READ MORE - Jade Invest

READ MORE - Jade Invest

READ MORE - Jade Invest

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

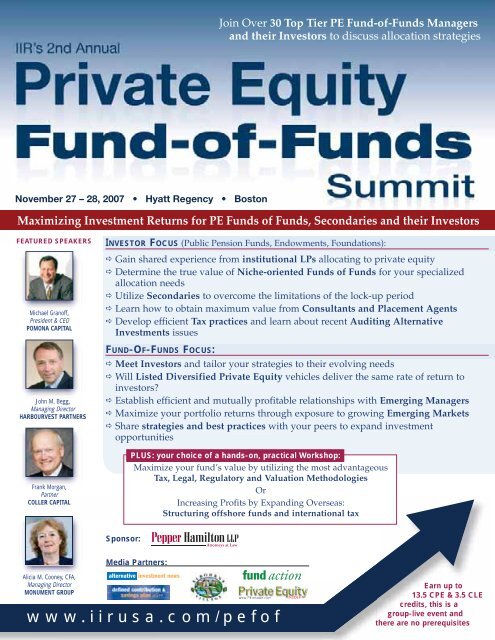

FEATURED SPEAKERS<br />

Michael Granoff,<br />

President & CEO<br />

POMONA CAPITAL<br />

John M. Begg,<br />

Managing Director<br />

HARBOURVEST PARTNERS<br />

Frank Morgan,<br />

Partner<br />

COLLER CAPITAL<br />

INVESTOR FOCUS (Public Pension Funds, Endowments, Foundations):<br />

Gain shared experience from institutional LPs allocating to private equity<br />

Determine the true value of Niche-oriented Funds of Funds for your specialized<br />

allocation needs<br />

Utilize Secondaries to overcome the limitations of the lock-up period<br />

Learn how to obtain maximum value from Consultants and Placement Agents<br />

Develop efficient Tax practices and learn about recent Auditing Alternative<br />

<strong>Invest</strong>ments issues<br />

FUND-OF-FUNDS FOCUS:<br />

Meet <strong>Invest</strong>ors and tailor your strategies to their evolving needs<br />

Will Listed Diversified Private Equity vehicles deliver the same rate of return to<br />

investors?<br />

Establish efficient and mutually profitable relationships with Emerging Managers<br />

Maximize your portfolio returns through exposure to growing Emerging Markets<br />

Share strategies and best practices with your peers to expand investment<br />

opportunities<br />

PLUS: your choice of a hands-on, practical Workshop:<br />

Maximize your fund’s value by utilizing the most advantageous<br />

Tax, Legal, Regulatory and Valuation Methodologies<br />

Or<br />

Increasing Profits by Expanding Overseas:<br />

Structuring offshore funds and international tax<br />

Sponsor:<br />

Media Partners:<br />

Alicia M. Cooney, CFA,<br />

Managing Director<br />

MONUMENT GROUP<br />

www.iirusa.com/pefof<br />

Earn up to<br />

13.5 CPE & 3.5 CLE<br />

credits, this is a<br />

group-live event and<br />

there are no prerequisites

Dear Private Equity Executive,<br />

Join us in Boston and learn about the best strategies and solutions for Primary and Secondary Funds of Funds<br />

and their <strong>Invest</strong>ors to help them maximize their investment returns, while mitigating risks of possible market<br />

decline.<br />

LIMITED PARTNER EXPANDED ROLE<br />

Based on your feedback from last year, we have expanded the Limited Partners’ role in the event: Hear firsthand<br />

insight on what the investors are looking for while considering allocation to PE Funds of Funds.<br />

NEW AND ADDED VALUE<br />

INTERACTIVE PANELS AND PROFESSIONAL DISCUSSIONS will give you:<br />

Solution to mitigate risks at possible stress in the Buy-out market<br />

<br />

<br />

<br />

<br />

Strategies to drive up returns by investing in Global Emerging Markets<br />

Benefits & drawbacks of going public: Will the growing trend affect investors’ fund valuations?<br />

Best strategies to accommodate <strong>Invest</strong>ors’ needs - Impact of Secondaries and Stapled Secondaries<br />

Solutions to meet investors’ needs for specialized capital allocations: Case studies from Focused and<br />

