Connect for the Month of February 2009 - Birla Sun Life Mutual Fund

Connect for the Month of February 2009 - Birla Sun Life Mutual Fund

Connect for the Month of February 2009 - Birla Sun Life Mutual Fund

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

F e b r u a r y 2 0 0 9<br />

<strong>Birla</strong> <strong>Sun</strong> <strong>Life</strong> Liquid Plus<br />

As on January 30, <strong>2009</strong><br />

Investment Style Box<br />

Credit Quality<br />

High Med Low<br />

Interest Rate<br />

Sensitivity<br />

High<br />

Investment Objective<br />

The primary objective <strong>of</strong> <strong>the</strong> schemes is to generate regular income through investments in debt and money market instruments. Income maybe<br />

generated through <strong>the</strong> receipt <strong>of</strong> coupon payments or <strong>the</strong> purchase and sale <strong>of</strong> securities in <strong>the</strong> underlying portfolio. The schemes will<br />

undernormal market conditions, invest its net assets in fixed income securities, money market instruments, cash and cash equivalents.<br />

Mid<br />

Low<br />

12<br />

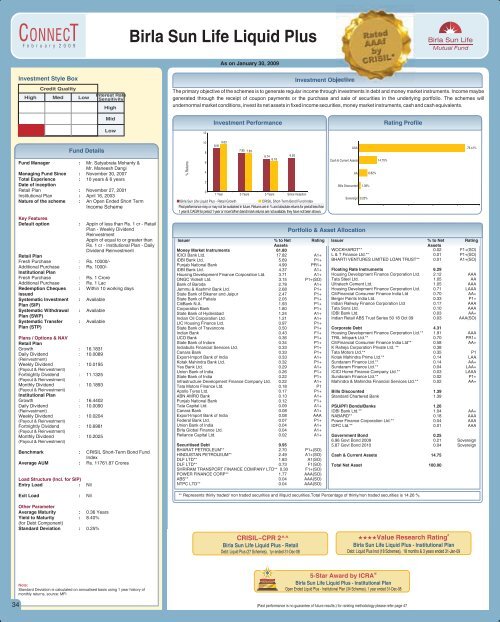

Investment Per<strong>for</strong>mance<br />

Rating Pr<strong>of</strong>ile<br />

<strong>Fund</strong> Details<br />

<strong>Fund</strong> Manager : Mr. Satyabrata Mohanty &<br />

Mr. Maneesh Dangi<br />

Managing <strong>Fund</strong> Since : November 30, 2007<br />

Total Experience : 10 years & 6 years<br />

Date <strong>of</strong> inception<br />

Retail Plan : November 27, 2001<br />

Institutional Plan : April 16, 2003<br />

Nature <strong>of</strong> <strong>the</strong> scheme : An Open Ended Short Term<br />

