Annual Report 2006 - Parkway Pantai

Annual Report 2006 - Parkway Pantai

Annual Report 2006 - Parkway Pantai

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

CULTIVATING GROWTH<br />

ANNUAL REPORT <strong>2006</strong>

ANNUAL REPORT <strong>2006</strong><br />

EXCEEDING EXPECTATIONS

The visual theme of this <strong>Annual</strong> <strong>Report</strong> is ‘Cultivating Growth’, which<br />

depicts the effort to nurture and nourish our business represented by the<br />

‘fruitful’ grove. The metaphor of the orchard connotes the cultivation of<br />

success and the concerted effort of our people to excel in all endeavours.<br />

BOUNTIFUL RETURNS<br />

SUSTAINED GROWTH<br />

STRATEGIC PRIORITIES<br />

<strong>Parkway</strong> is focused on People, Quality, Service, Finance and Growth.<br />

We want to be the employer of choice in the healthcare industry<br />

while delivering the finest clinical outcomes to our patients. We will<br />

provide the highest levels of service excellence to our customers<br />

while meeting and exceeding our financial plans in order to provide<br />

value to our shareholders. We are determined on growth and will<br />

do so by organic and acquisitive channels.<br />

SUSTAINED GROWTH<br />

We intend to sustain our growth momentum by exploring both<br />

organic initiatives and acquisitive ventures. <strong>Parkway</strong> is keen to<br />

expand and maintain our regional presence by increasing our<br />

regional investments, delivering more sophisticated services and<br />

procedures as well as maintaining our commitment to provide<br />

premier customer service.<br />

BOUNTIFUL RETURNS<br />

As <strong>Parkway</strong>’s reach grows and our presence throughout the region<br />

expands, our shareholders will reap the harvest with us. We believe<br />

in rewarding shareholders for their continued trust and faith in us<br />

by delivering higher value returns and superb growth prospects.<br />

STRATEGIC PRIORITIES<br />

PARKWAY HOLDINGS LIMITED

MISSION<br />

To make a difference in people’s lives through excellent patient care.<br />

VISION<br />

The global leader in value-based integrated healthcare.<br />

VALUES<br />

People above all... by treating those we serve and each other with<br />

compassion, dignity and respect.<br />

Excellence... by acting with integrity and striving for the highest quality<br />

care and service.<br />

Results... by exceeding the expectations of the people we serve and<br />

those we set for ourselves.<br />

CONTENTS<br />

Chairman’s Message/ 3 Managing Director’s Message/ 7 Global Presence/ 10 Operations Review/ 13<br />

Financial Highlights/ 19 Financial Review/ 20 Corporate Information/ 23 Board of Directors/ 24<br />

Senior Management/ 26 Financial <strong>Report</strong>/ 28<br />

ANNUAL REPORT <strong>2006</strong>

CHAIRMAN’s MESSAGE<br />

Richard Seow<br />

Chairman<br />

BRINGING PEOPLE CLOSER ,<br />

REACHING FURTHER<br />

Dear Shareholders,<br />

On behalf of the Board, I am pleased to share with you<br />

my thoughts on the highlights of the <strong>2006</strong> fiscal year<br />

leading to those of the current financial year.<br />

Beyond choice, to being global leader<br />

The year <strong>2006</strong> affirmed our position as the healthcare provider of choice for the region. <strong>Parkway</strong>’s<br />

facilities have seen an increase in contribution from our foreign patient pool. This reflects the changing<br />

trend in medical value travel as the numbers increase for higher value treatment services, while advances<br />

in technology reduce treatment costs and patients’ length of stay.<br />

We believe we made great advances to achieving our vision to be an international healthcare provider of<br />

choice. Over the past decades, <strong>Parkway</strong> has also contributed significantly towards Singapore’s reputation<br />

as a medical value destination. Our reputation in ensuring top clinical outcomes, comprehensive care<br />

and service excellence is supported by over 8,000 specialist physicians, experienced nurses and staff in<br />

our Group’s healthcare network across the region.<br />

By the end of <strong>2006</strong>, <strong>Parkway</strong>’s hospitals in Singapore enjoyed an increase of 32.3% in revenue from<br />

foreign patients. The growth was driven by higher value treatment such as transplant, cellular therapy,<br />

cancer treatment, and surgery. In 2007, our Group will focus on aligning these specialties into clinical<br />

programmes to achieve a seamless treatment strategy based on good clinical practice.<br />

Fuelled by strong performance across our business divisions, revenue increased 54% over the previous<br />

year to $868.0 million, with net profit at $70.1 million, excluding exceptional item and exchange losses.<br />

Our return on equity rose to 15.8%, up from 15.2% last fiscal year, which demonstrated the early<br />