Niche-oriented Funds of Funds<br />

Who Should Attend<br />

and Whom I Will Meet:<br />

✓ PE Limited Partners<br />

✓ Funds of Funds Managers<br />

✓ Secondary Fund Managers<br />

✓ Buy-out and Venture Capital<br />

Fund Managers<br />

✓ PE General Partners<br />

✓ Managing Partners<br />

✓ Principals<br />

✓ Chief <strong>Invest</strong>ment Officers<br />

✓ Chief Financial Officers<br />

✓ Alternative <strong>Invest</strong>ment Managers<br />

and Directors<br />

✓ High Net Worth Individuals<br />

✓ Consultants<br />

✓ Placement Agents<br />

✓ Accountants<br />

✓ Attorneys<br />

PLUS make sure you sign up for one of our in-depth, operational Workshops:<br />

Private Equity market is projected to have a record year in terms of size and scope of deals, according to a<br />

Credit Suisse Global Product Marketing Research. In this market, oversaturated with debt and with strong<br />

signs of investors’ high tolerance for risk, some analysts predict it is not too far from a rapid credit downturn.<br />

So, take this opportunity to hear and implement the most progressive tactical approaches to the most<br />

pressing industry issues. To register, call 888.670.8200, e-mail register@iirusa.com or visit us at<br />

