READ MORE - Jade Invest

READ MORE - Jade Invest

READ MORE - Jade Invest

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

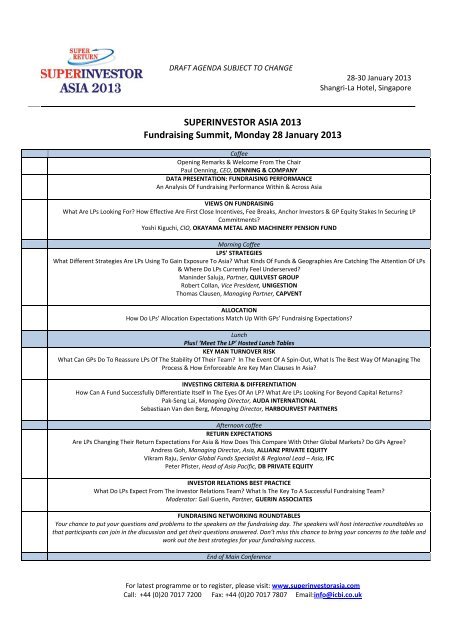

DRAFT AGENDA SUBJECT TO CHANGE<br />

28‐30<br />

January 2013<br />

Shangri‐La Hotel, Singapore<br />

SUPERINVESTOR ASIA 2013<br />

Fundraising Summit, Monday 28<br />

January 2013<br />

Coffee<br />

Opening Remarks & Welcome From The<br />

Chair<br />

Paul Denning, CEO, DENNING & COMPANY<br />

DATA PRESENTATION: FUNDRAISING PERFORMANCE<br />

An<br />

Analysis Of Fundraising Performance Within<br />

& Across Asia<br />

VIEWS ON FUNDRAISING<br />

What Are LPs Looking<br />

For? How Effective Are First Close Incentives, Fee Breaks, Anchor <strong>Invest</strong>orss & GP Equity Stakes In Securing LP<br />

Commitments?<br />

Yoshi Kiguchi, CIO, OKAYAMA METAL<br />

AND MACHINERY PENSION FUND<br />

Morning Coffee<br />

LPS’ STRATEGIES<br />

What Different Strategies<br />

Are LPs Using To Gain Exposure To Asia? What Kinds Of Funds & Geographies Are Catching The Attention Of LPs<br />

& Wheree Do LPs Currently Feel Underserved?<br />

Maninder Saluja, Partner, QUILVEST GROUP<br />

Robert Collan, Vice President, UNIGESTION<br />

Thomas Clausen, Managing Partner, CAPVENT<br />

ALLOCATION<br />

How Do LPs’ Allocation Expectations Match<br />

Up With GPs’ Fundraising Expectations?<br />

Lunch<br />

Plus! ‘Meet The LP’ Hosted Lunch Tables<br />

KEY MAN TURNOVER RISK<br />

What Can GPs Do To Reassure LPs Of The Stability Of Their Team? In<br />

The Event Of A Spin‐Out, What Is The Best Way Of Managing The<br />

Process & How<br />

Enforceable Are Key Man Clauses In Asia?<br />

INVESTING CRITERIA & DIFFERENTIATION<br />

How Can A Fund Successfully Differentiate Itself In The Eyes Of An LP? What Are LPs Looking<br />

For Beyond Capital Returns?<br />

Pak‐Seng Lai, Managing Director, AUDA INTERNATIONAL<br />

Sebastiaan Van den Berg, Managing Director, HARBOURVEST PARTNERS<br />

Afternoonn coffee<br />

RETURN EXPECTATIONS<br />

Are<br />

LPs Changing Their Return Expectations For Asia & How Does This Compare With Other Global Markets?<br />

