Annual Report 2003 - Parkway Pantai

Annual Report 2003 - Parkway Pantai

Annual Report 2003 - Parkway Pantai

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

PASSION FORPEOPLE &PROGRESSPARKWAY HOLDINGS<strong>Annual</strong> <strong>Report</strong> <strong>2003</strong>PARKWAY HOLDINGS LIMITED

CONTENTSAbout Us 01Our Businesses 02<strong>Parkway</strong>’s Regional Network 03Chairman’s Letter to Shareholders 04Managing Director’s Message 08Highlights of <strong>2003</strong> 12Financial Review 13Business Review 18Board of Directors 30Corporate Information 32Senior Management 33Financials 35

ABOUT US<strong>Parkway</strong> Holdings Limited is Asia’s premier integrated healthcare provider withthe largest regional network of private hospitals and healthcare facilities.We provide quality healthcare with a passion for people and progress.Taking the lead in the regional healthcare industry, we strive to be at thecutting-edge of medical developments, anchored by our values of integrity,excellence, innovation and enterprise.At <strong>Parkway</strong>, we understand and build value.VISIONOur vision is to bea leading international healthcare provider of choicewith a passion for people and progress.MISSIONWe aim to delivercomprehensive healthcare services and quality care consistentlyto provide value to our customers. We achieve this throughresponsible practices and continuous investments inour people and technologyto meet the challenges of tomorrow.

OUR BUSINESSESAN INTERNATIONAL HEALTHCARE PROVIDER OF CHOICEThe <strong>Parkway</strong> Group is proud to be at the forefront of healthcare provision in Asia.Backed by close to 50 years of experience in hospital development, management and operations, we arecommitted to providing quality care to patients through a full range of healthcare services. <strong>Parkway</strong>’s 1,110specialists deliver the most advanced treatment across 40 specialties, and under one roof.PARKWAY HOLDINGS LIMITEDHOSPITAL DIVISIONHEALTHCARE SERVICESDIVISIONNON-HEALTHCARESINGAPOREHOSPITALS• East Shore Hospital• Gleneagles Hospital• Mount Elizabeth HospitalINTERNATIONALHOSPITALS• Gleneagles JPMC, Brunei• Apollo Gleneagles Hospital,Kolkata• Gleneagles Intan MedicalCentre, Kuala Lumpur• Gleneagles Medical Centre,PenangPRIMARY HEALTHCARE• GP Services• Dental ServicesDIAGNOSTIC SERVICES• Radiology Services• Laboratory ServicesCLINICAL RESEARCHCONSULTANCY SERVICES• Hospital Development• Hospital ManagementMANAGED CAREPROPERTY ANDOTHER INVESTMENTSMEDICAL ASSISTANCEDIALYSIS SERVICEPROCUREMENT SERVICESHEALTHCARE IT SERVICESHOMECARE ANDREHABILITATIONMEDICAL ASSISTANCE2<strong>Parkway</strong> Holdings Limited <strong>Annual</strong> <strong>Report</strong> <strong>2003</strong>

Apollo Gleneagles Hospital, KolkataGleneagles JPMC, BruneiGleneagles Medical Centre, PenangGleneagles Intan, Kuala Lumpur

CHAIRMAN’S LETTER TO SHAREHOLDERS“The substantial investments which <strong>Parkway</strong> has madein our assets and our people are keys to sustainablelong-term growth and our success as a leader in theregional healthcare industry.”Dear Shareholders,<strong>2003</strong> was a year of unprecedented challenge for the global economy.Across the world, businesses experienced a harsh economic climateaccentuated by uncertainties posed by the US-led Iraqi war and theoutbreak of Severe Acute Respiratory Syndrome (SARS) in Asia.These events had a significant impact on <strong>Parkway</strong>, but I am pleased to saythat our dedicated team of healthcare professionals rose admirably tomeet these challenges. <strong>Parkway</strong>’s people are our greatest asset and theirresolve in a year of crisis reaffirms the Group’s strength and demonstratesits readiness to take on greater challenges and opportunities in the future.The fact that the overall performance of the Group remained resilient istestimony to the soundness of our business model and the strength of ourfundamentals.Beyond SARS, <strong>2003</strong> was a year of consolidation for <strong>Parkway</strong> followingthree years of restructuring. Our efforts concentrated on fine-tuning andimplementing the Group’s ‘Integrated Healthcare’ strategy to build the<strong>Parkway</strong> brand into Asia’s leading healthcare provider of choice, andtherefore to enhance the value of the corporation.Positioning the Group for sustained future growth has entailed continuedinvestment in both training and cutting-edge equipment and facilities.In particular, our ongoing focus on training and service improvement shouldcontinue to keep us at the top of the region’s healthcare industry.Our Strategy<strong>Parkway</strong> is the only private healthcare provider in Asia with a presenceacross primary, secondary and tertiary care as well as a number ofestablished hospitals outside its home country. In the face of steadilygrowing demand for high quality healthcare across the region, <strong>Parkway</strong> isuniquely positioned to meet these needs in an integrated way, tappingsynergies across the spectrum of medical care and across geographies.4<strong>Parkway</strong> Holdings Limited <strong>Annual</strong> <strong>Report</strong> <strong>2003</strong>