www.iirusa.com/PEFoF<br />

We look forward to meeting you this November.<br />

Best Regards,<br />

Maximize your fund’s value by utilizing the most advantageous<br />

Tax, Legal, Regulatory and Valuation Methodologies<br />

Or<br />

Increasing Profits by Expanding Overseas:<br />

Structuring offshore funds and international tax<br />

Andrey V. Lyutykh<br />

Event Executive Director<br />

INSTITUTE FOR INTERNATIONAL RESEARCH<br />

Why Attend:<br />

❑ Access an assembly of LPs,<br />

giving their perspectives on<br />

investing in Funds of Funds<br />

❑ The most active Fund-of-Funds<br />

industry experts share their<br />

perspectives on the most<br />

pressing industry issues<br />

❑ Maximize your return potentials<br />

by implementing the best<br />

practices in valuation<br />

methodologies<br />

❑ Discuss the most favorable tax<br />

and accounting compliance<br />

solutions for Funds of Funds<br />

and LPs<br />

❑ Find out what Consultants are<br />

looking for in a Fund-of-Funds<br />

while advising to LPs<br />

❑ Develop efficient due diligence<br />

practices while establishing new<br />

fund relationships<br />

❑ Assess the growing<br />

opportunities of investing in<br />

Emerging Markets<br />

HEAR FROM THE TOP INDUSTRY EXPERTS:<br />

Ken Lehman - Chair<br />

KENDALL INVESTMENTS, LLC<br />

Christopher Baucom<br />

FORT WASHINGTON CAPITAL<br />

PARTNERS GROUP<br />

John M. Begg<br />

HARBOURVEST PARTNERS, LLC<br />

Marc Bonavitacola, CFA<br />

SVG CAPITAL<br />

Steven D. Bortnick<br />

PEPPER HAMILTON LLP<br />

Colin McClellan Breeze<br />

BREEZE VENTURES<br />

Dan Cahill<br />

STANDARD LIFE INVESTMENTS<br />

Stephen H. Can<br />

CREDIT SUISSE<br />

Lorelei Chao<br />

OCERS<br />

Alicia M. Cooney, CFA<br />

MONUMENT GROUP<br />

Julia D. Corelli<br />

PEPPER HAMILTON LLP<br />

Neal Costello<br />

ALPINVEST PARTNERS<br />

Thomas P. Danis, Jr.<br />

RCP ADVISORS<br />

William B. Franklin<br />

BANK OF AMERICA CAPITAL<br />

CORPORATION<br />

Marc Friedberg, CFA<br />

WILSHIRE ASSOCIATES<br />

INCORPORATED<br />

Timothy Grady<br />

PRICEWATERHOUSECOOPERS LLP<br />

Michael Granoff<br />

POMONA CAPITAL<br />

Charles R. Grant, CPA<br />

LEXINGTON PARTNERS<br />

Jason Gull<br />

ADAMS STREET<br />

Kevin Kester<br />

SIGULER GUFF<br />

Peter von Lehe<br />

LEHMAN BROTHERS<br />

James Lim<br />

MONTAGU NEWHALL<br />

Brooks Lindberg<br />

PARTNERS GROUP<br />

William J. Monagle Jr.<br />

NEW ENGLAND PENSION<br />

CONSULTANTS<br />

Frank Morgan<br />

COLLER CAPITAL<br />

Ludvig Nilsson<br />

JADE ALTERNATIVE INVESTMENT<br />

ADVISORS<br />

Kurtay Ogunc<br />

STOWBRIDGE PARTNERS<br />

Ajay Saini<br />

GROVE STREET ADVISORS<br />

Kate Sidebottom<br />

PARISH CAPITAL<br />

Crocker Snow Jr.<br />

GLOBAL HORIZON PARTNERS, LLC<br />

Tina E. St. Pierre<br />

LANDMARK PARTNERS, INC.<br />

Michael B. Staebler<br />

PEPPER HAMILTON LLP<br />

Glen Stevenson, CPA, MST<br />

NAUTIC PARTNERS<br />

Steve J. Taubman<br />

VCFA<br />

Alexandre Tilmant<br />

BNP PARIBAS<br />

Peter Tropper<br />

INTERNATIONAL FINANCE<br />

CORPORATION<br />

Mel A. Williams<br />

TRUEBRIDGE CAPITAL PARTNERS<br />

(Formerly with UNC<br />

MANAGEMENT COMPANY)<br />

Brian Williamson<br />

OPPENHEIMER & CO.<br />

Shelley M. Zoler<br />

TIAA-CREF<br />

PCG INTERNATIONAL – TBC<br />

Fax: (941) 365-2507 • Call: (888) 670-8200 • E-Mail: register@iirusa.com • Internet: www.iirusa.com/PEFoF

