Annual Report - Adelaide to Outback GP Training Program

Annual Report - Adelaide to Outback GP Training Program

Annual Report - Adelaide to Outback GP Training Program

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

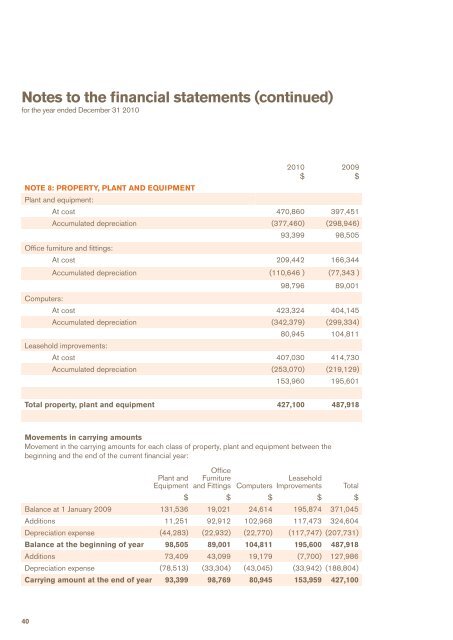

Notes <strong>to</strong> the financial statements (continued)<br />

for the year ended December 31 2010<br />

2010<br />

$<br />

2009<br />

$<br />

NOTE 8: PROPERTY, PLANT AND EQUIPMENT<br />

Plant and equipment:<br />

At cost 470,860 397,451<br />

Accumulated depreciation (377,460) (298,946)<br />

93,399 98,505<br />

Office furniture and fittings:<br />

At cost 209,442 166,344<br />

Accumulated depreciation (110,646 ) (77,343 )<br />

98,796 89,001<br />

Computers:<br />

At cost 423,324 404,145<br />

Accumulated depreciation (342,379) (299,334)<br />

80,945 104,811<br />

Leasehold improvements:<br />

At cost 407,030 414,730<br />

Accumulated depreciation (253,070) (219,129)<br />

153,960 195,601<br />

Total property, plant and equipment 427,100 487,918<br />

Movements in carrying amounts<br />

Movement in the carrying amounts for each class of property, plant and equipment between the<br />

beginning and the end of the current financial year:<br />

Plant and<br />

Equipment<br />

Office<br />

Furniture<br />

and Fittings Computers<br />

Leasehold<br />

Improvements<br />

Total<br />

$ $ $ $ $<br />

Balance at 1 January 2009 131,536 19,021 24,614 195,874 371,045<br />

Additions 11,251 92,912 102,968 117,473 324,604<br />

Depreciation expense (44,283) (22,932) (22,770) (117,747) (207,731)<br />

Balance at the beginning of year 98,505 89,001 104,811 195,600 487,918<br />

Additions 73,409 43,099 19,179 (7,700) 127,986<br />

Depreciation expense (78,513) (33,304) (43,045) (33,942) (188,804)<br />

Carrying amount at the end of year 93,399 98,769 80,945 153,959 427,100<br />

40