annual report 2008-2009 - V/Line

annual report 2008-2009 - V/Line

annual report 2008-2009 - V/Line

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

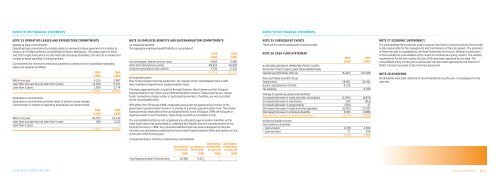

NOTES TO THE FINANCIAL STATEMENTS<br />

NOTES TO THE FINANCIAL STATEMENTS<br />

NOTE 23 OPERATING LEASES AND EXPENDITURE COMMITMENTS<br />

Operating lease commitments<br />

Operating lease commitments primarily relate to commercial lease agreements in relation to<br />

tenancy at 570 Bourke Street, and 628 Bourke Street, Melbourne. The leases expire in 2014<br />

and 2015 respectively which include fixed rate increases of between 3% and 5% or market rent<br />

reviews at dates specified in the agreements.<br />

Commitments for minimum contractual payments in relation to non-cancellable operating<br />

leases are payable as follows:<br />

<strong>2009</strong> <strong>2008</strong><br />

$’000 $’000<br />

Within one year 4,523 2,967<br />

Later than one year but not later than 5 years 12,919 9,151<br />

Later than 5 years 1,059 2,774<br />

18,501 14,892<br />

Expenditure commitments<br />

Expenditure commitments primarily relate to station access charges.<br />

Commitments in relation to operating expenditure are shown below:<br />

<strong>2009</strong> <strong>2008</strong><br />

$’000 $’000<br />

Within one year 25,573 10,312<br />

Later than one year but not later than 5 years 306 1,252<br />

Later than 5 years – –<br />

25,879 11,564<br />

NOTE 24 EMPLOYEE BENEFITS AND SUPERANNUATION COMMITMENTS<br />

(a) Employee benefits<br />

The aggregate employee benefit liability is comprised of:<br />

<strong>2009</strong> <strong>2008</strong><br />

$’000 $’000<br />

Accrued wages, salaries and on-costs 4,060 4,460<br />

Short term provisions (current) 48,933 44,503<br />

Long term provisions (non-current) 3,726 2,210<br />

56,719 51,173<br />

(b) Superannuation<br />

Prior to the original Franchise Agreement, the majority of the consolidated entity’s staff<br />

were members of government superannuation funds.<br />

The state-organised funds include the Revised Scheme, New Scheme and the Transport<br />

Superannuation Fund, which are all defined benefits schemes. These schemes are ‘master<br />

funds’ comprising a large number of participating members, therefore, are not controlled<br />

by the consolidated entity.<br />

With effect from 29 August 1999, employees were given the opportunity to remain in the<br />

government superannuation funds or to change to a private superannuation fund. The private<br />

funds joined by employees of the consolidated entity since 29 August 1999 are VicSuper or<br />

Superannuation Trust of Australia. These funds are both accumulation funds.<br />

The consolidated entity has not recognised any unfunded superannuation liabilities as the<br />

State Government has guaranteed to undertake this liability from the commencement of the<br />

original franchise in 1999. Any unfunded liabilities that may arise subsequent to the new<br />

franchise are calculated <strong>annual</strong>ly by the Government Superannuation Office and paid by V/<strong>Line</strong><br />

at the end of the financial year.<br />

(c) Superannuation schemes contributions and liabilities<br />

NOTE 25 SUBSEQUENT EVENTS<br />

There are no events subsequent to balance date.<br />

NOTE 26 CASH FLOW STATEMENT<br />

<strong>2009</strong> <strong>2008</strong><br />

$’000 $’000<br />

A) RECONCILIATION OF OPERATING PROFIT/(LOSS)<br />

AFTER TAX TO NET CASH FLOWS FROM OPERATIONS<br />

Operating profit/(loss) after tax (6,422) (15,295)<br />

Non-cash flows in profit /(loss)<br />

Depreciation 18,961 20,391<br />

Assets capitalised by VicTrack 8,315 –<br />

Tax expense – 6,290<br />

Change in operating assets and liabilities<br />

(Increase)/decrease in trade and other receivables (2,976) (8,874)<br />

(Increase)/decrease in inventories 524 (811)<br />

(Increase)/decrease in prepayments (354) 47<br />

(Decrease)/increase in trade and other payables (3,019) 21,037<br />

(Decrease)/increase in employee benefits 5,945 (1,899)<br />

Net cash from /(used in) operating activities 20,974 20,886<br />

(b) Reconciliation of cash<br />

Cash balance comprises:<br />

– Cash at bank 2,708 2,560<br />

– Cash on hand 77 104<br />

2,785 2,664<br />

NOTE 27 ECONOMIC DEPENDENCY.<br />

The consolidated entity provides public transport services to rural and regional Victoria and<br />

is also responsible for the management and maintenance of the rail network. The provision<br />

of these services is subsidised by the State Government of Victoria. Without the provision<br />

of that subsidy the consolidated entity could not continue as a going concern. The subsidy<br />

requirements for the year ending 30 June 2010 have been approved by the state. The<br />

consolidated entity’s three year business plan has also been approved by the Director of<br />

Public Transport pursuant to the Franchise Agreement.<br />

NOTE 28 DIVIDENDS<br />

No dividends were paid, declared or recommended during the year, or subsequent to the<br />

year end.<br />

Contribution<br />

for the year<br />

<strong>2009</strong><br />

Contribution<br />

for the year<br />

<strong>2008</strong><br />

Contribution<br />

outstanding<br />

at year end<br />

<strong>2009</strong><br />

Contribution<br />

outstanding<br />

at year end<br />

<strong>2008</strong><br />

Total Superannuation Contributions 10,388 9,311 – –<br />

V/LINE ANNUAL REPORT <strong>2008</strong>-<strong>2009</strong> FINANCIAL STATEMENTS 90/91