DAY ONE: 27 November 2007 • Main Conference<br />

8:30 Registration & Morning Coffee<br />

9:00 Chairman’s Welcome and Opening Remarks<br />

Ken Lehman, Managing Partner, KENDALL INVESTMENTS<br />

9:15 Opening Panel: Challenges and Opportunities in the<br />

Current Private Equity Fund-of-Funds Marketplace<br />

• Learn about the best practices to maximize your portfolio<br />

returns in the current economic environment<br />

• Determine effective exit strategies while considering the<br />

impending risk of a buy-out market downfall, triggered by<br />

increasing amounts of capital<br />

• Can Venture Capital investment allocations bring significant<br />

value to your FoF portfolio: Are returns in VC rebounding or<br />

is the venture model broken?<br />

• Develop successful co-investing programs: Determining risks<br />

and rewards of gaining access to premium funds<br />

• Matching your investment model to take advantage of<br />

current and forecast returns in the private capital markets<br />

Moderator<br />

Michael Granoff, President & CEO, POMONA CAPITAL<br />

Expert Speakers<br />

Thomas P. Danis, Jr., Managing Principal Discretion, RCP ADVISORS<br />

Charles R. Grant, CPA, Partner, LEXINGTON PARTNERS<br />

Dan Cahill, Managing Dir., PE, STANDARD LIFE INVESTMENTS<br />

10:20 Professional Roundtables<br />

Share your challenges, solutions and success stories with your<br />

peers, prospective clients and new market players during this<br />

informal and interactive session. Participants are encouraged to<br />

bring their specific issues or concerns to discuss with the group.<br />

NEW!<br />

10:45 Mid-Morning Break<br />

11:00 Panel Discussion: Niche-oriented Funds of Funds -<br />

Earn maximum value by employing focused strategies<br />

In this discussion, panelists will engage in a dynamic discussion<br />

on the essential differences among various niche-oriented Funds<br />

of Funds and where investors can find most value. You’ll leave<br />

this session with insight into how niche funds are differentiated,<br />

in terms of structure, risk profile and return expectations, and<br />

how to appropriately match these funds to your investment<br />

objectives. You’ll also hear real-world case studies<br />

demonstrating how FoF managers deploy niche funds into their<br />

allocation mix to complement their other investments, and how<br />

you can apply these tools to your own portfolio.<br />

NEW!<br />

Moderator<br />

Thomas P. Danis, Jr., Managing Principal Discretion, RCP ADVISORS<br />

Expert Speakers<br />

Kate Sidebottom, VP, PARISH CAPITAL<br />

Kevin Kester, Managing Dir., SIGULER GUFF<br />

James Lim, General Partner, MONTAGU NEWHALL<br />

• Determine the best models to assess the value of a<br />

transaction for an LP<br />

• Building effective due diligence, manager selection and<br />

screening models to ensure you’re hiring the most<br />

appropriate advisor for your funds<br />

Moderator<br />

Alicia M. Cooney, CFA, Managing Dir., MONUMENT GROUP<br />

Expert Speakers<br />

Christopher Baucom, VP of PE,<br />

FORT WASHINGTON CAPITAL PARTNERS<br />

Marc Friedberg, CFA, Managing Dir., WILSHIRE ASSOCIATES<br />

William J. Monagle Jr., Partner,<br />

NEW ENGLAND PENSION CONSULTANTS<br />

2:45 Afternoon Break<br />

3:05 Spotlight on Legal Issues: Developing FoF Strategies<br />

for Dealing With What You Don't Control<br />

• Negotiating favorable terms and conditions of the<br />

Underlying Funds in your portfolio - frequent side letter<br />

strategies<br />

• Structure optimally beneficial Co-<strong>Invest</strong>ment Rights to<br />

maximize returns on your investments and opportunities to<br />

your investors<br />

• Develop effective tactics for governing underlying funds and<br />

their portfolio companies<br />

• Ensure receipt of information valuable to you and your<br />

investors<br />

• Plan Asset Rules - strategies for structuring around fiduciary<br />

liabilities when VCOC is not an option<br />

• Ensure efficient indemnification provisions for your funds -<br />

identifying the proper indemnitor and ensuring the best<br />

protection<br />

Moderators<br />

Julia D. Corelli, Partner, PEPPER HAMILTON LLP<br />

Michael B. Staebler, Partner, PEPPER HAMILTON LLP<br />

3:35 <strong>Invest</strong>ors’ Panel: LPs’ perspective on PE Fund-of-Funds<br />

- Where do investors find the most value?<br />

• Practical approaches to selecting and monitoring FoF<br />

managers to address and overcome transparency and<br />

reporting issues<br />

• Determine the best allocation model that suits your<br />

investment needs: Primary v Secondaries<br />

• Search for better flexibility in managing funds: Employing an<br />

investment manager v allocating through FoF<br />

• Discuss the outflow of human capital from institutional<br />

investors to PE Funds of Funds<br />

• Hear about LPs’ return expectations and their position on<br />

pricing and fee structure<br />

• Learn how to partner with FoF by becoming a more active<br />

and strategic co-investor<br />

Expert Speakers<br />

12:00 Lunch for Conference Attendees and Speakers<br />

Lorelei Chao, <strong>Invest</strong>ment Officer, OCERS<br />

1:15 Panel Discussion: Successfully adapting your<br />

Mel A. Williams, General Partner,<br />

investment strategies amid the increasing role of<br />

TRUEBRIDGE CAPITAL PARTNERS<br />

(Former VP, Dir. of Private <strong>Invest</strong>ments with<br />

Consultants and Placement Agents in the Fund-of-<br />

UNC MANAGEMENT COMPANY)<br />

Funds marketplace<br />

Peter Tropper, Principal Funds Specialist,<br />

• Adapt to the criteria that consultants employ to select FoFs<br />

INTERNATIONAL FINANCE CORPORATION<br />

while advising to LPs<br />

• Do Placement Agents add value and really find better<br />

Shelley M. Zoler, Dir., Alternative <strong>Invest</strong>ments, TIAA-CREF<br />

opportunities for LPs?<br />

4:45 End of Day One<br />

Fax: (941) 365-2507 • Call: (888) 670-8200 • E-Mail: register@iirusa.com • Internet: www.iirusa.com/PEFoF<br />

NEW!<br />

NEW!<br />

NEW!