Income Scheme<br />

Key Features<br />

Default option : Appln <strong>of</strong> less than Rs. 1 cr - Retail<br />

Plan - Weekly Dividend<br />

Reinvestment<br />

Appln <strong>of</strong> equal to or greater than<br />

Rs. 1 cr - Institutional Plan - Daily<br />

Dividend Reinvestment<br />

Retail Plan<br />

Fresh Purchase : Rs. 10000/-<br />

Additional Purchase : Rs. 1000/-<br />

Institutional Plan<br />

Fresh Purchase : Rs. 1 Crore<br />

Additional Purchase : Rs. 1 Lac<br />

Redemption Cheques : Within 10 working days<br />

issued<br />

Systematic Investment : Available<br />

Plan (SIP)<br />

Systematic Withdrawal : Available<br />

Plan (SWP)<br />

Systematic Transfer : Available<br />

Plan (STP)<br />

Plans / Options & NAV<br />

Retail Plan<br />

Growth : 16.1831<br />

Daily Dividend : 10.0089<br />

(Reinvestment)<br />

Weekly Dividend : 10.0195<br />

(Payout & Reinvestment)<br />

Fortnightly Dividend : 11.1325<br />

(Payout & Reinvestment)<br />

<strong>Month</strong>ly Dividend : 10.1893<br />

(Payout & Reinvestment)<br />

Institutional Plan<br />

Growth : 16.4402<br />

Daily Dividend : 10.0090<br />

(Reinvestment)<br />

Weekly Dividend : 10.0204<br />

(Payout & Reinvestment)<br />

Fortnightly Dividend : 10.6981<br />

(Payout & Reinvestment)<br />

<strong>Month</strong>ly Dividend : 10.2025<br />

(Payout & Reinvestment)<br />

Benchmark : CRISIL Short-Term Bond <strong>Fund</strong><br />

Index<br />

Average AUM : Rs. 11761.87 Crores<br />

Load Structure (Incl. <strong>for</strong> SIP)<br />

Entry Load : Nil<br />

Exit Load : Nil<br />

% Returns<br />

10<br />

8<br />

6<br />

4<br />

2<br />

0<br />

8.91<br />

9.63<br />

7.95<br />

7.83<br />

6.74 6.93<br />

6.18<br />

1 Year 3 Years 5 Years Since Inception<br />

<strong>Birla</strong> <strong>Sun</strong> <strong>Life</strong> Liquid Plus - Retail Growth<br />

CRISIL Short-Term Bond <strong>Fund</strong> Index<br />

Past per<strong>for</strong>mance may or may not be sustained in future. Returns are in % and absolute returns <strong>for</strong> period less than<br />

1 year & CAGR <strong>for</strong> period 1 year or more.When benchmark returns are not available, <strong>the</strong>y have not been shown.<br />