This is the essence of our ‘Integrated Healthcare’ strategy, which we believewill generate steady growth over time and build shareholder value as wecapitalise on our position at the forefront of the region’s healthcare industry.The different facets of this ‘Integrated Healthcare’ strategy comprise:• Continually strengthening our position in Singapore’s private healthcaresector as the market leader for tertiary and quaternary care;• Enhanced marketing efforts to attract an increasing number ofinternational patients to Singapore;• Investing in our Healthcare Services businesses as key drivers of growththrough introduction of new, innovative and cutting-edge technologies;• Tapping our operating expertise to further develop our network ofInternational Hospitals through growth of existing facilities and addingnew hospitals under management;• Identifying and investing selectively in new initiatives which arecomplementary to our core activities and which have the promise ofattractive returns; and• Continually developing our expertise and core competencies throughtraining and motivating our personnel to create a dynamic andprogressive environment for our people.<strong>Parkway</strong> Holdings Limited <strong>Annual</strong> <strong>Report</strong> <strong>2003</strong> 5

CHAIRMAN’S LETTER TO SHAREHOLDERSIn line with this strategy, over the past year our Singapore Hospitals continuedto add to their capabilities in delivering specialised quaternary care in areassuch as cancer treatment and liver transplants. Our laboratories, radiology andprimary care businesses (‘Healthcare Services’) all implemented growth plansand introduced new services which will contribute to future growth.Our International Hospitals division is performing particularly well: the Malaysianhospitals continue to grow and the Gleneagles Jerudong Medical Centre inBrunei Darussalam has not only set new medical milestones for Brunei, buthas also become profitable in less than a year. Following on its success, we arelooking for additional opportunities in that market.The Apollo Gleneagles Hospital in Kolkata, our joint-venture with the ApolloHospitals Group in India, officially opened in November <strong>2003</strong>, and has thepotential to become the hospital of choice for India’s north-eastern region andthe neighbouring countries. To reinforce our commitment to expandinternationally, we have recently brought in new managerial talent to lead ourinternational business development team.Outlook for 2004The Group’s business outlook for 2004 is generally positive. The number oflocal and international patients has almost returned to pre-SARS levels.Additionally, revenue intensity at our hospitals continues to grow in line with ourfocus on high value-added services. These favourable trends should translateinto good financial performance for the Group.Our brand-building and staff training efforts have also shown good results.<strong>Parkway</strong> won the Superbrands Award for excellent branding of its premier MountElizabeth and Gleneagles Hospitals. Gleneagles Hospital also won the AsianHospital Management Award for Internal Service, beating 103 internationalentries.During the year, the Group partnered with Singapore government agenciesin the SingaporeMedicine initiative, to actively market Singapore as aninternational healthcare hub. This is naturally complementary to our ownregional marketing efforts.6<strong>Parkway</strong> Holdings Limited <strong>Annual</strong> <strong>Report</strong> <strong>2003</strong>

As the dominant player in the Singapore private healthcare market, we areconstantly looking for ways to leverage on the city’s strengths - its pro-businessenvironment, world-class infrastructure and high medical standards - tostrengthen <strong>Parkway</strong>’s brand and build shareholder value.Consistent with the regional expansion of our network, we have intensified ourmarketing efforts across Asia. A top choice for many patients around the world,<strong>Parkway</strong> currently attracts more than half of the international patients who visitSingapore each year. In 2002, some 200,000 foreign patients came toSingapore (Source: Singapore Tourism Board).As you know, we have also been divesting our non-core assets to position yourcompany as a pure healthcare services business. In line with this strategy,in January of 2004 we disposed of our 37% interest in Lee Hing DevelopmentLimited, one of our last remaining non-healthcare investments.ConclusionGiven the difficult year that we have all just come through, I am pleased thatyour company has been able to deliver a credible financial result. Thanks to astrong recovery in the third and fourth quarters of <strong>2003</strong>, we were able to achievea level of profitability that enabled us to declare an increased dividend payoutover the previous year.Naturally, none of this would have been possible without the dedication andeffort of all our colleagues, doctors and business partners. Consequently,I wish to take this opportunity to thank all of you for your significantcontributions through a trying period. Your ongoing support will enable theGroup to continue to remain at the forefront of the healthcare service providercommunity and to develop its business reach as it expands through Asia.ANIL THADANICHAIRMANPARKWAY HOLDINGS LIMITED<strong>Parkway</strong> Holdings Limited <strong>Annual</strong> <strong>Report</strong> <strong>2003</strong> 7

