Annual Report 2005 - Parkway Pantai

Annual Report 2005 - Parkway Pantai

Annual Report 2005 - Parkway Pantai

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

We Believeannual report <strong>2005</strong>PARKWAY HOLDINGS LIMITED

Chairman’s Letter to Shareholders 10A Letter from the Managing Director 13Milestones for <strong>2005</strong> 17A Premier Regional Healthcare Provider 18<strong>2005</strong> in Review 20Financial Review <strong>2005</strong> 26Board of Directors 30PARKWAY HOLDINGS LIMITEDSenior Management 33(Co. Reg No. 197400320R)Corporate Information 341 Grange Road#11-01 ContentsOrchard Building Financial Contents 35Singapore 239693Tel: (65) 6796 0600Fax: (65) 6796 0634/5www.parkwayholdings.comVision Our vision is to be a leading international healthcare providerof choice with a passion for people and progress.Mission We aim to deliver comprehensive healthcare servicesand quality care consistently to provide value to our customers. Weachieve this through responsible practices and continuous investmentsin our people and technology to meet the challenges of tomorrow.b

We believe... in delivering the very best to our patients.... in investing in leading-edge medical capabilitiesand technologies.... in training and equipping our people.... in extending a helping hand to our community.Trust is fundamental in any relationship but never a given.But with trust comes belief. Like a child knowing that therewill always be a safe pair of hands to fall back on. Or the samebelief that’s shared by each and every one of our patients whowalk through our doors, knowing that they are indeed in thevery best of hands.<strong>Parkway</strong> Holdings Limited is a leading fully integrated healthcareorganisation in Asia, with one of the largest network of hospitals andhealthcare services in the region.<strong>Parkway</strong> owns three premier hospitals in Singapore – East Shore,Gleneagles and Mount Elizabeth. It has a network of hospitals in Malaysia,India and Brunei.The Group’s healthcare network includes <strong>Parkway</strong> Shenton Pte. Ltd.,a major provider of primary healthcare services; Medi-Rad Associates Ltd.,a leading radiology services provider; and <strong>Parkway</strong> Laboratory ServicesLtd., a major provider of laboratory services. The Group offers contractresearch services through Gleneagles CRC Pte. Ltd.1

2We believe in going the extra mile.Distinguishing <strong>Parkway</strong> through unparalleledpatient care experience.

We believe that our patients are our fi rst priority. Delivering unmatched patient careexperience at every turn possible. Our limousine service for maternity patients is one of themany ways that we continue to heighten the <strong>Parkway</strong> experience. Making a difference andan impact on our patients is our driving force.3

4We believe in investing in our capabilities andremaining at the forefront of medical developments.

Built on a rich tradition of medical excellence and innovative spirit, <strong>Parkway</strong> continuesto be at the forefront of cutting-edge technologies and capabilities. This enables usto meet the increasingly complex medical needs of our patients.5

6We believe in investing in our future.The people behind <strong>Parkway</strong>.

<strong>Parkway</strong> is committed to investing in our staff. Through our robust trainingand development programmes, our people have earned a reputation for theirspecialist skills and exceptional service.7

8We believe that there is not a moment or a life to lose,extending a hand for mankind.

<strong>Parkway</strong> remains an organisation with a heart. We have a wider role to play,and that involves leveraging on our expertise and skills to care for those in need.9

Chairman’s Letter to ShareholdersRichard SeowChairmanDear Shareholders,I am delighted to come on board as <strong>Parkway</strong>’s Chairman asyour company stands poised for its next phase of growth.Over the past few years, you have witnessed <strong>Parkway</strong>’sdedicated focus on its core healthcare business,the establishment of our Centres of Excellence, newacquisitions, regional healthcare joint ventures and thecontinued divestment of non-core assets. Today, thesestrategies are starting to show returns. In addition, we haveseen a 39% increase in foreign patients visiting our facilitiesin Singapore over the last 2 years. We are well positioned toachieve our objective of being the premier private healthcareprovider of choice in the region.Our <strong>2005</strong> fi nancial results were positive and a goodimprovement from the previous year. Revenue of $549.0million and net profi t of $62.0 million brought <strong>Parkway</strong>’searnings to a record high. Our improvement in Return onEquity to 15% in <strong>2005</strong> indicates positive momentum inproviding better returns on our capital employed. We willcontinue to seek more opportunities to further improve keyaspects of our fi nancial performance.A signifi cant milestone for this year was the entryof Newbridge Capital and Associates as signifi cantshareholders of the Company. The acquisition of a 26%stake in <strong>Parkway</strong> Holdings lends testimony to the uniquehealthcare platform that <strong>Parkway</strong> has built in Asia.Newbridge is a proven healthcare investor and bringsconsiderable international healthcare experience, fi nancialsavvy and a global network of expertise to the <strong>Parkway</strong>equation. I am confi dent that the entry of Newbridge willprovide the impetus for further growth for <strong>Parkway</strong>.In September <strong>2005</strong>, we expanded our presence inMalaysia through the acquisition of a 31% stake in <strong>Pantai</strong>Holdings. With this investment, <strong>Parkway</strong> has become thelargest shareholder of Malaysia’s leading healthcare serviceprovider. <strong>Parkway</strong> has a long and successful presence inMalaysia and this move will expand our business basesignifi cantly and provide a critical mass of services andfacilities. In Malaysia we have grown from 2 to 9 hospitalsand ancillary facilities across the country. Malaysia is a keymarket for us and our investment in <strong>Pantai</strong> is a strategicmove to continue building on our strengths and growth inkey regional markets.Despite our leadership position, we recognise that wecannot rest on our laurels. Moving forward, our next stepis to achieve sustained growth and generate continuedshareholders’ value. We will achieve this through:10

“It is both a privilege and a great responsibility that patientsand their families entrust us with their well-being.We must never lose sight of our primary objective of providingour patients with the highest standards of healthcare andservice excellence….and we will continue to keep this fundamentalbelief ingrained in the minds of all at <strong>Parkway</strong>.”• A continued commitment to put patients fi rst.It is both a privilege and a great responsibilitythat patients and their families entrust us withtheir well-being. We must never lose sight of ourprimary objective of providing our patients withthe highest standards of healthcare and serviceexcellence. It will be our continued and relentlessfocus on serving our patients’ needs that will setus apart and establish our service quality andfacilities as the “Gold Standard” in our industry.We will continue to keep this fundamental beliefingrained in the minds of all at <strong>Parkway</strong> – from ouradministrators, to our nurses and from our doctorsright through to our management and the Board.• Continuing to recruit and attract the best specialistsand physicians who want to practice in theprivate healthcare arena. Our doctors’ standardsand reputation are respected and well regardedinternationally. <strong>Parkway</strong>’s role is to continue toprovide our doctors with the best possible workenvironment, superior medical support servicesand cutting-edge technologies.• Maintaining our niche as a specialist high-endvalue-added healthcare provider. Our expertisecovers areas such as cardiology, oncology,neurology, haematology, liver and stem celltransplants. With this, <strong>Parkway</strong> is able to leverageon its unique expertise and knowledge to caterto the complex needs and medical care requiredin the region, particularly in developing countrieswhere these services are largely limited.• Tapping on the growth in regional medical tourism.Healthcare has been identifi ed as a growth sectorand the Singapore government has been activelypromoting Singapore as a regional medical hub.We are well positioned to expand our roleas a leader in regional private healthcare. Atthe <strong>Parkway</strong> hospitals, our international patientservices team seeks to meet specifi c needs ofindividual foreign patients and their families.We recently introduced dedicated internationalpatient facilities, more translation services,special menus and new Arabic and Bangladeshistaff. Regionally, we have set up more medicalreferral centres and employed more marketingrepresentatives to reach out to the increasingnumber of international patients.11

• Growing our presence in the region. In <strong>2005</strong>, we builtup our Malaysian platform and expanded in Indiawith our joint venture with Apollo Hospitals Enterpriseto establish and operate a radio imaging centre inHyderabad. We also signed an agreement with theAsian Heart Institute and Research Centre to providemanagement and operational support in Mumbai.Moving forward, both parties intend to exploreopportunities to set up Centres of Excellence in tertiaryspecialties in Mumbai. <strong>Parkway</strong> will continue to seekregional opportunities that are synergistic to <strong>Parkway</strong>.• Ongoing investments in technology and training.<strong>Parkway</strong>’s recent developments include a newNeurosurgery Centre and a cutting-edge tomotheraphymachine. This adds to other quaternary services suchas a Haematology and Stem Cell Transplant Centre,a liver disease intensive care facility and a highlyadvanced robotic enhanced surgery programme. Wewill continue to remain at the forefront of adoptinginnovative technologies and medical capabilities toenhance our level of medical care. Training remainscentral to our organisation. In <strong>2005</strong>, we launched the<strong>Parkway</strong>-Toshiba training centre, Southeast Asia’s fi rstregional training centre for CT technology.<strong>Parkway</strong> is an excellent platform to fuel future growth ofhealthcare in the region. With our strategies outlinedabove, I am confi dent that we will be well poised to take onthe strong demand and high growth opportunities in Asiaand continue to maintain our position as a premier regionalhealthcare provider.At this point, I would like to acknowledge the signifi cantcontribution of my predecessor, Mr Anil Thadani. He hada clear vision for <strong>Parkway</strong> and over the last fi ve years,worked tirelessly to restructure the company and to buildthis excellent platform that <strong>Parkway</strong> is today. It is with hisleadership that <strong>Parkway</strong> has achieved its current success.I would also like to thank Mr Tony Tan, Mr Tan Kai Seng,Mr Ang Guan Seng and Dr Prathap Reddy for theirinvaluable contributions during their years of service asdirectors of the Group.Further changes to the Board have also been made andI welcome Mr Sunil Chandiramani as Vice-Chairman,and other new Non-executive Directors. Together, theybring extensive experience in international healthcare andinvestment.Now that the baton has been passed, I hope to carry on thegood work and achieve new levels of success for <strong>Parkway</strong>.I am confi dent that with the support of your Board andmanagement, we are well equipped for the challengesahead.In conclusion, I would like to extend my sincereappreciation to my colleagues, the doctors, nurses and allstaff at <strong>Parkway</strong> for their hard work. Special thanks alsoto our patients, partners and shareholders for their beliefin <strong>Parkway</strong>. This organisation would not have achieved itsstatus as the healthcare provider of choice in Asia withoutyour support. I look forward to your continued contributionin the year ahead.Mr Richard SeowChairman<strong>Parkway</strong> Holdings Limited12

