<br />

Choice of brand<br />

names and partners<br />

Large hotels with strong locations increase<br />

potential and reduce risks, and are attractive<br />

for both partners and guests. Such<br />

hotels have higher liquidity and are easier<br />

to finance.<br />

Business position: All <strong>Pandox</strong> hotels<br />

have strong locations with an average size<br />

of 207 rooms, which is significantly larger<br />

than the average hotel in Europe.<br />

The hotels shall belong to the uppermedium<br />

and high-price segment.<br />

Business position: The portfolio contains<br />

a mix of upper medium and high-priced<br />

hotels. Examples of upper medium-priced<br />

hotels include many Scandic hotels as<br />

well as the Hotel Berlin, Berlin. High-priced<br />

hotels include InterContinental Montreal<br />

and Hilton Stockholm Slussen.<br />

Each hotel shall have the best possible brand<br />

name that strengthens the profile. This requires<br />

that <strong>Pandox</strong> maintains a broad network with<br />

national and international hotel companies.<br />

Business position: <strong>Pandox</strong> currently works with<br />

11 partners under 19 well-known brand names,<br />

as well as a number of independent distribution<br />

channels, thus providing a unique position and<br />

extensive network.<br />

Radisson BLU Hotel, Basel<br />

Hotel Berlin, Berlin<br />

<strong>Pandox</strong> 2010<br />

| 9

Value-growth<br />

The value-growth chain in a hotel property forms the basis for <strong>Pandox</strong>’ vision,<br />

strategy and choice of agreement structure. Knowledge of the entire chain is<br />

a precondition for success.<br />

10. Financing and taxes<br />

1. Macro economy<br />

9. Agreement structure<br />

2. Hotel economic cycle<br />

8. Asset management<br />

3. Location and size<br />

7. Investments<br />

4. Competition – new capacity – different market positions<br />

6. Operation and management<br />

5. Brand names<br />

Types of agreement<br />

The value of a hotel property is determined to a considerable degree by how the hotel<br />

agreement is formulated. <strong>Pandox</strong> endeavours to find agreements that create mutual<br />

incentives and driving forces for maximum development for both parties.<br />

Optimal agreement framework<br />

<strong>Pandox</strong>’ active and situationadapted ownership<br />

is reflected in the different types of agreement.<br />

The design and formulation of agreements are<br />

guided by factors such as anticipated market<br />

trends, local competition, planned investments,<br />

as well as choice of operator and distributor. A<br />

mixture of different types of agreement provides<br />

<strong>Pandox</strong> with a structure that increases cash flow<br />

in good times and, with rental guarantees, protects<br />

in declining markets.<br />

Revenue-based agreements<br />

Revenue-based hotel leases are linked to the<br />

sales generated by the hotel business. This form<br />

of lease provides <strong>Pandox</strong> with a share of growth<br />

in both the market as a whole and in the market<br />

share. To limit the risk, these leases generally<br />

include a minimum guaranteed rent.<br />

Result-based agreements<br />

A result-based lease implies that <strong>Pandox</strong><br />

receives a share of the hotel operator’s operating<br />

net. This type of lease requires that <strong>Pandox</strong><br />

be informed of and have insight to the operating<br />

company’s finances and accounts. This form of<br />

lease can also have a guaranteed rent.<br />

Fixed-fee agreements<br />

Fixed-fee hotel leases are used in mature markets<br />

and in well-established hotel products. A fixed-fee<br />

lease limits the risk but also the potential.<br />

Management agreements<br />

A management agreement can be perceived as<br />

kind of agent contract, where <strong>Pandox</strong> owns the<br />

hotel business. Through a management agreement,<br />

a hotel company is assigned to operate<br />

and manage the hotel on behalf of <strong>Pandox</strong>.<br />

Franchise agreements<br />

In <strong>Pandox</strong> own operation, franchise contracts<br />

can be entered with a hotel company in order to<br />

gain the benefits of a larger system that embraces<br />

the hotel’s overall marketing and sales.<br />

Lease structure – Rental revenues<br />

Revenue-based lease, 34%<br />

Revenue-based lease<br />

with guarantee, 52%<br />

Management agreements,<br />

own operation, 4%<br />

Franchise agreement,<br />

own operation, 4%<br />

Own operation, 5%<br />

Other, 1%<br />

10 |<br />

<strong>Pandox</strong> 2010

Business processes<br />

<strong>Pandox</strong>’ five business processes are implemented to describe the business position,<br />

the external and internal driving forces, and how these interact with each other.<br />