MANAGING DIRECTOR’S MESSAGE“The <strong>Parkway</strong> team’s strong performance in <strong>2003</strong>,despite tough operating conditions, demonstrates thatour strategies are clearly able to create value.”Dear Shareholders,The Year in PerspectiveThe <strong>2003</strong> performance of the <strong>Parkway</strong> Group exceeded expectations,inspite of the ravages of the Severe Acute Respiratory Syndrome (SARS)outbreak on the regional economy.I am pleased to announce that the Group saw an improvement in earningscompared to 2002. Strong recovery in the third and fourth quarters bufferedthe impact of the SARS outbreak on the Group’s revenue earlier in <strong>2003</strong>.As we remember at <strong>Parkway</strong>, the year <strong>2003</strong> focused largely on theindomitable spirit of the <strong>Parkway</strong> team and its ability to respond swiftly tochallenges. I applaud our doctors, nurses and personnel for showingcourage and commitment.During the SARS period the Group took all measures necessary to ensurean infection-free environment at all our facilities. Stringent infection controlprotocols were implemented to provide our patients and personnel addedprotection. Not only was <strong>Parkway</strong> the first private hospital group to installthermal scanners at our Singapore hospitals, we were also the first inSingapore to adopt cutting-edge bio-decontamination technology.During the year, <strong>Parkway</strong>’s experience in hospital management anddevelopment was recognised in the Superbrands Award given to MountElizabeth and Gleneagles Hospitals.Our Accomplishments in <strong>2003</strong>During the year we consolidated our business strategies, fine-tuned ourfocus and moved towards greater integration of services.Our Singapore Hospitals registered higher admissions and revenueintensity due to increased competitiveness in common procedures and ourcontinued focus on high value-added tertiary and quaternary services,in which <strong>Parkway</strong> has a strategic advantage.Major investments in advanced equipment, new services and facilities weremade. The Group now offers the most advanced cancer diagnosis andmanagement techniques and the most comprehensive liver transplantservices in the region. Its newly upgraded Operating Theatre complex atMount Elizabeth Hospital is geared for complex procedures of the future.8<strong>Parkway</strong> Holdings Limited <strong>Annual</strong> <strong>Report</strong> <strong>2003</strong>

In Healthcare Services, the Group invested for growth. <strong>Parkway</strong> LaboratoryServices’ fully automated clinical laboratory is now able to handle commonand esoteric tests in greater volume and with improved efficiency to meetregional demands. MediRad invested in the cutting-edge Positron EmissionTomography – Computerised Tomography (PET-CT) scan and <strong>Parkway</strong> Shentonnot only established a new flagship clinic at Republic Plaza, but it also set upseven other clinics as well.On the international front, the Group is developing strategic partnerships withestablished healthcare players in the region, with a focus on China, India,Malaysia, Indonesia and Vietnam. The official opening of Apollo GleneaglesHospital, Kolkata, augurs well for the Group’s expansion into India. Ourexisting International Hospitals are doing exceptionally well.Further extending the <strong>Parkway</strong> network across Asia, the Group set up six newMedical Referral Centres (MRC) in major Asian cities to attract internationalpatients, bringing the total to 14. The MRC, a free service, connects patients inreal time to relevant medical services and doctors across the <strong>Parkway</strong> Group.During the year, investment in expertise, training and service quality initiativeswas stepped up as we continue to develop our strong, highly experienced team.With the <strong>Parkway</strong> Centre for Medical Simulation, we now have the region’smost advanced simulation training facility, setting a gold standard for healthcaretraining.The pool of specialists at the Group’s Medical Centres in Singapore hasexpanded from over 850 to 1,110. This is testimony to the <strong>Parkway</strong> Group’ssound business model, excellent business practices and dynamic, progressiveenvironment.Whilst enhancing our topline, we continually review ways of managing costs.This year, some of the initiatives include switching to more cost-effectivealternatives in purchasing, as well as centralising our supplies and sterilisationdepartment.Financial PerformanceThe <strong>Parkway</strong> Group maintained its level of earnings in <strong>2003</strong>, with a slightimprovement over the previous year, despite the impact of the SARS outbreakon the economy.For the financial year ended 31 December <strong>2003</strong>, the Group achieved a netprofit after tax and minority interest of S$33.6 million, representing a 1%increase over the S$33.3 million achieved in the previous year.Higher patient admissions and revenue intensity in the final quarters of theyear mitigated the impact of SARS on the Group’s performance in the secondquarter of <strong>2003</strong>.Revenues grew from S$337.6 million in 2002 to S$348.6 million in <strong>2003</strong>,representing a 3% growth. This reflects modest improvements across all corehealthcare operations in the second half of the year.<strong>Parkway</strong> Holdings Limited <strong>Annual</strong> <strong>Report</strong> <strong>2003</strong> 9

