Connect for the Month of February 2009 - Birla Sun Life Mutual Fund

Connect for the Month of February 2009 - Birla Sun Life Mutual Fund

Connect for the Month of February 2009 - Birla Sun Life Mutual Fund

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

F e b r u a r y 2 0 0 9<br />

<strong>Birla</strong> <strong>Sun</strong> <strong>Life</strong> Income Plus<br />

As on January 30, <strong>2009</strong><br />

Investment Style Box<br />

Credit Quality<br />

High Med Low<br />

Interest Rate<br />

Sensitivity<br />

High<br />

Mid<br />

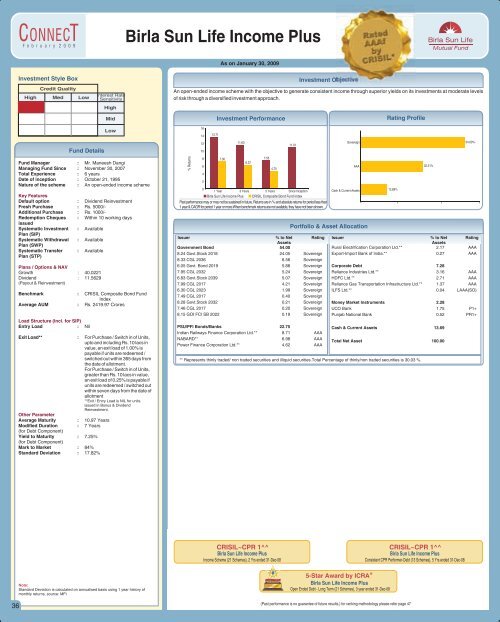

An open-ended income scheme with <strong>the</strong> objective to generate consistent income through superior yields on its investments at moderate levels<br />

<strong>of</strong> risk through a diversified investment approach.<br />

Investment Per<strong>for</strong>mance<br />

Investment Objective<br />

Rating Pr<strong>of</strong>ile<br />

<strong>Fund</strong> Details<br />

Low<br />

<strong>Fund</strong> Manager : Mr. Maneesh Dangi<br />

Managing <strong>Fund</strong> Since : November 30, 2007<br />

Total Experience : 6 years<br />

Date <strong>of</strong> inception : October 21, 1995<br />

Nature <strong>of</strong> <strong>the</strong> scheme : An open-ended income scheme<br />

Key Features<br />

Default option : Dividend Reinvestment<br />

Fresh Purchase : Rs. 5000/-<br />

Additional Purchase : Rs. 1000/-<br />

Redemption Cheques : Within 10 working days<br />

issued<br />

Systematic Investment : Available<br />

Plan (SIP)<br />

Systematic Withdrawal : Available<br />

Plan (SWP)<br />

Systematic Transfer : Available<br />

Plan (STP)<br />

Plans / Options & NAV<br />

Growth : 40.0221<br />

Dividend : 11.5629<br />

(Payout & Reinvestment)<br />

Benchmark : CRISIL Composite Bond <strong>Fund</strong><br />

Index<br />

Average AUM : Rs. 2419.97 Crores<br />

Load Structure (Incl. <strong>for</strong> SIP)<br />

Entry Load : Nil<br />

Exit Load** : For Purchase / Switch in <strong>of</strong> Units,<br />

upto and including Rs. 10 lacs in<br />

value, an exit load <strong>of</strong> 1.00% is<br />

payable if units are redeemed /<br />

switched out within 365 days from<br />

<strong>the</strong> date <strong>of</strong> allotment.<br />

For Purchase / Switch in <strong>of</strong> Units,<br />

greater than Rs. 10 lacs in value,<br />

an exit load <strong>of</strong> 0.25% is payable if<br />

units are redeemed / switched out<br />

within seven days from <strong>the</strong> date <strong>of</strong><br />

allotment<br />

**Exit / Entry Load is NIL <strong>for</strong> units<br />

issued in Bonus & Dividend<br />

Reinvestment.<br />

O<strong>the</strong>r Parameter<br />

Average Maturity : 10.97 Years<br />

Modified Duration : 7 Years<br />

(<strong>for</strong> Debt Component)<br />

Yield to Maturity : 7.25%<br />

(<strong>for</strong> Debt Component)<br />

Mark to Market : 84%<br />

Standard Deviation : 17.82%<br />

% Returns<br />

16<br />

14<br />

12<br />

10<br />

8<br />

6<br />

4<br />

2<br />

13.71<br />

7.30<br />

11.63<br />

6.37<br />

0<br />

1 Year 3 Years 5 Years Since Inception<br />

<strong>Birla</strong> <strong>Sun</strong> <strong>Life</strong> Income Plus CRISIL Composite Bond <strong>Fund</strong> Index<br />

