Asia Pacific general insurance - Credit Rating Agency of Bangladesh

Asia Pacific general insurance - Credit Rating Agency of Bangladesh

Asia Pacific general insurance - Credit Rating Agency of Bangladesh

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

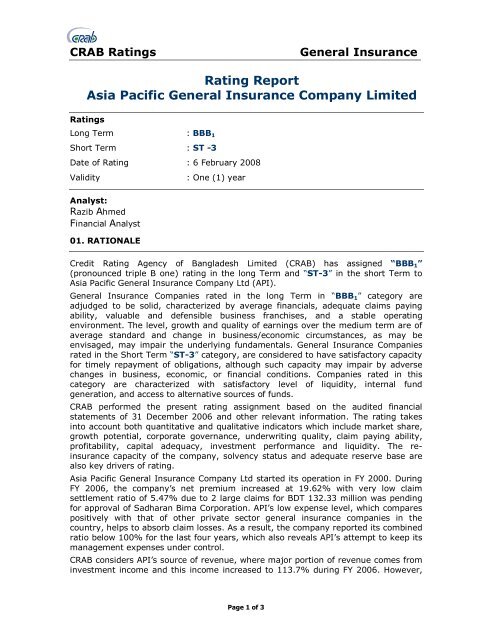

CRAB <strong>Rating</strong>s<br />

General Insurance<br />

<strong>Rating</strong> Report<br />

<strong>Asia</strong> <strong>Pacific</strong> General Insurance Company Limited<br />

<strong>Rating</strong>s<br />

Long Term : BBB 1<br />

Short Term : ST -3<br />

Date <strong>of</strong> <strong>Rating</strong> : 6 February 2008<br />

Validity<br />

: One (1) year<br />

Analyst:<br />

Razib Ahmed<br />

Financial Analyst<br />

01. RATIONALE<br />

<strong>Credit</strong> <strong>Rating</strong> <strong>Agency</strong> <strong>of</strong> <strong>Bangladesh</strong> Limited (CRAB) has assigned “BBB 1 ”<br />

(pronounced triple B one) rating in the long Term and “ST-3” in the short Term to<br />

<strong>Asia</strong> <strong>Pacific</strong> General Insurance Company Ltd (API).<br />

General Insurance Companies rated in the long Term in “BBB 1 ” category are<br />

adjudged to be solid, characterized by average financials, adequate claims paying<br />

ability, valuable and defensible business franchises, and a stable operating<br />

environment. The level, growth and quality <strong>of</strong> earnings over the medium term are <strong>of</strong><br />

average standard and change in business/economic circumstances, as may be<br />

envisaged, may impair the underlying fundamentals. General Insurance Companies<br />

rated in the Short Term “ST-3” category, are considered to have satisfactory capacity<br />

for timely repayment <strong>of</strong> obligations, although such capacity may impair by adverse<br />

changes in business, economic, or financial conditions. Companies rated in this<br />

category are characterized with satisfactory level <strong>of</strong> liquidity, internal fund<br />

generation, and access to alternative sources <strong>of</strong> funds.<br />

CRAB performed the present rating assignment based on the audited financial<br />

statements <strong>of</strong> 31 December 2006 and other relevant information. The rating takes<br />

into account both quantitative and qualitative indicators which include market share,<br />

growth potential, corporate governance, underwriting quality, claim paying ability,<br />

pr<strong>of</strong>itability, capital adequacy, investment performance and liquidity. The re<strong>insurance</strong><br />

capacity <strong>of</strong> the company, solvency status and adequate reserve base are<br />

also key drivers <strong>of</strong> rating.<br />

<strong>Asia</strong> <strong>Pacific</strong> General Insurance Company Ltd started its operation in FY 2000. During<br />

FY 2006, the company’s net premium increased at 19.62% with very low claim<br />

settlement ratio <strong>of</strong> 5.47% due to 2 large claims for BDT 132.33 million was pending<br />

for approval <strong>of</strong> Sadharan Bima Corporation. API’s low expense level, which compares<br />

positively with that <strong>of</strong> other private sector <strong>general</strong> <strong>insurance</strong> companies in the<br />

country, helps to absorb claim losses. As a result, the company reported its combined<br />

ratio below 100% for the last four years, which also reveals API’s attempt to keep its<br />

management expenses under control.<br />

CRAB considers API’s source <strong>of</strong> revenue, where major portion <strong>of</strong> revenue comes from<br />

investment income and this income increased to 113.7% during FY 2006. However,<br />