The Group’s EBITDA (earnings before interest, taxes, depreciation andamortisation) was slightly lower at S$85.8 million, relative to the S$89.4 millionin 2002. Strong contributions from the International and Singapore Hospitalssegments were offset by the weaker Healthcare Services segment which wasthe most badly impacted by SARS.Singapore HospitalsThe Group’s highest revenue contributor, the Singapore Hospitals segment,performed better than expected. Revenue contribution from this businesssegment rose to S$223.4 million in <strong>2003</strong>, up 3% from S$217.1 million in 2002.This is mainly attributable to higher inpatient admissions and revenue intensityand strong recovery post-SARS in the third and fourth quarters.EBITDA for the Singapore Hospitals improved to S$64.7 million, a 3% rise fromthat of the previous year, supported by both higher volume and intensity.Healthcare ServicesThe Group’s Healthcare Services segment registered a slight 1% growth inrevenue from S$78.2 million in 2002 to SS$78.7 million in <strong>2003</strong>. This was largelyattributable to new corporate contracts won by <strong>Parkway</strong> Shenton which helpedto offset the impact of SARS during the second quarter.Healthcare Services’ EBITDA, however, declined by 23% from S$18.1 millionin 2002 to S$13.9 million in <strong>2003</strong>. The Group’s aggressive expansion plans inthis segment which had been put in place prior to SARS, resulted in additionaloperating costs in the face of revenue declines during the SARS period.International HospitalsThe Group’s International Hospitals posted an impressive 43% growth inrevenue from S$29.8 million in 2002 to S$42.6 million in <strong>2003</strong>.International Hospitals made a significant 275% improvement in EBITDA fromS$1.62 million in the previous year to S$6.07 million in <strong>2003</strong>.This strong improvement was due to higher revenue intensity and admissionsat the Gleneagles Medical Centre in Penang, and maiden contributions fromthe Group’s Cardiac Centre in Brunei.Non-HealthcareRevenue from the Non-Healthcare segment decreased from S$12.5 milllion in2002 to S$3.9 million in <strong>2003</strong> due to continued divestment of Non-Healthcareassets in the year. EBITDA from this segment declined by 83%, consistent withour divestment strategy.10 <strong>Parkway</strong> Holdings Limited <strong>Annual</strong> <strong>Report</strong> <strong>2003</strong>

Prospects Looking ForwardThe Management is optimistic that operating performance in 2004 shouldimprove over <strong>2003</strong>, provided that the economy remains strong and regionalstability prevails. The strategies the Group has put in place in the pastthree years are showing results and will enable the Group to capitalise onopportunities.In the year ahead, a strong revenue stream from recently introduced andupgraded specialty services can be expected. These include our PET-CT scanservices, micro-multileaf collimator radiosurgery and our Liver Centre.Additional new services which are now being planned will further extend theGroup’s already comprehensive range of services and contribute positively toperformance. These include enhancement of bone marrow transplant and stemcell therapy, a second In-Vitro Fertilisation (IVF) centre and a Hand andMicrosurgery Centre.To develop the <strong>Parkway</strong> network further, our reinforced international team willfocus closely on key markets such as China, India, Malaysia, Indonesia andVietnam that have the promise of good returns.In closing, I wish to take this opportunity to thank the Board of Directors fortheir leadership and support. My heartfelt thanks and praise go out to all ourstaff for their hard work and commitment in making our performance in <strong>2003</strong> agood one despite trying conditions. As a tribute, this year’s annual report isentitled “Passion for People and Progress”, as inspired by our corporate vision.Your continued support will strengthen the <strong>Parkway</strong> Group’s lead in theSingapore and regional healthcare market.DR LIM CHEOK PENGMANAGING DIRECTORPARKWAY HOLDINGS LIMITED<strong>Parkway</strong> Holdings Limited <strong>Annual</strong> <strong>Report</strong> <strong>2003</strong> 11