success of our business strategies.<br />

<br />

<br />

PARKWAY HOLDINGS LIMITED<br />

ANNUAL REPORT <strong>2006</strong>

The changing trends in global healthcare markets<br />

are rapidly altering established patterns. The<br />

increase in treatment options alone suggests that<br />

<strong>Parkway</strong> will need a nimble structure to establish<br />

and entrench its leadership in medical specialty<br />

areas, while adhering to our strategy of proven<br />

approaches to ensure best clinical outcomes. This<br />

will be matched by renewed effort in branding<br />

and marketing our services worldwide.<br />

These achievements must reflect <strong>Parkway</strong>’s longer<br />

term strategic objectives and our belief in mission<br />

first, while looking after our people always.<br />

When I walk through our hospitals, I continue to<br />

feel the great passion, dedication and commitment<br />

towards making a difference in people’s lives<br />

through excellent patient care. This will be our<br />

driving force to realise our new vision in the global<br />

marketplace.<br />

Reiterating <strong>Parkway</strong>’s key commitment<br />

<strong>Parkway</strong>’s renewed vision is to be the global<br />

leader in value-based integrated healthcare, which<br />

follows our commitment to strive for excellent<br />

clinical outcomes. Building our reputation globally<br />

in healthcare is essential if physicians, patients and<br />

their loved ones are going to entrust their wellbeing<br />

in our care.<br />

This year, <strong>Parkway</strong> will continue to integrate<br />

our people, facilities and services. To achieve a<br />

seamless service that delivers quality outcomes,<br />

performance measures and benchmark<br />

performance standards are incorporated into each<br />

clinical programme. We will continue to engage<br />

our doctors with transparency and adopt models<br />

to adapt to the changing disease trends to ensure<br />

win-win partnerships.<br />

We are developing IT platforms to upgrade our<br />

medical information systems to support our plans<br />

for an integrated patient database.<br />

While such quality patient treatment through<br />

the use of advanced, proven, medical procedures<br />

remains our focus, we plan to ensure these clinical<br />

initiatives will lead to more balanced revenue<br />

generation, matched by global industry best<br />

practices.<br />

Seeding <strong>Parkway</strong>’s future growth<br />

We plan to set in place a clear and focused<br />

marketing and branding strategy which will be<br />

critical in the coming year, as <strong>Parkway</strong> becomes<br />

poised for its role in providing quality healthcare<br />

to a worldwide market. In <strong>2006</strong>, we partnered<br />

Khazanah Nasional in Malaysia, to privatise<br />

<strong>Pantai</strong> Holdings as part of our regional and global<br />

ventures to create synergy and a mutual vision in<br />

delivering top-notch medical care and services.<br />

Through the partnership, <strong>Pantai</strong> Holdings will<br />

enjoy the Group’s strengths in management and<br />

training, and eventually, consolidated services<br />

sourcing and cost benefits.<br />

Singapore will continue to play a central role as the<br />

Group’s leading edge medical hub. Investment in<br />

facilities and technologies will continue as we offer<br />

our patients the best in medical equipment and<br />

treatment services that the region can provide.<br />

We intend to continue with our plans for regional<br />

growth, bringing <strong>Parkway</strong>’s standards of care and<br />

services to a larger regional patient base.<br />

This commitment to growth and dedication to<br />

replicate clinical outcomes and service quality<br />

across our units will serve us well, as we take on<br />

new challenges to cater to existing patients and<br />

increasingly, a global audience.<br />

Recognising our people<br />

On behalf of the Board, I wish to thank Mr Daniel<br />

Ashton Carroll and Mr David R. White who have<br />

stepped down as Non-executive Directors. I bid<br />

them both a fond farewell, and thank them for<br />

their invaluable insights and advice. I would like<br />

to welcome to the Board Mr Ranvir Dewan and<br />

Mr Steven Joseph Schneider, who have joined<br />

as Non-executive Directors. I am confident<br />

that they bring extensive expertise from their<br />

respective fields that will benefit <strong>Parkway</strong> in<br />

innumerable ways.<br />

We also welcome into our Senior Leadership team<br />

Mr Daniel James Snyder as Group Chief Operating<br />

Officer and the newly established role of Group<br />

Executive Vice President. Dan brings a wealth of<br />

experience and knowledge to <strong>Parkway</strong>; he has over<br />

28 years of experience leading healthcare systems<br />

globally, and his appointment will strengthen the<br />

Group’s senior leadership as we set our sights on<br />

global leadership in healthcare.<br />

Our doctors and nurses are central in the roles they<br />

play in <strong>Parkway</strong>’s reputation and success. I would<br />

like to pay tribute to them and recognise their<br />

contributions and commitment over the past year.<br />

We will continue in our quest to make <strong>Parkway</strong>’s<br />

hospitals “magnet facilities” that attract and retain<br />

the best doctors and nurses in the region.<br />

Our partners and business associates have<br />

continued to contribute to our success, and I<br />

thank them for the vital roles that they each play.<br />

Our reputation, achievements, and our continued<br />

success would not be possible without the<br />

passion, professionalism and commitment of our<br />

doctors, nurses and staff. Each day, hundreds<br />

of our patients rely on them to rise up to the<br />

challenge of delivering the best quality care to<br />

those entrusted to their care. Our people truly<br />

represent the spirit of <strong>Parkway</strong> and I am grateful<br />

to every single member of our <strong>Parkway</strong> family. In<br />

the year ahead, we are determined to develop<br />

better compensation packages to attract and<br />

retain talent, while instilling a greater sense of<br />

culture, and of <strong>Parkway</strong> pride.<br />

Lastly, I would like to thank each and every one of<br />

you, our shareholders, for your steadfast support,<br />

and unwavering confidence in <strong>Parkway</strong>.<br />

I look forward to your continued contribution as<br />

we move ahead, and take on new and bolder<br />

ventures.<br />

Richard Seow<br />

Chairman<br />

PARKWAY HOLDINGS LIMITED<br />

<br />

<br />

PARKWAY HOLDINGS LIMITED<br />

ANNUAL REPORT <strong>2006</strong>

MANAGING DIRECTOR’s MESSAGE<br />

Dr Lim Cheok Peng<br />

Managing Director<br />

Dear Shareholders,<br />

DELIVERING RESULTS,<br />

SUSTAINING GROWTH<br />

Last year was a year of change and growth for<br />

<strong>Parkway</strong>. We have deployed strategies successfully,<br />

and the Company has reaped, and continues to reap,<br />

benefits and advantages from these plans. I am proud<br />

to present to you the Group’s performance and key<br />

milestones for the financial year ended 31 December<br />

<strong>2006</strong> (“FY<strong>2006</strong>’’).<br />

<br />

Growing in financial strength<br />

<strong>Parkway</strong>’s total revenue rose 54% to $868.0 million in FY<strong>2006</strong>, compared to FY2005. We turned in a<br />

net profit of $70.1 million, excluding exceptional item and exchange losses, compared to $62.9 million<br />

in 2005. The Group has seen growth in all business divisions, reaping divisional revenues of $356.3<br />

million from Singapore Hospitals Division, $239.2 million from International Hospitals Division and<br />

$269.1 million from Healthcare Services Division. These results were in part driven by the strong growth<br />

in health care provided, as well as our integration initiatives leading to operational costs savings.<br />

<strong>Parkway</strong> enjoyed a return on equity of 15.8% in <strong>2006</strong>, an improvement from 15.2% in the previous<br />

fiscal year. Earnings per share also rose by 4.9% to 9.01 cents compared to the previous corresponding<br />

period.<br />

In December <strong>2006</strong>, we utilised our tax credits under Section 44A, and completed a special dividend cum<br />

rights issue exercise, distributing approximately $65.7 million to our shareholders.<br />

Building on our strong fundamentals and good performance, we have put in place plans to further<br />

integrate our organisation, and increase the value of services that we provide to our patients.<br />

<br />

PARKWAY HOLDINGS LIMITED<br />

ANNUAL REPORT <strong>2006</strong>

Growing in unity<br />

In <strong>2006</strong>, Gleneagles Hospital and Mount Elizabeth<br />

Hospital received accreditation from the Joint<br />

Commission International (JCI); the accreditation<br />

acknowledges both facilities and the teams that<br />

work there, as having internationally-certified<br />

standards in healthcare. Furthermore, with East<br />

Shore Hospital aiming for the accreditation in late<br />

2007, all <strong>Parkway</strong>’s hospitals will have unstinting<br />

standards that match and surpass global healthcare<br />

expectations.<br />

We have set out to further improve our processes<br />

and enhance patient experiences. Initiatives aimed<br />

at further integration of our facilities and services<br />

will provide patients with increased comfort,<br />

comprehensive care and clinical excellence. For<br />

example, the <strong>Parkway</strong> Liver Centre and <strong>Parkway</strong><br />

Cancer Centre, set up in <strong>2006</strong>, bring professionals<br />

with different medical specialties together to<br />

provide integrated treatment programmes for<br />

our patients. These Centres offer an extensive<br />

spectrum of treatment, including external and<br />

internal radiation therapy, chemotherapy and<br />

laboratory tests, together with a full suite of<br />

services to provide patients with comprehensive<br />

treatment and care. This holistic approach, we<br />

believe, results in lesser emotional and physical<br />

stress for patients and their families and improves<br />

the delivery of care and clinical outcomes.<br />

Together with proven technologies and techniques,<br />

our Centres offer patients an environment in which<br />

their conditions are cared for in totality by the best<br />

professionals and with the best equipment. We<br />

believe that adopting a patient-centric, integrated<br />

approach in our treatment methodology will result<br />

in positive clinical outcomes, as well as enhance the<br />

excellent quality of healthcare services provided to<br />

our patients.<br />

<strong>Parkway</strong> aims to continue improving our clinical<br />

outcomes and service experiences. To this end, we<br />

have streamlined our clinical services into several<br />

clinical programmes - Heart and Vascular, Oncology,<br />

Transplant and Cellular Therapy, Neuroscience,<br />

Women and Children, Musculoskeletal, Surgery<br />

and Chronic Disease Management. These clinical<br />

programmes, each supervised by a programme<br />

leader, will provide patients with more integrated<br />

and convenient treatment programmes. Outcomes<br />

of these clinical programmes will be monitored<br />

and will propel us further in our constant bid to<br />

enhance clinical excellence. Patients on these<br />

clinical programmes will receive treatment that is<br />

evidence-based and be treated by specialists who<br />

meet set the clinical performance standards.<br />

Our initiatives are in line with <strong>Parkway</strong>’s vision to<br />

be the global leader in value-based integrated<br />

healthcare. Our people will work on common<br />

platforms and with the integration of systems,<br />

technology and facilities, patients can look<br />

forward to receiving an even higher level of care<br />

and clinical excellence from <strong>Parkway</strong>.<br />

Growing our team<br />

At <strong>Parkway</strong>, we believe that everyone matters.<br />

As an organisation, we believe that we have a<br />

responsibility to make a positive difference not only<br />

to our patients’ lives, but towards our associates<br />

and partners too. We continue to seek talents and<br />

provide a nurturing, motivating and professional<br />

environment in which everyone can do their best.<br />

<strong>Parkway</strong> continues to be an employer of choice<br />

for many.<br />

In <strong>2006</strong>, <strong>Parkway</strong> sponsored the first batch of<br />

student nurses at the <strong>Pantai</strong> Institute of Health<br />

Sciences & Nursing in Kuala Lumpur, Malaysia.<br />

In addition, 23 nurses who graduated from the<br />

Gleneagles Intan College of Nursing in August<br />

<strong>2006</strong> have started work as Registered Nurses at<br />

<strong>Parkway</strong>’s hospitals. I am glad that <strong>Parkway</strong> has<br />

played a role in educating and grooming these<br />

vibrant minds for their chosen careers.<br />

I am also pleased that our people are recognised<br />

as the best in their fields. Two of our nursing staff,<br />

Ms Lisa Chong Ah Yoke and Ms Rahmah bte Mohd<br />

Shariff, received the Healthcare Humanity Award,<br />

recognising their dedication to their work.<br />

At the <strong>2006</strong> Excellent Service Awards (EXSA),<br />

<strong>Parkway</strong> won 282 awards. The award recognises<br />

outstanding service, seeks to develop service<br />

models for staff to emulate and creates service<br />

champions to inspire dedicated and professional<br />

services.<br />

Growing our technological capabilities<br />

To further our leadership in delivering clinical<br />

excellence with high-end, specialised treatments,<br />

we have invested and continue to invest in proven<br />

medical technologies from around the globe.<br />

In <strong>2006</strong>, <strong>Parkway</strong> became the first hospital in<br />

