to Download the "Indo-US Business Magazine May-June 2011"

to Download the "Indo-US Business Magazine May-June 2011"

to Download the "Indo-US Business Magazine May-June 2011"

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

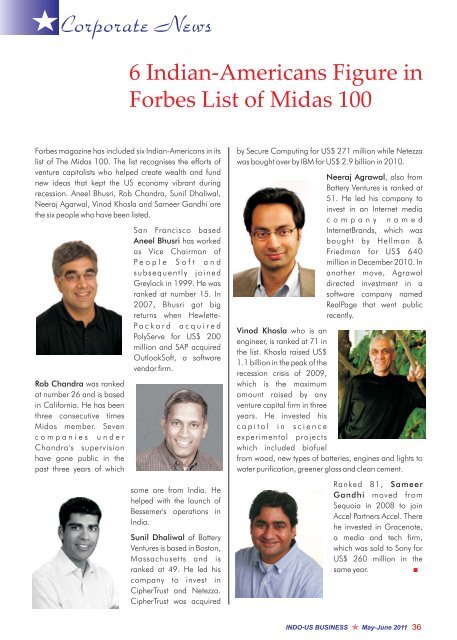

Corporate News<br />

6 Indian-Americans Figure in<br />

Forbes List of Midas 100<br />

Forbes magazine has included six Indian-Americans in its<br />

list of The Midas 100. The list recognises <strong>the</strong> efforts of<br />

venture capitalists who helped create wealth and fund<br />

new ideas that kept <strong>the</strong> <strong>US</strong> economy vibrant during<br />

recession. Aneel Bhusri, Rob Chandra, Sunil Dhaliwal,<br />

Neeraj Agarwal, Vinod Khosla and Sameer Gandhi are<br />

<strong>the</strong> six people who have been listed.<br />

Rob Chandra was ranked<br />

at number 26 and is based<br />

in California. He has been<br />

three consecutive times<br />

Midas member. Seven<br />

companies under<br />

Chandra's supervision<br />

have gone public in <strong>the</strong><br />

past three years of which<br />

San Francisco based<br />

Aneel Bhusri has worked<br />

as Vice Chairman of<br />

People Soft and<br />

subsequently joined<br />

Greylock in 1999. He was<br />

ranked at number 15. In<br />

2007, Bhusri got big<br />

returns when Hewlette-<br />

Packard acquired<br />

PolyServe for <strong>US</strong>$ 200<br />

million and SAP acquired<br />

OutlookSoft, a software<br />

vendor firm.<br />

some are from India. He<br />

helped with <strong>the</strong> launch of<br />

Bessemer's operations in<br />

India.<br />

Sunil Dhaliwal of Battery<br />

Ventures is based in Bos<strong>to</strong>n,<br />

Massachusetts and is<br />

ranked at 49. He led his<br />

company <strong>to</strong> invest in<br />

CipherTrust and Netezza.<br />

CipherTrust was acquired<br />

by Secure Computing for <strong>US</strong>$ 271 million while Netezza<br />

was bought over by IBM for <strong>US</strong>$ 2.9 billion in 2010.<br />

Neeraj Agrawal, also from<br />

Battery Ventures is ranked at<br />

51. He led his company <strong>to</strong><br />

invest in an Internet media<br />

company named<br />

InternetBrands, which was<br />

bought by Hellman &<br />

Friedman for <strong>US</strong>$ 640<br />

million in December 2010. In<br />

ano<strong>the</strong>r move, Agrawal<br />

directed investment in a<br />

software company named<br />

RealPage that went public<br />

recently.<br />

Vinod Khosla who is an<br />

engineer, is ranked at 71 in<br />

<strong>the</strong> list. Khosla raised <strong>US</strong>$<br />

1.1 billion in <strong>the</strong> peak of <strong>the</strong><br />

recession crisis of 2009,<br />

which is <strong>the</strong> maximum<br />

amount raised by any<br />

venture capital firm in three<br />

years. He invested his<br />

capital in science<br />

experimental projects<br />

which included biofuel<br />

from wood, new types of batteries, engines and lights <strong>to</strong><br />

water purification, greener glass and clean cement.<br />

Ranked 81, Sameer<br />

Gandhi moved from<br />

Sequoia in 2008 <strong>to</strong> join<br />

Accel Partners Accel. There<br />

he invested in Gracenote,<br />

a media and tech firm,<br />

which was sold <strong>to</strong> Sony for<br />

<strong>US</strong>$ 260 million in <strong>the</strong><br />

same year.<br />

<br />

INDO-<strong>US</strong> B<strong>US</strong>INESS <strong>May</strong>-<strong>June</strong> 2011 36