Page 1 <strong>of</strong> 3

CRAB <strong>Rating</strong>s<br />

General Insurance<br />

revenue from company’s core business, which is underwriting pr<strong>of</strong>it, is only 25% <strong>of</strong><br />

total revenue. API should take initiative to modify its revenue pattern by grabbing<br />

more <strong>insurance</strong> business.<br />

KEY FINANCIAL INDICATORS 2006 2005 2004<br />

Gross Premium 89.42 70.06 52.52<br />

Net Premium 46.35 38.75 31.23<br />

Underwriting Pr<strong>of</strong>it 7.70 7.08 6.37<br />

Net Pr<strong>of</strong>it (before tax) 26.59 14.41 11.33<br />

Paid up Capital 175.00 175.00 70.00<br />

Shareholders Equity 192.30 187.71 70.30<br />

Investment 212.20 191.40 82.00<br />

Investment Yield 10.73% 5.57% 8.82%<br />

Combined Ratio 99.58% 95.50% 73.49%<br />

Return on Average Assets (ROAA) 10.18% 7.85% 10.22%<br />

Current Ratio (times) 4.29 4.18 2.55<br />

Risk Retention Ratios 51.84% 55.31% 59.45%<br />

Although <strong>Asia</strong> <strong>Pacific</strong> General Insurance<br />

Company Ltd has experienced<br />

<strong>insurance</strong> pr<strong>of</strong>essionals at the top<br />

management, the company is yet to<br />

have a competent mid level<br />

management mainly due to relatively<br />

small size <strong>of</strong> the organization. Due to<br />

same reasons, there has been lack <strong>of</strong><br />

standardized internal control and<br />

management information system<br />

(MIS). The IT infrastructure <strong>of</strong> the<br />

company is in the primary stage and<br />

API is yet to adopt a computerized<br />

system and integrated s<strong>of</strong>tware for<br />

accounting, underwriting, claims and<br />

re<strong>insurance</strong>.<br />

The rating also considers the sponsor<br />

support <strong>of</strong> the company. Mr. A.H.M<br />

Mustafa Kamal, a chartered accountant<br />

and former Member <strong>of</strong> national<br />

Parliament is the founder chairman <strong>of</strong><br />

API. He is also the chairman <strong>of</strong> the LK<br />

Group. The rest <strong>of</strong> the Board members<br />

are also qualified and experienced in<br />

their respective fields. There is no<br />

independent director in the Board<br />

though SEC has instructed listed<br />

companies to do so.<br />

Solvency Margin <strong>of</strong> API declined to<br />

14.33 times in FY 2006 from 17.19<br />

times in FY 2005; however the position<br />

is still at a commendable level. The<br />

liquidity position <strong>of</strong> the company<br />

remained at satisfactory level. The<br />

Page 2 <strong>of</strong> 3

CRAB <strong>Rating</strong>s<br />

General Insurance<br />

current assets stood at BDT 248.52<br />

million in FY 2006, which is 4.29 times<br />

higher than company’s current<br />

liabilities.<br />

The company’s retention rate is in<br />

declining trend from the FY 2004 reach<br />

to 51.84% in FY 2006. From the very<br />

beginning, API maintained required<br />

technical reserve as per Insurance Act<br />

1938. In addition to such reserve, the<br />

company also maintained BDT 11.50<br />

million as exceptional losses and BDT<br />

5.50 as reserve fund which was<br />

cumulative over the years.<br />

During FY 2006, the company declared<br />

10% dividend for its shareholders. The<br />

management have plan to give at least<br />

10% dividend each year in future. For<br />

that purpose, API maintains reserve <strong>of</strong><br />

certain amount from its pr<strong>of</strong>it.<br />

Page 3 <strong>of</strong> 3