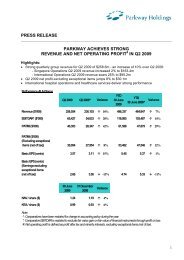

A Letter from the Managing DirectorDr Lim Cheok PengManaging DirectorDear Shareholders,<strong>2005</strong> was a good year for <strong>Parkway</strong>. Financially, we reachedanother high. Operationally, we saw further growth in all ourdivisions as we deepened our capabilities and expandedour services and network both locally and internationally.We have raised the hurdle higher yet again.<strong>2005</strong> saw <strong>Parkway</strong>’s revenue increase by 35% comparedto 2004. Revenue in 2004 was $407.8 million and thisgrew to $549.0 million in <strong>2005</strong>. Similarly, EBITDA grew by22%, from $110.9 million in 2004 to reach $135.0 millionin <strong>2005</strong>. Net profi t hit $62.0 million in <strong>2005</strong> compared to$50.5 million, and this is a 23% increase over 2004.<strong>Parkway</strong>’s <strong>2005</strong> strong performance was driven by growthacross all businesses with the International Hospitals divisioncontributing the most.Our past strategies are showing results. We have createda distinctive platform for <strong>Parkway</strong> to springboard into thenext phase of growth.13

Let us take a closer look at each of our three core businessdivisions:Singapore Hospitals DivisionThis division includes East Shore, Gleneagles and MountElizabeth hospitals. Our local hospitals are reputed fortheir extensive expertise in specialist and quaternaryhealthcare.Revenue for the Singapore Hospitals division grew by 16%,from $258.6 million in 2004 to $300.3 million in <strong>2005</strong>.EBITDA in 2004 was $79.7 million and this grew by 11%to reach $88.3 million in <strong>2005</strong>.The growth in hospital revenue and EBITDA areattributable to the increase in foreign patient admissionsand high-end cases treated at our hospitals. <strong>Parkway</strong> iswell poised to tap into the government’s latest initiativeof creating Singapore into a medical hub for the region.Our reputation for top-notch specialised care and state-ofthe-artequipment attracted both local and foreign patients.Over the last 2 years, foreign patient load to Singaporeincreased by 39%. As the number of foreign patientsseeking specialised treatment in Singapore continuesto grow, <strong>Parkway</strong> will enjoy its leadership role in medicaltourism in Asia. <strong>Parkway</strong>’s foreign patients come fromcountries in the region such as Indonesia, Malaysia, SouthAsia and more recently, the Middle East.The year <strong>2005</strong> also saw <strong>Parkway</strong> spearheading many newinitiatives. We set another record when we introducedthe fi rst tomotherapy machine to Southeast Asia. Thishighly advanced radiation therapy equipment aims toprovide more precise treatment and reduces radiation tosurrounding healthy cells. In addition, <strong>Parkway</strong> establishedanother Centre of Excellence with a new NeurosurgeryCentre at East Shore Hospital to cater to the growingdemand for full-service neurology care. We also launchedthe <strong>Parkway</strong>-Toshiba regional CT technology training centrefor radiologists and radiographers from the ASEAN region,as well as from Australia, China, India and Pakistan.At <strong>Parkway</strong>, we endeavour to maintain our premier statusin Singapore. This implies continual innovation, furtherinvestment in facilities, greater value-added services andhighly-trained staff.International Hospitals DivisionWe are excited about the growth demonstrated in thisdivision. Revenue contribution from our internationaloperations has been growing steadily. In 2004, we targetedto grow our international revenue to 50% of total revenueby 2009. We have now surpassed our target. Our fourthquarter <strong>2005</strong> international revenue is already half our totalrevenue.Revenue for the International division saw the largestgrowth compared to the other divisions. In 2004, <strong>Parkway</strong>reported divisional revenue of $54.0 million and this grewby a significant 94% to hit $104.5 million in <strong>2005</strong>. The largejump in revenue is due to the incorporation of revenue from<strong>Pantai</strong> Holdings in fourth quarter <strong>2005</strong>.The expansion of the Malaysian platform through the <strong>Pantai</strong>investment played a signifi cant role in the <strong>2005</strong> results.Our Penang, Kuala Lumpur, Brunei and Kolkata hospitalsalso saw increases in revenue, EBITDA and patientadmissions, with Penang and Kuala Lumpur seeingincreases in high-intensity cases.14

“<strong>2005</strong> was a good year for <strong>Parkway</strong>. Financially, we reachedanother high. Operationally, we saw further growth in all ourdivisions as we deepened our capabilities and expandedour services and network both locally and internationally.We have raised the hurdle higher yet again.”In <strong>2005</strong>, <strong>Parkway</strong> heightened its activity in the region.In India, <strong>Parkway</strong> entered into a joint venture with ApolloHospitals Enterprise to establish a radio imaging centrein Hyderabad. <strong>Parkway</strong> also sealed a managementcontract with the Asian Heart Institute and ResearchCentre in Mumbai.Moving forward, <strong>Parkway</strong> will look to both organic growthas well as acquisitions to increase the performance ofthe International Hospitals division. We will exploreopportunities that are synergistic to our existingoperations and strategies.Healthcare Services Division<strong>Parkway</strong>’s Healthcare Services division consists ofthe following core businesses: <strong>Parkway</strong> Shenton,Medi-Rad Associates and <strong>Parkway</strong> Laboratory. Thisdivision saw revenue increase from $93.0 million in2004 to $142.4 million in <strong>2005</strong>, which is a 53% rise.EBITDA also improved by 53% from $20.6 million to$31.5 million.In <strong>2005</strong>, we extended our foray into China. <strong>Parkway</strong>established a joint venture with Shanghai HuashanHealth Development, with plans to own and managemedical and surgical centres, clinics and hospitals.In Vietnam, <strong>Parkway</strong> obtained its operating licencefor a Plastic Surgery and Aesthetics Centre in Ho ChiMinh City.The Healthcare Services division remains akey contributing sector for <strong>Parkway</strong> and we willendeavour to strengthen our facilities and servicesin this division. Under <strong>Parkway</strong> Shenton’s extensivenetwork, we have over 30 owned or managed clinicsand 260 HealthNet clinics. Under Medi-Rad, weremain equipped with the latest service and state-ofthe-artequipment. We recently introduced Xper CT,Angio with CT capabilities and 2 additional 64-sliceCTs for more advanced diagnosis of heart- and neurorelateddiseases as well as cancers. In addition, weintroduced a web distribution service whereby digitalversions of patients’ X-rays are put on a secured website.Patients can now benefi t from faster results anddiagnosis. At <strong>Parkway</strong> Laboratory, we will seek toexpand its market share through enhancing its facilityand expertise.15

Conclusion<strong>Parkway</strong> is well poised for future growth. However, we willnot be complacent. A bird fl u epidemic remains a threatto our business, as well as to the region as a whole. Wewill continue to remain vigilant in these times, throughthe enforcement of infection control protocols, stockpilingon vaccines and training of our personnel. Ultimately, wehave a vital role in caring for the healthcare needs of ourcommunities.As <strong>Parkway</strong> broadens its local and international presence,we want to ensure that even as we grow, <strong>Parkway</strong> remainsan organisation with a heart. So while we continue ourpursuit of medical excellence, we do not want to forget thosewho need a helping hand. The tsunami and earthquakedisasters saw <strong>Parkway</strong> stepping in. Over the last year, wedispatched 3 teams of highly-skilled doctors, nurses andlogistics personnel to affected areas to provide medical aidand supplies. Such humanitarian aid is integral to <strong>Parkway</strong>’smission and we continue to remain dedicated to serving ourcommunity.The year <strong>2005</strong> saw many signifi cant milestones for <strong>Parkway</strong>.The entry of Newbridge Capital and Associates saw somechanges to the Board. At this point, I would like to extenda warm welcome to our new Chairman, Mr Richard Seowand our new directors. We have been working closelytogether over the last 6 months and their contribution hasbeen invaluable. The management at <strong>Parkway</strong> continuesto remain committed as we journey ahead.These are exciting times for <strong>Parkway</strong>. I am confi dentthat through your continued belief and support for theorganisation, we will be able to take <strong>Parkway</strong> to newheights. Once again, my heartfelt thanks to all customers,shareholders, partners and staff.Dr Lim Cheok PengManaging Director<strong>Parkway</strong> Holdings Limited16