DAY TWO: 28 November 2007 • Main Conference<br />

8:30 Registration & Morning Coffee<br />

8:50 Chairman’s Recap of Day One<br />

Ken Lehman, Managing Partner, KENDALL INVESTMENTS<br />

9:00 Secondaries’ Panel: Gaining Liquidity Through the Use<br />

of the Secondary Funds Marketplace<br />

• Stapled Secondaries: Assess the new ways to accommodate<br />

investors’ need for flexible investment conditions<br />

• Analyze the recent trends and future outlook to identify the<br />

most lucrative investment opportunities<br />

• Who brings the most value to investors, Primary FoFs or<br />

Secondaries?<br />

• Taking advantage of price competition in the secondary<br />

markets to uncover new return streams<br />

Moderator<br />

Frank Morgan, Partner, COLLER CAPITAL<br />

Expert Speakers<br />

John M. Begg, Managing Dir., HARBOURVEST PARTNERS<br />

Stephen H. Can, Managing Dir., CREDIT SUISSE<br />

Neal Costello, <strong>Invest</strong>ment Manager, ALPINVEST PARTNERS<br />

Steve J. Taubman, Managing Partner, VCFA<br />

Jason Gull, Partner, ADAMS STREET<br />

10:00 Panel Discussion: Global Emerging Markets Funds of<br />

Funds - Enhance Your Returns via Cross-Border<br />

<strong>Invest</strong>ment Programs<br />

• Improve success with cross-border investment programs by<br />

developing a comprehensive and strategic investment plan<br />

• Build trust with your partners and gain a deeper<br />

understanding of the regulatory environment by establishing<br />

a local presence in the market<br />

• Increase your returns by constructing an investment program<br />

that leverages the specific or unique competitive advantages<br />

of the market<br />

• Maximize potential returns by deploying robust risk<br />

management and due diligence practices when working with<br />

emerging products and GPs<br />

Expert Speakers<br />

Kurtay Ogunc, Partner & Co-Founder, STOWBRIDGE PARTNERS<br />

Crocker Snow Jr., Founder, Chairman,<br />

GLOBAL HORIZON PARTNERS<br />

Colin McClellan Breeze, Managing Member, BREEZE VENTURES<br />

Ludvig Nilsson, Managing Partner, JADE ADVISORS<br />

PCG INTERNATIONAL – (speaker confirmation forthcoming)<br />

11:00 Mid-Morning Break<br />

11:20 Panel Discussion: What <strong>Invest</strong>ors Should Expect From<br />

the Growing Market of Listed PE Vehicles<br />

• Learn how challenges with listed and private FoFs can<br />

reduce valuations or increase investment risks<br />

• Maximize the value of a listed PE vehicle by understanding<br />

how <strong>Invest</strong>ment Banks affect or influence the value of listed<br />

funds<br />

• Learn if LPs will see returns from Listed Diversified<br />

investment vehicles comparable to privately held funds<br />

• Strategies for FoFs to effectively market themselves in<br />

response to increased liquidity from Listed PE vehicles<br />

NEW!<br />

Expert Speakers<br />

Peter von Lehe, Managing Dir., LEHMAN BROTHERS<br />

Marc Bonavitacola, CFA, Dir., SVG CAPITAL<br />

William B. Franklin, Managing Dir.,<br />

BANK OF AMERICA CAPITAL CORP<br />

Brooks Lindberg, Principal, PARTNERS GROUP<br />

12:10 Panel Discussion: Challenges and Rewards in<br />

Identifying and Selecting Emerging General Partners<br />

• Terms and Conditions of investing with FoF: What is being<br />

negotiated between FoF and PE?<br />

• Develop effective due diligence practices while establishing<br />

new fund relationships<br />

• Tactics for setting reporting, disclosure and transparency<br />

agreements to ensure productive and clear communication<br />

among all parties<br />

NEW!<br />

Moderator<br />

Ken Lehman, Managing Partner, KENDALL INVESTMENTS<br />

Expert Speakers<br />

Alexandre Tilmant, Managing Dir., BNP PARIBAS<br />

Brian Williamson, Managing Dir., OPPENHEIMER & CO.<br />

1:00 Chairman’s Closing Remarks<br />

Ken Lehman, Managing Partner, KENDALL INVESTMENTS<br />

About the Venue:<br />

Fresh twists. Inspired decor. The<br />

distinctive Hyatt Regency Boston is<br />

ideally situated in the heart of Boston's<br />

theater, retail, and financial districts,<br />

within walking distance of Boston<br />

Common, Faneuil<br />

Hall, and Newbury<br />

Street. Spectacularly<br />

renovated to the tune of $10.5<br />

million, Hyatt Regency Boston is the<br />

ideal spot for your getaway. Feel the<br />

Hyatt Touch.<br />

About the Sponsor:<br />

Pepper Hamilton LLP (www.pepperlaw.com) is a multipractice<br />

law firm with more than 450 lawyers in seven<br />

states and the District of Columbia. The firm provides<br />

corporate, litigation and regulatory legal services to<br />

leading businesses, governmental entities,<br />

nonprofit organizations and individuals<br />

throughout the nation and the world. The<br />

firm was founded in 1890.<br />

Fax: (941) 365-2507 • Call: (888) 670-8200 • E-Mail: register@iirusa.com • Internet: www.iirusa.com/PEFoF