PARKWAY: HIGHLIGHTS OF <strong>2003</strong>February Upgrading of Mount Elizabeth Hospital’s Operating Theatres, Phases 4 and 5.The Operating Theatres have undergone a total facelift with structural modifications tailored tosupport complex surgical procedures.Set up in August 2002, Gleneagles Jerudong Park Medical Centre, Brunei Darussalam, wenton quickly to perform the first angiogram in Brunei Darussalam.MarchMayOnset of SARS outbreak in SingaporeMount Elizabeth Hospital:First hospital in Singapore to install a thermal scanner, in line with <strong>Parkway</strong>’s proactivemeasures to maintain its SARS-free status.<strong>Parkway</strong>’s hospitals are first to adopt state-of-the-art bio-decontamination technology toremain SARS-free.Gleneagles Jerudong Park Medical Centre performs the first open heart surgery in BruneiDarussalam.JuneThe World Health Organization officially declares Singapore SARS-free.Official launch of <strong>Parkway</strong> Centre for Medical Simulation, the region’s most advancedinteractive facility for medical simulation training.JulyAugustOctoberNovemberMount Elizabeth Hospital becomes the first private hospital in Singapore to offer PET-CT scans.At the same time, Medi-Rad Associates (a subsidiary of <strong>Parkway</strong> Holdings Limited), SingHealthand AsiaMedic, partner in the joint-venture Positron Tracers Pte Ltd, launch Singapore’s firstcyclotron facility to produce radioactive glucose isotopes for advanced diagnosticscanning via PET-CT scans.<strong>Parkway</strong> Laboratory Services:First in Asia to launch revolutionary prenatal screening test for genetic abnormalities.DNA-based quantitative fluorescent – polymerase chain reaction (QF-PCR) method providesrapid and effective prenatal diagnosis.Gleneagles Hospital:Set up Asia’s first specialised liver intensive care unit.<strong>Parkway</strong> Laboratory Services:Launch of first automated clinical laboratory in Asia outside Japan, in collaboration withGerman healthcare giant Bayer Diagnostics. Milestone collaboration boosts quality, efficiency,productivity and reinforces Singapore’s standing as a world class medical hub.Official opening of Apollo Gleneagles Hospital, Kolkata.<strong>Parkway</strong>’s joint-venture with the Apollo Hospitals Group signifies our expansion beyondSoutheast Asia into India.12 <strong>Parkway</strong> Holdings Limited <strong>Annual</strong> <strong>Report</strong> <strong>2003</strong>

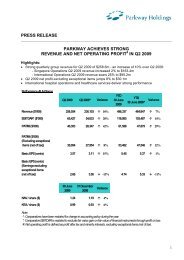

<strong>2003</strong> FINANCIAL REVIEWGROUP CONSOLIDATED STATEMENTS<strong>2003</strong>S$’0002002S$’0002001S$’0002000#S$’0001999^S$’000Profit and Loss AccountRevenueHealthcareNon-core344,7433,905348,648325,09612,463337,559344,77512,357357,132337,49943,064380,563319,25956,023375,282Profit before interest, tax,depreciation and amortisation ∞% of revenue85,78824.6%89,39326.5%86,84824.3%103,68627.2%111,58029.7%Profit after tax and minority interestsbut before exceptional items% of revenue33,6089.6%33,3019.9%24,8917.0%23,4626.2%38,84110.3%Net profit after tax and minority interests% of revenue33,6089.6%33,3019.9%12,4793.5%131,44034.5%123,83333.0%Balance SheetTotal AssetsTotal BorrowingsTotal Shareholders’ funds815,460264,752430,500832,881290,485427,970824,280286,733411,1071,091,435363,186575,4801,592,412643,185794,845Profitability Ratios (%)Return on Shareholders’ fundsBefore exceptional itemsAfter exceptional items7.87.87.87.86.13.04.122.84.915.6Return on AssetsBefore exceptional itemsAfter exceptional items4.14.14.04.03.01.52.112.02.47.8Gearing RatioDebt equity ratio0.610.680.700.630.81Per Share DataEarnings per share (S$)Before exceptional itemsAfter exceptional items0.050.050.050.050.030.020.030.180.110.35Gross dividend (S$) +0.060.050.030.050.07Net tangible asset backing per share (S$)*0.550.550.571.602.21Net asset value backing per share (S$)*0.600.590.571.602.21∞ Profit before exceptional items, exchange differences and share of results of associates.# Certain comparative figures in FY2000 have been restated due to the adoption of the new and revised accounting standards that wereimplemented in 2001.^ Comparative figures for FY1999 have not been adjusted to take into account the adoption of the new and revised accounting standardsthat were implemented in 2001.* The net tangible asset and net asset value backing per share for FY2001 onwards were computed after taking into account the return ofcapital amounting to approximately S$180 million in 2001 and based on the enlarged share capital of the Company following the capitaldistribution exercise.+ Gross dividend comprises interim dividend declared during the year and final dividend proposed by directors in respect of that financialyear under review.<strong>Parkway</strong> Holdings Limited <strong>Annual</strong> <strong>Report</strong> <strong>2003</strong>13