Milestones for <strong>2005</strong>January• <strong>Parkway</strong> provides humanitarian aid to tsunamivictims in Sri Lanka and Indonesia.March• <strong>Parkway</strong>’s subsidiary <strong>Parkway</strong>-Healthcare (Mauritius)Ltd. enters into a joint venture agreement withApollo Hospitals Enterprise Ltd. to jointly establishand operate a radio imaging centre in Hyderabad,India.May• <strong>Parkway</strong>’s subsidiary, <strong>Parkway</strong> Group HealthcarePte. Ltd. establishes a Sino-Foreign Contractualjoint venture contract with Shanghai HuashanHealth Development Co. Ltd. with plans to ownand manage medical and surgical centres, clinicsand hospitals in China.• <strong>Parkway</strong> Hospitals Singapore (Gleneagles andMount Elizabeth) achieves medical milestone withthe successful separation of Indonesian conjoinedtwins, Anggi and Anjeli.June• Newbridge Capital and Associates acquire 26%stake in <strong>Parkway</strong> Holdings Ltd.July• East Shore Hospital opens a Neurosurgery Centre.August• <strong>Parkway</strong>’s subsidiary, <strong>Parkway</strong> Promotions Pte.Ltd. organises the International HealthcareFacilities Exhibition & Conference <strong>2005</strong>, thespecialised trade event for world-class medicalexperts, market leaders, health offi cials andhealthcare providers.September• <strong>Parkway</strong> acquires 31% of <strong>Pantai</strong> Holdings Bhd.to increase its stable of hospitals in Malaysia from2 to 9.• <strong>Parkway</strong> offi cially opens its marketingrepresentative offi ce in Vladivostok, Russia.• Gleneagles Hospital launches high-speed wirelessbroadband internet access.October• <strong>Parkway</strong> sends a medical disaster relief team of12 doctors and nurses to Pakistan to treat victimsof the 8 October earthquake measuring 7.6 on theRichter scale.• Gleneagles Hospital wins awards for Patient Safety/ Quality Medical Care and Internal Service at theAsian Hospital Management Awards <strong>2005</strong>.• Staff of Gleneagles and Mount Elizabeth hospitalsgarner a total of 233 Singapore Excellent ServiceAwards (EXSA) for excellent service. The <strong>Parkway</strong>hospitals are the only private hospitals to win.• Gleneagles Hospital won the HealthcareHumanitarian Award <strong>2005</strong> in Singapore.November• Chefs from Mount Elizabeth Hospital were part ofthe Singapore Culinary National Team which wascrowned the Overall Winner in the Salon CulinaireMondial, a prestigious international culinarycompetition held only once in 6 years. This year’scompetition took place in Basel, Switzerland.December• <strong>Parkway</strong> Shenton Pte. Ltd. obtains its operatinglicence for its Plastic Surgery and AestheticsCentre in Ho Chi Minh City, Vietnam.• Mount Elizabeth Hospital doctors remove a massive2 kg tumour in the neck (one of the largest in theAsia Pacific) of a 12-year-old Indonesian islandboy, giving him a new lease of life.• <strong>Parkway</strong> launches the fi rst regional trainingcentre for computed tomography (CT) technologyfor more accurate and effi cient patient diagnosisand improved emergency care.17

<strong>Parkway</strong> Holdings- A Premier Regional Healthcare Provider<strong>Parkway</strong> has an extensive presence throughout Asia.Our operations cover 14 hospitals with about 2,800beds in countries including Brunei, India, Malaysiaand Singapore. <strong>Parkway</strong> has also established medicalreferral centres throughout the world includingBangladesh, Brunei, Canada, China, Hong Kong, India,Indonesia, Malaysia, Myanmar, Pakistan, Philippines,Russia, Sri Lanka, Thailand, United Arab Emirates,United Kingdom and Vietnam.With over 1,200 accredited specialists covering over 40areas of specialty, <strong>Parkway</strong> delivers medical excellenceacross the full range of healthcare services.18

IndiaHOSPITALApollo Gleneagles Hospital,KolkataNo. of beds: 300BruneiHOSPITALGleneagles JPMC,BruneiNo. of beds: 20MalaysiaHOSPITALSGleneagles Medical Centre,PenangNo. of beds: 212Gleneagles IntanMedical Centre,Kuala LumpurNo. of beds: 331<strong>Pantai</strong> Medical Centre,Kuala LumpurNo. of beds: 264<strong>Pantai</strong> CherasMedical Centre,Kuala LumpurNo. of beds: 139<strong>Pantai</strong> Klang SpecialistMedical Centre,KlangNo. of beds: 69Hospital <strong>Pantai</strong> Mutiara,PenangNo. of beds: 180Hospital <strong>Pantai</strong> Ayer Keroh,MelakaNo. of beds: 250Hospital <strong>Pantai</strong> Indah,Kuala LumpurNo. of beds: 86Hospital <strong>Pantai</strong> Putri,IpohNo. of beds: 121SingaporeHOSPITALSMount Elizabeth HospitalNo. of beds: 505Gleneagles HospitalNo. of beds: 380East Shore HospitalNo. of beds: 157HEALTHCARE SERVICESDIVISIONPrimary HealthcareGP ServicesNo.of clinics: 39Dental ServicesNo. of clinics: 3Diagnostic ServicesRadiology ServicesMedi-Rad AssociatesNo. of clinics: 7Laboratory Services<strong>Parkway</strong> Laboratory ServicesNo. of laboratories: 4Clinical ResearchGleneagles CRC HQConsultancy ServicesHospital DevelopmentHospital Management<strong>Parkway</strong> facilities in Singapore<strong>Parkway</strong> International Hospitals<strong>Parkway</strong> Healthcare Services(Clinical Research Offi ces & Clinic)<strong>Parkway</strong> Medical Referral Centre(Please refer to back page for complete list)19

<strong>2005</strong> in ReviewAs one of the leading healthcare providers in Asia,thousands of patients place their trust in us each year andat <strong>Parkway</strong>,We believe in a patient-fi rst approachWe believe in innovation and medical excellenceWe believe in our peopleWe believe in our communityBelieving In A Patient-First ApproachAt <strong>Parkway</strong> we are driven by a patient-fi rst approach indeveloping our medical and service potential. We seekto provide unrivalled patient experience with variousinnovative patient services and unmatched medical carethrough momentous investments in our clinical expertise,cutting-edge technology, staff and infrastructure. Not onlywill our emphasis on providing exceptional patient carepropel us ahead of our competitors, it will empower us tomeet the challenges of tomorrow.Caring for patients at <strong>Parkway</strong> extends from providingexcellent medical care to delivering innovative hospitalityand lifestyle services. Our new initiatives in service, workredesign and training ensure that <strong>Parkway</strong> continuesto deliver distinctive patient care and experience. Newpatient initiatives include shuttle bus services, massagechairs, complimentary massage for maternity patientsand spouses, in-house spa services, hair-styling services,wireless hi-speed broadband internet access, a roof terracecafé and wide-screen plasma televisions. In addition, tocater to our growing international patients, we have setup an international patient lounge, hired new Arabic andBangladeshi foreign staff, created a special Arabic menuand other ‘customised food’ as well as expanded on ourtranslation services.Increasing the speed of service to our patients, <strong>Parkway</strong>’sRadiology division introduced a web distribution servicewhereby digital versions of patients’ X-rays are put on asecured internet site. This will enable doctors to view theirpatients’ images and report through the internet from theiroffi ces or home. Patients benefi t from much faster resultsand diagnosis.We continue to pursue service excellence throughvarious service initiatives such as “Our Winning Attitude”,“Innovation” and “Whale Done” training programmes.These not only help deliver memorable service to ourpatients, they boost customer service ratings and decreasestaff turnover.As a testament to <strong>Parkway</strong>’s vision of having a “passion forpeople and progress”, we are pleased to have once againbeen awarded the following prestigious awards:• The Asian Hospital Management Award recogniseshospital management practices and thrusts outstandinghospital projects into the regional spotlight. <strong>Parkway</strong> hasbeen the proud recipient of this award for the past twoyears and the year <strong>2005</strong> was no exception – GleneaglesHospital clinched awards in 2 major categories: PatientSafety / Quality Medical Care and Internal Service.20

• The Singapore Excellent Service Award (EXSA)recognises organisations for their effort in promotingservice excellence and continuous training foremployees. The staff at both Gleneagles and MountElizabeth hospitals received a total of 233 EXSAawards. The <strong>Parkway</strong> hospitals were also the onlyprivate hospitals to receive this award.• The Superbrands Award identifi es the strongestcorporate brands in the country and is awarded byan independent panel of judges. Gleneagles Hospitaland Mount Elizabeth Hospital are proud to be awardedSuperbrands status every year since its inceptionin 2002.• The Singapore Quality Class (SQC) is a schemethat recognises organisations that have attaineda commendable level of performance in the journeytowards business excellence. Mount Elizabeth Hospitaland Gleneagles Hospital are proud to have heldthat distinction since 1998 and have been re-certifi edtill 2007.• The Salon Culinaire Mondial is a prestigious internationalculinary competition held only once in 6 years.Chefs from Mount Elizabeth Hospital were part of theSingapore Culinary National Team which was crownedthe Overall Winner in the Salon Culinaire Mondial.This year’s competition took place in Basel,Switzerland.<strong>Parkway</strong>’s position as a leader has commissioned our activecontributions not only to our local community, but also toaddress pressing healthcare issues in the world today.Spearheading the global sharing of medical ideas andtechnology, <strong>Parkway</strong>’s subsidiary, <strong>Parkway</strong> PromotionsPte. Ltd. organised the International Healthcare FacilitiesExhibition & Conference (IHFEC) in <strong>2005</strong>. The IHFEC <strong>2005</strong>addressed the growing needs of healthcare facilities in Asiaand the Middle East, and is the fi rst-of-its-kind outside theUnited States since its inception.21