1<br />

Market survey<br />

Gains knowledge of the market situation<br />

and change-pattern.<br />

4<br />

Economic and<br />

financial reporting<br />

Operations are monitored through established<br />

goals, evaluations and valuations.<br />

2<br />

The <strong>Pandox</strong> Model<br />

The Company’s working methodology<br />

increases cash flow and limits the risk<br />

for each respective hotel.<br />

3<br />

Asset management<br />

Daily management plus major investments<br />

with the objective of increasing the<br />

value of the properties in the long-term.<br />

5<br />

Market<br />

communication<br />

<strong>Pandox</strong> regularly performs marketing<br />

activities towards target groups.<br />

The <strong>Pandox</strong> Model – and its four phases<br />

Market analysis<br />

A market analysis is performed<br />

in order to assess a hotel’s profitability<br />

potential and subsequent<br />

ability to pay the agreed rent.<br />

The local market is identified and<br />

analysed with regard to demand,<br />

competition and the current and<br />

future supply.<br />

Market strategy<br />

A strategic plan for each hotel<br />

property is established based on<br />

the respective hotel’s specific<br />

prerequisites, the local market,<br />

and its position in the hotel economic<br />

cycle. The property’s continued<br />

area of use is unconditionally<br />

evaluated while preparing<br />

the strategic plan.<br />

Profitability optimisation<br />

In view of that the value of a property<br />

is influenced by the profitability<br />

of the related hotel operations,<br />

the operator is <strong>Pandox</strong>’ most<br />

important partner. The hotel<br />

operator is constantly assessed<br />

in order to ensure positive developments<br />

of the hotel’s operations<br />

and the value of the property.<br />

Agreement optimisation<br />

The optimal cash flow of each<br />

respective hotel property is<br />

divided between the operator,<br />

<strong>Pandox</strong> and other related parties.<br />

Each agreement is formulated in<br />

such a way that all parties<br />

involved are given an incentive to<br />

continuously improve the hotel<br />

property’s overall profitability.<br />

Possibility to<br />

acquire a<br />

hotel property<br />

Action plan<br />

with concrete<br />

measures<br />

Evaluation of<br />

each respective<br />

hotel property<br />

and the portfolio<br />

Market analysis Market strategy Profitability<br />

optimisation<br />

Agreement<br />

optimisation<br />

Sales in accordance<br />

with the strategy<br />

<strong>Pandox</strong> 2010<br />

| 11

Investments in developm<br />

<strong>Pandox</strong> has developed a<br />

large number of hotel<br />

properties and hotel<br />

operations during the years.<br />

A selection of the past years’<br />

successful repositioning<br />

and ongoing projects are<br />

here presented.<br />

Investment program: CAD 7.5 million<br />

Accomplished: Modernisation and improvement<br />

of the banqueting hall and other meeting areas.<br />

Holiday Inn Brussels Airport<br />

Vision – the best!<br />

Crowne Plaza<br />

Brussels City Centre<br />

Established<br />

in Brussels<br />

Holiday Inn Brussels Airport was acquired in 2006 when the hotel required substantial<br />

refurbishment and development. With the vision of creating the best upper-mediumpriced<br />

hotel in the area, the change process has been successfully implemented based<br />