FINANCIAL REVIEWOverviewDespite the impact of SARS in <strong>2003</strong>, the Group not only posted positive earnings but its revenue and profit aftertax and minority interests (PATMI) also showed marginal increases.The <strong>2003</strong> results were largely driven by strong performance in the International and Singapore Hospitalssegments. The Healthcare Services segment was worst hit by SARS and showed weaker performance than inthe prior year.The second half of the year showed a strong recovery from SARS. Looking forward, drivers of growth for ourSingapore hospitals are our focus on high value-added services and marketing to international patients.The International Hospitals segment also has further growth potential as the Penang, Brunei and Kolkatahospitals mature. Finally, the Healthcare Services segment has significant recovery potential as a result ofrecent investments in new equipment, facilities and services.REVENUE BY BUSINESS SEGMENTS$ million250.0200.0223.4217.1150.0100.050.042.629.878.7 78.23.9 12.5<strong>2003</strong>2002SINGAPOREHOSPITALSINTERNATIONALHOSPITALSHEALTHCARESERVICESNON-CORESEGMENTRevenueThe effect of SARS in the second quarter was mitigated by strong patient volumes in the third and fourthquarters of <strong>2003</strong>. As a result, Group revenues rose by 3% to S$348.6m in <strong>2003</strong> with increases in all thehealthcare businesses. Highest growth was generated by the International Hospitals segment, which saw a43% increase in revenues compared to 2002, resulting from maiden contributions from Gleneagles JPMC inBrunei and growth in the Gleneagles Medical Centre, Penang. The Singapore Hospitals segment grew by 3%compared to last year, largely due to strong patient volumes during the second half of <strong>2003</strong>. The HealthcareServices segment was most impacted by SARS, with only marginal growth despite the introduction of severalnew services. Non-Core revenues declined in line with our strategy of divesting non-core assets.14 <strong>Parkway</strong> Holdings Limited <strong>Annual</strong> <strong>Report</strong> <strong>2003</strong>

FINANCIAL REVIEWHospital StatisticsSINGAPORE HOSPITALS2002<strong>2003</strong><strong>2003</strong>VS2002NUMBER OF HOSPITALS33INPATIENT ADMISSIONS43,75445,4703.9%NO. OF DAY CASES *11,67411,537-1.2%AVERAGE LENGTH OF STAY (days)3.553.52-0.8%PATIENT DAYS155,421160,2603.1%* Day Ward Admissions onlyDuring the year, the Group’s Singapore hospitals’ inpatient admissions grew by 3.9% compared to the previousyear. Strong patient volumes in the third and fourth quarters more than offset volume declines experiencedduring the SARS outbreak. Day cases however declined marginally by 1.2%. The Group’s focus on highervalue-added tertiary healthcare services continued to impact the performance of the Singapore hospitalspositively, resulting in a 3% increase in revenue intensity at the two tertiary hospitals, Mount Elizabeth andGleneagles.2002INTERNATIONAL HOSPITALS + <strong>2003</strong><strong>2003</strong>++VS2002NUMBER OF HOSPITALS12INPATIENT ADMISSIONS13,43214,3927.1%NO. OF DAY CASES-95N.M.AVERAGE LENGTH OF STAY (days)3.203.19-0.3%PATIENT DAYS42,96145,9006.8%+ Excludes associates++ Includes Gleneagles JPMC, BruneiAdmissions in the international hospitals grew by 7.1% as a result of the opening of the Cardiac Centre inBrunei in May <strong>2003</strong> as well as growth at the Gleneagles Medical Centre, Penang.<strong>Parkway</strong> Holdings Limited <strong>Annual</strong> <strong>Report</strong> <strong>2003</strong>15

FINANCIAL REVIEWPROFIT BEFORE INTEREST, TAX, DEPRECIATION ANDAMORTISATION (EBITDA)* BY BUSINESS SEGMENTS$ million80.060.040.064.662.820.00.0SINGAPOREHOSPITALS6.11.6INTERNATIONALHOSPITALS13.918.1HEALTHCARESERVICES1.2 6.9NON-CORESEGMENT<strong>2003</strong>2002 ^* EBITDA exclude exchange differences and share of results of associates^ Prior year’s figures have been restated for comparative purposesEBITDA registered a 4% decline to S$85.8m largely due to poorer performance in the Healthcare Servicessegment, as well as lower contributions from the Non-Core segment.The Singapore Hospitals and International Hospitals segments posted 3% and 275% growth in EBITDArespectively. Growth in the Singapore Hospitals was driven by increased hospital admissions and revenueintensity, whilst the International Hospitals segment grew due to maiden contributions from Gleneagles JPMC,Brunei and improved performance at Gleneagles Medical Centre, Penang.The Healthcare Services segment was significantly affected by SARS. In addition, the segment’s aggressiveexpansion plans, which had been put in place prior to SARS, resulted in higher operating costs from upgradingfacilities, acquisition of new equipment and opening of new clinics.The Non-Core segment generated lower contributions, in line with the Group’s divestment strategy.16 <strong>Parkway</strong> Holdings Limited <strong>Annual</strong> <strong>Report</strong> <strong>2003</strong>

