Connect for the Month of February 2009 - Birla Sun Life Mutual Fund

Connect for the Month of February 2009 - Birla Sun Life Mutual Fund

Connect for the Month of February 2009 - Birla Sun Life Mutual Fund

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

F e b r u a r y 2 0 0 9<br />

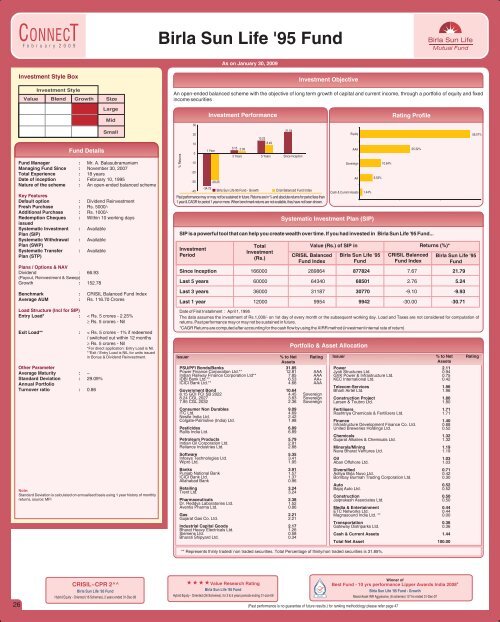

<strong>Birla</strong> <strong>Sun</strong> <strong>Life</strong> '95 <strong>Fund</strong><br />

As on January 30, <strong>2009</strong><br />

Investment Style Box<br />

Investment Style<br />

Value Blend Growth Size<br />

<strong>Fund</strong> Details<br />

<strong>Fund</strong> Manager : Mr. A. Balasubramaniam<br />

Managing <strong>Fund</strong> Since : November 30, 2007<br />

Total Experience : 18 years<br />

Date <strong>of</strong> inception : <strong>February</strong> 10, 1995<br />

Nature <strong>of</strong> <strong>the</strong> scheme : An open-ended balanced scheme<br />

Key Features<br />

Default option : Dividend Reinvestment<br />

Fresh Purchase : Rs. 5000/-<br />

Additional Purchase : Rs. 1000/-<br />

Redemption Cheques : Within 10 working days<br />

issued<br />

Systematic Investment : Available<br />

Plan (SIP)<br />

Systematic Withdrawal : Available<br />

Plan (SWP)<br />

Systematic Transfer : Available<br />

Plan (STP)<br />

Plans / Options & NAV<br />

Dividend : 66.93<br />

(Payout, Reinvestment & Sweep)<br />

Growth : 152.78<br />

Benchmark : CRISIL Balanced <strong>Fund</strong> Index<br />

Average AUM : Rs. 116.70 Crores<br />

Load Structure (Incl <strong>for</strong> SIP)<br />

Entry Load* : < Rs. 5 crores - 2.25%<br />

Rs. 5 crores - Nil<br />

Exit Load** : < Rs. 5 crores - 1% if redeemed<br />

/ switched out within 12 months<br />

Rs. 5 crores - Nil<br />

*For direct application: Entry Load is Nil.<br />

**Exit / Entry Load is NIL <strong>for</strong> units issued<br />

in Bonus & Dividend Reinvestment.<br />

O<strong>the</strong>r Parameter<br />

Average Maturity : –<br />

Standard Deviation : 29.09%<br />

Annual Portfolio<br />

Turnover ratio : 0.86<br />

Large<br />

Mid<br />

Small<br />

Note:<br />

Standard Deviation is calculated on annualised basis using 1 year history <strong>of</strong> monthly<br />

returns, source: MFI<br />

An open-ended balanced scheme with <strong>the</strong> objective <strong>of</strong> long term growth <strong>of</strong> capital and current income, through a portfolio <strong>of</strong> equity and fixed<br />

income securities<br />

% Returns<br />

30<br />

20<br />

10<br />

0<br />

-10<br />

-20<br />

-30<br />

-40<br />

Past per<strong>for</strong>mance may or may not be sustained in future. Returns are in % and absolute returns <strong>for</strong> period less than<br />

1 year & CAGR <strong>for</strong> period 1 year or more. When benchmark returns are not available, <strong>the</strong>y have not been shown.<br />

Investment Objective<br />

Systematic Investment Plan (SIP)<br />

SIP is a powerful tool that can help you create wealth over time. If you had invested in <strong>Birla</strong> <strong>Sun</strong> <strong>Life</strong> '95 <strong>Fund</strong>...<br />

Investment<br />

Period<br />

Investment Per<strong>for</strong>mance<br />

1 Year<br />

-34.75<br />

-28.25<br />

3.13<br />

Total<br />

Investment<br />

(Rs.)<br />

CRISIL Balanced<br />

<strong>Fund</strong> Index<br />

<strong>Birla</strong> <strong>Sun</strong> <strong>Life</strong> '95<br />

<strong>Fund</strong><br />

CRISIL Balanced<br />

<strong>Fund</strong> Index<br />

<strong>Birla</strong> <strong>Sun</strong> <strong>Life</strong> '95<br />

<strong>Fund</strong><br />

Since Inception 166000 289864 877824 7.67 21.79<br />

Last 5 years 60000 64340 68501 2.76 5.24<br />

Last 3 years 36000 31187 30770 -9.10 -9.93<br />

Last 1 year 12000 9954 9942 -30.00 -30.71<br />

Date <strong>of</strong> First Installment : April 1, 1995<br />

The data assumes <strong>the</strong> investment <strong>of</strong> Rs.1,000/- on 1st day <strong>of</strong> every month or <strong>the</strong> subsequent working day. Load and Taxes are not considered <strong>for</strong> computation <strong>of</strong><br />

returns. Past per<strong>for</strong>mance may or may not be sustained in future.<br />