South Asia to launch the TomoTherapy Hi-Art<br />

system, which delivers more effective and precise<br />

cancer treatment, while reducing side effects<br />

commonly associated with traditional methods of<br />

treatments.<br />

We are also the first private healthcare operator<br />

in Singapore to provide an enhanced ultrasound<br />

device for safer cataract surgery. Our off-site<br />

Central Sterilisation Supply Department, the first<br />

of its kind in Southeast Asia, is equipped with<br />

state-of-the-art technology to ensure the highest<br />

level of clinical and hygiene standards for our<br />

doctors and patients.<br />

Besides medical technology, we are also further<br />

integrating our management systems across our<br />

divisions. An integrated platform will strengthen<br />

our administrative efficiency and patient service<br />

quality. Patients can look forward to increased<br />

convenience and improved service experiences as<br />

we continue to streamline our facilities, services<br />

and treatment procedures.<br />

Growing beyond Singapore<br />

Since our inception, <strong>Parkway</strong> has established a firm<br />

base of operations in Singapore. Our facilities here<br />

are recognised for bearing the highest standard<br />

of clinical care and service excellence, and we<br />

are known as the provider of high-end, specialist<br />

healthcare.<br />

With this strong heritage, we intend to continue<br />

establishing our presence overseas. Work has<br />

already begun on furthering our growth offshore.<br />

In Shanghai, we have opened a 32,000 squarefoot<br />

ambulatory surgical centre. The Shanghai<br />

Gleneagles International Medical and Surgical<br />

Centre specialises in healthcare services such as<br />

health screenings, aesthetics, dental work, and<br />

obstetrics and gynaecology. Our Apollo Gleneagles<br />

Hospital in India is doing well, with a 28.3%<br />

increase in revenue over the last year. Our Brunei<br />

facility, the Gleneagles JPMC Cardiac Centre, has<br />

seen a 24.2% year-on-year increase in revenue as<br />

well. Our entry into <strong>Pantai</strong> Holdings, one of the<br />

largest healthcare groups in Malaysia, has allowed<br />

us opportunities to re-engineer processes and<br />

achieve operational efficiency, and I hope to see<br />

good results arising from our efforts.<br />

The current momentum in growth of our offshore<br />

interests, together with our local flagships and<br />

facilities, will see <strong>Parkway</strong> growing into a global<br />

healthcare player, delivering value-based services<br />

to an increasing number of patients worldwide.<br />

<strong>Parkway</strong> is also reaching out to the region beyond<br />

the scope of business, by offering our medical<br />

expertise in times of disaster. In June <strong>2006</strong>, we sent<br />

a team of doctors, nurses and paramedical staff<br />

to Yogyakarta, Indonesia, to provide humanitarian<br />

aid to earthquake victims. I am proud that <strong>Parkway</strong><br />

continues to be an organisation that cares, not<br />

just for patients who come through our doors, but<br />

also for communities who require our help.<br />

A note of appreciation<br />

I would like to thank the staff, nurses and doctors<br />

at <strong>Parkway</strong>, who renew their commitment and<br />

dedication every single day, in order to provide<br />

the highest level of care and treatment to our<br />

patients.<br />

To my colleagues and business associates, I deeply<br />

appreciate the support shown as we continue our<br />

drive to serve our patients better.<br />

As <strong>Parkway</strong> ventures into 2007, with renewed<br />

confidence and strength, I look forward to sharing<br />

with you our continued growth and progress.<br />

Dr Lim Cheok Peng<br />

Managing Director<br />

PARKWAY HOLDINGS LIMITED<br />

<br />

PARKWAY HOLDINGS LIMITED<br />

ANNUAL REPORT <strong>2006</strong>

GLOBAL PRESENCE<br />

Canada<br />

Russia<br />

USA<br />

China<br />

Egypt<br />

United<br />

Arab<br />

Emirates<br />

Pakistan<br />

India<br />

Bangladesh<br />

Myanmar<br />

Thailand<br />

Vietnam<br />

Cambodia<br />

Philippines<br />

Nigeria<br />

Sri Lanka<br />

Malaysia<br />

Brunei<br />

SINGAPORE<br />

Indonesia<br />

Hospitals & Medical Centres<br />

IPAC (International Patient<br />

Assistance Centre)<br />

10<br />

HOSPITALS AND MEDICAL CENTRES<br />

Singapore<br />

Mount Elizabeth Hospital<br />

No. of beds: 505<br />

Gleneagles Hospital<br />

No. of beds: 380<br />

East Shore Hospital<br />

No. of beds: 123<br />

Brunei<br />

Gleneagles JPMC Cardiac Centre,<br />

Brunei<br />

No. of beds: 20<br />

China<br />

Shanghai Gleneagles International<br />

Medical and Surgical Centre<br />

India<br />

Apollo Gleneagles Hospital,<br />

Kolkata<br />

No. of beds: 325<br />

Malaysia<br />

Gleneagles Intan Medical Centre,<br />

Kuala Lumpur<br />

No. of beds: 330<br />

Gleneagles Medical Centre, Penang<br />

No. of beds: 212<br />

<strong>Pantai</strong> Medical Centre, Kuala Lumpur<br />

No. of beds: 328<br />

<strong>Pantai</strong> Cheras Medical Centre,<br />

Kuala Lumpur<br />

No. of beds: 139<br />

<strong>Pantai</strong> Klang Specialist Medical Centre,<br />

Klang<br />

No. of beds: 69<br />

Hospital <strong>Pantai</strong> Putri, Ipoh<br />

No. of beds: 121<br />

Hospital <strong>Pantai</strong> Mutiara, Penang<br />

No. of beds: 180<br />

Hospital <strong>Pantai</strong> Ayer Keroh, Melaka<br />

No. of beds: 250<br />

Hospital <strong>Pantai</strong> Indah, Kuala Lumpur<br />

No. of beds: 86<br />

Hospital <strong>Pantai</strong> Batu Pahat, Johor<br />

No. of beds: 50<br />

HEALTHCARE SERVICES DIVISION<br />

Primary Healthcare<br />

GP Services<br />

No. of clinics: 42<br />

Dental Services<br />

No. of clinics: 3<br />

Diagnostic Services<br />

Radiology Services<br />

Medi-Rad Associates<br />

No. of clinics: 7<br />

Laboratory Services<br />

<strong>Parkway</strong> Laboratory Services<br />

No. of laboratories: 4<br />

Clinical Research<br />

Gleneagles CRC HQ<br />

Consultancy Services<br />

Hospital Development<br />

Hospital Management<br />

IPAC (INTERNATIONAL PATIENT<br />

ASSISTANCE CENTRE)<br />

Singapore: 1<br />

Bangladesh: 3<br />

Chittagong<br />

Dhaka<br />

Sylhet<br />

Brunei Darussalam: 2<br />

Cambodia:1<br />

Phnom Penh<br />

Canada: 1<br />

Vancouver<br />

China: 1<br />

Shanghai<br />

Egypt:1<br />

Cairo<br />

India: 4<br />

Chennai<br />

Mumbai<br />

New Delhi<br />

Punjab<br />

Indonesia: 17<br />

Balikpapan<br />

Bandung<br />

Batam<br />

Jakarta: 2<br />

Makassar<br />

Manado<br />

Malang<br />

Medan<br />

Padang<br />

Palembang<br />

Pekan Baru<br />

Pontianak<br />

Semarang<br />

Solo<br />

Surabaya<br />

Yogyakarta<br />

Malaysia: 4<br />

Johor Bahru<br />

Kota Kinabalu<br />

Kuala Lumpur<br />

Kuching<br />

Myanmar: 1<br />

Yangon<br />

Nigeria: 1<br />

Lagos<br />

Pakistan: 3<br />

Islamabad<br />

Karachi<br />

Lahore<br />

Philippines: 1<br />

Manila<br />

Russia: 1<br />

Vladivostok<br />

Sri Lanka: 1<br />

Colombo<br />

Thailand: 1<br />

Bangkok<br />

United Arab Emirates: 1<br />

Abu Dhabi<br />

USA: 1<br />

New Mexico<br />

Vietnam: 3<br />

Hanoi<br />

Ho Chi Minh<br />

Da Nang<br />

11<br />

PARKWAY HOLDINGS LIMITED<br />

ANNUAL REPORT <strong>2006</strong>

OPERATIONS REVIEW<br />

Review of operations in <strong>2006</strong><br />

CULTIVATING STRENGTHS,<br />

CREATING SUCCESS<br />

The TomoTherapy Hi-Art System delivers highly accurate radiation<br />

doses with precision.<br />

12<br />

Integrating our services<br />

At <strong>Parkway</strong> we believe in providing our patients with integrated, holistic treatment experiences. Apart<br />

from offering a pleasant and soothing environment, we also ensure our patients are attended to by<br />

caring and understanding staff. In <strong>2006</strong>, we began streamlining our facilities and services, including<br />

<strong>Parkway</strong>’s support services to bring patients greater convenience and improved service experiences.<br />

