2011 Annual Report and Accounts - Investing In Africa

2011 Annual Report and Accounts - Investing In Africa

2011 Annual Report and Accounts - Investing In Africa

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Notes to the Financial Statements (continued)<br />

4 Financial risk management (continued)<br />

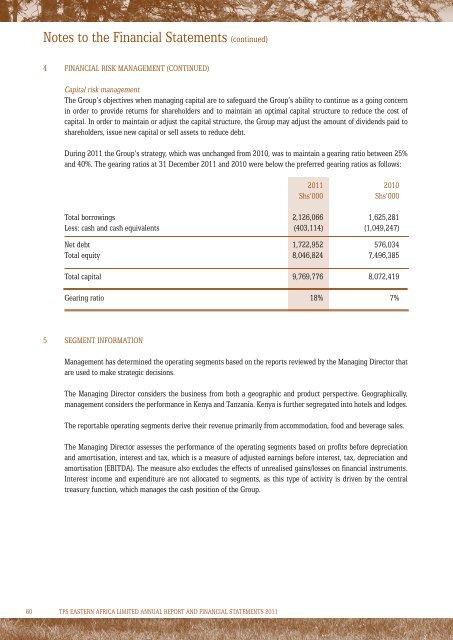

Capital risk management<br />

The Group’s objectives when managing capital are to safeguard the Group’s ability to continue as a going concern<br />

in order to provide returns for shareholders <strong>and</strong> to maintain an optimal capital structure to reduce the cost of<br />

capital. <strong>In</strong> order to maintain or adjust the capital structure, the Group may adjust the amount of dividends paid to<br />

shareholders, issue new capital or sell assets to reduce debt.<br />

During <strong>2011</strong> the Group’s strategy, which was unchanged from 2010, was to maintain a gearing ratio between 25%<br />

<strong>and</strong> 40%. The gearing ratios at 31 December <strong>2011</strong> <strong>and</strong> 2010 were below the preferred gearing ratios as follows:<br />

<strong>2011</strong> 2010<br />

Shs’000<br />

Shs’000<br />

Total borrowings 2,126,066 1,625,281<br />

Less: cash <strong>and</strong> cash equivalents (403,114) (1,049,247)<br />

Net debt 1,722,952 576,034<br />

Total equity 8,046,824 7,496,385<br />

Total capital 9,769,776 8,072,419<br />

Gearing ratio 18% 7%<br />

5 Segment information<br />

Management has determined the operating segments based on the reports reviewed by the Managing Director that<br />

are used to make strategic decisions.<br />

The Managing Director considers the business from both a geographic <strong>and</strong> product perspective. Geographically,<br />

management considers the performance in Kenya <strong>and</strong> Tanzania. Kenya is further segregated into hotels <strong>and</strong> lodges.<br />

The reportable operating segments derive their revenue primarily from accommodation, food <strong>and</strong> beverage sales.<br />

The Managing Director assesses the performance of the operating segments based on profits before depreciation<br />

<strong>and</strong> amortisation, interest <strong>and</strong> tax, which is a measure of adjusted earnings before interest, tax, depreciation <strong>and</strong><br />

amortisation (EBITDA). The measure also excludes the effects of unrealised gains/losses on financial instruments.<br />

<strong>In</strong>terest income <strong>and</strong> expenditure are not allocated to segments, as this type of activity is driven by the central<br />

treasury function, which manages the cash position of the Group.<br />

60 TPS EASTERN AFRICA LIMITED ANNUAL REPORT AND FINANCIAL STATEMENTS <strong>2011</strong>