on the catchwords of full service, attractive design and high efficiency.<br />

Crowne Plaza Brussels City Centre was<br />

acquired in 2003, and has for several years been<br />

one of Brussels’ business and meeting hotels –<br />

and indeed continues to strengthen its market<br />

position year after year. The hotel, which has<br />

received several international awards, has the<br />

vision of becoming Brussels’ best meeting hotel<br />

in the city centre.<br />

Investment program: EUR 15 million<br />

Accomplished: Repositioning towards the<br />

meeting segment with new concept called<br />

“Balanced Senses”. Upgrading of all rooms,<br />

as well as new restaurant and bar concept in a<br />

classic environment.<br />

Investment program: EUR 8 million<br />

Accomplished: Completely new design for rooms and<br />

lobby, new meeting concept, upgrading of general<br />

facilities and major organisational development.<br />

12 |<br />

<strong>Pandox</strong> 2010

ent and repositioning<br />

Success<br />

stories<br />

Hyatt Regency Montreal<br />

Outstanding!<br />

InterContinental Montreal<br />

Business<br />

and pleasure<br />

<strong>Pandox</strong> acquired the InterContinental Montreal<br />

in the summer of 2007. Extensive development<br />

work has since created a completely<br />

new hotel concept – and reactions have been<br />

nothing less than fantastic with several distinctions<br />

and awards. Work is now continuing<br />

with the vision of becoming RevPAR-leader in<br />

Montreal.<br />

<strong>Pandox</strong> acquired the Hyatt Regency Montreal<br />

in the summer of 2008, and is now investing<br />

in the vision of creating Montreal’s best<br />

meeting and festival hotel. And the hotel is<br />

well on the way to becoming outstanding!<br />

The first stage is already completed with the<br />

upgrading of the hotel’s large banqueting<br />

hall and other meeting rooms. Work is now<br />

continuing with the upgrading of the<br />

reception and lobby.<br />

Investment program: CAD 14 million<br />

Accomplished: New management, new<br />

profile and design in all rooms and the<br />

lobby, new F&B offer.<br />

Hotel BLOOM!, Brussels<br />

Talk of<br />

the town<br />

<strong>Pandox</strong> acquired the hotel in 2005, which at the<br />

time was considered to be one of the city’s absolutely<br />

poorest hotels. During more than two<br />

years, the hotel was refurbished, upgraded and<br />

developed, and a new concept was produced.<br />

Hotel BLOOM! is a unique hotel with a completely<br />

own concept based on art and design. It has<br />

become a challenger in the Brussels hotel market<br />

and now competes with the major hotels.<br />

Investment program: EUR 13 million<br />

Accomplished: Repositioning, upgrading and<br />

development of the entire hotel. New<br />

management, new concept and new name.<br />

Hotel Berlin, Berlin<br />

Meeting place<br />

Since acquiring the hotel in 2006, <strong>Pandox</strong> has<br />

created the meeting place of the future in one of<br />

the city’s largest hotels. Extensive re-profiling has<br />

moved the Hotel Berlin, Berlin back to the top –<br />

and is now established as one of the leading<br />

meeting hotels, as well as one of Berlin’s most<br />

creative meeting places.<br />

Investment program: EUR 10 million<br />

Accomplished: Modernisation and improvement<br />

of all rooms and meeting product, as well as<br />

facade, entrance and lobby. New market profile<br />

and new management.<br />

<strong>Pandox</strong> 2010<br />

| 13

Operated<br />

by <strong>Pandox</strong><br />

Crowne Plaza Brussels City Centre<br />

Holiday Inn Brussels Airport<br />

Hotel BLOOM!, Brussels<br />

Hilton Brussels City<br />

The Hotel, Brussels<br />

Crowne Plaza Antwerp<br />

Hotel Berlin, Berlin<br />

Hyatt Regency Montreal<br />

InterContinental Montreal<br />

Pelican Bay, Bahamas<br />

A natural part of <strong>Pandox</strong>’ active ownership<br />

is to operate its own hotels. Depending on<br />

the local prerequisites, the best strategy<br />

can be to develop operations oneself, and<br />

to choose another solution at a later stage.<br />

This creates a situation adapted strategy –<br />

hotel by hotel.<br />

Another reason is that business cultures vary<br />

among different geographical areas. In the<br />

Nordic region, leases dominate while in North<br />

America the most common form is management<br />

and franchise agreements. Europe has a<br />

mixture of both. It is therefore important to command<br />

different strategies in order to successfully<br />

operate in an international hotel environment.<br />

Having one’s own operational competence also<br />

implies possessing specialist knowledge to<br />

evaluate the hoteloperators, and be able to<br />

carry out acquisitions that include both the<br />

property and operating company.<br />

Further to the growing industry trend of hotel<br />

companies becoming management companies,<br />

it is also natural for <strong>Pandox</strong> to integrate vertically<br />

and take over operational responsibility.<br />

At the end of 2010, <strong>Pandox</strong>’ operating companies,<br />

including management agreements,<br />

embraced ten hotels with total revenues of SEK<br />

1.2 billion – located in Berlin, Brussels, Antwerp,<br />

Montreal and the Bahamas.<br />

In recent years, four of the operations that had<br />

been acquired as under-performers and thereafter<br />

redeveloped, were leased with long-term<br />

agreements to well-known operators. In turn,<br />

this created prerequisites for new acquisitions.<br />

The philosophy behind <strong>Pandox</strong>’ operating<br />

companies is to build up each hotel’s strategy<br />

and competence locally. This implies that the main<br />

part of decision-taking is delegated, and reporting<br />

is made to a board of directors with, normally,<br />

external members who are elected for their specialist<br />

expertise. To be successful with the business<br />

processes requires an ability to attract the<br />

best management, and that such persons be<br />

given substantial influence over operations.<br />

Hotels operated by <strong>Pandox</strong><br />

City Hotel Brand name No. rooms Location<br />

Berlin Hotel Berlin, Berlin Independent hotel 701 Central<br />

Montreal Hyatt Regency Hyatt Regency 605 Central<br />

InterContinental Montreal InterContinental 357 City centre<br />

Brussels Crowne Plaza Brussels City Centre Crowne Plaza 354 City centre<br />

Hotel BLOOM! Independent hotel 305 Central<br />

Hilton Brussels City Hilton 283 City centre<br />

The Hotel Independent hotel 4334 City centre<br />

Holiday Inn Brussels Airport Holiday Inn 310 Airport<br />

Antwerp Crowne Plaza Antwerp Crowne Plaza 264 Central<br />

Bahamas Pelican Bay Independent hotel 184 Central<br />

14 |<br />