Do GPs Agree?<br />

Andress Goh, Managing Director, Asia, ALLIANZ PRIVATE EQUITY<br />

Vikram<br />

Raju, Senior Global Funds Specialist & Regional Lead – Asia,<br />

IFC<br />

Peter Pfister, Head of Asia Pacific, DB PRIVATE EQUITY<br />

INVESTOR RELATIONS BEST PRACTICE<br />

What Do LPs Expect From<br />

The <strong>Invest</strong>or Relations Team?<br />

What Is The Key To A Successful Fundraising<br />

Team?<br />

Moderator: Gail Guerin, Partner, GUERIN ASSOCIATES<br />

FUNDRAISING NETWORKING ROUNDTABLES<br />

Your chance to put your questions and problems to the<br />

speakers on the fundraising day. The speakers will host interactive roundtables so<br />

that participants can join in the discussion and get their<br />

questions answered. Don’t miss this chance to bring your concerns to the table and<br />

work out the best strategies for your fundraising success.<br />

End of Main Conference<br />

For latest programme or to register, please visit: www.superinvestorasia.com<br />

Call: +44 (0)20 7017 7200 Fax: +44 (0)20 7017 7807 Email:info@icbi.co.uk

DRAFT AGENDA SUBJECT TO CHANGE<br />

28‐30<br />

January 2013<br />

Shangri‐La Hotel, Singapore<br />

Main Conference Day 1, Tuesday 29 January<br />

2013<br />

Coffee & Registration<br />

Opening Remarks & Welcome From The<br />

Chair<br />

GLOBAL MACROECNOMIC ADDRESS<br />

Examining<br />

The Impact Of<br />

The Continuing Euro Crisis, Sluggish Growth In Developed Economies, Scarcity Of Debt & Volatile <strong>Invest</strong>ment &<br />

Capital Flows<br />

On The Asia Pacific Regional Economies<br />

Joseph Cherian, Director, CAMRI, NATIONAL UNIVERSITY OF SINGAPORE<br />

SINGAPORE<br />

How Is Singapore Developing Itself As An International Finance Hub?<br />

LP CONFIDENTIAL<br />

What Strategies Are LPs Using To Gain Exposure To Asia? How Do Returns Compare Between Funds of Funds, Global, Pan Asian & Country<br />

Specific Funds?<br />

Where Do Secondaries Fit Into This Mix?<br />

Moderator: Claudia Zeisberger, Professor of Decision Sciences & Entrepreneurship, Director Global Private Equity<br />

Initiative, INSEAD<br />

Pierre Fortier, Vice President Funds, CAISSE<br />

DE DÉPÔT ET PLACEMENT DU<br />

QUÉBEC<br />

John Brakey, Head of Private Equity, MLC PRIVATE EQUITY<br />

KEYNOTE ADDRESS<br />

Guy<br />

Hands, Founder, TERRA FIRMA<br />

Morning Coffee<br />

LOCAL CAPITAL<br />

ASIAN LPS<br />

DATA<br />

How Important Will Local LP <strong>Invest</strong>ment Be As A Source Of Capital<br />

For Asian Private Equity? How<br />

Are Regulatory & Other Barriers<br />

Changing For The Different Classes Of LP?<br />

ASIAN LPS<br />

How Do Asian LPs View Private Equity Within & Outside<br />

Of Asia? What Are Their Return Objectives & How Do They<br />

Plan To Reach Them?<br />

Yoshi Kiguchi, CIO, OKAYAMA METAL<br />

AND MACHINERY PENSION FUND<br />

Hideo Kondo, Asset Management Director, DIC PENSION FUND<br />

Houl Lee, CFO & Head of Private Equity, WAH<br />

HIN & CO.<br />

ASIA’S INDUSTRY LEADERS<br />

Which Funds & Strategies Are Destined<br />

To Succeed In The Asian Market? Where Will The Best Opportunities Be Found In Asia Over The<br />