FINANCIAL REVIEWPROFIT AFTER TAX AND MINORITY INTERESTS (PATMI)*BY BUSINESS SEGMENTS$ million40.030.032.535.120.010.00.02.8(1.0)2.9 4.9(4.6) (5.7)<strong>2003</strong>(10.0)2002 ^SINGAPOREHOSPITALSINTERNATIONALHOSPITALSHEALTHCARESERVICESNON-CORESEGMENT* Includes share of results of associates^ Prior year’s figures have been restated for comparative purposesPATMI improved marginally by 1% to S$33.6m in <strong>2003</strong> despite a slightly lower EBITDA. The improvement inPATMI was largely due to the lower financing costs offset by higher income tax expense due to write back ofoverprovision of taxation in 2002.Group BorrowingsAs at 31 December <strong>2003</strong>, total borrowings for the Group were S$265m with S$31m in cash and bank balances.Total borrowings were S$290m with S$48m in cash and bank balances as at 31 December 2002.DividendsThe Group has proposed a final dividend of 4 cents per ordinary share, which is higher than the 3.5 cents perordinary share declared in the previous year. This is in addition to the interim dividend of 2 cents per ordinaryshare paid in September <strong>2003</strong>.<strong>Parkway</strong> Holdings Limited <strong>Annual</strong> <strong>Report</strong> <strong>2003</strong>17

37,876total number ofoperationsperformedin <strong>2003</strong>To meet the rising demand for quality medical andsurgical services, the <strong>Parkway</strong> Group has investedheavily into state-of-the-art technology.Our equipment and operating theatres arecontinually being upgraded to enable us to offerpatients the most advanced treatment options ofinternational standards.

MEDICAL EXCELLENCEAs a leading international quality healthcare provider, the <strong>Parkway</strong> Group maintainsits cutting edge by continuously evolving and advancing to meet changing marketdemands. Our continual investment in state-of-the-art technology, equipment andfacilities has enabled us to offer the most advanced treatment options available, anddeliver our patients the best value.COMMITMENT TO MEDICAL EXCELLENCEAt <strong>Parkway</strong>, our passion for progress begins withour passion for people.Our patients are our top priority. Both local andinternational patients from all over the world seekquality medical care at <strong>Parkway</strong>. With this trustinvested in our professional competence, <strong>Parkway</strong>is fully committed to upholding the highest levels ofmedical excellence to deliver the best treatment andpatient care.We deliver a comprehensive suite of specialisedtertiary and quaternary healthcare services throughan experienced multidisciplinary team which includes1,100 specialists across 40 specialties.To support our integrated delivery of services,significant capital expenditure has been made toacquire new equipment and technology, upgradefacilities and intensify training.These strategic investments are consistent with<strong>Parkway</strong>’s vision to progressively develop valueaddedcapabilities and expand the Group’sextensive range of specialised services, to securelong-term sustainability and success.Moves have been made towards a seamlessintegrated hospital information system, leading toenhanced integration in the delivery of services.FACILITIES UPGRADINGAdding value to the <strong>Parkway</strong> experience, the Group’sSingapore Hospitals continued their major upgradingprogramme during the year.At Mount Elizabeth Hospital, major upgrading highlightsincluded the restructuring of operating rooms, suchas the endo-vascular and cardiac theatres, andsophisticated Mizuho operating tables in the neurosurgeryand urology theatres for finer operative care.In addition, two surgical wards, the maternity ward,the lobby and the business office were renovated.At Gleneagles Hospital, a medical ward wasrenovated to feature neuro and geriatric-friendlyfacilities.To enhance patients’ hospital stays, GleneaglesHospital introduced infotainment-on-demandservices in hospital rooms. This is a first inSingapore. A sophisticated Video-On-Demand (VOD)facility installed in hospital rooms allows patients toview videos and surf the Internet from their beds.This value-added service promotes patientrecovery by boosting psychological well-being, andis one of the many services <strong>Parkway</strong> has introducedto differentiate its hospitals from the competitors.Business Review<strong>Parkway</strong> Holdings Limited <strong>Annual</strong> <strong>Report</strong> <strong>2003</strong>19