Believing In Innovation And Medical ExcellenceOur patients are at the center of everything we do.At <strong>Parkway</strong>, what sets us apart is our focus on medicalexcellence and our innovative spirit to explore new groundsand deliver specialist, high-quality medical care to meetthe increasingly complex needs of our patients today.<strong>Parkway</strong> is reputed for providing not just a wide spectrumof specialist care but quaternary healthcare as well.We continue to deliver this through our cutting-edgeexpertise, such as in haematology and stem cell transplant,living-related liver transplant and kidney transplant. In<strong>2005</strong>, we have heightened our offering in providing thebest in complex clinical areas.Separation of Conjoined twinsIn May <strong>2005</strong>, through our multidisciplinary team of topexperts, <strong>Parkway</strong> achieved a medical milestone with thesuccessful separation of a pair of Indonesian conjoinedtwins after a 10-hour operation.Neurosurgery CentreTo stay at the forefront of neurosurgical advancement,we launched another Neurosurgery Centre at East ShoreHospital in July <strong>2005</strong>. The centre will provide a full rangeof services from screening to surgeries and rehabilitationtherapy for general neurosurgical conditions, includingstroke, brain / spinal cord tumours and degenerative spineconditions.OncologyIn the area of oncology, <strong>Parkway</strong> further enhanced itstreatment in cancer by investing in a highly advancedtomotherapy machine. We have become the fi rst inSoutheast Asia to introduce this new medical equipment.The new system provides revolutionary advancement inradiation therapy and is designed to ensure more precisedelivery of treatment and minimises radiation to thesurrounding healthy tissues. The new investment adds to<strong>Parkway</strong>’s competitive advantage in cancer treatment.<strong>Parkway</strong>-Toshiba regional training centre for CT technology<strong>Parkway</strong>’s investment in medical excellence goes beyondadopting cutting-edge technologies and methodologies.It extends to training and education. In September <strong>2005</strong>,<strong>Parkway</strong> launched the fi rst regional training centre for CTtechnology. This training centre will target radiographersand radiologists from the ASEAN region as well as fromAustralia, China, India and Pakistan. Training programmeswill equip trainees with the skills and knowledge to use thehigh-end CT scanners and will also incorporate the lateste-learning techniques and hands-on sessions.22

Believing In Our PeopleOur staff forms the backbone of our organisation.At <strong>Parkway</strong>, we recognise that in order to deliver highquality and exceptional service, staff training, developmentand welfare are fundamental.The <strong>Parkway</strong> Hospitals are proud to have some ofthe fi nest specialists in the region accredited with us.We are committed to ensuring that in addition to providingexcellent care for patients, we also cater to the professionaldevelopment of these specialists.Continual medical education talks are conducted for ourdoctors at each of our three hospitals on a weekly basis.In addition, Mount Elizabeth and Gleneagles hospitalsorganise an <strong>Annual</strong> Scientifi c meeting and an <strong>Annual</strong>Seminar for doctors accredited with them. Our hospitalsalso make arrangements to ensure that the appropriatespecialists are trained and become familiar with all newmedical equipment our hospitals acquire.The <strong>Parkway</strong> Academy was set up to conduct leadership,clinical skills and service quality related training. TheAcademy employs a team of well-qualifi ed instructors andeducators who use advanced training methods including ahighly sophisticated Clinical Simulation Centre. In addition,we have nursing colleges in Malaysia to meet our nursingmanpower needs.Our effort and commitment to excellence through clinicaland non-clinical training has not gone unrecognised. Ourhospitals have received numerous awards including:• The People Developer Award - <strong>Parkway</strong> hospitals havebeen consistently awarded with the People DeveloperStandard since 2000. This standard aims to motivatestaff to constantly upgrade their skills and remainrelevant to the current dynamic environment andthereby achieve excellence in their relevant industries.• National Quality Circle Convention - <strong>Parkway</strong> remainsactive in the area of quality and training. Since 1997,our hospitals have been receiving numerous awardsthrough their participation at the National Quality CircleConvention, organised by SPRING Singapore.• Singapore Quality Class - This award acknowledgesbusiness excellence including staff development andtraining. Mount Elizabeth and Gleneagles hospitalshave received this award since 1998.At <strong>Parkway</strong>, providing unsurpassed patient care is ourdriving force. With all the above programmes in place, ourhighly skilled and motivated staff are well placed to provideour patients with exceptional service.23

Believing In Extending A Helping Hand To Those In NeedExemplifying the spirit of volunteerism, our <strong>Parkway</strong> hospitalsheld their annual Christmas Light-Up and Charity Drive thispast Christmas season, to collect funds for various charitybenefi ciaries. This fund raising initiative has been ongoingfor the last ten years.Beyond Singapore, our volunteers promptly reacted tothe devastating 2004 Boxing Day tsunami disaster thatclaimed the lives of many off the Indian Ocean. A 28-manteam of doctors, nurses and support staff from <strong>Parkway</strong>’sthree hospitals - East Shore, Gleneagles and MountElizabeth – left for Sri Lanka on New Year’s Day <strong>2005</strong>. Theteam brought with them medicine, medical supplies andequipment to work in some of the worst affected areas.In February <strong>2005</strong>, another mission headed for Indonesia toprovide medical relief and aid to the Aceh refugees.Then in October <strong>2005</strong>, an earthquake measuring 7.6 onthe Richter scale unleashed its devastating powers ontoPakistan, India, and Afghanistan. This time, <strong>Parkway</strong>organised a 14-man team comprising four doctors,six nurses, two support staff and two logisticians, whoheaded for Pakistan to provide humanitarian aid to victimsthere. The team treated an average of 400 patients a dayduring their 11-day mission in Pakistan.Extending Our Beliefs To The RegionHaving established a strong presence in Singapore withour premier hospitals, <strong>Parkway</strong> is setting its sights on theoverseas market. Ultimately, we aim to leverage on ourspecialist knowledge and medical expertise to meet thegrowing need for medical excellence in the region.This year alone, <strong>Parkway</strong> took signifi cant strides to extendits footprint in Asia. This began with the joint ventureagreement between <strong>Parkway</strong>’s subsidiary <strong>Parkway</strong>-Healthcare (Mauritius) Ltd. and Apollo Hospitals EnterpriseLtd., to establish and operate a radio imaging centre inHyderabad, India.In June <strong>2005</strong>, private equity fi rm, Newbridge Capital andAssociates acquired approximately 26% stake in <strong>Parkway</strong>Holdings and this made it the fi rst major healthcareinvestment for Newbridge Capital in Singapore.24

Newbridge Capital is a major investor in the healthcareand life sciences sector and brings to <strong>Parkway</strong> signifi cantexpertise in international healthcare management andpractices, which will further boost <strong>Parkway</strong>’s regionalgrowth plans.A milestone growth strategy for <strong>Parkway</strong> took place in thelater half of the year with the acquisition of approximately31% stake in <strong>Pantai</strong> Holdings Bhd. This resulted in<strong>Parkway</strong> being the largest shareholder of Malaysia’s leadinghealthcare service provider. The acquisition escalated<strong>Parkway</strong>’s presence in Malaysia from 2 to 9 hospitals andancillary facilities across the country.Other joint ventures established in the region includedthe partnership between <strong>Parkway</strong>’s subsidiary, <strong>Parkway</strong>Group Healthcare Pte. Ltd. and Shanghai Huashan HealthDevelopment Co. Ltd., to manage medical and surgicalcentres, clinics and hospitals in China.On 31 December <strong>2005</strong>, <strong>Parkway</strong>’s primary healthcarearm, <strong>Parkway</strong> Shenton Pte. Ltd. obtained its operatinglicence for its Plastic Surgery and Aesthetics Centre in HoChi Minh City, Vietnam. This clinic will be fully operationalby fi rst quarter 2006 and is <strong>Parkway</strong>’s fi rst entry into theVietnam healthcare market.To date, <strong>Parkway</strong>’s presence in the region covers 14hospitals in countries including Singapore, Malaysia, Indiaand Brunei. <strong>Parkway</strong> has also established representativeoffi ces throughout the world including Bangladesh, Brunei,Canada, China, Hong Kong, India, Indonesia, Malaysia,Myanmar, Philippines, Sri Lanka, Thailand, United ArabEmirates, United Kingdom and Vietnam. The latestaddition is the offi cial opening of a representative offi ce inVladivostok, Russia.25