Past per<strong>for</strong>mance may or may not be sustained in future. Returns are in % and absolute returns <strong>for</strong> period less than<br />

1 year & CAGR <strong>for</strong> period 1 year or more.When benchmark returns are not available, <strong>the</strong>y have not been shown.<br />

Issuer % to Net Rating<br />

Assets<br />

Government Bond 54.00<br />

8.24 Govt.Stock 2018 24.05 Sovereign<br />

8.33 CGL 2036 6.56 Sovereign<br />

6.05 Govt. Bond 2019 5.88 Sovereign<br />

7.95 CGL 2032 5.24 Sovereign<br />

6.83 Govt.Stock 2039 5.07 Sovereign<br />

7.99 CGL 2017 4.21 Sovereign<br />

6.30 CGL 2023 1.99 Sovereign<br />

7.49 CGL 2017 0.40 Sovereign<br />

8.28 Govt.Stock 2032 0.21 Sovereign<br />

7.46 CGL 2017 0.20 Sovereign<br />

8.15 GOI FCI SB 2022 0.19 Sovereign<br />

PSU/PFI Bonds/Banks 22.75<br />

Indian Railways Finance Corporation Ltd.** 8.71 AAA<br />

NABARD** 6.98 AAA<br />

Power Finance Corporation Ltd.** 4.62 AAA<br />

7.55<br />

4.75<br />

11.01<br />

Sovereign<br />

Cash & Current Assets<br />

Portfolio & Asset Allocation<br />

Issuer % to Net Rating<br />

Assets<br />

Rural Electrification Corporation Ltd.** 2.17 AAA<br />

Export-Import Bank <strong>of</strong> India.** 0.27 AAA<br />

Corporate Debt 7.28<br />

Reliance Industries Ltd.** 3.16 AAA<br />

HDFC Ltd.** 2.71 AAA<br />

Reliance Gas Transportation Infrastructure Ltd.** 1.37 AAA<br />

ILFS Ltd.** 0.04 LAAA(SO)<br />

Money Market Instruments 2.28<br />

UCO Bank 1.75 P1+<br />

Punjab National Bank 0.52 PR1+<br />

Cash & Current Assets 13.69<br />

Total Net Asset 100.00<br />

** Represents thinly traded/ non traded securities and illiquid securities.Total Percentage <strong>of</strong> thinly/non traded securities is 30.03 %.<br />

AAA<br />

13.69%<br />

32.31%<br />

54.00%<br />

CRISIL~CPR 1^^<br />

<strong>Birla</strong> <strong>Sun</strong> <strong>Life</strong> Income Plus<br />

Income Scheme (21 Schemes), 2 Yrs ended 31-Dec-08<br />

CRISIL~CPR 1^^<br />

<strong>Birla</strong> <strong>Sun</strong> <strong>Life</strong> Income Plus<br />

Consistent CPR Per<strong>for</strong>mer-Debt (13 Schemes), 5 Yrs ended 31-Dec-08<br />

36<br />

Note:<br />

Standard Deviation is calculated on annualised basis using 1 year history <strong>of</strong><br />

monthly returns, source: MFI<br />

@<br />

5-Star Award by ICRA<br />

<strong>Birla</strong> <strong>Sun</strong> <strong>Life</strong> Income Plus<br />

Open Ended Debt - Long Term (21 Schemes), 3 year ended 31-Dec-08<br />

(Past per<strong>for</strong>mance is no guarantee <strong>of</strong> future results.) <strong>for</strong> ranking methodology please refer page 47