<strong>Pandox</strong> 2010

Market<br />

communication<br />

<strong>Pandox</strong> organises a Hotel Market Day<br />

each year, where current topics that<br />

affect the industry and sector are presented<br />

and discussed. The event has<br />

been held every year since 1997 and<br />

interest is constantly growing. Recent<br />

years have seen a full house with around<br />

300 people taking part, of which a large<br />

part is composed of international guests.<br />

The Hotel Market Day is a dynamic meeting<br />

place where hotel owners, operators, hotel<br />

companies, banks, public opinion lobbyists,<br />

construction companies, politicians and media<br />

come together. They can listen to interesting<br />

presentations that increase knowledge and<br />

insight about the hotel sector’s conditions, and<br />

are given the opportunity to network and obtain<br />

a forecast and prognosis for next year. The<br />

evening always closes with a dinner in a pleasant<br />

and relaxed environment. The event is held<br />

in November at the Hilton Stockholm Slussen,<br />

which apart from being owned by <strong>Pandox</strong> is a<br />

conference hotel of the highest class. In recent<br />

years, themes taken up have included the effect<br />

of low-price airlines on the hotel industry, the<br />

significance of shopping tourism for a destination,<br />

as well as the signification of the term<br />

“brand profitability” and the business models it<br />

offers. The themes for 2010 were the economic<br />

situation and its consequences for the hotel<br />

industry, as well as social media and their effect<br />

on the sector.<br />

The speakers are top-quality. In November<br />

2010, we had the honour of presenting Simon<br />

Johnson, Director EMEA from CBRE Hotels,<br />

Jan Tissera, CEO of TravelClick International,<br />

and Hermine Coyet Ohlén, Chief Editor of<br />

Swedish Elle. Staffan Olsson, well-known handball<br />

profile and Swedish national handball team<br />

manager and Stefan Lövgren, handball icon and<br />

expert commentator for TV4, were also there<br />

and talked about the Handball World Championship<br />

2011 – a mega event.<br />

Regular information about market trends and acquisitions<br />

When <strong>Pandox</strong> was formed in 1995, the<br />

publication of a newsletter was started in<br />

order to market the Company vis-à-vis the<br />

capital market prior to being listed on the<br />

stock exchange. The newsletter later was<br />

replaced by the public reports distributed<br />

by the Company. In spite of <strong>Pandox</strong> no<br />

longer being listed on the Stockholm Stock<br />

Exchange, the flow of information was<br />

maintained to people interested in the hotel<br />

sector and the hotel property market,<br />

which is why <strong>Pandox</strong> Upgrade is still<br />

regularly issued. The newsletter contains<br />

topics such as market trends and current<br />

Swedish and international hotel market<br />

questions.<br />

Welcome as a subscriber<br />

<strong>Pandox</strong> Upgrade is free of charge and may<br />

be ordered from <strong>Pandox</strong> either by telephone<br />

at +46 (0)8-506 205 50 or by sending<br />

an email to pandox@pandox.se<br />

<strong>Pandox</strong> Upgrade is also available on<br />

www.pandox.com<br />

<strong>Pandox</strong> 2010<br />

| 15

Development of<br />

the hotel property market<br />

Historically, hotel properties were perceived<br />

as part of the overall property market. Ownership<br />

was often in the hands of institutions<br />

and large property companies that lacked<br />

hotel expertise and had few contact surfaces<br />

with hotel operators. The relationship<br />

between tenant and landlord was in general<br />

based on long leases with solid guarantee<br />

components where the operator/hotel<br />

company took care of all development,<br />

maintenance and service of the properties.<br />

The distinctive features of hotel properties<br />

became clear<br />

During the financial and property crisis in the beginning<br />

of the 1990s, it became clear that the owners,<br />

often institutions and large property companies,<br />

lacked industrial competence. The economic<br />

downturn hit the hotels, which suddenly could not<br />

afford to pay their rent – which in turn caused farreaching<br />

problems for the property owners.<br />

The property crisis led to the banks being<br />

forced to take over a number of hotels, and<br />

banks and other passive owners discovered<br />

that hotels have distinctive features that distinguish<br />

them from, for example, housing and<br />

office buildings. The value growth of a hotel<br />

property is complex in view of that revenues and<br />

results are affected by several factors that<br />

demand extensive knowledge of the sector,<br />

including knowledge of driving forces within the<br />

hotel industry, effects of the choice of brand<br />

name and type of agreement, as well as different<br />

price and product segments, and much more.<br />

Functional and geographical focus<br />

Further to this baptism of fire, the capital market<br />

increased its requirements regarding the strategies<br />

of property companies. The companies<br />

started to specialise, and two principal paths<br />

crystallised: functional and geographical focus.<br />

The majority of property companies chose the<br />

latter and concentrated their portfolio around a<br />

few locations, which also led to them selling<br />

special properties such as hotels and shopping<br />

centres. New structures arose from this situation<br />

where companies with a functional strategy<br />

were formed, and the first pure hotel property<br />

companies were established.<br />

At the same time, several of the large hotel<br />

companies changed their strategies and chose<br />

an “asset light” orientation, implying that they<br />

started to sell their property portfolios.<br />

These were the most important driving forces<br />

behind greater liquidity in the hotel property market.<br />

The new companies were active and in general<br />

managed by people with considerable hotel<br />

experience – which in turn led to greater dynamics<br />

in the market with new contact surfaces and<br />

the spreading of interest in the new players.<br />

Scandinavia led the changes in Europe<br />

Scandinavia was in the forefront of these developments.<br />

<strong>Pandox</strong> was the first hotel property company<br />

in Europe to be listed on the stock market.<br />

The listing in 1997 in Stockholm led to a more<br />

transparent hotel market further to the improved<br />

availability of information, and the confidence<br />

grew within the capital market. Capona was listed<br />

InterContinental, Montreal<br />

10 largest hotel property owners in Europe<br />

Starwood Capital Group<br />