With integration, doctors will also engage in deeper sharing of knowledge and experiences; patients will<br />

benefit from the synergy achieved and have more treatment options available. Our effort to integrate<br />

our services resulted in the establishment of comprehensive care centres such as the Mount Elizabeth<br />

Diabetes Care Centre, <strong>Parkway</strong> Cancer Centre and <strong>Parkway</strong> Liver Centre.<br />

The <strong>Parkway</strong> Cancer Centre aims to provide patients with quality cancer care by bringing together<br />

specialist physicians, nurses, other medical professionals and pastoral care counsellors. The highly<br />

skilled, multidisciplinary team deploys the latest proven technology in cancer diagnostics and treatment,<br />

affording patients easy access to personalised services for their conditions, including laboratory services,<br />

under one roof.<br />

We have also established the Mount Elizabeth Diabetes Care Centre, a one-stop centre for the management<br />

of diabetes and diabetes related diseases, at a cost of $800,000. The Centre offers treatment from prediabetes<br />

stage to fully-developed diabetes, including diabetes-related complications. The Diabetes Care<br />

Centre provides a holistic approach to the management of diabetes. Specialist teams comprising the<br />

presiding doctor, diabetes nurse, dietician, podiatrist, psychologist, exercise trainer are among those<br />

providing quality integrated care for patients.<br />

The <strong>Parkway</strong> Liver Centre, located at Gleneagles Hospital, was set up in November <strong>2006</strong> at the cost of<br />

$3.0 million. The Liver Centre features a dedicated intensive care unit and is the first fully integrated<br />

facility for liver transplant and treatment in Asia. Patients at the Liver Centre receive comprehensive<br />

tertiary care, supported by a dedicated team of professionals, with extensive experience in critical care,<br />

liver transplantation and liver disease.<br />

13<br />

PARKWAY HOLDINGS LIMITED<br />

ANNUAL REPORT <strong>2006</strong>

In surgery, the sterilisation of equipment is vital to ensure the finest<br />

clinical outcomes.<br />

Highly skilled, multidisciplinary teams deploy the latest proven<br />

technology.<br />

<strong>Parkway</strong> Laboratory Services located at Ayer Rajah in Singapore<br />

provides a full spectrum of laboratory support to the Group’s<br />

hospitals and other clients.<br />

In addition to providing high-end medical services, the staff at<br />

Shanghai Gleneagles International Medical and Surgical Centre are<br />

also dedicated to service excellence with a local touch.<br />

14<br />

In December <strong>2006</strong>, the Central Sterilisation<br />

Supply Department (“CSSD”) became the first in<br />

Southeast Asia to be located off the hospital site.<br />

In surgery, the sterilisation of equipment is a very<br />

vital element in ensuring finest clinical outcomes<br />

through effective infection control. The 12,000<br />

square-foot off-site facility with automated<br />

systems, designed for efficiency and productivity,<br />

is fully compliant with international standards.<br />

A unique feature is the system’s ability to<br />

accurately track all instruments sent to the facility<br />

for sterilisation through real time documented<br />

processes. Through automation, the CSSD aims<br />

to improve operational efficiency, lower costs<br />

over time and more importantly, provide and<br />

maintain the highest standards of sterilisation for<br />

instruments used in clinical procedures. In addition,<br />

the CSSD is an advanced training academy for<br />

infection control in Southeast Asia. This facility will<br />

help <strong>Parkway</strong> reinforce and educate staff on the<br />

correct practices for disinfection and sterilisation,<br />

instrument logistics management, and quality<br />

control. The CSSD is an important part of the<br />

ongoing plan to develop expertise in healthcare<br />

support services while streamlining our support<br />

operations.<br />

To achieve the finest clinical outcomes for our<br />

patients, we are creating structured clinical<br />

programmes, where patients and their conditions<br />

will be cared for in a seamless manner. Facilities,<br />

processes and services will be integrated; there<br />

will be performance measures and benchmarks,<br />

including professional reviews, put in place, to<br />

deliver excellent clinical results for our patients.<br />

Some of these clinical programmes include Heart<br />

and Vascular, Oncology, Transplant and Cellular<br />

Therapy, Neuroscience, Women and Children,<br />

Musculoskeletal, Surgery and Chronic Disease<br />

Management.<br />

Deploying advanced technology<br />

Our commitment to constantly improve clinical<br />

expertise is demonstrated by deploying proven<br />

advanced technologies that provide patients<br />

with more effective treatment pathways that are<br />

reliable and life-saving.<br />

To provide patients with precise and safe radiation<br />

treatment for cancer, <strong>Parkway</strong> invested $7.0<br />

million in the TomoTherapy Hi-Art System which is<br />

located at the Oncology Centre in Mount Elizabeth<br />

Hospital. Being the first in South Asia to deploy<br />

this most advanced integrated cancer treatment<br />

system in the world, <strong>Parkway</strong>’s doctors now have<br />

a system that delivers highly accurate radiation<br />

doses with precision, and advanced diagnostic<br />

imaging that captures moment-by-moment<br />

images of targeted tumor immediately before<br />

and after treatment. The benefits to our cancer<br />

patients include faster, more effective treatment<br />

with fewer side effects.<br />

<strong>Parkway</strong> is the only healthcare provider in Singapore<br />

to offer an improved ultrasound device for safer<br />

cataract surgery. Patients who have experienced<br />

treatment using our new device reported minimal<br />

post-surgery discomfort. The ultrasound probe<br />

device located at Gleneagles Hospital, produces<br />

less heat than older probes and thus, risk of<br />

injury to the cornea or other parts of the eye is<br />

reduced.<br />

We have also begun plans to revamp our<br />

information technology (“IT”) system. In 2007, we<br />

have several project plans in place to propel the<br />

Group forward. The $6.0 million agreement with<br />

Tata Consultancy Services (TCS), one of the world’s<br />

largest IT services provider, will see an integration<br />

and overhaul of IT platforms across the Group.<br />

With the system upgrade, patients in <strong>Parkway</strong> will<br />

experience a seamless level of care, regardless of<br />

which facility they are in. The new platform will be<br />

more versatile and enable enhancements as well<br />

as improve healthcare medical information system<br />

upgrades over time.<br />

With improved integration across our IT platforms,<br />

we will bring our patients increased convenience,<br />

efficiency and service quality. In addition, our<br />

staff will also benefit from the enhanced system,<br />

including having the ability to perform their duties<br />

more efficiently and having access to better skills<br />

development programmes.<br />

Growing the business<br />

With a firm base of operations established here<br />

in Singapore, <strong>Parkway</strong> is setting its sights further,<br />

and has begun plans to provide value-based<br />

healthcare to a wider audience. We regard this as<br />

a great privilege and responsibility to care for our<br />

patients whose well being we have been entrusted<br />

with. The <strong>Parkway</strong> commitment to standards<br />

will continue to be maintained as we expand<br />

our operations. Our growth initiatives include<br />

enhancing our clinical programmes to leverage<br />

on local and overseas patients through new<br />

strategic marketing partnerships. Our investment<br />

in innovative, proven technology, remains an<br />

integral part of our strategy for growth.<br />

In addition, the Group will also establish new<br />

facilities and upgrade existing facilities to<br />

complement our clinical programmes. A good<br />

example is the planned <strong>Parkway</strong> Children’s Centre<br />

to be set up at East Shore Hospital in the second<br />

quarter of 2007. Together with the <strong>Parkway</strong> Cancer<br />

Centre, the <strong>Parkway</strong> Children’s Centre will further<br />

enhance the Oncology clinical programme.<br />

We also continue to seek new ventures and<br />

partnerships across the region and the world. The<br />

Shanghai Gleneagles International Medical and<br />

Surgical Centre has been established at the cost<br />

of $10 million and is expected to be operational<br />

in the first half of 2007. A joint venture with<br />

Shanghai Huashan Hospital, one of Shanghai’s<br />

premier hospitals, the Centre will provide high-end<br />

medical care to the local and foreign community<br />

in Shanghai.<br />

In April <strong>2006</strong>, our primary healthcare arm, <strong>Parkway</strong><br />

