Putnam Short Duration Income Fund - Putnam Investments

Putnam Short Duration Income Fund - Putnam Investments

Putnam Short Duration Income Fund - Putnam Investments

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

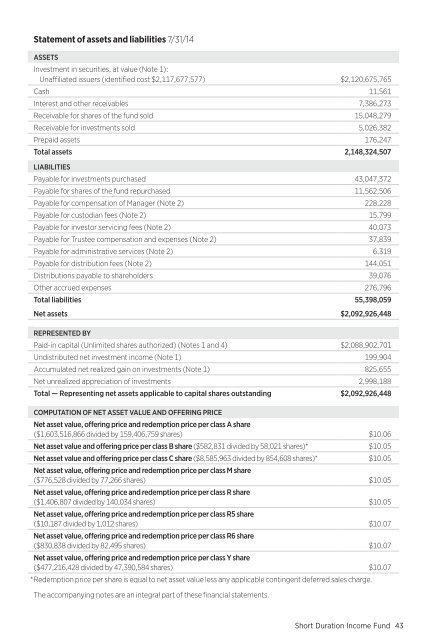

Statement of assets and liabilities 7/31/14<br />

ASSETS<br />

Investment in securities, at value (Note 1):<br />

Unaffiliated issuers (identified cost $2,117,677,577) $2,120,675,765<br />

Cash 11,561<br />

Interest and other receivables 7,386,273<br />

Receivable for shares of the fund sold 15,048,279<br />

Receivable for investments sold 5,026,382<br />

Prepaid assets 176,247<br />

Total assets 2,148,324,507<br />

LIABILITIES<br />

Payable for investments purchased 43,047,372<br />

Payable for shares of the fund repurchased 11,562,506<br />

Payable for compensation of Manager (Note 2) 228,228<br />

Payable for custodian fees (Note 2) 15,799<br />

Payable for investor servicing fees (Note 2) 40,073<br />

Payable for Trustee compensation and expenses (Note 2) 37,839<br />

Payable for administrative services (Note 2) 6,319<br />

Payable for distribution fees (Note 2) 144,051<br />

Distributions payable to shareholders 39,076<br />

Other accrued expenses 276,796<br />

Total liabilities 55,398,059<br />

Net assets $2,092,926,448<br />

REPRESENTED BY<br />

Paid-in capital (Unlimited shares authorized) (Notes 1 and 4) $2,088,902,701<br />

Undistributed net investment income (Note 1) 199,904<br />

Accumulated net realized gain on investments (Note 1) 825,655<br />

Net unrealized appreciation of investments 2,998,188<br />

Total — Representing net assets applicable to capital shares outstanding $2,092,926,448<br />

COMPUTATION OF NET ASSET VALUE AND OFFERING PRICE<br />

Net asset value, offering price and redemption price per class A share<br />

($1,603,516,866 divided by 159,406,759 shares) $10.06<br />

Net asset value and offering price per class B share ($582,831 divided by 58,021 shares)* $10.05<br />

Net asset value and offering price per class C share ($8,585,963 divided by 854,608 shares)* $10.05<br />

Net asset value, offering price and redemption price per class M share<br />

($776,528 divided by 77,266 shares) $10.05<br />

Net asset value, offering price and redemption price per class R share<br />

($1,406,807 divided by 140,034 shares) $10.05<br />

Net asset value, offering price and redemption price per class R5 share<br />

($10,187 divided by 1,012 shares) $10.07<br />

Net asset value, offering price and redemption price per class R6 share<br />

($830,838 divided by 82,495 shares) $10.07<br />

Net asset value, offering price and redemption price per class Y share<br />

($477,216,428 divided by 47,390,584 shares) $10.07<br />

*Redemption price per share is equal to net asset value less any applicable contingent deferred sales charge.<br />

The accompanying notes are an integral part of these financial statements.<br />

<strong>Short</strong> <strong>Duration</strong> <strong>Income</strong> <strong>Fund</strong>43