DAY TWO: 28 November 2007<br />

• Post-Conference Workshop<br />

1:10 Workshop Registration and Lunch for Workshop Attendees and Leaders<br />

2:00 Workshop A: Earn 3.5 CLE<br />

2:00 Workshop B:<br />

Credits<br />

Maximize your fund’s value by utilizing the<br />

most advantageous Tax, Legal, Regulatory<br />

and Valuation Methodologies<br />

Increasing Profits by Expanding Overseas:<br />

Structuring offshore funds and international tax<br />

Attendees will analyze various GPs’ and LPs’ perspectives on the underlying issues<br />

affecting Funds of Funds’ and their investors’ operations. Participants will learn the<br />

best tactics to mitigate litigation risk, gain advantage of recent tax regulations and<br />

effectively apply reporting valuation guidelines.<br />

Delegates then will be asked to analyze practical examples and work through<br />

hypothetical case studies to illustrate how these issues affect the structure,<br />

investment process, and returns of a fund of funds. Following the hypothetical case<br />

study, there will be plenty of time for Q&A and discussion of your own deals.<br />

Delegates will leave the workshop with practical tools to:<br />

• Effectively structure your fund operations based on Federal tax regulations and<br />

increasingly more aggressive approach by the states to tax collection<br />

• Gain maximum tax advantage through hands-on analysis of domestic and<br />

foreign LPs tax withholding issues<br />

• Mitigate the impact of FAS 157, Fair Value Measurements and recent trends<br />

when performing valuations or accounting activities<br />

• Improve your accounting practices by understanding the impact of the AICPA's<br />

Interpretation of AU 332, Auditing Alternative <strong>Invest</strong>ments<br />

• Manage FOIA and other disclosure requirements when structuring deals<br />

• Learn how valuations are put together and how to effectively calculate fair<br />

market value for the underlying funds<br />

Leaders:<br />

Tina E. St. Pierre, Principal, LANDMARK PARTNERS<br />

Timothy Grady, Assurance Partner, PWC LLP<br />

Glen Stevenson, CPA, MST, Tax Dir., NAUTIC PARTNERS<br />

Ajay Saini, CFO, GROVE STREET ADVISORS<br />

Steven D. Bortnick, Partner, PEPPER HAMILTON LLP<br />

Exploring opportunities abroad exposes for major funding and tax advantages, but<br />

structuring and maintaining your offshore funds requires a concrete understanding<br />

of international taxation and regulations.<br />

Using a practical, hands-on approach, participants will walk through hypothetical<br />

case studies to identify requirements and obtain the skills to successfully establish<br />

offshore funds.<br />

Leading Offshore Fund Formation and Structuring<br />

• Choosing where to domicile your fund and fund management<br />

• Managing U.S. tax sensitive investors with foreign investment target limitations<br />

• Measures to reduce taxable presence risks in the US and other high-tax<br />

jurisdictions<br />

• Reducing currency risk and choosing a denomination that benefits both sides of<br />

the partnership<br />

• The “nuts and bolts” of maintaining and operating an offshore fund<br />

Minimizing US and Foreign Taxes<br />

• Harnessing the value of bi-lateral income tax treaties and avoiding unfavorable<br />

tax regimes<br />

• Managing off-shore funds in tax favorable jurisdictions such as the Cayman and<br />

Jersey Islands<br />

• Planning around anti-deferral tax regimes and minimizing phantom income<br />

risks<br />

• Avoiding taxation as a corporation and choosing the most tax-favorable entity<br />

Capitalizing on International Structural Opportunities<br />

• Attracting a larger investor base using alternative and parallel investment<br />

vehicles<br />

• Taking advantage of structures to facilitate regional or country specific<br />

investments (e.g., The Netherlands, Luxembourg, Mauritius, Cyprus, Spain and<br />

Singapore )<br />

• Managing exit events and planning for tax efficient repatriation and exit<br />

transactions<br />

Leaders:<br />

Kathleen Hayes, CFO and Controller, AMCI CAPITAL<br />

Arturo Requenez, Partner, MCDERMOTT, WILL AND EMORY<br />

5 Easy Ways to Register<br />

REGISTRATIONS:<br />

Please complete and return the registration form to Customer Service Manager:<br />