Next 2‐3 Years?<br />

Charles Ong,<br />

Co‐Chairman and Co‐CEO, RRJ CAPITAL<br />

INDONESIA MACROECONOMIC ADDRESS<br />

How Sustainable Is Indonesia’s Current Growth Story? Examining Political,<br />

Demographic & Macroeconomic Change<br />

SOUTH EAST ASIA<br />

What Is The Best Way To Approach <strong>Invest</strong>ing Into South<br />

East Asia? How<br />

Much Capital Can This Region Absorb & Will <strong>Invest</strong>ors Ever<br />

Benefit<br />

From Integration Initiatives Within The ASEAN Region?<br />

Lunch<br />

Plus! ‘Meet The LP’ Hosted Lunch Tables<br />

Track A – INDONESIA & FRONTIER MARKETS<br />

Track B – LP PERSPECTIVES<br />

GENERATING ALPHAA IN INDONESIAN PRIVATE EQUITY<br />

ALLOCATION TO ASIA<br />

On A Rising Market, How Will GPs Generate Alpha In Indonesia?<br />

What Are LPs’ Allocation Plans To & Within Asian Economies?<br />

What<br />

How Sustainable Is The<br />

Development Of The Private Equity<br />

Factors Could Cause This to Change?<br />

Industry & How Effectively Will Capital Be Deployed?<br />

Melissa Ma, Partner, ASIA ALTERNATIVES<br />

Kay Mock, Founding Partner, SARATOGA (tbc)<br />

Leenong<br />

Li, Director, COMMONFUND<br />

CAPITAL<br />

For latest programme or to register, please visit: www.superinvestorasia.com<br />

Call: +44 (0)20 7017 7200 Fax: +44 (0)20 7017 7807 Email:info@icbi.co.uk

DRAFT AGENDA SUBJECT TO CHANGE<br />

28‐30<br />

January 2013<br />

Shangri‐La Hotel, Singapore<br />

ACCESSING THE INDONESIAN GROWTH STORY<br />

How Much Exposure To Indonesia Is Appropriate As Part Of A<br />

South East Asia Strategy? How Do Local, Pan‐Asia & Funds Of<br />

Funds Compare As Entry Routes? What Do LPs Need To Be<br />

Aware Of Before Committing?<br />

Marc Lau, Partner, AXIOM ASIA<br />

FRONTIER MARKETS<br />

How Large & How Robust Is The <strong>Invest</strong>ment Scope In Frontier<br />

Asian Markets Such As Myanmar, Mongolia & Cambodia? How<br />

Attractive Is The Risk Return Ratio Compared To Other Asian<br />

Markets?<br />

MANAGED ACCOUNTS & PREFERENTIAL DEALS<br />

How Fair Are Managed Accounts & Preferential Deals To Smaller LPs?<br />

How Can GPs Demonstrate That<br />

They Are Protecting The Interests Of<br />

Other LPs & Avoiding Conflict Of Interest?<br />

Jay<br />

Park, Managing Director, BLACKROCK<br />

Khim<br />

Tan Huck, Partner, CREDIT SUISSE CFIG<br />

FUNDS OF FUNDS STRATEGIES<br />

How Can Funds Of Funds Differentiate Themselves In A Crowded<br />

Market? How Are They Adapting Their Strategies In Light Of The<br />

Market Environment & LP Demands? How Do They Add Value?<br />

Moderator: Daniel Dupont, Managing Director,<br />

NORTLEAF CAPITAL PARTNERS<br />

Jonathann A. English, Director, PORTFOLIO ADVISORS<br />

Afternoon Refreshments<br />

Track A ‐ INDIA<br />

Track B – LP PERSPECTIVES<br />

TO PIPE OR NOT TO PIPE?<br />

CO‐INVESTMENT PERFORMANCE<br />

How Open<br />

Are LPs To PIPE Transactions & What Do The<br />

Returns<br />

Why Do LPs Want Co‐<strong>Invest</strong>ment Opportunities? How Do The Returns<br />

Look Like? To What Extent Is The Trend Towards PIPE<br />

Deals<br />

Compare With Blind Fund <strong>Invest</strong>ments?<br />

Driven By Lack Of Opportunities Elsewhere Or Is There An<br />

Alternative Rationale?<br />

Followed by panel session:<br />

CO‐INVESTMENTS<br />

How Big Is The Co‐<strong>Invest</strong>ment Opportunity In Asia & How Well Can<br />

This Complement Private Equity? Who Benefits & Do LPs Really Get<br />

The Best Deals? How Can Pitfalls Around Structure & Governance Be<br />

Avoided?<br />

Frewen Lam, Senior Vice President,<br />

MACQUARIE FUNDS<br />

GROUP PRIVATE EQUITY<br />

DEBATE: LPS ON INDIA<br />

India: Continued Disappointment Or Diamond In The Rough?<br />

LP VIEWS ON CHINA<br />

What Do LPs View As The Short & Long Term Risks Of <strong>Invest</strong>ing In<br />