*CAGR Returns are computed after accounting <strong>for</strong> <strong>the</strong> cash flow by using <strong>the</strong> XIRR method (investment internal rate <strong>of</strong> return)<br />

Issuer % to Net Rating<br />

Assets<br />

PSU/PFI Bonds/Banks 31.85<br />

Power Finance Corporation Ltd.** 12.81 AAA<br />

Indian Railway Finance Corporation Ltd** 7.85 AAA<br />

IDBI Bank Ltd.** 6.53 AA+<br />

ICICI Bank Ltd.** 4.66 AAA<br />

Government Bond 10.64<br />

8.15 GOI FCI SB 2022 4.45 Sovereign<br />

8.24 CGL 2027 3.83 Sovereign<br />

7.95 CGL 2032 2.36 Sovereign<br />

Consumer Non Durables 9.09<br />

ITC Ltd. 4.69<br />

Nestle India Ltd. 2.42<br />

Colgate-Palmolive (India) Ltd. 1.98<br />

Pesticides 6.89<br />

Rallis India Ltd. 6.89<br />

Petroleum Products 5.79<br />

Indian Oil Corporation Ltd. 2.91<br />

Reliance Industries Ltd. 2.88<br />

S<strong>of</strong>tware 5.35<br />

Infosys Technologies Ltd. 3.41<br />

Wipro Ltd. 1.95<br />

Banks 3.91<br />

Punjab National Bank 1.57<br />

ICICI Bank Ltd. 1.37<br />

Allahabad Bank 0.96<br />

Retailing 3.24<br />

Trent Ltd. 3.24<br />

Pharmaceuticals 2.38<br />

Dr. Reddys Laboratories Ltd. 1.52<br />

Aventis Pharma Ltd. 0.86<br />

Gas 2.21<br />

Gujarat Gas Co. Ltd. 2.21<br />

Industrial Capital Goods 2.17<br />

Bharat Heavy Electricals Ltd. 1.26<br />

Siemens Ltd. 0.58<br />

Bharati Shipyard Ltd. 0.34<br />

2.09<br />

<strong>Birla</strong> <strong>Sun</strong> <strong>Life</strong> 95 <strong>Fund</strong> - Growth<br />

13.23<br />

8.49<br />

21.54<br />

3 Years 5 Years Since Inception<br />

Crisil Balanced <strong>Fund</strong> Index<br />

Equity<br />

AAA<br />

Sovereign<br />

Portfolio & Asset Allocation<br />

AA<br />

Cash & Current Assets<br />

1.44%<br />

6.53%<br />

10.64%<br />

Rating Pr<strong>of</strong>ile<br />

25.32%<br />

Value (Rs.) <strong>of</strong> SIP in Returns (%)*<br />

Issuer % to Net Rating<br />

Assets<br />

Power 2.11<br />

Jyoti Structures Ltd. 0.94<br />

GVK Power & Infrastructure Ltd. 0.75<br />

KEC International Ltd. 0.42<br />

Telecom-Services 1.96<br />

Bharti Airtel Ltd. 1.96<br />

Construction Project 1.80<br />

Larsen & Toubro Ltd. 1.80<br />

Fertilisers 1.71<br />

Rashtriya Chemicals & Fertilizers Ltd. 1.71<br />

Finance 1.40<br />

Infrastructure Development Finance Co. Ltd. 0.88<br />

United Breweries Holdings Ltd. 0.52<br />

Chemicals 1.32<br />

Gujarat Alkalies & Chemicals Ltd. 1.32<br />

Minerals/Mining 1.19<br />

Nava Bharat Ventures Ltd. 1.19<br />

Oil 1.03<br />

Aban Offshore Ltd. 1.03<br />

Diversified 0.71<br />

Aditya <strong>Birla</strong> Nuvo Ltd. 0.42<br />

Bombay Burmah Trading Corporation Ltd. 0.30<br />

Auto 0.52<br />

Bajaj Auto Ltd. 0.52<br />

Construction 0.50<br />

Jaiprakash Associates Ltd. 0.50<br />

Media & Entertainment 0.44<br />

ETC Networks Ltd. 0.44<br />

Magnasound India Ltd. ** 0.00<br />

Transportation 0.36<br />

Gateway Distriparks Ltd. 0.36<br />

Cash & Current Assets 1.44<br />

Total Net Asset 100.00<br />

56.07%<br />

** Represents thinly traded/ non traded securities. Total Percentage <strong>of</strong> thinly/non traded securities is 31.85%.<br />

26<br />

CRISIL~CPR 2^^<br />

<strong>Birla</strong> <strong>Sun</strong> <strong>Life</strong> ‘95 <strong>Fund</strong><br />

Hybrid Equity - Oriented (16 Schemes), 2 years ended 31-Dec-08<br />

Value Research Rating<br />

<strong>Birla</strong> <strong>Sun</strong> <strong>Life</strong> ‘95 <strong>Fund</strong><br />

Hybrid Equity - Oriented (26 Schemes), <strong>for</strong> 3 & 5 years periods ending 31-Jan-09<br />

Winner <strong>of</strong><br />

&<br />

Best <strong>Fund</strong> - 10 yrs per<strong>for</strong>mance Lipper Awards India 2008<br />

<strong>Birla</strong> <strong>Sun</strong> <strong>Life</strong> ‘95 <strong>Fund</strong> - Growth<br />

Mixed Asset INR Aggressive, (6 schemes) 10 Yrs ended 31-Dec-07<br />

(Past per<strong>for</strong>mance is no guarantee <strong>of</strong> future results.) <strong>for</strong> ranking methodology please refer page 47