Shenton, began operations of an aesthetics clinic<br />

in Ho Chi Minh, Vietnam. This venture aims to<br />

cater to the growing aesthetics needs of the local<br />

and expatriate community.<br />

15<br />

PARKWAY HOLDINGS LIMITED<br />

ANNUAL REPORT <strong>2006</strong>

The number of <strong>Parkway</strong>’s international patient<br />

assistance centres grew to over 45 worldwide with<br />

two more set up in Cairo, Egypt and Lagos, Nigeria.<br />

More such centres are planned for emerging and<br />

growth markets such as India, Russia and Saudi<br />

Arabia.<br />

<strong>Parkway</strong> won 282 awards. The award recognises outstanding service,<br />

seeks to develop service models for staff to emulate and creates<br />

service champions to inspire dedicated and professional services.<br />

Also in August <strong>2006</strong>, <strong>Parkway</strong> established a<br />

joint venture known as <strong>Pantai</strong> Irama Ventures<br />

Sdn Bhd with Khazanah Nasional Berhad - the<br />

investment arm of the Malaysian government.<br />

<strong>Parkway</strong> plans to provide hospital operating and<br />

management expertise to <strong>Pantai</strong> Holdings while<br />

pursuing growth opportunities in the hospital and<br />

healthcare services business in Malaysia through<br />

<strong>Pantai</strong> Irama Ventures Sdn Bhd.<br />

Extending care to the community, both locally and around the region.<br />

A team of doctors, nurses and ground support staff were despatched to<br />

render medical aid in Yogyakarta after a powerful earthquake struck.<br />

Recognition<br />

Joint Commission International (JCI)<br />

Accreditation<br />

Two of our premier hospitals, Gleneagles Hospital<br />

and Mount Elizabeth Hospital were both awarded<br />

with Joint Commission International accreditation<br />

in May and June <strong>2006</strong> respectively. The Joint<br />

Commission International, based in United States, is<br />

an independent accreditation body for international<br />

healthcare and quality improvement with standards<br />

based on international consensus. Having the<br />

accreditation demonstrates <strong>Parkway</strong>’s commitment<br />

to delivering quality, safe and efficient patient care.<br />

Singapore Excellent Service Award (EXSA)<br />

In recognition of <strong>Parkway</strong>’s belief in service<br />

excellence and continuous training, 282 staff from<br />

East Shore Hospital, Gleneagles Hospital and Mount<br />

Elizabeth Hospital received the EXSA.<br />

Humanitarian Awards<br />

Two of <strong>Parkway</strong>’s staff, Ms Lisa Chong Ah Yoke<br />

and Ms Rahmah bte Mohd Shariff, received the<br />

prestigious Healthcare Humanity Award from<br />

Health Minister Mr Khaw Boon Wan, in June <strong>2006</strong>.<br />

The awards are in recognition of their courage,<br />

compassion and dedication as healthcare workers.<br />

Ms Chong and Ms Rahmah are active volunteers<br />

and have participated in various humanitarian relief<br />

missions around the region.<br />

While nurturing our offshore growth strategy,<br />

homegrown interests will continue to feature<br />

importantly. To meet specific treatment capacity<br />

needs, Mount Elizabeth Hospital was renovated to<br />

include a new intensive care unit with 10 beds to<br />

cater to growing bone marrow transplant patient<br />

numbers. In addition, at Gleneagles Hospital,<br />

a new ward with 18 beds for liver patients was<br />

opened in November <strong>2006</strong>. The <strong>Parkway</strong> Liver<br />

Centre and the Asian Centre for Liver Disease and<br />

Transplantation (“ACLDT”) successfully performed<br />

85 liver transplant cases to date and has leading<br />

reputation for living donor liver transplants. Our<br />

expertise in stem cell therapy continues to grow<br />

with 85 stem cell transplant cases performed to<br />

date. These initiatives and successes demonstrate<br />

our commitment to use proven approaches<br />

to achieve the best clinical outcomes for our<br />

patients.<br />

Caring for the region<br />

<strong>Parkway</strong> believes strongly in caring for the<br />

community, both locally and around the region.<br />

Our success today propels us further in our<br />

humanitarian and social responsibility efforts.<br />

Over the past 11 years, the Group’s hospitals<br />

hold their annual Christmas Light-up and Charity<br />

drive to collect funds for various local charity<br />

beneficiaries.<br />

In May <strong>2006</strong>, when a powerful earthquake struck<br />

Yogyakarta in Indonesia causing widespread<br />

damage to the city infrastructure, medical support<br />

was severely disrupted. <strong>Parkway</strong> immediately<br />

responded by assembling a team of doctors, nurses<br />

and ground support staff who were dispatched<br />

to render emergency medical care there. The 17<br />

strong team, comprising seven doctors, seven<br />

nurses and three support staff, spent six days<br />

performing surgery in hospitals and treating<br />

victims at various disaster sites.<br />

<strong>Parkway</strong>’s commitment to support humanitarian<br />

efforts in the region continued after the 2004<br />

December tsunami catastrophe when we partnered<br />

with Mercy Relief missions to provide medical aid<br />

to the affected areas in 2005. The Group also<br />

provided medical relief and humanitarian aid to<br />

the earthquake victims in Pakistan in 2005.<br />

Poised for the future<br />

Strategies are now in place to take <strong>Parkway</strong> to<br />

the next level as the global leader in value-based<br />

integrated healthcare. From <strong>Parkway</strong>’s global<br />

medical hub based in Singapore, the Group aims<br />

to continue its reach to new markets, through<br />

medical value travel, regional expansion and<br />

new acquisitions. <strong>Parkway</strong> remains committed<br />

to spread the same standard of clinical care and<br />

service excellence to the global community.<br />

Moving forward, <strong>Parkway</strong> has plans to establish<br />

several new facilities to add to our repertoire<br />

of capabilities that include a day surgery and<br />

specialist centre in the heart of Singapore and<br />

a new radiology clinic. These new facilities will<br />

enhance our treatment expertise and provide<br />

integrated support for our clinical programmes.<br />

The Group continues to see strong demand in<br />

the existing facilities and expects good growth<br />

potential from overseas investments such as<br />

Shanghai’s medical centre. These new ventures<br />

take time to be established and start-up expenses<br />

are expected to be incurred in the short term as<br />

<strong>Parkway</strong> pursues opportunities for future growth.<br />

To meet the challenges of the rising tide of global<br />

competition in healthcare, <strong>Parkway</strong> will continue<br />

to develop greater synergies within the Group,<br />

create and enhance shareholder value, and<br />

measure performance through benchmarks across<br />

our operations.<br />

16<br />

17<br />

PARKWAY HOLDINGS LIMITED<br />

ANNUAL REPORT <strong>2006</strong>

Financial Highlights<br />

Review of financials in <strong>2006</strong><br />

Group Consolidated Statements<br />

Profit and Loss Account<br />

Revenue<br />

Healthcare 864,508 560,876 416,232 350,620 328,744<br />

Others 3,496 2,740 2,797 4,343 12,804<br />

<strong>2006</strong><br />

$’000<br />

2005 #<br />

$’000<br />

2004 #<br />

$’000<br />

2003 #<br />

$’000<br />

2002 #<br />

$’000<br />

868,004 563,616 419,029 354,963 341,548<br />

Earnings before interest expense, tax, depreciation and amortisation<br />

(EBITDA) ~ 189,641 141,939 112,750 86,860 89,556<br />

% of revenue 21.8% 25.2% 26.9% 24.5% 26.2%<br />

Earnings before interest expense, tax and exceptional items (EBIT) ~ 129,377 101,330 77,641 55,137 58,892<br />

% of revenue 14.9% 18.0% 18.5% 15.5% 17.2%<br />

Earnings after tax and minority interests but before exceptional items 66,955 63,344 51,945 34,988 33,301<br />

% of revenue 7.7% 11.2% 12.4% 9.9% 9.8%<br />

Profit attributable to equity holders of the Company 55,283 61,969 50,463 33,608 33,301<br />

% of revenue 6.4% 11.0% 12.0% 9.5% 9.8%<br />

REAPING REWARDS,<br />

STRIVING BEYOND<br />

Balance Sheet<br />

Total Assets 1,231,403 1,344,042 975,889 852,912 867,464<br />

Net Borrowings 354,570 367,497 222,780 260,780 262,215<br />

Total Shareholders’ Funds 423,928 415,517 425,027 430,500 427,970<br />

Profitability Ratios (%):<br />

Return on Shareholders’ Funds<br />

Before exceptional items 15.8 15.2 12.2 8.1 7.8<br />

After exceptional items 13.0 14.9 11.9 7.8 7.8<br />

Return on Assets<br />

Before exceptional items 5.4 4.7 5.3 4.1 3.8<br />

After exceptional items 4.5 4.6 5.2 3.9 3.8<br />

Gearing Ratio:<br />

Net debt equity ratio 0.84 0.88 0.52 0.61 0.61<br />

Per Share Data:<br />

Earnings per share ($)<br />

Before exceptional items 0.09 0.09 0.07 0.05 0.05<br />

After exceptional items 0.08 0.09 0.07 0.05 0.05<br />

Gross dividend ($) + 0.2225* 0.105 0.09 0.06 0.05<br />

Net tangible asset backing per share ($) 0.35 0.32 0.54 0.55 0.55<br />

Net asset value backing per share ($) 0.55 0.57 0.59 0.60 0.59<br />

~ Earnings before exceptional items, exchange differences and share of results of associates.<br />