China? How<br />

Do LPs Overcome Issues Around Governance,<br />

Transparency & The Proliferation Of RMB Funds?<br />

Moderator: Ludvig Nilsson, Managing Director, JADE INVEST<br />

Yan Yang, Director, Private Equity, BLACKROCK<br />

Super<strong>Invest</strong>or Asia Country & Sector<br />

Specific Champagne Roundtables<br />

Your chance to participate in in‐depth discussion around specialist topics. Sign up on the day to one of the roundtables and be prepared to<br />

join<br />

in the debate.<br />

Topics include:<br />

Myanmar | Thailand | Malaysia | Singapore | Consumer | Infrastructure | Natural Resources | Real Estate<br />

| Renewables<br />

Super<strong>Invest</strong>or Asia Networking Gala Drinks Reception<br />

End of Main Conference Day 1<br />

For latest programme or to register, please visit: www.superinvestorasia.com<br />

Call: +44 (0)20 7017 7200 Fax: +44 (0)20 7017 7807 Email:info@icbi.co.uk

DRAFT AGENDA SUBJECT TO CHANGE<br />

28‐30<br />

January 2013<br />

Shangri‐La Hotel, Singapore<br />

Main Conferencee Day 2, Wednesday<br />

30 January 2013<br />

LP ONLY BREAKFAST Supported & Sponsored by:<br />

&<br />

Featuring country & data focused roundtable discussions.<br />

Open to pre‐qualified pension funds, foundations, endowments, sovereign wealth funds, DFIs & ILPA members only.<br />

To see if you qualify<br />

for a place, please contact: lgriffin@icbi.co. .uk<br />

Coffee<br />

Opening Remarks & Welcome From The<br />

Chair<br />

INDIA MACROECONOMICC & POLITICAL ADDRESS<br />

How Will India’s Fiscal Policy Continue To Impact Inflation & Interest Rates, Rupee Valuation & Domestic Consumption? How Long Will<br />

The Indian Government’s Policy Paralysis Continue? How Effectively Will India Benefit From Its Democratic Dividend?<br />

Taimur Baig, Chief Economist, India/Indonesia/Philippines, DEUTSCHEE BANK<br />

THE FUTURE OF INDIAN PRIVATE EQUITY<br />

Which Firms Will Do Best In The Current Economic Environment & How Will They Generate Returns? What Does GP Consolidationn Mean<br />

For Indiann Private Equity & What Will The Characteristics Be Of The Winners?<br />

Ajay Relan, Co‐Founder, CX PARTNERS<br />

NEW WAYS OF INVESTING IN PRIVATE EQUITY<br />

DATA PRESENTATION<br />

Where Is The Capital Coming From For Asian Private Equity? What Are The Trends In<br />

Fund <strong>Invest</strong>ments, Directs, Co‐<strong>Invest</strong>ments & Joint<br />

Ventures?<br />

LP PANEL – DISINTERMEDIATION<br />

How Are<br />

Directs, Co‐<strong>Invest</strong>ments, Customised Accounts & Joint Ventures Fundamentally Altering The Dynamics Of The Private Equity<br />

Businesss Model In Asia? What Are The<br />

Potential Pitfalls For LPs To Avoid?<br />

Phillip Cummins,<br />

Principal, QIC<br />

Han Seng Low, Executive Director, UNITED OVERSEAS BANK<br />

Ivan Vercoutere, Partner Head of Private Equity, LGT CAPITAL PARTNERS<br />

Morning Coffee<br />

CHINA MACROECONOMIC ADDRESS<br />

How Will RMB Internationalisation, Political Change, Local & Regional Government <strong>Invest</strong>ment Policy & Access To Leverage Impact<br />

Chinese Economic & <strong>Invest</strong>ment Environment?<br />

EVOLUTION OF CHINESE PRIVATE EQUITY<br />

How Are GPs Differentiating Themselves In China & What Will Characterise The Winners Of The Impending Market Shake Out? Can<br />