Foncière des Murs<br />

OCPI<br />

<strong>Pandox</strong><br />

Moor Park Capital Partners<br />

Westmont Hospitality Group<br />

The Blackstone Group<br />

Prupim/Prudential<br />

Quinland Private Capital<br />

CapMan<br />

0 200 400<br />

No. of hotels<br />

Source: The information in the graph is an estimation based<br />

on public information and research. Deviations may occur.<br />

16 |<br />

<strong>Pandox</strong> 2010

Comfort Hotel Børsparken, Oslo<br />

on the Stockholm stock exchange at the end of<br />

the 1990s, and was also founded further to the<br />

reorganisation and industrialisation of the sector.<br />

Over the years that followed, interest in the<br />

hotel industry grew and the number of players<br />

increased. Private equity companies, institutional<br />

owners, high net worth individuals and various<br />

kinds of funds took positions in the market.<br />

Only a few diversified hotel property portfolios<br />

Even if the hotel property market is now established<br />

and transactions with gigantic amounts are<br />

carried out, ownership is still fragmented and<br />

being restructured. If the point of departure is that<br />

there have been, and still are, functional focus<br />

towards one type of property, the situation should<br />

have led to the market’s players owning hotel<br />

properties in many countries managed by several<br />

brand names, so as to be able to benefit from the<br />

change in the hotel economic cycle and use their<br />

specialist competence. But this is not the situation<br />

today. Few companies have any pronounced<br />

global strategy, and only a minority has operations<br />

in several countries and continents.<br />

At company level, there are only eight companies<br />

that have a European property portfolio<br />

with more than 50 hotels. The largest is Starwood<br />

Capital Group that owns close to 1,000 hotel<br />

properties across the world, and where Europe<br />

represents just under 40 percent. Another large<br />

player is Westmont Hospitality Group that owns<br />

about 500 hotels in total, of which 16 percent are<br />

in Europe. <strong>Pandox</strong> is also a significant player with<br />

120 hotels in 10 countries together with 11 partners<br />

under 19 brand names.<br />

Buyers and sellers in 2010<br />

2010 proved to be a year of surprises. The transactions<br />

market in Europe touched bottom in<br />

2009 and finished at close to 90 percent under<br />

the peak year of 2007. The backdrop to the<br />

downturn was strong macro-economic factors,<br />

which were expected to prevent a rapid recovery.<br />

But after a cautious, albeit positive, start to<br />

2010 both the underlying hotel market and<br />

transactions within the sector accelerated.<br />

By the end of the year one could see that the<br />

trend of the hotel market showed a pattern of a<br />

very sharp V, with a rapid and strong recovery.<br />

The transaction market in Europe had increased<br />

by 150 percent at the end of the year compared<br />

with 2009 and reached a level of EUR 7.8 billion.<br />

The transactions completed during the year<br />

were mainly domestic or within Europe, and the<br />

banks’ continued stringent loan requirements<br />

held down the size of the transactions. About 60<br />

percent were less than EUR 35 million and only<br />

17 percent were over EUR 70 million. The largest<br />

transaction in Europe was <strong>Pandox</strong>’ acquisition<br />

of Norgani for just over EUR 1 billion.<br />

The most active buyers in the hotel property<br />

market in 2010 were high net worth individuals<br />

and private equity or investment companies.<br />

The largest sales group was composed of<br />

receivers, companies assigned by banks to sell<br />

distressed assets.<br />

Transaction volume on the hotel property market, EMEA 1)<br />

Buyer and seller net shift analysis, EMEA 1) 2010<br />

EUR million<br />

25,000<br />

Sovereign Wealth Fund 2.8<br />

20,000<br />

REIT 2)<br />

Receiver 3)<br />

−13.7<br />

−0.1<br />

15,000<br />

Investment fund/Private equity<br />

Institutional investor<br />

−4.5<br />

9.1<br />

10,000<br />

Hotel operator<br />

HNWI<br />

−2.0<br />

12.8<br />

5,000<br />

Developer/Property company<br />

Other corporates<br />

−5.3<br />

0.9<br />

0<br />

2007<br />

2008<br />

2009<br />

2010<br />

%<br />

–15 0 15<br />

Single acquisitions<br />

Portfolio acquisitions<br />

1)<br />

Europe, Middle East, Africa<br />

2)<br />

Real Estate Investment Trust<br />

1)<br />

Europe, Middle East, Africa<br />

Source: Hotel Investment Outlook 2011, Jones Lang LaSalle<br />

3)<br />

Companies assigned by banks to sell distressed assets<br />

Source: Hotel Investment Outlook 2011, Jones Lang LaSalle<br />

<strong>Pandox</strong> 2010<br />

| 17

<strong>Pandox</strong> – 120 hotel prop<br />

one congress centre<br />

and 19 well-known<br />

brand names<br />

presented on<br />

pages 20–39<br />

<strong>Pandox</strong> currently works with 11 partners<br />

under 19 hotel brand names that<br />

are active within different price and<br />

product segments. Our partners are all<br />

well-known, established and successful.<br />

These partnerships strengthen<br />

<strong>Pandox</strong>’ knowledge and network and<br />

enable a unique position in the industry.<br />

The hotels are spread over 10<br />

countries and a total of 59 towns and<br />

cities. <strong>Pandox</strong>’ most extensive partnership<br />

is with Scandic, who operate 57 of<br />

the hotels in <strong>Pandox</strong>’ portfolio, followed<br />

by Quality Hotel with 12 hotels. <strong>Pandox</strong><br />

also works with international brands<br />

such as Hilton, Hyatt, Radisson BLU,<br />

Crowne Plaza and InterContinental.<br />

Each hotel is handled and analysed<br />

based on its individual prerequisites<br />

and surroundings. The business<br />

model, form of partnership and agreement<br />

are chosen depending on each<br />

situation so as to create optimal preconditions<br />

for maximum development<br />

for both parties.<br />

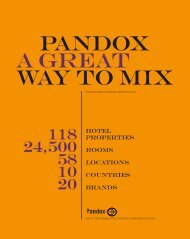

120<br />

hotels<br />

24,800<br />

hotel rooms<br />

18 |<br />

<strong>Pandox</strong> 2010

erties,<br />

10 COUNTRIES<br />

59 CITIES<br />

19 BRAND<br />

NAMES<br />

<strong>Pandox</strong> 2010<br />

| 19

Scandic Grand Marina, Helsinki<br />

Scandic Ferrum, Kiruna<br />

Scandic Hasselbacken, Stockholm<br />

Scandic Grand Marina, Helsinki<br />

Strong hotels in good locations<br />

Scandic is the leading hotel chain in the Nordic<br />

Region, and currently has 160 hotels in nine countries.<br />

<strong>Pandox</strong> and Scandic have a long business<br />

relationship and have collaborated closely ever<br />

since <strong>Pandox</strong> was established. Today, <strong>Pandox</strong><br />