FAX: (941) 365-2507 • CALL: (888) 670-8200 or (941) 951-7885<br />

MAIL: IIR NY, P.O. Box 3685, Boston, MA 02241-3685<br />

EMAIL: register@iirusa.com • WEB: http://www.iirusa.com/PEFoF<br />

Group Discounts Available: Please contact Aloycia Bellillie at (212) 661-3500 ext. 3702 for<br />

details. No two discounts can be combined.<br />

Fee: The standard fee for attending IIR’s 2nd Annual Private Equity Fund-of-Funds Summit is<br />

outlined on the registration form. This includes the luncheon and refreshments, and the<br />

conference documentation and materials submitted by the speakers. You may enclose payment<br />

with your registration or we will send an invoice. Payment is due within 30 days of registering. If<br />

registering within 30 days of the event, payment is due immediately. Payments may be made by<br />

check, Visa, MasterCard, Discover, Diners Club or American Express. Please make all checks<br />

payable to the “Institute for International Research, Inc.” and write the name of the delegate(s)<br />

on the face of the check, as well as our reference code: U2056. If payment has not been<br />

received prior to registration the morning of the conference, a credit card hold will be required.<br />

Dates and Venue:<br />

27-28 November 2007<br />

Hyatt Regency Boston • One Avenue de Lafayette, Boston, MA 02111<br />

Accommodations: A block of rooms will be held for a limited period of time at the Hyatt<br />

Regency Boston. All hotel bookings must be made through The Global Executive's<br />

Internet booking site. Please visit www.globalexec.com/iir to make your reservation. If you<br />

do not have web access, or need additional assistance, please call The Global Executive at<br />

(800) 516-4265 or (203) 431-8950. You can also send them an email at conf@globalexec.com<br />

or fax them at (203) 431-9305. The hotel will not accept individual calls for room reservations at<br />

the IIR negotiated group rate. Please make sure you mention the event code U2056.<br />

Substitutions and Cancellations: If you need to make any changes or have any questions,<br />

please feel free to contact us via email at register@iirusa.com. Cancellations must be in writing<br />

and must be received by IIR prior to 10 business days before the start of the event. Upon<br />

receipt of a timely cancellation notice, IIR will issue a credit voucher for the full amount of your<br />

payment, which may be applied towards registration fees at any future IIR event held within 12<br />

months after issuance (the “Expiration Date”). All credit vouchers shall automatically expire on<br />

the Expiration Date and shall thereupon become void. In lieu of issuance of a credit voucher, at<br />

your request, IIR will issue a refund less a $395 processing fee per registration. Registrants are<br />

5:00 Workshops Conclude * There will be a 20-minute break at 3:15pm.<br />

ADMINISTRATIVE DETAILS<br />

advised that no credit vouchers or refunds will be issued for cancellations received less than ten business days prior to<br />

start of the event, including cancellations due to weather or other causes beyond the Registrant’s control. IIR therefore<br />

recommends that registrants allow for unexpected delays in making travel plans. Substitutions are welcome at any time.<br />

If for any reason IIR decides to cancel this conference, IIR accepts no responsibility for covering airfare, hotel or other<br />

costs incurred by registrants, including delegates, sponsors, speakers and guests.<br />

Documentation Order: If you are unable to attend the program, or would simply like to order additional sets of<br />

documentation for your colleagues, they are available for $395 per set, including taxes, postage and shipping in the U.S.<br />

Please fill out the order form on the back of the brochure. The documentation is available for shipment two weeks after the<br />

conference takes place. CREDIT CARD PAYMENT ONLY.<br />

Any disabled individual desiring an auxiliary aid for this conference should notify IIR at least 3 weeks prior to the<br />

conference in writing by faxing (212) 661-6045.<br />

Sponsored Events and Table Top Exhibits: Are you looking for a creative way to reach top-level decision-makers? Why<br />

not consider sponsoring a luncheon, cocktail party or refreshment break? Maybe you’re looking for the perfect forum to<br />

showcase your products and services or an onsite communication center. For information on sponsorship or exhibition<br />

opportunities please contact Jeffrey Dubs, 212-661-3500, ext. 3082, or JDubs@IIRUSA.com.<br />

Exhibitions: Exhibit space will be available at this conference offering you the perfect forum to showcase your products<br />

and services. This is your chance to make valuable contacts and have your tabletop display serve as your<br />

communications center. Please call Jeffrey Dubs, 212-661-3500, ext. 3082, or JDubs@IIRUSA.com for showcase<br />

opportunities.<br />

Complaint Resolution Policy: For more information regarding administrative policies such as complaint and refund, please<br />

contact our offices at (888) 670-8200 or (941) 951-7885.<br />

Institute for International Research is registered with the National Association of State Boards of Accountancy<br />