RMB &<br />

US Dollar Funds Successfully Co‐Exist?<br />

Vincent Huang, Partner, PANTHEON<br />

Rebecca Xu, Co‐Founder,<br />

ASIA ALTERNATIVES<br />

SECONDARIES & LIQUIDITY IN ASIA<br />

How Is The Secondaries Market Playing A Role In The<br />

Development Of The Asian Private Equity Market? How Do<br />

Funds Differentiate<br />

Themselves As Sourcers Of The Best Deals?<br />

Moderator: John Wolak, Managing Partner, MORGAN STANLEY<br />

ALTERNATIVEE INVESTMENT PARTNERS<br />

Lucian Wu, Managing Director, PAUL CAPITAL PARTNERS<br />

Daniel Dupont, Managing Director, r, NORTLEAF CAPITAL PARTNERS<br />

For latest programme or to register, please visit: www.superinvestorasia.com<br />

Call: +44 (0)20 7017 7200 Fax: +44 (0)20 7017 7807 Email:info@icbi.co.uk

DRAFT AGENDA SUBJECT TO CHANGE<br />

28‐30<br />

January 2013<br />

Shangri‐La Hotel, Singapore<br />

KEYNOTE ADDRESS<br />

SUPERINVESTOR ASIA DELEGATE QUICKFIRE<br />

SHOWCASE<br />

In this informal session, delegates will have 90 secondss to promote their fund to a panel of LPs without using fund data, statistics or overt<br />

comparisons to other funds. Our expert<br />

LP judging panel give each delegate a score out of 10 for content, style and<br />

presentation and the<br />

winner receives a fabulous prize. LP judging panel includes:<br />

Lunch<br />

Plus! ‘Meet The LP’ Hosted Lunch Tables<br />

Track A – LP/GP RELATIONS<br />

Track B – COUNTRY CLINICS<br />

DEALING WITH UNDERPERFORMING GPS<br />

VIETNAM<br />

What Are The Options Available To LPs <strong>Invest</strong>ed<br />

In<br />

How Compelling Is Vietnam As An <strong>Invest</strong>ment Destination Today?<br />

Underperforming Funds? Maximising Value & Liquidity When What Lessons Has This Region<br />

Learnt & What<br />

Is Required To<br />

Ensure<br />

Things Go Wrong<br />

It Is Not Overlooked Going Forward?<br />

AGENCY<br />

To What Extent Are LP & GP Interests Truly Aligned? Examining<br />

The Implications Of GP Sources Of Income & Plans To Raise<br />

Successor Funds: How Far<br />

Have ILPA Principles Been Implemented<br />

In Asia?<br />

David Pierce, CEO, SQUADRON CAPITAL<br />

DUE DILIGENCEE<br />

How Can LPs Be Resourceful When Performing Due Diligence On<br />

Asian Private Equity Funds? What Are Recent Lessons Learned?<br />

JAPAN & KOREA – DEVELOPED ASIA<br />

What Benefits Do Japan & Korea Have As Developed Markets In Asia<br />

& How Should LPs Adapt To Maximise These?<br />

What Are The Types &<br />

Sizes Of Opportunities Available In These Regions Today?<br />

Kazushige Kobayashi, Managingg Director,<br />

CAPITAL DYNAMICS<br />

AUSTRALIA<br />

How Is The Australian Private Equity Market Evolving? Who Will Be<br />

The Main Sources Of Capital For <strong>Invest</strong>mentt In The Region & How<br />

