READ MORE - Jade Invest

READ MORE - Jade Invest

READ MORE - Jade Invest

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

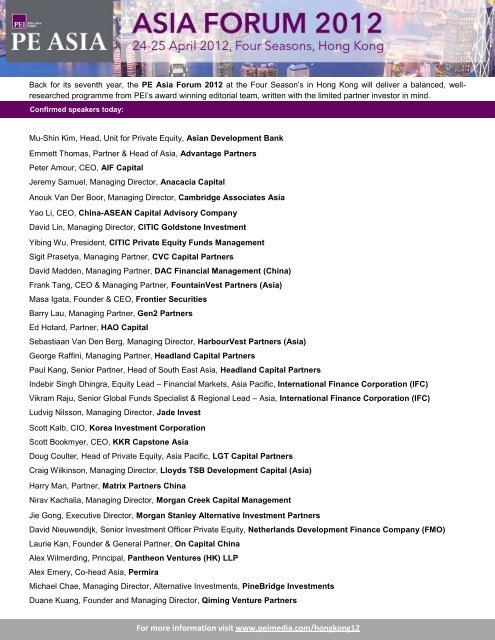

Back for its seventh year, the PE Asia Forum 2012 at the Four Season’s in Hong Kong will deliver a balanced, wellresearched<br />

programme from PEI’s award winning editorial team, written with the limited partner investor in mind.<br />

Confirmed speakers today:<br />

Mu-Shin Kim, Head, Unit for Private Equity, Asian Development Bank<br />

Emmett Thomas, Partner & Head of Asia, Advantage Partners<br />

Peter Amour, CEO, AIF Capital<br />

Jeremy Samuel, Managing Director, Anacacia Capital<br />

Anouk Van Der Boor, Managing Director, Cambridge Associates Asia<br />

Yao Li, CEO, China-ASEAN Capital Advisory Company<br />

David Lin, Managing Director, CITIC Goldstone <strong>Invest</strong>ment<br />

Yibing Wu, President, CITIC Private Equity Funds Management<br />

Sigit Prasetya, Managing Partner, CVC Capital Partners<br />

David Madden, Managing Partner, DAC Financial Management (China)<br />

Frank Tang, CEO & Managing Partner, FountainVest Partners (Asia)<br />

Masa Igata, Founder & CEO, Frontier Securities<br />

Barry Lau, Managing Partner, Gen2 Partners<br />

Ed Hotard, Partner, HAO Capital<br />

Sebastiaan Van Den Berg, Managing Director, HarbourVest Partners (Asia)<br />

George Raffini, Managing Partner, Headland Capital Partners<br />

Paul Kang, Senior Partner, Head of South East Asia, Headland Capital Partners<br />

Indebir Singh Dhingra, Equity Lead – Financial Markets, Asia Pacific, International Finance Corporation (IFC)<br />

Vikram Raju, Senior Global Funds Specialist & Regional Lead – Asia, International Finance Corporation (IFC)<br />

Ludvig Nilsson, Managing Director, <strong>Jade</strong> <strong>Invest</strong><br />

Scott Kalb, CIO, Korea <strong>Invest</strong>ment Corporation<br />

Scott Bookmyer, CEO, KKR Capstone Asia<br />

Doug Coulter, Head of Private Equity, Asia Pacific, LGT Capital Partners<br />

Craig Wilkinson, Managing Director, Lloyds TSB Development Capital (Asia)<br />

Harry Man, Partner, Matrix Partners China<br />

Nirav Kachalia, Managing Director, Morgan Creek Capital Management<br />

Jie Gong, Executive Director, Morgan Stanley Alternative <strong>Invest</strong>ment Partners<br />

David Nieuwendijk, Senior <strong>Invest</strong>ment Officer Private Equity, Netherlands Development Finance Company (FMO)<br />

Laurie Kan, Founder & General Partner, On Capital China<br />

Alex Wilmerding, Principal, Pantheon Ventures (HK) LLP<br />

Alex Emery, Co-head Asia, Permira<br />

Michael Chae, Managing Director, Alternative <strong>Invest</strong>ments, PineBridge <strong>Invest</strong>ments<br />

Duane Kuang, Founder and Managing Director, Qiming Venture Partners<br />

For more information visit www.peimedia.com/hongkong12

Vincent Chan, CEO, Spring Capital<br />

David Pierce, CEO, Squadron Capital Advisors<br />

Peter Martisek, Vice President, Swiss Re Private Equity Partners<br />

Edwin Wong, Managing Partner & CIO, SSG Capital Management (Hong Kong)<br />

Sarit Chopra, Managing Director, Mezzanine and Alternative Solutions, Standard Chartered Bank<br />