# Certain comparative figures from FY2002 to FY2005 have been restated and reclassified for comparative purposes due to adoption of<br />

new and revised accounting standards as well as change in accounting treatment for joint ventures.<br />

+ Gross dividend comprises interim dividend declared during the year and final dividend proposed by directors in respect of that financial<br />

year under review.<br />

* Includes special dividend of 11.25 cents per share less tax paid in respect of year <strong>2006</strong>.<br />

18<br />

19<br />

PARKWAY HOLDINGS LIMITED<br />

ANNUAL REPORT <strong>2006</strong>

FINANCIAL REVIEW<br />

Review of financials in <strong>2006</strong><br />

in $’m<br />

Highlights<br />

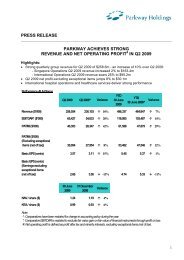

• Group Revenue soared 54% to $868.0 million<br />

• EBITDA grew 34% to $189.6 million<br />

• Rewarded shareholders with special cash dividend<br />

and rights issue exercise<br />

Revenue by Business Segment<br />

350.0<br />

300.0<br />

250.0<br />

200.0<br />

150.0<br />

100.0<br />

50.0<br />

0<br />

356.3<br />

300.3<br />

Singapore<br />

Hospitals<br />

239.2<br />

116.1<br />

International<br />

Hospitals<br />

<strong>2006</strong> 2005<br />

269.1<br />

144.5<br />

Healthcare<br />

Services<br />

3.5<br />

2.7<br />

Others<br />

Growing consistently<br />

Consolidated total revenue of the Group for<br />

FY<strong>2006</strong> soared 54% to $868.0 million, compared<br />

with $563.6 million in the previous fiscal year.<br />

Similarly, the Group’s EBITDA climbed 34% to<br />

$189.6 million, from $141.9 million in FY2005.<br />

<strong>Pantai</strong> Holdings Berhad (“<strong>Pantai</strong>”), acquired in<br />