Will Alpha Be Achieved?<br />

Afternoon Refreshments<br />

Track A – LP/GP RELATIONS<br />

Track B – VC & DISTRESSED<br />

TRANSPARENCY<br />

DISTRESSEDD & DEBT FINANCE<br />

Information & The Private<br />

Equity Industry: How Much Information<br />

Is Too Much? What Level & Nature Of Transparency Is Genuinely<br />

What Do Distressed Opportunities Look Like<br />

In Asia & Have<br />

They<br />

Been Overlooked? Examining Credit Opportunities, Debt, Mezzanine<br />

Useful For LPs?<br />

& Special Situations – What’s Changed?<br />

FEES, T&CS<br />

How Are LPs Using Their New Found Strength To Dictate Changes<br />

In Fees, Terms & Conditions? What Is Realistically Achievable<br />

While Maintaining Good Relations With PE Firms?<br />

VENTURE CAPITAL<br />

How Is The VC<br />

Market In Asia<br />

Evolving & How<br />

Does It Compare To<br />

That Elsewhere? Where Are The Hubs Of Innovation & Do The Likely<br />

Returns Justify<br />

The Additional Risk?<br />

Henry Nguyen, Managing General Partner,<br />

IDG VENTURES VIETNAM<br />

End of Main Conference<br />

For latest programme or to register, please visit: www.superinvestorasia.com<br />

Call: +44 (0)20 7017 7200 Fax: +44 (0)20 7017 7807 Email:info@icbi.co.uk

P R I O R I T Y B O O K I N G F O R M<br />

To: Super<strong>Invest</strong>or Asia 2013 Fax: +44 (0) 20 7017 7807<br />

Alternatively, please return this form to: Super<strong>Invest</strong>or Asia 2013, ICBI, 3 rd Floor, Maple House, 149<br />

Tottenham Court Road, London, W1T 7AD, UK<br />

Tel: 44 (0)20 7017 7200 Email: info@icbi.co.uk Web: www.superinvestorasia.com<br />

Venue: Shangri‐La Hotel, Singapore<br />

Dates: 28 th January 2013: Fundraising Summit<br />

29 th – 30 th January 2013: Super<strong>Invest</strong>or Asia Main Conference<br />

VIP CODE: URN:<br />

DELEGATE 1 NAME.............................................................………………………………… ………………………………………………………<br />

JOBTITLE....……...………………...................................……. DEPT……………………………….………………………………………………………<br />

DIRECT PHONE..…………………………………………………………..MOBILE NUMBER………………………………………………………………..<br />

DIRECT FAX..……………………………………………………….…EMAIL………………………………………………………………………………………….<br />

By giving my email address I am giving IIR companies permission to contact me by email about future events and services.<br />

I REPORT TO........................................................................………………………………………………………………..<br />

HIS/HER JOB TITLE................................................................………………..……………………………………………..<br />

BOOKING CONTACT…………………………………………………………………………………..……………………………………..<br />

HIS/HER JOB TITLE.......................................……………………………………………………………………………………….<br />

PLEASE SELECT YOUR<br />

EARLY BIRD PACKAGE<br />

3 DAY PACKAGE: Main Conference and<br />

Summit<br />

2 DAY PACKAGE: Main Conference Only<br />

1 DAY PACKAGE: Summit Only<br />

DATES<br />

28 – 30 January<br />

2013<br />

29 – 30 January<br />

2013<br />

Register By<br />

26 th October 2012<br />

DELEGATE 2 NAME.............................................................………………………………… ………………………………………………………..<br />

JOBTITLE....……...………………...................................…….DEPT……………………………….……………………………………………………………..<br />

DIRECT PHONE..………………………………MOBILE NUMBER………………………………………………………………………………………………<br />

DIRECT FAX..………………………………………EMAIL…………………………………………………………………………………………………………………<br />

By giving my email address I am giving IIR companies permission to contact me by email about future events and<br />

services.<br />

DELEGATE 3 NAME.............................................................………………………………….50% DISCOUNT for 3 rd delegate<br />

(packages must include the main conference)<br />

JOBTITLE....……...………………...................................…….DEPT……………………………….………………………………………………………<br />

DIRECT PHONE..………………………………MOBILE NUMBER……………………………………………………………………………………………<br />

DIRECT FAX..………………………………………EMAIL……………………………………………………………………………………………………………<br />

By giving my email address I am giving IIR companies permission to contact me by email about future events and<br />

services.<br />

COMPANY..…………………..................................................………………………………………………………………………<br />

ADDRESS......................................................................................................................................……………<br />