Brian Bunker, Managing Director, Asia, The Riverside Company<br />

Mark Chiba, Group Chairman and Partner, The Longreach Group<br />

Soichi Sam Takata, Deputy Head of Private Equity, Tokio Marine Asset Management<br />

Han Seng Low, Executive Director, United Overseas Bank<br />

Jason Shin, Co-founder and Managing Partner, Vogo Fund<br />

For more information:<br />

Speaking opportunities<br />

Maggie Ma<br />

+852 3182 7546<br />

maggie.m@peimedia.com<br />

Monday 23 rd April 2012<br />

1930 VIP dinner (By invitation only)<br />

Sponsorship packages<br />

Matthew Pocock<br />

+852 3182 7531<br />

matt.p@peimedia.com<br />

Delegate registration<br />

Iris Mui<br />

+852 3182 7629<br />

iris.m@peimedia.com<br />

Tuesday 24 th April 2012<br />

0800 Registration & coffee<br />

0850 PE Asia welcome & opening remarks<br />

0900 Keynote presentation: <strong>Invest</strong>ing with the KIC<br />

Scott Kalb, CIO of Korea <strong>Invest</strong>ment Corporation, will finish his 3 year term with KIC in March 2012. As an<br />

industry veteran, Scott will share his unique experience overseeing Korea’s $45 billion sovereign wealth fund,<br />

including his views on partnering with GPs and the role of emerging markets in the portfolio.<br />

0930 Impact of global uncertainty on individual strategies: Is Asian private equity turning over a new leaf?<br />

Representing different private equity strategies (buyout, growth, venture, distressed), 4 GPs will comment on and<br />

discuss new opportunities and the changing rules of engagement in evolving economic and capital markets.<br />

- Buyouts: Are we getting closer to the time that a majority of the buyouts are taking place in Asia’s developing<br />

countries?<br />

- Growth capital: How do GPs adjust to challenging capital markets? How do exit concerns impact decisions to<br />

invest?<br />

- VC: Where will the next wave of opportunities likely emerge?<br />

- Distress: What are the new themes to explore as liquidity gets less abundant?<br />

1020 Panel: interests and incentives<br />

- Will the interests of GPs and LPs align more closely in 2012 than in 2008?<br />

- What has changed in the terms and conditions of limited-partnership agreements? What further changes are<br />

GPs likely to accept?<br />

- Resolving communication issues between LPs and GPs: What are best ways to start the discussion and keep<br />

it going?<br />

For more information visit www.peimedia.com/hongkong12

- To what extent are fee schedules evolving?<br />

- The transparency issue: What is the minimum level of reporting now expected by LPs? Does this go beyond<br />

the ILPA guidelines?<br />

1100 Coffee break & networking<br />

1130 Panel: The rising influence of Asian LPs: spotlight on LPs from China, Korea, Japan and Singapore<br />

- How do LPs weigh the return and risk of private equity, as compared to other alternative asset classes?<br />

- How willing are LPs to invest in funds that are focused on ESG and SRI issues? How important are ESG and<br />

SRI in their investment decision making?<br />

- How do the needs of Asian LPs differ from global LPs?<br />

1210 Case study: Private equity in a downturn – lessons from successful deals that rode out the 08/09 storm<br />

• What worked and what did not during the downturn?<br />

• How can PE firms adjust their investment strategy and change their investment focus?<br />

Portfolio company: Lomb Scientific<br />

Speaker: Jeremy A. Samuel, Managing Director, Anacacia Capital and lead director of Lomb Scientific<br />

