2011 Annual Report and Accounts - Investing In Africa

2011 Annual Report and Accounts - Investing In Africa

2011 Annual Report and Accounts - Investing In Africa

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Notes to the Financial Statements (continued)<br />

4 Financial risk management (continued)<br />

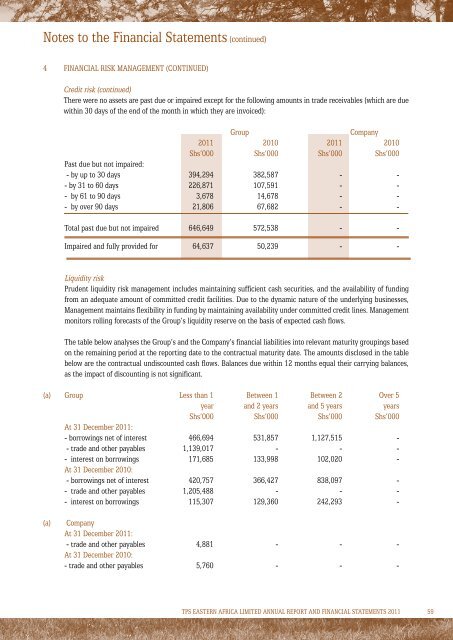

Credit risk (continued)<br />

There were no assets are past due or impaired except for the following amounts in trade receivables (which are due<br />

within 30 days of the end of the month in which they are invoiced):<br />

Group<br />

Company<br />

<strong>2011</strong> 2010 <strong>2011</strong> 2010<br />

Shs’000 Shs’000 Shs’000 Shs’000<br />

Past due but not impaired:<br />

- by up to 30 days 394,294 382,587 - -<br />

- by 31 to 60 days 226,871 107,591 - -<br />

- by 61 to 90 days 3,678 14,678 - -<br />

- by over 90 days 21,806 67,682 - -<br />

Total past due but not impaired 646,649 572,538 - -<br />

Impaired <strong>and</strong> fully provided for 64,637 50,239 - -<br />

Liquidity risk<br />

Prudent liquidity risk management includes maintaining sufficient cash securities, <strong>and</strong> the availability of funding<br />

from an adequate amount of committed credit facilities. Due to the dynamic nature of the underlying businesses,<br />

Management maintains flexibility in funding by maintaining availability under committed credit lines. Management<br />

monitors rolling forecasts of the Group’s liquidity reserve on the basis of expected cash flows.<br />

The table below analyses the Group’s <strong>and</strong> the Company’s financial liabilities into relevant maturity groupings based<br />

on the remaining period at the reporting date to the contractual maturity date. The amounts disclosed in the table<br />

below are the contractual undiscounted cash flows. Balances due within 12 months equal their carrying balances,<br />

as the impact of discounting is not significant.<br />

(a) Group less than 1 Between 1 Between 2 Over 5<br />

year <strong>and</strong> 2 years <strong>and</strong> 5 years years<br />

Shs’000 Shs’000 Shs’000 Shs’000<br />

At 31 December <strong>2011</strong>:<br />

- borrowings net of interest 466,694 531,857 1,127,515 -<br />

- trade <strong>and</strong> other payables 1,139,017 - - -<br />

- interest on borrowings 171,685 133,998 102,020 -<br />

At 31 December 2010:<br />

- borrowings net of interest 420,757 366,427 838,097 -<br />

- trade <strong>and</strong> other payables 1,205,488 - - -<br />

- interest on borrowings 115,307 129,360 242,293 -<br />

(a)<br />

Company<br />

At 31 December <strong>2011</strong>:<br />

- trade <strong>and</strong> other payables 4,881 - - -<br />

At 31 December 2010:<br />

- trade <strong>and</strong> other payables 5,760 - - -<br />

TPS EASTERN AFRICA LIMITED ANNUAL REPORT AND FINANCIAL STATEMENTS <strong>2011</strong> 59