has 57 hotels and one congress centre under the<br />

Scandic brand name, representing 49 percent of<br />

revenues in the total <strong>Pandox</strong> portfolio.<br />

Scandic has two principal product segments:<br />

city-centre hotels and highway hotels. Of the<br />

city-centre hotels, <strong>Pandox</strong>’ portfolio includes for<br />

example Scandic Park on Karlavägen and Scandic<br />

Hasselbacken at Djurgården in Stockholm,<br />

Scandic Grand Marina and Scandic Continental<br />

in Helsinki as well as Scandic KNA in Oslo.<br />

20 |<br />

<strong>Pandox</strong> 2010

Scandic Rosendal,<br />

Tammerfors<br />

Scandic KNA, Oslo<br />

Scandic Star, Lund<br />

Scandic KNA, Oslo<br />

Scandic Park, Stockholm<br />

Scandic Malmen, Stockholm<br />

Scandic Highway City centre Resort No. hotels<br />

Sweden 25 17 42<br />

Norway 1 1 2<br />

Finland 1 6 2 9<br />

Denmark 1 1<br />

Germany 1 1<br />

Belgium 1 1 2<br />

TOTAL 57<br />

CITY centre<br />

hasselbacken<br />

SCANDIC PARK<br />

GRAND MARINA<br />

CONTINENTAL<br />

SCANDIC KNA<br />

SKOGSHÖJD<br />

FERRUM<br />

ROSENDAL<br />

MALMEN<br />

STAR<br />

and others<br />

<strong>Pandox</strong> 2010<br />

| 21

30 well-positioned highway hotels<br />

The original Scandic hotels are classic highway<br />

hotels that were opened so as to offer car-travellers<br />

overnight accommodation. This hotel<br />

segment is now established over the whole in<br />

the Nordic Region. <strong>Pandox</strong>’ portfolio contains<br />

30 highway hotels, of which well-known and<br />

popular examples include Scandic Järva Krog,<br />

located just by the E4 at Stockholm’s northern<br />

approach, Scandic Backadal by the E6 at<br />

Gothenburg’s western approach, and Scandic<br />

Klarälven at Karlstad’s E18 ring road.<br />

Scandic and <strong>Pandox</strong> have created a specific<br />

project with a vision of developing the new<br />

generation of highway hotels – a process that<br />

will start in 2011.<br />

22 |<br />

<strong>Pandox</strong> 2010

Scandic Linköping Väst<br />

Scandic Västerås<br />

Scandic Örebro Väst<br />

Scandic Järva Krog, Solna<br />

Scandic Västerås<br />

Scandic Backadal, Gothenburg<br />

highway hotels<br />

ÖREBRO VÄST<br />

järva krog<br />

BACKADAL<br />

NORRKÖPING NORD<br />

LINKÖPING VÄST<br />

KLARÄLVEN<br />

VÄSTERÅS<br />

and others<br />

Scandic Bollnäs<br />

Scandic Norrköping Nord<br />

<strong>Pandox</strong> 2010<br />

| 23

Hilton Stockholm Slussen<br />

BRUSSELS<br />

STOCKHOLM<br />

LONDON<br />

helsinki<br />

BREMEN<br />

DORTMUND<br />

Hilton hotels<br />

– high class in all locations<br />

Hilton is a global hotel company, and is to be<br />

found in most major cities across the world.<br />

<strong>Pandox</strong> has seven Hilton hotels in its portfolio.<br />

The locations include London, Brussels,<br />

helsinki and Stockholm. Currently a joint refurbishment<br />

program is in progress at the Hilton<br />

Stockholm Slussen.<br />

Hilton Hotels & Resorts Country City No. rooms<br />

Hilton London Docklands UK London 365<br />

Hilton Stockholm Slussen Sweden Stockholm 289<br />

Hilton Brussels City Belgium Brussels 283<br />

Hilton Helsinki Kalastajatorppa Finland Helsinki 238<br />

Hilton Helsinki Strand Finland Helsinki 192<br />

Hilton Bremen Germany Bremen 235<br />

Hilton Dortmund Germany Dortmund 190<br />

TOTAL 1,792<br />

24 |<br />

<strong>Pandox</strong> 2010

Hilton London Docklands<br />

Hilton, Bremen<br />

Hilton London Docklands<br />

Hilton, Dortmund<br />

Hilton Helsinki Strand<br />

Hilton Helsinki Kalastajatorppa<br />

<strong>Pandox</strong> 2010<br />

| 25

CLARION<br />

HELSINGBORG<br />

ÖSTERSUND<br />

KARLSTAD<br />

CLARION<br />

COLLECTION<br />

COPENHAGEN<br />

HARSTAD<br />

OSLO<br />

Clarion Collection Hotel Bastion, Oslo<br />

Nordic Choice Hotels – the portfolio<br />

contains all five of the chain’s brands<br />

Nordic Choice Hotels is the fastest growing hotel company<br />

in the Nordic Region and is one of <strong>Pandox</strong>’ largest<br />

partners with a total of 22 hotels in the portfolio.<br />

The hotels within the Choice family represent 19<br />

percent of <strong>Pandox</strong>’ revenues. The hotel company<br />

has several brands, and <strong>Pandox</strong> has all five in its<br />

portfolio, where Quality is the largest with a total of<br />

12 hotels located in Norway and Sweden.<br />

26 |<br />

<strong>Pandox</strong> 2010

Quality Hotel&Resort, Fagernes<br />

Clarion Hotel Plaza, Karlstad<br />

Clarion Hotel Grand, Helsingborg<br />

Clarion Hotel Mayfair, Copenhagen<br />

comfort<br />

OSLO<br />

COPENHAGEN<br />

BERGEN<br />

qUALITY<br />

resort<br />

fagernes<br />

ØYER<br />

KRISTIANSAND<br />

qUALITY<br />

MOLDE<br />

LINKÖPING<br />

GOTHENBURG<br />

stockholm<br />

KRISTIANSTAD<br />

SÖDERTÄLJE<br />

LULEÅ<br />

SKÖVDE<br />

Quality Park Hotel, Södertälje<br />

Comfort Hotel Børsparken, Oslo<br />

Nordic Choice Hotels Country No. hotels<br />

Clarion Sweden 3<br />

Clarion Collection Norway, Denmark 4<br />

Quality Norway, Sweden 9<br />

Quality Resort Norway 3<br />

Comfort Norway, Denmark 3<br />

TOTAL 22<br />

<strong>Pandox</strong> 2010<br />

| 27

MONTREAL<br />

BRUSSELS<br />

ANTWERP<br />

Centre of attention<br />

in the Canadian metropolis<br />

InterContinental Hotels & Resorts is one of the<br />

world’s largest hotel companies, and owns the<br />

InterContinental, Crowne Plaza and Holiday Inn<br />

brands. <strong>Pandox</strong>’ portfolio includes four hotels<br />

located in Antwerp, Brussels and Montreal. The<br />

InterContinental Montreal was acquired in 2007<br />

and has since then been developed and<br />

repositioned. It was named Montreal’s best<br />

hotel last year and ranked as one of the 100<br />

best hotels in the world.<br />

Holiday Inn, Brussels<br />

28 |<br />

<strong>Pandox</strong> 2010

Crowne Plaza Brussels City Centre, Brussels<br />

Leading in Brussels<br />

<strong>Pandox</strong> owns two hotel properties operated<br />

under the Crowne Plaza brand name – both<br />

located in Belgium. Crowne Plaza Brussels City<br />

Centre was acquired in 2003 and thereafter<br />

underwent an important investment program.<br />

The hotel has since become one of Brussels’<br />

leading business and meeting hotels, and is<br />

owned and operated by <strong>Pandox</strong> under a franchise<br />

agreement.<br />

The Crowne Plaza Antwerp, acquired in 2007,<br />

is also owned and operated by <strong>Pandox</strong> under a<br />

franchise agreement. The hotel has 264 rooms<br />

and is strategically located by Antwerp’s ring<br />

road just 10 minutes from the airport. It is currently<br />

undergoing an extensive refurbishment<br />

program that will be completed in 2011.<br />

Crowne Plaza Brussels<br />

City Centre, Brussels<br />

BRUSSELS<br />

Successful change process<br />

The Holiday Inn Brussels Airport was acquired<br />

in 2006, and needed extensive refurbishment<br />

and development. With the vision of creating<br />

the best upper-medium-priced hotel in the<br />

area, the change process has been<br />

successfully carried out with the catchwords of<br />

full service, attractive design and high efficiency.<br />

Today the hotel is runner-up in its market, and is<br />

owned and operated by <strong>Pandox</strong> under a<br />

franchise agreement.<br />

InterContinental Hotels & Resorts Country City No. hotels<br />

Crowne Plaza Belgium Antwerp, Brussels 2<br />

Holiday Inn Belgium Brussels 1<br />

InterContinental Canada Montreal 1<br />

TOTAL 4<br />

<strong>Pandox</strong> 2010<br />

| 29

MONTREAL<br />

Hotel Country City No. rooms<br />

Hyatt Regency Montreal Canada Montreal 605<br />

On the way to something big<br />

Hyatt is an American, stock-market-listed hotel<br />

company with headquarters in Chicago. The<br />

company has eight different brands. <strong>Pandox</strong>’<br />

hotel in Montreal is operated under the Hyatt<br />

Regency brand.<br />

The Hyatt Regency has a strategically<br />

important position in central Montreal within<br />

walking distance to the Palais des Congrès –<br />

Montreal’s exhibition and congress centre. The<br />

hotel is undergoing refurbishment with the<br />

objective of repositioning as one of Canada’s<br />

best leisure and meeting hotels. The Hyatt<br />

Regency Montreal has 605 rooms and extensive<br />

meeting and conference facilities for 1,000<br />

people.<br />

30 |<br />

<strong>Pandox</strong> 2010

Radisson BLU Lillehammer Hotel<br />

Radisson BLU Lillehammer Hotel<br />

Lillehammer<br />

Malmö<br />

bodØ<br />

STOCKHOLM<br />

BASEL<br />

linköping<br />

Radisson BLU Hotel, Basel<br />

Radisson BLU Arlandia Hotel, Arlanda<br />

Rezidor Country City No. rooms<br />

Radisson BLU Arlandia Hotel Sweden Stockholm 335<br />

Radisson BLU Hotel, Malmö Sweden Malmö 229<br />

Radisson BLU Hotel, Linkoping Sweden Linköping 91<br />

Radisson BLU Lillehammer Hotel Norway Lillehammer 303<br />

Radisson BLU Hotel, Bodø Norway Bodø 191<br />

Radisson BLU Hotel, Basel Switzerland Basel 205<br />

TOTAL 1,354<br />

Six hotels, three countries<br />

Rezidor is the fastest growing hotel company in Europe. With Scandinavian<br />

origins, the company is now listed on the stock market and is<br />

head quartered in Brussels. <strong>Pandox</strong> has a long relationship with Rezidor<br />

and currently owns six Radisson BLU hotels located in Sweden, Norway<br />

and Switzerland. During 2010, the Radisson BLU hotels in Malmö and<br />

Basel were developed jointly by Rezidor and <strong>Pandox</strong> with good results<br />

and where the companies’ respective competences could be utilised.<br />

Radisson BLU Arlandia Hotel, Arlanda<br />

<strong>Pandox</strong> 2010<br />

| 31

Gothenburg<br />

JÖNKÖPING<br />

Elite Park Avenue Hotel, Gothenburg<br />

Elite Park Avenue Hotel, Gothenburg<br />

Well-known city profiles<br />

Elite Hotels is a privately owned hotel chain with 21 hotels, and has specialised in operating<br />

classic hotels. The <strong>Pandox</strong> portfolio contains the Elite Park Avenue Hotel on Gothenburg’s<br />