end 3Q 2005, accounted for approximately 35%<br />

in revenues and 29% in EBITDA of the Group for<br />

FY<strong>2006</strong>, contributing positively to the healthy<br />

growth to the Group’s International Hospitals and<br />

Healthcare Services Divisions. Net profit excluding<br />

exceptional item and exchange losses was $70.1<br />

million, an increase of 11% from $62.9 million in the<br />

previous fiscal year. The Group achieved this strong<br />

operational performance despite expenditure<br />

incurred from investing in future growth in the<br />

region as a result of improved performances across<br />

all core healthcare operations with continuing<br />

focus on delivering more sophisticated and higher<br />

value-added services.<br />

Including exceptional item and exchange losses,<br />

the Group’s net profit was $55.3 million, an 11%<br />

reduction from FY2005. This was mainly due to<br />

the exceptional item of the impairment loss of<br />

$11.7 million on available-for-sale financial assets<br />

relating to the Group’s investment in Auric Pacific<br />

Group Limited.<br />

The Group’s Singapore Hospitals Division,<br />

comprising of Mount Elizabeth Hospital,<br />

Gleneagles Hospital and East Shore Hospital,<br />

delivered $356.3 million in revenue for FY<strong>2006</strong>,<br />

a 19% increase compared with $300.3 million in<br />

FY2005. The Division’s EBITDA also grew 17% in<br />

the same period to reach $103.7 million, compared<br />

with $88.3 million in the previous financial year.<br />

The growth was largely driven by the continuing<br />

focus on the development of clinical programmes<br />

which resulted in an increase in higher revenue<br />

intensity cases and higher utilisation of outpatient<br />

services such as diagnostic services and cancer<br />

treatments.<br />

The Group experienced tremendous growth from<br />

our International Hospitals Division as well. The<br />

Division includes our facilities in Malaysia, Brunei<br />

and India. Revenue climbed 106% from $116.1<br />

million in FY2005 to $239.2 million in FY<strong>2006</strong>.<br />

EBITDA grew at a similar pace rising 69% to reach<br />

$35.6 million in FY<strong>2006</strong>. All international hospitals<br />

performed well in FY<strong>2006</strong>, delivering an increase<br />

in revenue and admissions. With the restructuring<br />

of our interests in Malaysia completed, <strong>Parkway</strong><br />

had ceased to consolidate <strong>Pantai</strong> as a subsidiary<br />

and commencing 4Q <strong>2006</strong> had proportionately<br />

consolidated <strong>Pantai</strong>’s contributions instead. We<br />

will integrate <strong>Pantai</strong>’s hospitals within existing<br />

operations and realign teams for increased synergy.<br />

The partnership with Khazanah serves as a strong<br />

platform to capitalise on the growing healthcare<br />

opportunities in Malaysia.<br />

Revenue from our Healthcare Services Division rose<br />

86% from $144.5 million in FY2005 to $269.1<br />

million in FY<strong>2006</strong>. EBITDA increased by 54%,<br />

from $31.0 million in FY2005 to $47.7 million in<br />

FY<strong>2006</strong>. Despite increased business development<br />

activities and expenditure incurred in new start-up<br />

clinics and facilities in Singapore and the region<br />

such as Shanghai and Vietnam, the division<br />

continued to show healthy growth in revenues<br />

and EBITDA largely fuelled by contributions from<br />

<strong>Pantai</strong>’s healthcare services in Malaysia, and the<br />

growth in the Singapore radiology and laboratory<br />

businesses. To provide patients with increased<br />

convenience, the <strong>Parkway</strong> Shenton group opened<br />

new clinics and remained focused on corporate<br />

clients. Medi-Rad Associates continued adding<br />

and upgrading its spectrum of diagnostic imaging<br />

equipment. <strong>Parkway</strong> Laboratory Services delivered<br />

top-notch laboratory services and will continue to<br />

upgrade its facilities and expertise.<br />

Hospitals Statistics<br />

Number of Hospitals<br />

(at end of period)<br />

Singapore Hospitals<br />

2005 <strong>2006</strong> <strong>2006</strong> vs 2005<br />

3 3 0.0%<br />

Inpatient Admissions 49,980 48,193 -3.6%<br />

Number of Day Cases * 13,444 13,866 3.1%<br />

Average Length of Stay (days) 3.56 3.57 0.2%<br />

* Day Ward Admissions only<br />

Number of Hospitals<br />

(at end of period)<br />

in $’m<br />

EBITDA by Business Segment<br />

110.0<br />

100.0<br />

90.0<br />

80.0<br />

70.0<br />

60.0<br />

50.0<br />

40.0<br />

30.0<br />

20.0<br />

10.0<br />

0<br />

103.7<br />

88.3<br />

Singapore<br />

Hospitals<br />

35.6<br />

21.1<br />

International<br />

Hospitals<br />

International Hospitals<br />

2005 <strong>2006</strong> <strong>2006</strong> vs 2005<br />

11 11 0.0%<br />

Inpatient Admissions + 16,649 17,862 7.3%<br />

Average Length of Stay (days) + 3.37 3.49 3.6%<br />

Patient Days + 56,176 62,344 11.0%<br />

+<br />

Statistics on inpatient volume, average length of stay and patient days<br />

are those of Brunei and Penang hospitals only.<br />

<strong>2006</strong> 2005<br />

47.7<br />

31.0<br />

Healthcare<br />

Services<br />

2.7 1.5<br />

Others<br />

20<br />

21<br />

PARKWAY HOLDINGS LIMITED<br />

ANNUAL REPORT <strong>2006</strong>

CORPORATE INFORMATION<br />

<strong>Parkway</strong>’s earnings per share (EPS) 1 increased<br />

by 4.9% to $0.0901 compared to the previous<br />

financial year. The Group’s return on equity (ROE) 1<br />

was 15.8%, an improvement from 15.2% in<br />

FY2005. Net debt (inclusive of related hedging<br />

financial derivatives) was $361.2m and net debt<br />

equity ratio was 0.85 as at 31 December <strong>2006</strong>.<br />

Strong cashflows from healthcare operations<br />

have helped the Group retain an efficient capital<br />

structure.<br />

Reaping rewards<br />

The Group believes in sharing our growth with<br />

our stakeholders. With robust performance across<br />

all business segments, the Directors paid out<br />

aggregate interim quarterly dividends of $0.055<br />

per share less tax paid.<br />

In 3Q <strong>2006</strong>, the Group further announced a special<br />

cash dividend and rights issue exercise which<br />

was completed during the year. The exercise was<br />

held to reward our shareholders with a special<br />

cash dividend as well as provide shareholders<br />

with an option to re-invest their special dividend<br />

by subscribing for the rights shares. The special<br />

dividend also allowed us to pass on our tax credits<br />

available under Section 44A of the Income Tax Act<br />

(Cap. 134) to our shareholders.<br />

Shareholders were rewarded with a special cash<br />

dividend of $0.1125 per share less tax, as well as a<br />

rights issue of new ordinary shares at $1.80 each,<br />

for every 20 shares held. The aggregate amount<br />

of this special dividend is approximately $65.7<br />

million, net of tax.<br />

This rights issue strengthened the capital base of<br />

<strong>Parkway</strong>, and together with the special dividend,<br />

converted a portion of our accumulated profits<br />

into permanent share capital.<br />

With a strong finish for FY<strong>2006</strong>, the Directors<br />

recommended a final dividend of $0.055 per share<br />

less tax, generating a total of $0.11 of ordinary<br />

dividend per share less tax for FY<strong>2006</strong>.<br />

Earnings Per Share 1<br />

cents<br />

12.00<br />

9.00<br />

7.07<br />

6.00<br />

3.00<br />

2004<br />

Return On Equity 1<br />

20.0%<br />

16.0%<br />

12.2%<br />

12.0%<br />

8.0%<br />

4.0%<br />

0.0%<br />

2004<br />

8.59<br />

2005<br />

15.2%<br />

2005<br />

9.01<br />

<strong>2006</strong><br />

15.8%<br />

<strong>2006</strong><br />

BOARD OF DIRECTORS<br />

Richard Seow Yung Liang<br />

Chairman<br />

Sunil Chandiramani<br />

Vice Chairman<br />

Dr Lim Cheok Peng<br />

Managing Director<br />

Alain Ahkong Chuen Fah<br />

Non-executive Director<br />

Chang See Hiang<br />

Non-executive Director<br />

Timothy David Dattels<br />

Non-executive Director<br />

Ranvir Dewan<br />

Non-executive Director<br />

(Appointed on 8 March 2007)<br />

Ho Kian Guan<br />

Non-executive Director<br />

Dr Ronald Ling Jih Wen<br />

Non-executive Director<br />

Steven Joseph Schneider<br />

Non-executive Director<br />

(Appointed on 8 March 2007)<br />

Ashish Jaiprakash Shastry<br />

Non-executive Director<br />

David R White<br />

Non-executive Director<br />

(Resigned on 8 March 2007)<br />

Ho Kian Hock<br />

(Alternate Director to<br />

Ho Kian Guan)<br />

AUDIT COMMITTEE<br />

Alain Ahkong Chuen Fah<br />

Chairman<br />

Chang See Hiang<br />

Ho Kian Guan<br />

Ashish Jaiprakash Shastry<br />

MANAGEMENT COMMITTEE<br />

Dr Lim Cheok Peng<br />

Chairman<br />

Richard Seow Yung Liang<br />

Ashish Jaiprakash Shastry<br />

NOMINATING COMMITTEE<br />

Chang See Hiang<br />

Chairman<br />

Richard Seow Yung Liang<br />

Sunil Chandiramani<br />

Alain Ahkong Chuen Fah<br />

Timothy David Dattels<br />

REMUNERATION COMMITTEE<br />

Timothy David Dattels<br />

Chairman<br />

Richard Seow Yung Liang<br />

Sunil Chandiramani<br />

Ashish Jaiprakash Shastry<br />

SHARE OPTION SCHEME<br />

COMMITTEE *<br />

Timothy David Dattels<br />

Chairman<br />

Richard Seow Yung Liang<br />

Sunil Chandiramani<br />

Ashish Jaiprakash Shastry<br />

SHARE PURCHASE COMMITTEE<br />

Chang See Hiang<br />

Chairman<br />

Richard Seow Yung Liang<br />

Sunil Chandiramani<br />

STRATEGIC PLANNING<br />

COMMITTEE<br />

Richard Seow Yung Liang<br />

Chairman<br />

Dr Lim Cheok Peng<br />

Dr Ronald Ling Jih Wen<br />

Ashish Jaiprakash Shastry<br />

David R White<br />

(Resigned on 8 March 2007)<br />

REGISTERED OFFICE<br />

1 Grange Road #11-01<br />

Orchard Building<br />

Singapore 239693<br />

Tel: (65) 6796 0600<br />

www.parkwayholdings.com<br />

COMPANY SECRETARIES<br />

June Tay Kwok Fung<br />

Ho Li Li<br />

SHARE REGISTRAR<br />

M & C Services Private Limited<br />

138 Robinson Road #17-00<br />

The Corporate Office<br />

Singapore 068906<br />

Tel: (65) 6227 6660<br />

AUDITORS<br />

KPMG<br />

Certified Public Accountants<br />

Singapore<br />

16 Raffles Quay #22-00<br />

Hong Leong Building<br />

Singapore 048581<br />

Partner-In-Charge<br />

– Tay Puay Cheng<br />

PRINCIPAL BANKERS<br />

Citibank N.A., Singapore Branch<br />

1<br />

ROE and EPS are computed based on net profit attributable to<br />

shareholders before exceptional item.<br />

EXECUTIVE COMMITTEE<br />

Richard Seow Yung Liang<br />

Chairman<br />

Ho Kian Guan<br />

Ashish Jaiprakash Shastry<br />

Oversea-Chinese Banking<br />

Corporation Limited<br />

Standard Chartered Bank<br />

Sunil Chandiramani<br />

Dr Lim Cheok Peng<br />

Ashish Jaiprakash Shastry<br />

22<br />

* Dissolved on 9 November <strong>2006</strong><br />

23<br />

PARKWAY HOLDINGS LIMITED<br />

ANNUAL REPORT <strong>2006</strong>

BOARD OF DIRECTORS<br />

Mr Richard Seow Yung Liang<br />

Chairman<br />