Financial Review <strong>2005</strong>Net Profi tS$ m -70 -OverviewIn <strong>2005</strong>, <strong>Parkway</strong> delivered another set of strong fi nancialresults. Revenue for the full year surged to a record highof $549.0 million in <strong>2005</strong> as the year saw increasedcontributions from all our core healthcare services. Growingcontinuously over the last 5 years, net profi t attributable toshareholders hit $62.0 million.60 -50 -40 -30 -20 -33.333.650.562.0With <strong>Parkway</strong>’s strategies yielding tangible results, weexpect to see more organic growth moving forward. Ourfocus on providing high value-added healthcare services,state-of-the-art equipment, facilities and services andincreasing our marketing efforts are the key growth drivers.In addition, the investment in <strong>Pantai</strong> saw its maidencontribution in the fourth quarter of this year.Moving forward, <strong>Parkway</strong> will seek to enhance its fi nancialand strategic position with other new businesses andpossible acquisitions that are synergistic to the Group whilefocusing on our key strategies for growth.Revenue by Business SegmentS$ m -300 -250 -300.3258.6<strong>2005</strong>2004200 -150 -100 -104.5142.493.050 -1.82.212.510 -200154.0200220032004<strong>2005</strong>RevenueThe Group’s revenue for the year surged by 35%, increasingfrom $407.8 million in 2004 to $549.0 million in <strong>2005</strong>.This is due largely to strong international growth with <strong>Pantai</strong>contributing about $92.0 million in the fourth quarter.The revenue for the International Hospital division sawthe largest increase of 94% to reach $104.5 million,compared to $54.0 million in FY2004. The other twodivisions, the Singapore Hospitals and Healthcare Servicessaw revenues of $300.3 million and $142.4 million orrevenue growth of 16% and 53% respectively.SingaporeHospitalInternationalHospitalHealthcareServicesOthers26

Singapore Hospitals2004 <strong>2005</strong> <strong>2005</strong>vs 2004Number of Hospitals 3 3 0.0%Inpatient Admissions 49,109 49,980 1.8%Number of Day Cases* 13,011 13,444 3.3%Average Length of Stay (days) 3.48 3.56 2.3%* Day Ward Admissions onlyOur Singapore Hospitals showed an increase in inpatient admissions and day cases, driven largelyby the increase in foreign patients. Average length of stay increased with more high intensitypatient admissions.International Hospitals2004 <strong>2005</strong> <strong>2005</strong>vs 2004Number of Hospitals 4 11 175.0%Statistics for 2 Majority-owned FacilitiesInpatient Admissions 15,461 16,649 7.7%Average Length of Stay (days) 3.32 3.37 1.5%Our international hospitals increased from 4 to 11. The table above shows the increase ininpatient volume as well as average length of stay in the Brunei and Penang hospitals.27

Financial Review <strong>2005</strong>EBITDA<strong>2005</strong>2004EarningsThe Group’s EBITDA in <strong>2005</strong> mirrored the growth inrevenue, increasing by 22% from $110.9 million in 2004to $135.0 million in <strong>2005</strong>.S$ m -90 -80 -70 -88.379.7The Group’s EBITDA grew by $24.1 million or 22% inFY<strong>2005</strong>. $8.6 million of this increase was from the SingaporeHospitals division. The International division contributed$7.9 million and the Healthcare services added another$10.9 million. There was a reduction in the Others segmentcompared to 2004, when there was a gain from the sale ofour stake in Lee Hing last year.60 -50 -40 -30 -20 -10 -15.47.531.520.60.13.2Net Financial IncomeThe strong growth of 22% in EBITDA translated to acorresponding increase of 23% in net income. The resultis a fi ve year high net income of $62.0 million in FY<strong>2005</strong>compared to the $50.5 million in FY2004.DividendsThe directors proposed a fi nal dividend of 5.0 cents perordinary share compared to 4.5 cents per ordinary sharein the preceding year. Together with the interim dividendsof 5.5 cents, this brings annual dividend to 10.5 cents perordinary share for the full year <strong>2005</strong>.SingaporeHospitalInternationalHospitalHealthcareServicesOthers28

Group Consolidated Statements<strong>2005</strong> 2004 # 2003 2002 2001$’ 000 $’ 000 $’ 000 $’ 000 $’ 000Profi t and Loss AccountRevenueHealthcare 547,221 405,614 344,743 325,096 344,775Others 1,750 2,218 3,905 12,463 12,357548,971 407,832 348,648 337,559 357,132Earnings before interest expense, tax, depreciationand amortisation (EBITDA) ~ 134,982 110,925 85,865 89,201 86,848% of revenue 24.6% 27.2% 24.6% 26.4% 24.3%Earnings before interest expense, taxand exceptional items (EBIT) 96,429 71,922 55,381 58,547 56,115% of revenue 17.6% 17.6% 15.9% 17.3% 15.7%Earnings after tax and minority interest but beforeexceptional items 61,969 50,463 33,608 33,301 24,891% of revenue 11.3% 12.4% 9.6% 9.9% 7.0%Net Profi t for the year 61,969 50,463 33,608 33,301 12,479% of revenue 11.3% 12.4% 9.6% 9.9% 3.5%Balance SheetTotal Assets 1,304,179 937,049 815,460 832,881 824,280Net Borrowings 336,114 192,951 233,853 242,645 217,874Total Shareholders’ Funds 415,517 425,027 430,500 427,970 411,107Profi tability Ratios (%):Return on Shareholders’ FundsBefore exceptional items 14.9 11.9 7.8 7.8 6.1After exceptional items 14.9 11.9 7.8 7.8 3.0Return on AssetsBefore exceptional items 4.8 5.4 4.1 4.0 3.0After exceptional items 4.8 5.4 4.1 4.0 1.5Gearing Ratio:Net debt equity ratio 0.81 0.45 0.54 0.57 0.53Per share Data:Earnings per share (S$)Before exceptional items 0.09 0.07 0.05 0.05 0.03After exceptional items 0.09 0.07 0.05 0.05 0.02Gross dividend (S$) + 0.105 0.09 0.06 0.05 0.03Net tangible asset backing per share (S$) 0.32 0.54 0.55 0.55 0.57Net asset value backing per share (S$) 0.57 0.59 0.60 0.59 0.57~ Earnings before exceptional items, exchange differences and share of results of associates.# Certain comparative fi gures in FY2004 have been restated for comparative purposes due to the adoption of the new and revised accounting standards that wereimplemented in <strong>2005</strong>.+ Gross dividend comprises interim dividend declared during the year and fi nal dividend proposed by directors in respect of that fi nancial year under review.29

Mr Richard Seow Yung LiangChairmanMr Sunil ChandiramaniVice ChairmanDr Lim Cheok PengManaging DirectorMr Alain Ahkong Chuen FahNon-executive DirectorBoard of DirectorsMr Daniel Ashton CarrollNon-executive DirectorMr Chang See HiangNon-executive DirectorMr Timothy David DattelsNon-executive DirectorMr Ho Kian GuanNon-executive DirectorDr Ronald Ling Jih WenNon-executive Director30Mr Ashish Jaiprakash ShastryNon-executive DirectorMr David R. WhiteNon-executive Director

Mr Richard Seow Yung LiangChairmanMr Richard Seow was appointed Chairman of the Boardof <strong>Parkway</strong> Holdings and the Executive Committee in July<strong>2005</strong>. A former investment banker with over 16 years ofindustry experience, he was previously with Citigroup,Goldman Sachs and JP Morgan. Mr Seow is also a directorof Twinwood Engineering Limited, Lee Hing DevelopmentLimited and a member of the Anglo Chinese School Boardof Governors.Mr Sunil ChandiramaniVice ChairmanMr Sunil Chandiramani is a Director and Partner ofSymphony Group of companies which invest in Healthcareand other consumer businesses throughout the Asia Pacifi cregion. Mr Chandiramani is a member of the ExecutiveCommittee and various other committees and sits on theboards of several companies.Dr Lim Cheok PengManaging DirectorDr Lim Cheok Peng is the Managing Director of <strong>Parkway</strong>Holdings and he sits on the Executive Committee. Dr Limhas been steering the Group’s healthcare efforts since 1987and was recently appointed a director of <strong>Pantai</strong> HoldingsBerhad. He is also a cardiologist by profession.Mr Alain Ahkong Chuen FahNon-executive DirectorMr Alain Ahkong is the Chairman of the Audit Committeeof <strong>Parkway</strong> Holdings. Currently a Director of PioneerManagement Services Pte Ltd, Mr Ahkong also holdsdirectorships in several companies, including listedcompany, Twinwood Engineering Limited.Mr Daniel Ashton CarrollNon-executive DirectorMr Daniel Carroll is a Managing Partner of NewbridgeCapital, LLC, which he joined in 1995. Mr Carroll runsNewbridge’s investment committee and oversees the fi rm’sinvestment strategy and operations. Mr Carroll is a Directorof Shenzhen Development Bank and AIT (Mauritius) Ltd.Mr Chang See HiangNon-executive DirectorMr Chang See Hiang sits on various committees of <strong>Parkway</strong>Holdings. An Advocate and Solicitor of the Supreme Courtof Singapore, he is the Senior Partner of his own law fi rm,M/s Chang See Hiang and Partners. Mr Chang is a Directorof Jardine Cycle & Carriage Limited, MCL Land Limited,Yeo Hiap Seng Limited, Singapore Technologies AerospaceLtd, STT Communications Ltd and Honorary Secretary andmember, Management Committee of the Singapore TurfClub.31