most well-known avenue, and the Elite Stora Hotellet in Jönköping.<br />

Hotel Country City No. rooms<br />

Elite Park Avenue Hotel Sweden Gothenburg 317<br />

Elite Stora Hotellet Jönköping Sweden Jönköping 135<br />

TOTAL 452<br />

Elite Park Avenue Hotel, Gothenburg<br />

32 |<br />

<strong>Pandox</strong> 2010

Rica Hotel Bodø<br />

hamar<br />

bodØ<br />

Hotel Country City No. rooms<br />

Rica Hotel Bodø Norway Bodø 113<br />

Rica Hotel Hamar Norway Hamar 176<br />

TOTAL 289<br />

Rica Hotel Hamar<br />

Two Norwegians<br />

Rica Hotel Hamar<br />

Rica Hotels has more than 80 hotels in Norway<br />

and Sweden, and two of the Norwegian hotels<br />

are included in <strong>Pandox</strong>’ portfolio.<br />

The Rica Hotel Bodø is located within walking<br />

distance of the town centre, and has 113<br />

rooms as well as conference facilities for 250<br />

participants.<br />

The Rica Hotel Hamar is a business and<br />

conference hotel located centrally in Østlandet<br />

with 176 rooms and conference facilities for<br />

600 people.<br />

<strong>Pandox</strong> 2010<br />

| 33

First Hotel, Linköping<br />

First Hotel Royal Star, Stockholm<br />

halmstad<br />

LINKÖPING<br />

STOCKHOLM<br />

BORÅS<br />

Four First hotels<br />

in Sweden<br />

First Hotels is represented with 46 hotels in Sweden, Norway and Denmark. The <strong>Pandox</strong> portfolio<br />

contains four hotels in Sweden under this brand name, located in Älvsjö outside Stockholm and in<br />

Borås, Linköping and Halmstad.<br />

First Hotels Country City No. rooms<br />

First Hotel Grand, Borås<br />

First Hotel Royal Star Sweden Stockholm 103<br />

First Hotel Linköping Sweden Linköping 133<br />

First Hotel Grand Borås Sweden Borås 158<br />

First Hotel Mårtenson Sweden Halmstad 103<br />

TOTAL 497<br />

Best Western Royal Corner<br />

MORA<br />

växjö<br />

vantaa<br />

Best Western Mora Hotel & Spa<br />

Central locations<br />

Best Western Hotels is a global hotel chain with operations<br />

in 80 countries. The hotels are owned and operated<br />

privately but marketed under the joint name of Best<br />

Western. The <strong>Pandox</strong> portfolio contains three hotels that<br />

are members of Best Western Hotels, of which the Best<br />

Western Mora Hotell & Spa and the Best Western Royal<br />

Corner in Växjö are two centrally located four-star hotels.<br />

The Best Western Hotel Pilotti is located in Vantaa, Finland.<br />

Hotel, other brand names Country City No. rooms<br />

Best Western Mora Hotell & Spa Sweden Mora 135<br />

Best Western Royal Corner Sweden Växjö 158<br />

Best Western Hotel Pilotti Finland Vantaa 112<br />

Ibis Stockholm Hägersten Sweden Stockholm 190<br />

Omena Hotel Copenhagen Denmark Copenhagen 228<br />

Rantasipi Imatran Valtionhotelli Finland Imatra 135<br />

34 |<br />

<strong>Pandox</strong> 2010

IMATRA<br />

Castle environment in Finland<br />

Rantasipi Imatran Valtionhotelli is a spa hotel in a castle environment close to the town of Imatra in Finland.<br />

The hotel has 135 rooms, conference facilities for 250 people, and a complete spa centre.<br />

Copenhagen<br />

STOCKHOLM<br />

Ibis – budget<br />

in southern Stockholm<br />

Accor is one of the world’s largest hotel companies with operations in 90<br />

countries and 15 different brands in all segments – including the Ibis brand<br />

name for low-priced hotels represented in 43 countries. The <strong>Pandox</strong> portfolio<br />

includes the Ibis Stockholm Hägersten, located in southern Stockholm, just<br />

10 minutes from Stockholmsmässan and 15 minutes from central Stockholm.<br />

The hotel has 190 rooms, a restaurant, and several conference rooms.<br />

Centrally located<br />

in Copenhagen<br />

Omena Hotels has ten hotels, of which nine are in Finland and one in<br />

Denmark. The <strong>Pandox</strong>-owned Omena Hotel Copenhagen is centrally<br />

