Statement of Additional Info - Gabelli

Statement of Additional Info - Gabelli

Statement of Additional Info - Gabelli

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

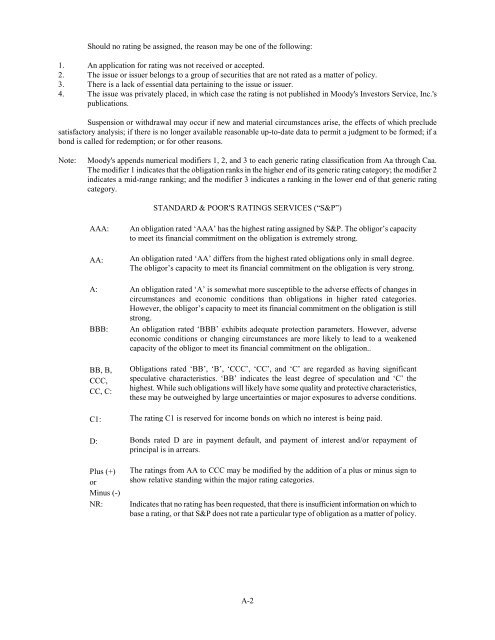

Should no rating be assigned, the reason may be one <strong>of</strong> the following:<br />

1. An application for rating was not received or accepted.<br />

2. The issue or issuer belongs to a group <strong>of</strong> securities that are not rated as a matter <strong>of</strong> policy.<br />

3. There is a lack <strong>of</strong> essential data pertaining to the issue or issuer.<br />

4. The issue was privately placed, in which case the rating is not published in Moody's Investors Service, Inc.'s<br />

publications.<br />

Suspension or withdrawal may occur if new and material circumstances arise, the effects <strong>of</strong> which preclude<br />

satisfactory analysis; if there is no longer available reasonable up-to-date data to permit a judgment to be formed; if a<br />

bond is called for redemption; or for other reasons.<br />

Note:<br />

Moody's appends numerical modifiers 1, 2, and 3 to each generic rating classification from Aa through Caa.<br />

The modifier 1 indicates that the obligation ranks in the higher end <strong>of</strong> its generic rating category; the modifier 2<br />

indicates a mid-range ranking; and the modifier 3 indicates a ranking in the lower end <strong>of</strong> that generic rating<br />

category.<br />

STANDARD & POOR'S RATINGS SERVICES (“S&P”)<br />

AAA:<br />

AA:<br />

An obligation rated ‘AAA’ has the highest rating assigned by S&P. The obligor’s capacity<br />

to meet its financial commitment on the obligation is extremely strong.<br />

An obligation rated ‘AA’ differs from the highest rated obligations only in small degree.<br />

The obligor’s capacity to meet its financial commitment on the obligation is very strong.<br />

A: An obligation rated ‘A’ is somewhat more susceptible to the adverse effects <strong>of</strong> changes in<br />

circumstances and economic conditions than obligations in higher rated categories.<br />

However, the obligor’s capacity to meet its financial commitment on the obligation is still<br />

strong.<br />

BBB: An obligation rated ‘BBB’ exhibits adequate protection parameters. However, adverse<br />

economic conditions or changing circumstances are more likely to lead to a weakened<br />

capacity <strong>of</strong> the obligor to meet its financial commitment on the obligation..<br />

BB, B,<br />

CCC,<br />

CC, C:<br />

Obligations rated ‘BB’, ‘B’, ‘CCC’, ‘CC’, and ‘C’ are regarded as having significant<br />

speculative characteristics. ‘BB’ indicates the least degree <strong>of</strong> speculation and ‘C’ the<br />

highest. While such obligations will likely have some quality and protective characteristics,<br />

these may be outweighed by large uncertainties or major exposures to adverse conditions.<br />

C1: The rating C1 is reserved for income bonds on which no interest is being paid.<br />

D: Bonds rated D are in payment default, and payment <strong>of</strong> interest and/or repayment <strong>of</strong><br />

principal is in arrears.<br />

Plus (+)<br />

or<br />

Minus (-)<br />

NR:<br />

The ratings from AA to CCC may be modified by the addition <strong>of</strong> a plus or minus sign to<br />

show relative standing within the major rating categories.<br />

Indicates that no rating has been requested, that there is insufficient information on which to<br />

base a rating, or that S&P does not rate a particular type <strong>of</strong> obligation as a matter <strong>of</strong> policy.<br />

A-2