COMPANY TEL…............................................……....FAX……………………………………………………………………………..<br />

SAVE<br />

Off the final<br />

booking fee<br />

Register By<br />

7 th December 2012<br />

SAVE<br />

Off the final<br />

booking fee<br />

Register By<br />

7 th December 2012<br />

£2298 £800 £2498 £600 £2598 £500<br />

£1499 £200 £1599 £100 £1699<br />

28 January 2013 £1299 £100 £1399 £1399<br />

SAVE<br />

Off the final<br />

booking fee<br />

The VAT rate is subject to change and may differ from the advertised rate. The amount you are charged will be determined when your invoice is raised. Savings include Multiple Package & Early Booking Discounts. All<br />

discounts can only be applied at the time of registration and discounts cannot be combined (apart from Early booking discounts which apply to everyone). All discounts are subject to approval. Please note the conference fee<br />

does not include travel or hotel accommodation costs. 50% discount for third and subsequently registered delegate fee for any packages that include the main conference. We are happy to accept a replacement delegate for<br />

the whole event, however delegate passes cannot be split or shared between delegates under any circumstances. Conference code FKR2336.<br />

3 MEANS OF PAYMENT Please use this form as our request for payment. Your participation is guaranteed only when full payment has been received. Please tick one:<br />

Please send me an invoice or BY BANK TRANSFER ‐ Bank Transfer: Full details of bank transfer options will be given with your invoice on registration<br />

To make payment by CREDIT CARD: to ensure we provide the highest level of security for your credit card details we are unable to accept such payments via email or fax which ensures that these details are never stored on our network. To<br />

make payment by credit card on‐line, please enter your credit card details in our secure payments website that you will use when making your booking via the event website (the event web address is near the top of the booking<br />

form). Alternatively call our customer service team on +44 (0) 20 7017 7200.<br />

TERMS AND CONDITIONS: Attendance at this conference is subject to the ICBI Delegate Terms and Conditions at https://icbi‐events.com/assets/files/Terms‐and‐Conditions.pdf. Your attention is drawn in particular to clauses 6, 8 and 14 of the ICBI Delegate<br />

Terms and Conditions which have been set out. Cancellation Policy: If you cancel in accordance with this policy, you will receive a refund of your fees paid to ICBI (if any): (i) if you cancel your registration 28 days or more before the Conference, subject to an<br />

administration charge equivalent to 10% of the total amount of your fees plus VAT; or (ii) if you cancel your registration less than 28 days, but more than 14 days before the Conference, subject to an administration charge equivalent to 50% of the total amount<br />

of your fees plus VAT. ICBI regrets that the full amount of your fee remains payable in the event that your cancellation is 14 days or less before the Conference or if you fail to attend the Conference. All cancellations must be sent by email to info@icbi.co.uk<br />

marked for the attention of Customer Services and must be received by ICBI. You acknowledge that the refund of your fees in accordance with this policy is your sole remedy in respect of any cancellation of your registration by you and all other liability is<br />

expressly excluded. Changes to the conference: ICBI may (at its sole discretion) change the format, speakers, participants, content, venue location and programme or any other aspect of the Conference at any time and for any reason, whether or not due to a<br />

Force Majeure Event, in each case without liability. Data protection: The personal information which you provide to us will be held by us on a database. You agree that ICBI may share this information with other companies in the Informa group.<br />

Occasionally your details may be made available to selected third parties who wish to communicate with you offers related to your business activities. If you do not wish to receive these offers please contact the database manager. For more information about<br />

how ICBI use the information you provide please see our privacy policy at: https://icbi‐events.com/assets/files/Terms‐and‐Conditions.pdf. If you do not wish your details to be available to companies in the Informa Group, or selected third parties, please contact<br />

the Database Manager, Informa UK Ltd, Maple House, 149 Tottenham Court Road, London, W1T 7AD, UK. Tel: +44 (0)20 7017 7077, fax: +44 (0)20 7017 7828 or email integrity@iirltd.co.uk. Incorrect Mailing: If you are receiving multiple mailings or you would<br />

like us to change any details, or remove your name from our database, please contact the Database Manager at the above address quoting the reference number printed on the mailing label.<br />

By completing and submitting this registration form, you confirm that you have read and understood the ICBI Delegate Terms and Conditions and you agree to be bound by them.