Putnam Short Duration Income Fund - Putnam Investments

Putnam Short Duration Income Fund - Putnam Investments

Putnam Short Duration Income Fund - Putnam Investments

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

“<br />

We have been positioning the fund for<br />

higher future rates.<br />

”<br />

Joanne Driscoll<br />

In terms of risk management, we seek to<br />

limit the fund’s sensitivity to interest-rate<br />

movements by generally keeping the portfolio’s<br />

duration at or less than one year. We<br />

seek to control the fund’s credit risk by only<br />

investing in investment-grade securities and<br />

limiting its exposure to individual issuers.<br />

Lastly, we utilize high-quality commercial<br />

paper and other money-market-eligible<br />

securities for liquidity purposes and as a<br />

temporary repository for cash that will be<br />

invested in short-term bonds.<br />

Turning to you, Mike, how was the fund<br />

positioned during the period?<br />

We continued to target opportunities in<br />

securities with maturities up to three years<br />

or those with marginally lower credit quality.<br />

We sought to mitigate these risks by counterbalancing<br />

them. Specifically, the Baa-rated<br />

securities that we owned — which provided<br />

the fund with higher yields, given their greater<br />

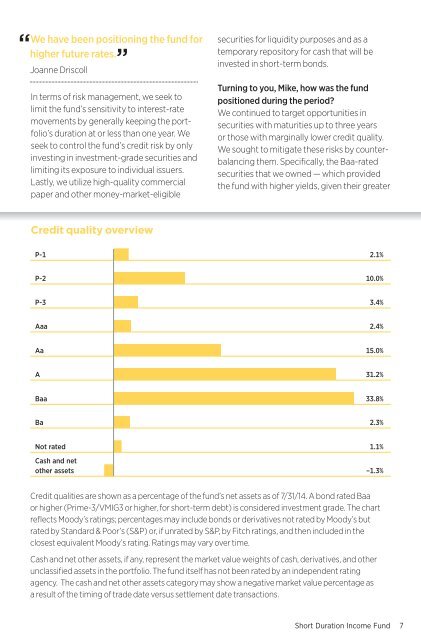

Credit quality overview<br />

P-1<br />

2.1%<br />

P-2<br />

10.0%<br />

P-3<br />

3.4%<br />

Aaa<br />

2.4%<br />

Aa<br />

15.0%<br />

A<br />

31.2%<br />

Baa<br />

33.8%<br />

Ba<br />

2.3%<br />

Not rated<br />

Cash and net<br />

other assets<br />

1.1%<br />

–1.3%<br />

Credit qualities are shown as a percentage of the fund’s net assets as of 7/31/14. A bond rated Baa<br />

or higher (Prime-3/VMIG3 or higher, for short-term debt) is considered investment grade. The chart<br />

reflects Moody’s ratings; percentages may include bonds or derivatives not rated by Moody’s but<br />

rated by Standard & Poor’s (S&P) or, if unrated by S&P, by Fitch ratings, and then included in the<br />

closest equivalent Moody’s rating. Ratings may vary over time.<br />

Cash and net other assets, if any, represent the market value weights of cash, derivatives, and other<br />

unclassified assets in the portfolio. The fund itself has not been rated by an independent rating<br />

agency. The cash and net other assets category may show a negative market value percentage as<br />

a result of the timing of trade date versus settlement date transactions.<br />

<strong>Short</strong> <strong>Duration</strong> <strong>Income</strong> <strong>Fund</strong> 7