Portfolio company: Arysta LifeScience Corp.<br />

Speaker: Alex Emery, Co-Head Asia, Permira<br />

1250 Networking lunch<br />

1400 Workshop A: Monitoring portfolio company risk<br />

and effective due diligence<br />

- Foreign Corrupt Practices Act issues: what must be<br />

done to avoid breaching the law?<br />

- What is the best way to extract relevant information<br />

from management?<br />

- Conducting thorough due diligence to best minimize<br />

the risks of investing in Asia<br />

Workshop B: Credit crunch - how is Private equity<br />

positioned to fill the financing gap?<br />

- A number of domestic and international private<br />

equity firms have expanded their business lines to<br />

include credit -focused strategies. Has this become<br />

a trend for private equity firms in Asia?<br />

- Private equity Funds morphing into credit providers:<br />

what are the drivers? What is the long term<br />

potential?<br />

- What are the pros and cons of providing mezzanine<br />

and other forms of financing? Why are these types<br />

of lending getting more popular?<br />

- What are the criteria/requirements that companies<br />

should demonstrate to innovative lenders?<br />

1500 Workshop C: Impact of changes to VIE on China<br />

deals<br />

- What are the best options for private equity funds<br />

who would like to continue backing China’s most<br />

promising companies?<br />

- What are the viable alternatives for fund managers<br />

to prevent any regulatory action from reducing the<br />

potential return?<br />

Workshop D: Frontier market investment –<br />

Cambodia, Burma, Vietnam, and Mongolia<br />

- Landscape for the market: upcoming opportunity<br />

for international funds to enter these markets<br />

- What are the potential risks of working with local<br />

partners?<br />

- Exit strategies: how to get money out from your<br />

investment?<br />

- How to manage political risks<br />

- Comparing the pros and cons of investing both<br />

directly and indirectly through existing funds<br />

For more information visit www.peimedia.com/hongkong12

1600 Coffee break & networking<br />

1620 Panel: Asia regulatory outlook<br />

- What are the most important upcoming regulatory changes in Asia? How would these affect the global private<br />

equity industry?<br />

- Will increased regulation dampen private equity’s ability to produce superior returns?<br />

- Access to Asian deals: Is the regional regulatory environment becoming more liberalized?<br />

- Going political: Should the industry increase government lobbying? How?<br />

1700 Finding the best exit strategies in 2012: What are today’s options?<br />

- Examining the viability of IPOs in Asia compared to overseas: what are other options? Where are<br />

subscribers/buyers coming from?<br />

- What is the M&A landscape across the region? Will there be more cross-border deals in the region?<br />

- How to efficiently work with Asian entrepreneurs from deal origination to exits and beyond?<br />

- What works the best with regards to involving intermediaries in the exit process?<br />

- Opportunities in strategic sales: Will there be an increase in Asia?<br />

1745 PEI closing remarks<br />

Following the conference there will be the presentation of PE Asia Awards 2012 and cocktail reception for<br />

speakers, sponsors and delegates<br />

Wednesday 25 th April, 2012<br />

0855 Opening remarks & recap of day one<br />

0900 Keynote on-stage interview<br />

Yibing Wu, President, CITIC Private Equity Funds Management<br />

<strong>Invest</strong>ment interviewed by Drew Wilson, Editor, PE Asia<br />

0930 Rise of Asian fund of funds: What are the challenges and opportunities ahead?<br />

- What are their challenges in getting capital from LPs? Will the growth in funds under management continue?<br />

- What is the future trend for these funds? How will they thrive and differentiate?<br />

- How do funds allocate capital in different regions and for different strategies?<br />

- How does local knowledge weigh against global reach?<br />

1010 Panel: Implementing operational improvements to add value to your portfolio companies<br />

- What operations capability can private equity firms bring to their Asian portfolio?<br />

- How can private equity firms add value to your portfolio companies as a minority shareholder?<br />

- How do GPs help portfolio companies overcome both financial and non-financial challenges from the market?<br />

- How are operating partners or consulting teams structured within the GP, and what arrangements typically<br />

work best?<br />

- What roles can GPs play in improving ESG/SRI of their portfolio companies?<br />

1050 Coffee break & networking<br />

1120 The Big Debate: This house believes deal competition has the biggest impact on generating alpha<br />

returns.<br />

Audience will vote on the debate winner<br />

1150 Fundraising in 2012<br />

For more information visit www.peimedia.com/hongkong12

1230 China panel: How can new LPs participate in China’s PE industry?<br />

- Funds vs. direct investment: What are the pros and cons? What should be taken into consideration?<br />

- Venture capital market: Does the maturation of China’s VC market mean that outsized returns can no longer<br />

be expected?<br />

- Will more JV funds form? How will investment funds in China be shaped?<br />

- How to manage the RMB/dollar conflict?<br />

- Is QFLP an effective route for foreign LPs to access China? How does RMB convertibility affect QFLP?<br />

1310 Close of conference<br />

Following the conference there is a networking lunch for speakers, sponsors and delegates<br />

This is a working agenda and remains subject to change at the discretion of the organisers.<br />

For more information visit www.peimedia.com/hongkong12