Mr Timothy David DattelsNon-executive DirectorMr Timothy Dattels is a Managing Director of NewbridgeCapital, LLC. Prior to joining Newbridge in 2002,Mr Dattels was a Managing Director of Goldman Sachsand led the fi rm’s investment banking business in Asia.Mr Dattels is a Director of Shenzhen Development Bank,SingTao News Corp. Limited, Shangri-La Asia Ltd andPrimedia Inc.Mr Ho Kian GuanNon-executive DirectorMr Ho Kian Guan has been a director of <strong>Parkway</strong> Holdingssince 1985. Mr Ho is also the Chairman of publicly-listedKeck Seng (Malaysia) Berhad whose principal activitiesinclude palm oil cultivation, the processing and refi ningof palm oil and real estate development.Dr Ronald Ling Jih WenNon-executive DirectorDr Ronald Ling trained as a medical doctor and subsequentlyworked as a management consultant with McKinsey & Co.in London, and as General Manager with <strong>Parkway</strong> GroupHealthcare. Dr Ling is a Principal with the SymphonyGroup of companies which invest in Healthcare and otherconsumer businesses throughout the Asia Pacifi c region.He also sits on the Boards of Twinwood Engineering Limitedin Singapore and Strides Arcolabs Limited in India.Mr Ashish Jaiprakash ShastryNon-executive DirectorMr Ashish Shastry is a Director and Head of SoutheastAsia at Newbridge Capital, LLC. Mr Shastry has workedat Newbridge since 1998, during which time he has beenbased in Singapore and Hong Kong, focusing on Newbridge’sinvestment activities in India, Australia and Southeast Asia.He serves on boards of <strong>Pantai</strong> Holdings Berhad (Malaysia),Lee Hing Development Limited (Hong Kong) and MatrixLaboratories Ltd (India; Alternate Director).Mr David R. WhiteNon-executive DirectorMr David White is the Chairman of the Board and ChiefExecutive Offi cer of Iasis Healthcare LLC, headquartered inthe United States. Mr White was also previously ExecutiveVice President and Chief Executive Offi cer of CommunityHealth Systems, Inc., a hospital management companythat operated about 20 acute care hospitals in the UnitedStates.Mr Ho Kian Hock(alternate director to Mr Ho Kian Guan)32

Senior ManagementDr Lim Cheok PengManaging DirectorDr Lim Cheok Peng, 59, is the Managing Director of<strong>Parkway</strong> Holdings and he sits on the Executive Committee.Dr Lim has been steering the Group’s healthcare effortssince 1987. He is also a cardiologist by profession.Molly FooChief Financial Offi cerMolly Foo, 46, was appointed as Chief Financial Offi cer on1 April 2003. Ms Foo started with Mount Elizabeth Hospitalin August 1993 and was the General Manager, Finance.Prior to this, Ms Foo was the Financial Controller for MountAlvernia Hospital from 1990 to 1993. Ms Foo graduatedwith a Bachelor in Accountancy from the National Universityof Singapore.Vivek JetleySenior Vice President/HeadInternational Business DevelopmentVivek Jetley, 48, joined <strong>Parkway</strong> on 16 January 2004, andis responsible for the formulation and implementation of<strong>Parkway</strong>’s international business strategy. Prior to joining<strong>Parkway</strong>, Mr Jetley was the Managing Director of Max IndiaLtd, a listed multi business enterprise, from 1998 to 2003.Mr Jetley holds a Master in Business Management fromBanaras Hindu University and is a Fellow Member of theInstitute of Cost and Works Accountants of India.Dr Timothy LowGeneral ManagerGleneagles HospitalDr Timothy Low, 43, joined <strong>Parkway</strong> as General Manager ofGleneagles Hospital on 1 August 2000 and is responsiblefor the general management and operations of the Hospital.Prior to joining <strong>Parkway</strong>, Dr Low was the Senior RegionalDirector of Covance (ASIA) Pte Ltd from 1995 to 2000 andRegional Medical Advisor with Glaxo Wellcome SingaporePte Ltd from 1993 to 1995. Dr Low graduated with a MBBSfrom the National University of Singapore.Nellie TangGeneral ManagerMount Elizabeth HospitalNellie Tang, 61, was appointed as General Manager ofMount Elizabeth Hospital on 1 July 1998 and is responsiblefor the general management and operations of the Hospital.Mrs Tang started with Mount Elizabeth Hospital in May1981 and was Director of Nursing prior to her appointmentas General Manager, Patient Care Services in 1998.Mrs Tang holds a Master of Science in HealthcareManagement from the University of Wales, UK.Dr Goh Jin HianExecutive Director<strong>Parkway</strong> Shenton Pte LtdDr Goh Jin Hian, 37, was appointed as Executive Directorof <strong>Parkway</strong> Shenton on 1 April 1999. Dr Goh is responsiblefor the general management of all the primary care servicesunder <strong>Parkway</strong> Shenton which includes, Shenton FamilyClinics, Executive Health Screeners, Nippon Medical Careand Maritime Medical.Prior to joining <strong>Parkway</strong>, Dr Goh was with the Ministryof Health. Dr Goh graduated with a MBBS from theNational University of Singapore and holds an MBA fromthe University of Hull, UK and completed the AdvancedManagement Programme at Wharton.Lim Poh SuanGeneral ManagerMedi-Rad Associates LtdLim Poh Suan, 53, was appointed as General Managerof Medi-Rad on 1 March 2002, and is responsible forthe general management and operations of the Group’sradiology services. Ms Lim started with Mount ElizabethHospital in July 1984 and was Head of Radiology with theHospital prior to her appointment with Medi-Rad.Ms Lim graduated with a Bachelor of Science in Economicsfrom the University of London and holds a Diploma of theCollege of Radiographers.George PusavatGeneral Manager<strong>Parkway</strong> Laboratory Services LtdGeorge Pusavat, 53, was appointed General Managerof <strong>Parkway</strong> Laboratory Services on 1 July 1997 and isresponsible for the general management and operations ofthe Group’s laboratory services. Prior to joining the Group,Mr Pusavat was Project and Systems Manager with SanJoaquin Community Hospital, USA from 1992 to 1994.Mr. Pusavat graduated with a Bachelor of Science inBiochemistry from University of California at Los Angeles, aBachelor of Science in Medical Technology from CaliforniaState University and a Master of Business Administrationfrom University of Southern California. He also holds aMT(ASCP) from American Society for Clinical Pathologyand a CLS from State of California, USA.33

Corporate InformationBOARD OF DIRECTORSRichard Seow Yung LiangChairmanSunil ChandiramaniVice ChairmanDr Lim Cheok PengManaging DirectorAlain Ahkong Chuen FahNon-executive DirectorDaniel Ashton CarrollNon-executive DirectorChang See HiangNon-executive DirectorTimothy David DattelsNon-executive DirectorHo Kian GuanNon-executive DirectorDr Ronald Ling Jih WenNon-executive DirectorAshish Jaiprakash ShastryNon-executive DirectorDavid R WhiteNon-executive DirectorHo Kian Hock(Alternate Director to Ho Kian Guan)EXECUTIVE COMMITTEERichard Seow Yung LiangChairmanSunil ChandiramaniDr Lim Cheok PengAshish Jaiprakash ShastryAUDIT COMMITTEEAlain Ahkong Chuen FahChairmanChang See HiangHo Kian GuanAshish Jaiprakash ShastryMANAGEMENT COMMITTEEDr Lim Cheok PengChairmanRichard Seow Yung LiangAshish Jaiprakash ShastrySHARE OPTION SCHEME COMMITTEETimothy David DattelsChairmanRichard Seow Yung LiangSunil ChandiramaniAshish Jaiprakash ShastryREMUNERATION COMMITTEETimothy David DattelsChairmanRichard Seow Yung LiangSunil ChandiramaniAshish Jaiprakash ShastryNOMINATING COMMITTEEChang See HiangChairmanRichard Seow Yung LiangSunil ChandiramaniAlain Ahkong Chuen FahTimothy David DattelsSHARE PURCHASE COMMITTEEChang See HiangChairmanRichard Seow Yung LiangSunil ChandiramaniHo Kian GuanAshish Jaiprakash ShastrySTRATEGIC PLANNING COMMITTEERichard Seow Yung LiangChairmanDr Lim Cheok PengDr Ronald Ling Jih WenAshish Jaiprakash ShastryDavid R WhiteREGISTERED OFFICE1 Grange Road #11-01Orchard BuildingSingapore 239693Tel: (65) 6796 0600http://www.parkwayholdings.comCOMPANY SECRETARIESJune Tay Kwok FungHo Li LiSHARE REGISTRARM & C Services Private Limited138 Robinson Road #17-00The Corporate Offi ceSingapore 068906Tel: (65) 6227 6660AUDITORSKPMGCertifi ed Public AccountantsSingaporePartner-In-Charge since theFinancial year ended 31 December <strong>2005</strong>– Tay Puay ChengPRINCIPAL BANKERSABN AMRO Bank N.V.Calyon, Singapore BranchCitibank N.A., Singapore BranchDBS Bank LtdThe Hongkong and ShanghaiBanking Corporation LimitedOversea-Chinese BankingCorporation LimitedStandard Chartered BankUnited Overseas Bank Limited34

ContentsDirectors’ <strong>Report</strong> 36Statement by Directors 42<strong>Report</strong> of the Auditors 43Balance Sheets 44Consolidated Profit and Loss Account 45Consolidated Statement of Changes in Equity 46Statement of Changes in Equity 49Consolidated Statement of Cash Flows 50Notes to the Financial Statements 52Supplementary Information –SGX-ST Listing Manual Requirements 102Analysis of Shareholdings 119Notice of <strong>Annual</strong> General Meeting 121Proxy Form35