(NASBA) as a sponsor of continuing professional education on the National Registry of CPE Sponsors. State<br />

boards of accountancy have final authority on the acceptance of individual courses for CPE credit. Complaints<br />

regarding registered sponsors may be addressed to the National Registry of CPE Sponsors, 150 Fourth Avenue<br />

North, Nashville, TN 37219-2417. Web site: www.nasba.org This is an intermediate course and no advance preparation<br />

is required<br />

The Institute for International Research has been certified by the New York State Continuing Legal Education<br />

Board as an Accredited Provider of continuing legal education in the State of New York through June 30, 2003.<br />

Application for renewal of Accredited Provider status is currently pending. CLE credits are available for most other<br />

states and may vary depending on your state’s rules and regulations. For more information on IIR's financial<br />

hardship policy, call Kessha Jones at (212) 661-3500 x 3052.<br />

Institute for International Research (IIR) is dedicated to providing quality continuing legal education to<br />

professionals interested in its course offerings. In that regard, IIR has a financial hardship policy for professionals<br />

who are unable to afford the course tuition but are interested in continuing legal education courses offered at IIR.<br />

For further information regarding IIR’s financial hardship policy, please contact Kessha Jones at 212-661-3500, ex<br />

3052 or via email at kjones@iirusa.com<br />

Fax: (941) 365-2507 • Call: (888) 670-8200 • E-Mail: register@iirusa.com • Internet: www.iirusa.com/PEFoF

IIR’s 2nd Annual Private Equity Fund-of-Funds Summit<br />

Five Easy Ways to Register<br />

Fax: (941) 365-2507 • Call: (888) 670-8200<br />

Mail: Institute for International Research, NY<br />

P.O. Box 3685, Boston, MA 02241-3685<br />

E-Mail: register@iirusa.com • Internet: www.iirusa.com/PEFoF<br />

Yes! Please register the following individual(s) for IIR’s 2nd Annual Private Equity<br />

Fund-of-Funds Summit<br />

Check appropriate box:<br />

Registration Fees<br />

❑ Conference (Including<br />

Workshop*) U2056<br />

Register by<br />

September 21, 2007<br />

Register before<br />

October 26, 2007<br />

Name<br />

Title Department<br />

Name<br />

Title Department<br />

Your Manager Title<br />

Company<br />

Address<br />

City State Zip<br />

Tel: ( ) Fax: ( )<br />

❑ YES! Please keep me informed about future IIR events via fax<br />

Signature<br />

E-Mail:<br />

❑ Yes! Keep me informed about future events via e-mail<br />

Signature<br />

Register after<br />

October 26, 2007<br />

$2,295 $2,395 $2,495<br />

* Please indicate workshop ❑ Workshop A ❑ Workshop B<br />

Plan Sponsor Discount:<br />

❑ Conference (Including<br />

Workshop) U2056C<br />

$795 $895 $995<br />

METHOD OF PAYMENT<br />

❑ I have enclosed my payment ❑ I will register now and pay later**<br />

❑ Please charge my credit card:<br />

❑ Visa ❑ MasterCard ❑ American Express ❑ Diner’s Club ❑ Discover<br />

Credit Card No.<br />

Exp. Date<br />

Signature<br />

**Payment must be received within 30 days of the event<br />

EXHIBITIONS/SPONSORSHIPS:<br />

Please send me more information on how to: ❑ Exhibit ❑ Sponsor<br />

INCORRECT MAILING INFORMATION<br />

If you are receiving multiple mailings, have updated information or would like to be<br />

removed from our database, please call (212) 661-3876 or fax this page to (419)<br />

781-6036. Please keep in mind that amendments can take up to 6 weeks.<br />

PLEASE DO NOT REMOVE MAILING LABEL<br />

U2056<br />

Chairman<br />

Ken Lehman,<br />

Managing Partner<br />

KENDALL INVESTMENTS<br />

Michael Granoff,<br />

President & CEO<br />

POMONA CAPITAL<br />

John M. Begg,<br />

Managing Director<br />

HARBOURVEST PARTNERS<br />

Frank Morgan,<br />

Partner<br />

COLLER CAPITAL<br />

Alicia M. Cooney, CFA,<br />

Managing Director<br />

MONUMENT GROUP<br />

www.iirusa.com/pefof