Issuer % to Net Rating<br />

Assets<br />

Money Market Instruments 61.80<br />

ICICI Bank Ltd. 17.82 A1+<br />

IDBI Bank Ltd. 5.69 P1+<br />

Punjab National Bank 4.99 PR1+<br />

IDBI Bank Ltd. 4.37 A1+<br />

Housing Development Finance Corporation Ltd. 3.71 A1+<br />

ONGC Videsh Ltd. 3.15 P1+(SO)<br />

Bank <strong>of</strong> Baroda 2.78 A1+<br />

Jammu & Kashmir Bank Ltd. 2.68 P1+<br />

State Bank <strong>of</strong> Bikaner and Jaipur 2.47 P1+<br />

State Bank <strong>of</strong> Patiala 2.05 P1+<br />

CitiBank N.A. 1.93 P1+<br />

Corporation Bank 1.80 P1+<br />

State Bank <strong>of</strong> Hyderabad 1.24 A1+<br />

Indian Oil Corporation Ltd. 1.21 A1+<br />

LIC Housing Finance Ltd. 0.97 P1+<br />

State Bank <strong>of</strong> Travancore 0.50 P1+<br />

Indian Bank 0.43 F1+<br />

UCO Bank 0.36 P1+<br />

State Bank <strong>of</strong> Indore 0.34 P1+<br />

Indiabulls Financial Services Ltd. 0.33 P1+<br />

Canara Bank 0.33 P1+<br />

Export-Import Bank <strong>of</strong> India 0.33 A1+<br />

Kotak Mahindra Bank Ltd. 0.32 P1+<br />

Yes Bank Ltd. 0.29 A1+<br />

Union Bank <strong>of</strong> India 0.26 P1+<br />

State Bank <strong>of</strong> India 0.22 P1+<br />

Infrastructure Development Finance Company Ltd. 0.22 A1+<br />

Tata Motors Finance Ltd. 0.18 P1<br />

Apollo Tyres Ltd. 0.17 P1+<br />

ABN AMRO Bank 0.13 A1+<br />

Punjab National Bank 0.12 F1+<br />

Tata Capital Ltd. 0.09 A1+<br />

Canara Bank 0.08 A1+<br />

Export-Import Bank <strong>of</strong> India 0.08 AAA<br />

Federal Bank Ltd. 0.07 P1+<br />

Union Bank <strong>of</strong> India 0.04 A1+<br />

<strong>Birla</strong> Global Finance Ltd. 0.04 A1+<br />

Reliance Capital Ltd. 0.02 A1+<br />

Securitised Debt 9.95<br />

BHARAT PETROLEUM** 2.70 P1+(SO)<br />

HINDUSTAN PETROLEUM** 2.49 A1+(SO)<br />

DLF LTD** 1.83 A1(SO)<br />

DLF LTD** 0.73 F1(SO)<br />

SHRIRAM TRANSPORT FINANCE COMPANY LTD** 0.30 F1+(SO)<br />

POWER FINANCE CORP** 1.77 AAA(SO)<br />

ABS** 0.04 AAA(SO)<br />

NTPC LTD** 0.04 AAA(SO)<br />

Cash & Current Assets<br />

Bills Discounted<br />

Sovereign<br />

Portfolio & Asset Allocation<br />

Issuer % to Net Rating<br />

Assets<br />

WOCKHARDT** 0.02 F1+(SO)<br />

L & T Finance Ltd.** 0.01 P1+(SO)<br />

BHARTI VENTURES LIMITED LOAN TRUST** 0.01 A1+(SO)<br />

Floating Rate Instruments 6.29<br />

Housing Development Finance Corporation Ltd. 2.12 AAA<br />

Tata Steel Ltd. 1.05 AA<br />

Ultratech Cement Ltd. 1.05 AAA<br />

Housing Development Finance Corporation Ltd. 0.71 LAAA<br />

CitiFinancial Consumer Finance India Ltd 0.70 AA+<br />

Berger Paints India Ltd. 0.33 P1+<br />

Indian Railway Finance Corporation Ltd 0.17 AAA<br />

Tata Sons Ltd. 0.10 AAA<br />

IDBI Bank Ltd. 0.03 AA+<br />

Indian Retail ABS Trust Series 50 18 Oct 09 0.03 AAA(SO)<br />

Corporate Debt 4.31<br />

Housing Development Finance Corporation Ltd.** 1.91 AAA<br />

TRIL Infopark Ltd.** 0.70 PR1+<br />

CitiFinancial Consumer Finance India Ltd** 0.58 AA+<br />

K Raheja Corporation Private Ltd. ** 0.38<br />

Tata Motors Ltd.** 0.35 P1<br />

Kotak Mahindra Prime Ltd.** 0.14 LAA<br />

<strong>Sun</strong>daram Finance Ltd.** 0.14 AA+<br />

<strong>Sun</strong>daram Finance Ltd.** 0.04 LAA+<br />

ICICI Home Finance Company Ltd.** 0.03 LAAA<br />

<strong>Sun</strong>daram Finance Ltd.** 0.02 P1+<br />

Mahindra & Mahindra Financial Services Ltd.** 0.02 AA+<br />

Bills Discounted 1.39<br />

Standard Chartered Bank 1.39<br />

PSU/PFI Bonds/Banks 1.26<br />

IDBI Bank Ltd.** 1.04 AA+<br />

NABARD** 0.18 AAA<br />

Power Finance Corporation Ltd.** 0.04 AAA<br />

IDFC Ltd.** 0.01 AAA<br />

Government Bond 0.25<br />

6.96 Govt Bond <strong>2009</strong> 0.21 Sovereign<br />

5.87 Govt Bond 2010 0.04 Sovereign<br />

Cash & Current Assets 14.75<br />

Total Net Asset 100.00<br />

** Represents thinly traded/ non traded securities and illiquid securities.Total Percentage <strong>of</strong> thinly/non traded securities is 14.26 %.<br />

AAA<br />

AA<br />

1.39%<br />

0.25%<br />

6.82%<br />

14.75%<br />

76.41%<br />

O<strong>the</strong>r Parameter<br />

Average Maturity : 0.36 Years<br />

Yield to Maturity : 8.40%<br />

(<strong>for</strong> Debt Component)<br />

Standard Deviation : 0.25%<br />

CRISIL~CPR 2^^<br />

<strong>Birla</strong> <strong>Sun</strong> <strong>Life</strong> Liquid Plus - Retail<br />

Debt: Liquid Plus (27 Schemes), 1yr ended 31-Dec-08<br />

#<br />

Value Research Rating<br />

<strong>Birla</strong> <strong>Sun</strong> <strong>Life</strong> Liquid Plus - Institutional Plan<br />

Debt: Liquid Plus Inst (18 Schemes), 18 months & 3 years ended 31-Jan-09<br />

34<br />

Note:<br />

Standard Deviation is calculated on annualised basis using 1 year history <strong>of</strong><br />

monthly returns, source: MFI<br />

@<br />

5-Star Award by ICRA<br />

<strong>Birla</strong> <strong>Sun</strong> <strong>Life</strong> Liquid Plus - Institutional Plan<br />

Open Ended Liquid Plus - Institutional Plan (34 Schemes), 1 year ended 31-Dec-08<br />

(Past per<strong>for</strong>mance is no guarantee <strong>of</strong> future results.) <strong>for</strong> ranking methodology please refer page 47