located in Copenhagen with 228 rooms and a café.<br />

<strong>Pandox</strong> 2010<br />

| 35

Independent hotels<br />

Brussels<br />

A unique and own concept<br />

<strong>Pandox</strong> acquired Hotel BLOOM! in 2005, which<br />

since September 2007 has been totally refurbished<br />

and has undergone a complete facelift.<br />

Today, the Hotel BLOOM! is a unique hotel<br />

product with its own concept based on art and<br />

design. It is a distinct challenger in the Brussels<br />

hotel market, with 305 rooms and large conference<br />

facilities, in the city centre that competes<br />

with the major hotels. Hotel BLOOM! is both<br />

owned and operated by <strong>Pandox</strong>.<br />

Independent hotels Country City No. rooms<br />

Hotel Berlin, Berlin Germany Berlin 701<br />

The Hotel Belgium Brussels 433<br />

Hotel BLOOM! Belgium Brussels 305<br />

Pelican Bay<br />

Bahamas<br />

Grand Bahama<br />

Island 184<br />

Airport Hotel Bonus Inn Finland Vantaa 211<br />

Vildmarkshotellet Kolmården Sweden Norrköping 213<br />

Mr Chip, Kista Sweden Stockholm 150<br />

Stadshotellet Princess Sandviken Sweden Sandviken 84<br />

Hotel Korpilampi Finland Espoo 150<br />

36 |<br />

<strong>Pandox</strong> 2010

Hotel BLOOM!, Brussels<br />

Hotel BLOOM!, Brussels<br />

Brussels<br />

Best location in the EU city<br />

Hotel BLOOM!, Brussels<br />

The Hotel was acquired in 2010 and is one of<br />

the largest and best-known hotels in Brussels.<br />

The hotel property is located on Boulevard<br />

Waterloo next to the city’s most prestigious<br />

shopping street, Avenue Louise. The hotel,<br />

which is a landmark, has 433 rooms on 26<br />

floors with several conference areas, two restaurants,<br />

as well as a fitness and spa centre.<br />

<strong>Pandox</strong>’ vision is to recreate the hotel’s historically<br />

strong position as one of the city’s leading<br />

business and meeting hotels in the premium<br />

segment.<br />

<strong>Pandox</strong> 2010<br />

| 37

Independent hotels, continued<br />

BERLIN<br />

Creative meeting place in Berlin<br />

Since the acquisition of the hotel in 2006, <strong>Pandox</strong><br />

has created the meeting place of the future<br />

in one of Berlin’s largest hotels. A comprehensive<br />

repositioning program has brought the Hotel<br />

Berlin, Berlin back to the top. It is now established<br />

as one of the leading meeting hotels and is<br />

one of Berlin’s most creative meeting places. The<br />

hotel has 701 guest rooms and 22 conference<br />

rooms, as well as several restaurants and bars.<br />

The hotel is owned and operated by <strong>Pandox</strong>.<br />

38 |<br />

<strong>Pandox</strong> 2010

Complete resort<br />

in the Caribbean<br />

The Pelican Bay Hotel is located in the beautiful<br />

Bahamas, on Grand Bahama Island. The hotel has<br />

been repositioned since <strong>Pandox</strong> took over the management<br />

agreement, and is now one of the leading<br />

business and meeting hotels in the Bahamas.<br />

Bahamas<br />

kolmården<br />

The major family attraction in Sweden<br />

Vildmarkshotellet is one of the best-known<br />

resort and tourist complexes in Sweden. The<br />

hotel is located outside Norrköping, about<br />

150 kilometres from Stockholm, next to<br />

Scandinavia’s largest wildlife park,<br />

Kolmården. The complex has 213 rooms, of<br />

which most are family-adapted, a large<br />

conference area with capacity for 370 people<br />

in the largest room, a large restaurant and a<br />

lobby bar. A new family spa centre has<br />

recently been completed with waterway,<br />

relaxation areas and treatment room.<br />

Mr Chip, Kista is strategically located in<br />

central Kista, one of Stockholm’s most<br />

expansive areas that is also the centre for<br />

leading companies within the IT and telecom<br />

sectors. The hotel has 150 rooms, conference<br />

facilities, as well as bar and restaurant,<br />

oriented towards business travellers.<br />

The Airport hotel bonus Inn has 211 rooms<br />

and is located just 5 minutes’ drive from Helsinki-<br />

Vantaaa airport and 30 minutes from Helsinki railway<br />

station. The hotel is next to the Leija Business Park –<br />

a shopping and leisure centre.<br />

The stadshotellet princess,<br />

sandviken is located right in the centre of<br />

Sandviken with 84 rooms, conference room<br />

with capacity for 80 people, and a restaurant.<br />

<strong>Pandox</strong> 2010<br />

| 39

Hotel properties<br />

Property<br />

Operator / Brand name<br />

Type of<br />

agreement Country City Location<br />

Scandic Antwerp Scandic O Belgium Antwerp Ring road<br />

Scandic Grand Place, Brussels Scandic O Belgium Brussels City centre<br />

Scandic Copenhagen Scandic O Denmark Copenhagen City centre<br />

Scandic Continental, Helsinki Scandic OG Finland Helsinki City centre<br />

Scandic Espoo Scandic OG Finland Espoo Ring road<br />

Scandic Grand Marina, Helsinki Scandic OG Finland Helsingfors City centre<br />

Scandic Marina Congress Center, Helsinki Scandic O Finland Helsingfors City centre<br />

Scandic Jyväskylä Scandic OG Finland Jyväskylä Central<br />

Scandic Kajanus, Kajaani Scandic OG Finland Kajaani Exhibition centre<br />

Scandic Kuopio Scandic OG Finland Kuopio Central<br />

Scandic Luosto Scandic OG Finland Luosto Ski resort<br />

Scandic Rosendahl Scandic OG Finland Tampere Central<br />

Scandic Tampere City Scandic OG Finland Tampere Central<br />

Scandic Bergen Airport Scandic O Norway Bergen Airport<br />

Scandic KNA, Oslo Scandic O Norway Oslo City centre<br />

Scandic Alvik, Stockholm Scandic OG Sweden Stockholm Ring road<br />

Scandic Backadal, Gothenburg Scandic OG Sweden Gothenburg Ring road<br />

Scandic Billingen, Skövde Scandic O Sweden Skövde Central<br />

Scandic Bollnäs Scandic OG Sweden Bollnäs Central<br />

Scandic Bromma, Stockholm Scandic OG Sweden Stockholm Ring road<br />

Scandic Crown, Gothenburg Scandic O Sweden Gothenburg City centre<br />

Scandic Elmia, Jönköping Scandic O Sweden Jönköping Exhibition centre<br />

Scandic Ferrum, Kiruna Scandic OG Sweden Kiruna Central<br />

Scandic Grand, Örebro Scandic O Sweden Örebro Central<br />

Scandic Gävle Väst Scandic OG Sweden Gävle Ring road<br />

Scandic Hallandia, Halmstad Scandic O Sweden Halmstad Central<br />

Scandic Hasselbacken, Stockholm Scandic OG Sweden Stockholm City centre<br />

Scandic Helsingborg Nord Scandic OG Sweden Helsingborg Ring road<br />

Scandic Järva Krog, Stockholm Scandic O Sweden Stockholm Ring road<br />

Scandic Kalmar Väst Scandic OG Sweden Kalmar Airport<br />

Scandic Klarälven, Karlstad Scandic OG Sweden Karlstad Ring road<br />

Scandic Kramer, Malmö Scandic O Sweden Malmö City centre<br />

Scandic Kungens Kurva, Stockholm Scandic OG Sweden Stockholm Ring road<br />

Scandic Linköping Väst Scandic OG Sweden Linköping Ring road<br />

Scandic Luleå Scandic OG Sweden Luleå Ring road<br />

Scandic Malmen, Stockholm Scandic OG Sweden Stockholm City centre<br />

Scandic Mölndal, Gothenburg Scandic O Sweden Gothenburg City centre<br />

Scandic Norrköping Nord Scandic OG Sweden Norrköping Ring road<br />

Scandic Park, Stockholm Scandic O Sweden Stockholm City centre<br />

Scandic Plaza, Borås Scandic OG Sweden Borås Central<br />

Scandic S:t Jörgen, Malmö Scandic OG Sweden Malmö City centre<br />

Scandic Segevång, Malmö Scandic OG Sweden Malmö Ring road<br />

Scandic Skogshöjd, Södertälje Scandic O Sweden Södertälje Central<br />

Scandic Star Sollentuna Scandic OG Sweden Stockholm Ring road<br />

Scandic Star, Lund Scandic OG Sweden Lund Central<br />