Mr Alain Ahkong Chuen Fah<br />

Non-executive Director<br />

Mr Ranvir Dewan<br />

Non-executive Director<br />

Mr Steven Joseph Schneider<br />

Non-executive Director<br />

Mr Richard Seow Yung Liang Mr Sunil Chandiramani Dr Lim Cheok Peng<br />

Mr Alain Ahkong Chuen Fah Mr Chang See Hiang Mr Timothy David Dattels<br />

Mr Ranvir Dewan<br />

(Appointed on 8 March 2007)<br />

Mr Steven Joseph Schneider<br />

(Appointed on 8 March 2007)<br />

24<br />

Mr Ho Kian Guan<br />

Mr Ashish Jaiprakash Shastry<br />

Dr Ronald Ling Jih Wen<br />

Mr David R. White<br />

(Resigned on 8 March 2007)<br />

Mr Richard Seow has been<br />

the Chairman of the Board<br />

of <strong>Parkway</strong> Holdings and the<br />

Executive Committee since July<br />

2005. A former investment<br />

banker with over 16 years of<br />

industry experience, he was<br />

previously with Citigroup,<br />

Goldman Sachs and JP Morgan.<br />

Mr Seow is also a director of<br />

Twinwood Engineering Limited<br />

and Lee Hing Development<br />

Limited. Mr Seow is a member<br />

of the Singapore Sports Council<br />

and a Governor of the Anglo<br />

Chinese School.<br />

Mr Sunil Chandiramani<br />

Vice Chairman<br />

Mr Sunil Chandiramani is<br />

a Director and Partner of<br />

Symphony Group of companies<br />

which invest in Healthcare and<br />

other consumer businesses<br />

throughout the Asia Pacific<br />

region. Mr Chandiramani is<br />

a member of the Executive<br />

Committee and various other<br />

committees and sits on the<br />

boards of several companies.<br />

Dr Lim Cheok Peng<br />

Managing Director<br />

Dr Lim Cheok Peng is the<br />

Managing Director of <strong>Parkway</strong><br />

Holdings and he sits on the<br />

Executive Committee. Dr Lim<br />

has been steering the Group’s<br />

healthcare efforts since 1987<br />

and recently, has also been<br />

designated as the Group<br />

President and Chief Executive<br />

Officer. He is a cardiologist by<br />

profession.<br />

Mr Alain Ahkong is the<br />

Chairman of the Audit<br />

Committee of <strong>Parkway</strong><br />

Holdings. Currently a Director of<br />

Pioneer Management Services<br />

Pte Ltd, Mr Ahkong also<br />

holds directorships in several<br />

companies, including listed<br />

company, Twinwood Engineering<br />

Limited.<br />

Mr Chang See Hiang<br />

Non-executive Director<br />

Mr Chang See Hiang sits on<br />

various committees of <strong>Parkway</strong><br />

Holdings. An Advocate and<br />

Solicitor of the Supreme Court<br />

of Singapore, he is the Senior<br />

Partner of his own law firm,<br />

M/s Chang See Hiang and<br />

Partners. Mr Chang is a Director<br />

of Jardine Cycle & Carriage<br />

Limited, MCL Land Limited,Yeo<br />

Hiap Seng Limited, Singapore<br />

Technologies Aerospace Ltd,<br />

STT Communications Ltd and<br />

Honorary Secretary and member,<br />

Management Committee of the<br />

Singapore Turf Club.<br />

Mr Timothy David Dattels<br />

Non-executive Director<br />

Mr Timothy Dattels is<br />

a Managing Director of TPG<br />

Capital, L.P. Prior to joining TPG<br />

in 2002, Mr Dattels was<br />

a Managing Director of<br />

Goldman Sachs and led the<br />

firm’s investment banking<br />

business in Asia. Mr Dattels<br />

is a Director of Shenzhen<br />

Development Bank, SingTao<br />

News Corp. Limited, Shangri-La<br />

Asia Ltd and Primedia Inc.<br />

Mr Ranvir Dewan is a Fellow<br />

of the Institute of Chartered<br />

Accountants in England<br />

& Wales and a member of the<br />

Canadian Institute of Chartered<br />

Accountants. Mr Dewan joined<br />

TPG Capital (Singapore) Pte Ltd<br />

in July <strong>2006</strong> as Senior Advisor<br />

and is based in Singapore. From<br />

April 2000 to July <strong>2006</strong><br />

he was Executive Vice President<br />

and Chief Financial Officer of<br />

Standard Chartered First Bank<br />

(formerly Korea First Bank) in<br />

Seoul, Korea. Prior to that,<br />

Mr Dewan spent 13 years with<br />

Citibank and held various senior<br />

positions in its international<br />

businesses. Mr Dewan has also<br />

held senior positions with KPMG<br />

in Canada and England where<br />

he specialized in the audits of<br />

financial institutions. Mr Dewan<br />

serves on the board of Shriram<br />

Transport Finance Co. Ltd.<br />

Mr Ho Kian Guan<br />

Non-executive Director<br />

Mr Ho Kian Guan has been<br />

a director of <strong>Parkway</strong> Holdings<br />

since 1985. Mr Ho is also the<br />

Chairman of publicly-listed Keck<br />

Seng (Malaysia) Berhad whose<br />

principal activities include palm<br />

oil cultivation, the processing<br />

and refining of palm oil and real<br />

estate development.<br />

Dr Ronald Ling Jih Wen<br />

Non-executive Director<br />

Dr Ronald Ling trained as a<br />

medical doctor and subsequently<br />

worked as a management<br />

consultant with McKinsey & Co.<br />

in London, and as General<br />

Manager with <strong>Parkway</strong> Group<br />

Healthcare. Dr Ling is a Principal<br />

with the Symphony Group<br />

of companies which invest in<br />

Healthcare and other consumer<br />

businesses throughout the Asia<br />

Pacific region. He also sits on the<br />

Boards of Twinwood Engineering<br />

Limited in Singapore and Strides<br />

Arcolabs Limited in India.<br />

Mr Steven Schneider is a Partner<br />

& Managing Director of TPG<br />

Capital, Limited. Prior to joining<br />

TPG in 2005, Mr Schneider was<br />

the President & CEO of GE Asia-<br />

Pacific where he previously spent<br />

20 years at GE Company, 14 of<br />

which were in Asia. Mr Schneider<br />

is a Director of Hanaro Telecom,<br />

Myer Department Store and<br />

Sigma Manufacturing.<br />

Mr Ashish Jaiprakash Shastry<br />

Non-executive Director<br />

Mr Ashish Shastry is a Managing<br />

Director and Head of Southeast<br />

Asia at TPG Capital (Singapore)<br />

Pte Ltd. Mr Shastry has worked<br />

at TPG since 1998, during<br />

which time he has been based<br />

in Singapore and Hong Kong,<br />

focusing on TPG’s investment<br />

activities in India, Australia<br />

and Southeast Asia. He also<br />

serves on the board of Lee Hing<br />

Development Limited.<br />

Mr David R. White<br />

Non-executive Director<br />

Mr David White is the Chairman<br />

of the Board and Chief Executive<br />

Officer of Iasis Healthcare<br />

LLC, headquartered in the<br />

United States. Mr White was<br />

also previously Executive Vice<br />

President and Chief Executive<br />

Officer of Community Health<br />

Systems, Inc., a hospital<br />

management company that<br />

operated about 20 acute care<br />

hospitals in the United States.<br />

Mr Ho Kian Hock<br />

(alternate director to Mr Ho Kian<br />

Guan)<br />

25<br />

PARKWAY HOLDINGS LIMITED<br />

ANNUAL REPORT <strong>2006</strong>

2007 SENIOR MANAGEMENT<br />

Dr Lim Cheok Peng<br />

Group President and Chief<br />

Executive Officer<br />

Dr Lim Cheok Peng, 60, is the<br />

Managing Director of <strong>Parkway</strong><br />

Holdings and he sits on the<br />

Executive Committee. Dr Lim<br />

has been steering the Group’s<br />

healthcare efforts since 1987<br />

and recently, has also been<br />

designated as the Group<br />

President and Chief Executive<br />

Officer. Dr Lim is a cardiologist<br />

by profession and holds the<br />

following qualifications:<br />

MBBS (Singapore), M.Med.<br />

Int. Med (Singapore), MRCP<br />

(UK), FRCP (Edinburgh), FRCP<br />

(Glasgow), FAMS (Cardiology).<br />

Daniel James Snyder, FACHE<br />

Group Executive Vice President<br />

and Group Chief Operating<br />

Officer<br />

Dan Snyder, 52, was appointed<br />

as Group Chief Operating<br />

Officer on 19 June <strong>2006</strong> and<br />

was recently designated as<br />

Group Executive Vice President<br />

and Group Chief Operating<br />

Officer. Mr Snyder leads all<br />

healthcare operations within<br />

<strong>Parkway</strong>’s integrated healthcare<br />

system.<br />

Prior to joining <strong>Parkway</strong>,<br />

Mr Snyder served as the<br />

President of Banner Health’s<br />

Western Region. Based in<br />

Phoenix, Arizona, Mr Snyder<br />

led twelve hospitals across the<br />

western United States. Prior to<br />

Banner Health, he spent three<br />

years with the Intermountain<br />

Health Care, Salt Lake City,<br />

Utah, leading several hospitals<br />

across the Intermountain<br />

West of the United States.<br />

Prior to Intermountain Health<br />

Care, Mr Snyder served as<br />

a commissioned officer and<br />

healthcare executive in the<br />

United States Navy’s Medical<br />

Service Corps. Over the<br />

course of two decades, he led<br />

myriad hospital and healthcare<br />

operations around the world<br />

serving in Asia, Europe, the<br />

Middle East, Africa and the<br />

United States. Mr Snyder<br />

also served in multiple tours<br />

on the staff of the Chief of<br />

Naval Operations, Office of the<br />

Surgeon General, the Pentagon.<br />

In the Pentagon, Mr Snyder<br />

directed the strategic planning,<br />

programming, budgeting and<br />

operations for the Department<br />

of the Navy’s global integrated<br />

health system.<br />

Mr Snyder holds undergraduate<br />

(Southern Illinois University)<br />

and graduate (Webster<br />

University) degrees in hospital<br />

administration and a graduate<br />

degree in National Resource<br />

Strategy from the National<br />

Defense University, Washington,<br />

DC. Mr Snyder is a Fellow in the<br />

American College of Healthcare<br />

Executives having served as both<br />

a Regent and Governor for the<br />

college.<br />

Molly Foo<br />

Group Senior Vice President,<br />

Finance<br />

Molly Foo, 47, was appointed<br />

as Chief Financial Officer<br />

on 1 April 2003 and was<br />

recently designated as Senior<br />

Vice President, Finance/Chief<br />

Financial Officer. Ms Foo started<br />

with Mount Elizabeth Hospital<br />

in August 1993 and was the<br />

General Manager, Finance. Prior<br />

to this, Ms Foo was the Financial<br />

Controller for Mount Alvernia<br />

Hospital from 1990 to 1993.<br />

Ms Foo graduated with<br />

a Bachelor in Accountancy<br />

from the National University of<br />

Singapore.<br />

Choo Oi Yee<br />

Group Senior Vice President,<br />

Strategic Planning & Business<br />

Development<br />

Choo Oi Yee, 33, joined<br />

<strong>Parkway</strong> on 15 May <strong>2006</strong> and<br />

was recently designated as<br />

Group Senior Vice President,<br />

Strategic Planning & Business<br />

Development. Ms Choo is<br />

responsible for the formulation<br />

and implementation of<br />

<strong>Parkway</strong>’s business strategy and<br />

business development. Prior<br />

to joining <strong>Parkway</strong>, Ms Choo<br />

was an investment banker with<br />

Citigroup from 2000 to <strong>2006</strong>.<br />

She was with Arthur Anderson<br />

from 1996 to 1998.<br />

Ms Choo graduated with<br />

a Bachelor in Accountancy from<br />

the Nanyang Technological<br />

University of Singapore and<br />