Directors’ <strong>Report</strong>Year ended 31 December <strong>2005</strong>We are pleased to submit this annual report to the members of the Company, together with the audited financial statements for thefinancial year ended 31 December <strong>2005</strong>.DirectorsThe directors in office at the date of this report are as follows:Richard Seow Yung Liang (Chairman) (Appointed on 10 June <strong>2005</strong>)Sunil Chandiramani(Vice Chairman)Dr Lim Cheok Peng(Managing Director)Alain Ahkong Chuen FahDaniel Ashton Carroll (Appointed on 10 June <strong>2005</strong>)Chang See HiangTimothy David Dattels (Appointed on 10 June <strong>2005</strong>)Ho Kian GuanDr Ronald Ling Jih Wen (Appointed on 15 July <strong>2005</strong>)Ashish Jaiprakash Shastry (Appointed on 10 June <strong>2005</strong>)David R. White (Appointed on 15 July <strong>2005</strong>)Ho Kian Hock(alternate to Ho Kian Guan)Directors’ InterestsAccording to the register kept by the Company for the purposes of Section 164 of the Companies Act, Chapter 50 (the Act), particularsof interests of directors who held office at the end of the financial year (including those held by their spouses and infant children) inshares, debentures, warrants and share options in the Company and in related corporations (other than wholly-owned subsidiaries) areas follows:Holdings in the nameOther holdings in whichName of director and corporation of the director, spouse the director is deemedin which interests are held or infant children to have an interestAt beginning At end At beginning At endof the year of the year of the year of the yearCompanyOrdinary Shares fully paidSunil Chandiramani 50,000 50,000 – –Dr Lim Cheok Peng 2,000 2,000 – –Chang See Hiang – 125,000 – –Ho Kian Guan 625,000 693,000 – 10,000,000Ho Kian Hock 50,000 100,000 – 10,000,000Holdings atHoldingsName of director and corporation beginning of at endin which interests are held the year of the year<strong>Parkway</strong> Share Option Scheme 2001Options to subscribe for Ordinary Shares(exercise price at $0.865 per share andexercisable between 10/4/2002 and 9/4/2006)Dr Lim Cheok Peng 500,000 500,00036

Directors’ <strong>Report</strong>Year ended 31 December <strong>2005</strong>Directors’ Interests (Cont’d)Holdings atHoldingsName of director and corporation beginning of at endin which interests are held the year of the year<strong>Parkway</strong> Share Option Scheme 2001 (Cont’d)Options to subscribe for Ordinary Shares(exercise price at $0.94 per share andCompany (Cont’d) exercisable between 20/9/2002 and 19/9/2006)Sunil Chandiramani 200,000 200,000Alain Ahkong Chuen Fah 150,000 150,000Chang See Hiang 100,000 25,000Ho Kian Guan 25,000 –Ho Kian Hock 50,000 –Options to subscribe for Ordinary Shares(exercise price at $0.835 per share andexercisable between 20/4/2003 and 19/4/2007)Sunil Chandiramani 200,000 200,000Dr Lim Cheok Peng 500,000 500,000Alain Ahkong Chuen Fah 150,000 150,000Chang See Hiang 100,000 50,000Ho Kian Guan 50,000 25,000Options to subscribe for Ordinary Shares(exercise price at $1.4267 per share andexercisable between 20/11/<strong>2005</strong> and 19/11/2009)Sunil Chandiramani 100,000 100,000Dr Lim Cheok Peng 500,000 500,000Alain Ahkong Chuen Fah 100,000 100,000Chang See Hiang 100,000 100,000Ho Kian Guan 75,000 57,000Holdings atbeginning ofHoldingsName of director and corporation the year / Date at endin which interests are held of appointment of the year<strong>Parkway</strong> Share Option Scheme 2001Options to subscribe for Ordinary Shares(exercise price at $2.087 per share andexercisable between 10/12/2006 and 9/12/2010)Richard Seow Yung Liang – 1,000,000Sunil Chandiramani – 100,000Dr Lim Cheok Peng – 1,500,000Alain Ahkong Chuen Fah – 100,000Chang See Hiang – 100,000Ho Kian Guan – 100,000Dr Ronald Ling Jih Wen – 50,000Ashish Jaiprakash Shastry – 60,00037

Directors’ <strong>Report</strong>Year ended 31 December <strong>2005</strong>Directors’ Interests (Cont’d)Except as disclosed in this report, no director who held office at the end of the financial year had interests in shares, debentures,warrants or share options of the Company, or of related corporations, either at the beginning of the financial year, or date of appointmentif later, or at the end of the financial year.Subsequent to the end of the financial year and before 21 January 2006, the following directors accepted the share options granted on9 December <strong>2005</strong> as follows:Options to subscribe for OrdinaryShares (exercise price at $2.087per share and exercisable between10/12/2006 and 9/12/2010)Daniel Ashton Carroll 60,000Timothy David Dattels 60,000David R. White 50,000Except as disclosed in this report, there were no changes in any of the above-mentioned interests in the Company between the end ofthe financial year and 21 January 2006.Except as disclosed under the “Share Options” section of this report, neither at the end of, nor at any time during the financial year, wasthe Company a party to any arrangement whose objects are, or one of whose objects is, to enable the directors of the Company toacquire benefits by means of the acquisition of shares in or debentures of the Company or any other body corporate.During the year, certain transactions were made between the Company and/or its subsidiaries and its directors, or the subsidiaries’directors or a firm in which one of the directors is a member or companies in which the directors of the Company or its subsidiaries havesubstantial financial interest in the ordinary course of business. However, these directors have neither received nor will they becomeentitled to receive any benefit from these transactions other than as suppliers, directors and members of these firms/companies.Except for salaries, bonuses and fees and those benefits that are disclosed in this report and in notes 23 and 29 to the financialstatements, since the end of the last financial year, no director has received or become entitled to receive, a benefit by reason of acontract made by the Company or a related corporation with the director, or with a firm of which he is a member or with a company inwhich he has a substantial financial interest.Share Options<strong>Parkway</strong> Share Option Scheme 2001 (<strong>Parkway</strong> Scheme 2001)The <strong>Parkway</strong> Scheme 2001 was approved by the shareholders of the Company at an Extraordinary General Meeting held on 18 January2001. Details of the <strong>Parkway</strong> Scheme 2001 and amendments effected by a resolution passed at the Extraordinary General Meeting ofthe Company held on 4 July 2001 were set out in the Directors’ <strong>Report</strong> for the year ended 31 December 2001. The <strong>Parkway</strong> Scheme2001 is administered by the Company’s Share Option Scheme Committee, comprising 4 directors, Timothy David Dattels, Richard SeowYung Liang, Sunil Chandiramani and Ashish Jaiprakash Shastry.Information regarding the <strong>Parkway</strong> Scheme 2001 is set out below:(i)(ii)The exercise price of the option is determined at the average of the last dealt price of the Company’s shares on the SingaporeExchange Securities Trading Limited (SGX-ST) prevailing on the three consecutive trading days immediately preceding the date ofgrant of such options.The options vest one year after the grant date in accordance with the vesting schedule set out below:Vesting schedulePercentage of shares over whichthe options are exercisableOn or before the first anniversary of the grant dateNilAfter the first anniversary, and on or before the second anniversary of the grant date 25%After the second anniversary, and on or before the third anniversary of the grant date 50%After the third anniversary, and on or before the fourth anniversary of the grant date 75%After the fourth anniversary, and on or before the fifth anniversary of the grant date 100%38

Directors’ <strong>Report</strong>Year ended 31 December <strong>2005</strong>Share Options (Cont’d)<strong>Parkway</strong> Share Option Scheme 2001 (<strong>Parkway</strong> Scheme 2001) (Cont’d)(iii)The options granted expire on the fifth anniversary of the grant date unless they have been cancelled or have lapsed prior tothat date.At the end of the financial year, details of the options granted under the <strong>Parkway</strong> Scheme 2001 on the unissued ordinary shares of theCompany are as follows:NumberOptions Options of optionDate of Exercise outstanding outstanding holdersgrant of price per at 1 Jan Options Options Options at 31 Dec at 31 Dec Exerciseoptions share <strong>2005</strong> granted exercised cancelled <strong>2005</strong> <strong>2005</strong> period9/4/2001 $0.8650 1,869,750 – 1,120,750 13,000 736,000 16 10/4/2002 to9/4/20068/5/2001 $0.9933 100,000 – 100,000 – – – 9/5/2002 to8/5/200619/9/2001 $0.9400 1,115,000 – 652,500 87,500 375,000 3 20/9/2002 to19/9/200619/4/2002 $0.8350 5,237,250 – 2,040,500 200,000 2,996,750 202 20/4/2003 to19/4/200719/11/2004 $1.4267 2,600,000 – 188,000 275,000 2,137,000 29 20/11/<strong>2005</strong> to19/11/200915/11/<strong>2005</strong> $2.053 – 3,855,000 – – 3,855,000 59 16/11/2006 to15/11/20109/12/<strong>2005</strong> $2.087 – 3,010,000 # – – 3,010,000 8 10/12/2006 to9/12/201010,922,000 6,865,000 4,101,750 575,500 13,109,750#Excludes 170,000 options granted on 9 December <strong>2005</strong> but accepted only subsequent to the end of the financial year.Details of options granted to directors of the Company under the <strong>Parkway</strong> Scheme 2001 are as follows:Aggregate Aggregate AggregateOptions options granted options options Aggregategranted for since exercised since cancelled since optionsfinancial commencement commencement commencement outstandingyear ended of scheme to of scheme to of scheme to as atName of director 31 Dec <strong>2005</strong> 31 Dec <strong>2005</strong> 31 Dec <strong>2005</strong> 31 Dec <strong>2005</strong> 31 Dec <strong>2005</strong>Richard Seow Yung Liang 1,000,000 1,000,000 – – 1,000,000Sunil Chandiramani 100,000 600,000 – – 600,000Dr Lim Cheok Peng 1,500,000 3,000,000 – – 3,000,000Alain Ahkong Chuen Fah 100,000 500,000 – – 500,000Daniel Ashton Carroll 60,000 60,000 – – – *Chang See Hiang 100,000 400,000 125,000 – 275,000Timothy David Dattels 60,000 60,000 – – – *Ho Kian Guan 100,000 375,000 193,000 – 182,000Dr Ronald Ling Jih Wen 50,000 50,000 – – 50,000Ashish Jaiprakash Shastry 60,000 60,000 – – 60,000David R. White 50,000 50,000 – – – *Ho Kian Hock – 100,000 100,000 – –*The options granted were accepted subsequent to the end of the financial year.Since the commencement of the <strong>Parkway</strong> Scheme 2001, no options have been granted to the controlling shareholders of the Companyor their associates.39

Directors’ <strong>Report</strong>Year ended 31 December <strong>2005</strong>Share Options (Cont’d)<strong>Parkway</strong> Share Option Scheme 2001 (<strong>Parkway</strong> Scheme 2001) (Cont’d)Since the commencement of the <strong>Parkway</strong> Scheme 2001, no participant under the <strong>Parkway</strong> Scheme 2001 has been granted 5% or moreof the total options available under the <strong>Parkway</strong> Scheme 2001.During the financial year, 6,865,000 options were granted to and accepted by the employees and non-executive directors of theCompany and its subsidiaries under the <strong>Parkway</strong> Scheme 2001. 19,295,000 options have been granted to the employees andnon-executive directors of the Company and its subsidiaries since the commencement of the <strong>Parkway</strong> Scheme 2001 to the end of thefinancial year under review.Subsequent to the balance sheet date, 170,000 share options which were granted during the financial year were accepted while296,500 share options were exercised under the <strong>Parkway</strong> Scheme 2001.Except as disclosed above, there were no unissued shares of the Company or its subsidiaries under options granted by the Company orits subsidiaries as at the end of the financial year.The options granted by the Company and its subsidiaries do not entitle the holders of the options, by virtue of such holding, to any rightsto participate in any share issue of any other company.Audit CommitteeThe members of the Audit Committee during the year and at the date of this report are as follows:Alain Ahkong Chuen Fah (Chairman), non-executive directorChang See Hiang, non-executive directorHo Kian Guan, non-executive directorAshish Jaiprakash Shastry, non-executive directorAng Guan Seng, non-executive director**resigned on 10 June <strong>2005</strong>The Audit Committee performs the functions specified in Section 201B of the Act, the SGX-ST Listing Manual (the Listing Manual), theSGX-ST Best Practices Guide and the Code of Corporate Governance.The Audit Committee met four times during the year.The principal responsibility of the Audit Committee is to assist the Board of Directors in the identification and monitoring of areas ofsignificant business risks including the following:• the effectiveness of the management of principal business risks;• the effectiveness of the management of financial business risks and the reliability of management and financial reporting;• compliance with laws and regulations, particularly those of the Act and the Listing Manual, and its own code of business conduct;• the appropriateness of quarterly and full year announcements and reports;• the effectiveness of the Group’s system of internal controls;• the effectiveness and efficiency of internal and external audits; and• interested person transactions.40

Directors’ <strong>Report</strong>Year ended 31 December <strong>2005</strong>Audit Committee (Cont’d)Specific functions of the Audit Committee include reviewing the scope of work of the internal and external auditors, reviewing the levelof assistance provided by the Company’s officers to the internal and external auditors, receiving and considering the reports of theinternal and external auditors, and ensuring that management responds to recommendations made by the internal and external auditors.The committee also recommends the appointment of the external auditors and reviews the level of audit and non-audit fees.In addition, the Audit Committee has, in accordance with Chapter 9 of the Listing Manual, reviewed the requirements for approval anddisclosure of interested person transactions, and with the assistance of the internal auditors, reviewed the interested person transactions.The Audit Committee has full access to management and is given the resources required for it to discharge its functions. It has fullauthority and discretion to invite any director or executive officer to attend its meetings.The Audit Committee carried out a review of the external auditors’ remuneration, non-audit services provided by the external auditors,and the independence of the external auditors as required under Section 206(1A) of the Act and Rule 1207(6b) of the Listing Manualand determined that the auditors were independent in carrying out their audit of the financial statements. The Audit Committee hasrecommended to the Board of Directors that the auditors, KPMG, be nominated for re-appointment as auditors at the forthcoming<strong>Annual</strong> General Meeting of the Company.The auditors, KPMG, have indicated their willingness to accept re-appointment.On behalf of the Board of DirectorsRichard Seow Yung LiangDirectorDr Lim Cheok PengDirector24 February 200641

Statement by DirectorsYear ended 31 December <strong>2005</strong>In our opinion:(a)(b)the financial statements set out on pages 44 to 101 are drawn up so as to give a true and fair view of the state of affairs of the Groupand of the Company as at 31 December <strong>2005</strong> and of the results, changes in equity and cash flows of the Group and of the changesin equity of the Company for the year ended on that date; andat the date of this statement, there are reasonable grounds to believe that the Company will be able to pay its debts as and whenthey fall due.The Board of Directors has, on the date of this statement, authorised these financial statements for issue.On behalf of the Board of DirectorsRichard Seow Yung LiangDirectorDr Lim Cheok PengDirector24 February 200642

<strong>Report</strong> of the Auditorsto the Members of <strong>Parkway</strong> Holdings LimitedWe have audited the accompanying financial statements of <strong>Parkway</strong> Holdings Limited and its subsidiaries for the year ended 31December <strong>2005</strong> as set out on pages 44 to 101. These financial statements are the responsibility of the Company’s directors. Ourresponsibility is to express an opinion on these financial statements based on our audit.We conducted our audit in accordance with Singapore Standards on Auditing. Those Standards require that we plan and perform theaudit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includesexamining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includesassessing the accounting principles used and significant estimates made by the directors, as well as evaluating the overall financialstatement presentation. We believe that our audit provides a reasonable basis for our opinion.In our opinion:(a)(b)the consolidated financial statements of the Group and the balance sheet and statement of changes in equity of the Company areproperly drawn up in accordance with the provisions of the Companies Act, Chapter 50 (the Act) and Singapore Financial <strong>Report</strong>ingStandards to give a true and fair view of the state of affairs of the Group and of the Company as at31 December <strong>2005</strong> and of the results, changes in equity and cash flows of the Group and of the changes in equity of the Companyfor the year ended on that date; andthe accounting and other records required by the Act to be kept by the Company and by those subsidiaries incorporated inSingapore of which we are the auditors have been properly kept in accordance with the provisions of the Act.KPMGCertified Public AccountantsSingapore24 February 200643

Balance Sheetsas at 31 December <strong>2005</strong>GroupCompanyNote <strong>2005</strong> 2004 <strong>2005</strong> 2004$’000 $’000 $’000 $’000Non-current assetsProperty, plant and equipment 3 765,830 542,873 – –Intangible assets 4 180,901 31,361 – –Interests in subsidiaries 5 – – 690,137 546,689Interests in associates 6 54,390 14,362 (4,329) (4,524)Interests in partnerships 7 123 191 – –Other financial assets 8 28,884 46,656 – –Notes receivables 9 35,463 42,106 35,463 42,106Deferred tax assets 10 1,813 – 212 –1,067,404 677,549 721,483 584,271Current assetsCompleted properties held for resale 11 579 579 – –Inventories 12 16,947 10,063 – –Trade receivables 13 75,413 32,886 – –Other receivables, deposits and prepayments 14 23,696 9,336 437 634Tax recoverable 7,875 4,066 2,118 2,967Notes receivables 9 6,021 6,194 6,021 6,194Other financial assets 8 220 211 – –Cash and cash equivalents 15 106,024 196,165 8,692 174,125236,775 259,500 17,268 183,920Total assets 1,304,179 937,049 738,751 768,191Equity attributable to equity holders of the CompanyShare capital 16 181,753 180,728 181,753 180,728Share premium 18 114,041 111,412 114,041 111,412Other reserves 18 (20,517) (5,048) 12,968 12,691Accumulated profits 140,240 137,935 116,214 120,233415,517 425,027 424,976 425,064Minority interests 231,230 9,548 – –Total equity 646,747 434,575 424,976 425,064Non-current liabilitiesInterest-bearing borrowings 19 394,611 310,793 310,000 310,000Deferred tax liabilities 10 35,541 27,970 – 35430,152 338,763 310,000 310,035Current liabilitiesBank overdrafts 15 3,349 997 – –Trade payables and accrued operating expenses 112,600 55,641 3,213 2,582Other payables 20 39,455 10,180 562 510Interest-bearing borrowings 19 44,178 77,326 – 30,000Employee benefits 17 2,455 2,188 – –Current tax payable 25,243 17,379 – –227,280 163,711 3,775 33,092Total liabilities 657,432 502,474 313,775 343,127Total equity and liabilities 1,304,179 937,049 738,751 768,191The accompanying notes form an integral part of these financial statements.44