BUSINESS REVIEWWe make strategic investments in technology to support our specialists in providingour patients the latest treatment options, and, therefore, the best value.CENTRES OF EXCELLENCEOne of the cornerstones of our commitment tomedical excellence is the development ofmultidisciplinary centres for key specialties whichenable <strong>Parkway</strong> to offer the most advanced andsophisticated treatments in the region.These Centres of Excellence currently focus oncancer, liver, cardiac and neurology conditions.<strong>Parkway</strong> Cancer CentresDuring the year, <strong>Parkway</strong> made particular progressin developing its Cancer Centres at Gleneagles andMount Elizabeth Hospitals, which offer a comprehensiverange of oncology services, ranging fromdiagnosis to treatment and counselling.The Group has made significant capital investmentin cutting-edge equipment and facilities to maintainits lead in oncology services.Positron Emission Tomography -Computerised Tomography (PET-CT) ScannerConsistent with our focus on high value-addedservices, the Group invested almost S$5 million inthe highly sophisticated PET-CT scanner to providethis service to our cancer patients.From mid-July <strong>2003</strong>, PET-CT scans were availableat Mount Elizabeth Hospital. The Hospital becamethe first private hospital in Singapore to offerPET-CT scans.PET-CT has been described as one of the top 10inventions of the century. This scanner enables datafusion from both the PET and CT, thus providinganother dimension to diagnostic imaging.The image from the PET-CT is based on the organs’physiological function while CT data is based purelyon anatomy. Data fusion of these two modalitiesprovides a quantum leap in diagnosis, makingPET-CT one of the most accurate and rapid meansof detecting and managing cancer and otherconditions which are otherwise impossible to detect.Recent developments have made PET-CT integralto the management of lung, colorectal, liver and braincancers, lymphomas, melanomas as well as epilepsyand coronary heart disease.Demand for PET-CT scan services will be fuelled bythe regional market.20 <strong>Parkway</strong> Holdings Limited <strong>Annual</strong> <strong>Report</strong> <strong>2003</strong>

BUSINESS REVIEWMicro-multi-leaf collimator-based radiosurgeryThe Group has also recently added a specialisedoncology treatment to the extensive range ofservices offered at Gleneagles Cancer Centre.The multi-million equipment provides micro-multi-leafcollimator-based radiosurgery.BrainLab M3 micro-multi-leaf collimator-basedradiosurgery is one of the latest cancer treatmenttechniques that maximises irradiation to the tumourwhile minimising damage to healthy tissues, thusproviding cancer patients with significantimprovement in treatment outcomes.CanHOPEAs an extension of our oncology services, the Grouplaunched a free non-profit cancer counsellingservice, hotline and website, CanHOPE in August<strong>2003</strong>. Our professional counsellors offer cancerpatients emotional and psychosocial support, andassist them in making clear, informed decisions ontreatment options.Specialised Liver Intensive Care UnitBuilding upon our reputation for hepatobiliary andtransplant surgeries, the Group launched the LiverIntensive Care Unit at Gleneagles Hospital,Singapore, in October <strong>2003</strong>.It is Asia’s onlydedicated ICU to serve the specialised needs ofpatients with acute liver failure (ALF).The Unit is fully equipped with sophisticateddiagnostic tools, monitoring devices, ventilators, liverand kidney dialysis machines and other equipment.It offers liver dialysis using the advanced MolecularAdsorbents Recirculating System (MARS).The Unit supplements the Group’s dedicatedoperating theatres for hepatobiliary and transplantsurgeries and state-of-the-art equipment for livingdonor liver transplant (LDLT).Serving both <strong>Parkway</strong> and non-<strong>Parkway</strong> patients,CanHOPE is an added resource to cancer patientsas well as our contribution to the community.<strong>Parkway</strong> Holdings Limited <strong>Annual</strong> <strong>Report</strong> <strong>2003</strong>21

BUSINESS REVIEWOur International Hospitals extend the unique <strong>Parkway</strong> brand across Asia.HEALTHCARE SERVICES<strong>Parkway</strong> Laboratory Services<strong>Parkway</strong> Laboratory Services (PLS), a wholly-ownedsubsidiary of <strong>Parkway</strong> Holdings Limited, set up aclinical laboratory automation system in November<strong>2003</strong>, in collaboration with German healthcare giantBayer Diagnostics.The first of its kind in Asia outside Japan, this new26,000 sq ft facility at Ayer Rajah Industrial Parkpositions PLS favourably to capture the potential ofthe vast regional market. Its capacity can potentiallybe scaled up to 10 million tests per year, comparedwith three million in 2002.The system speeds up result-reporting and increasesefficiency in patient data management, allowing forseamless integrated patient information system. Itsunique sample handling process treats each sampleindividually - precisely recognising where a sampleshould go, then routing it for optimal efficiency.PLS also became the first in Asia to develop andlaunch a revolutionary prenatal screening test forgenetic abnormalities.The DNA-based quantitative fluorescent-polymerasechain reaction method (QF-PCR) cuts reporting timefrom two weeks to a day and provides 99.9%accuracy, compared to the labour-intensive cultureanalysis.INTERNATIONAL HOSPITALSGleneagles Jerudong Park Medical Centre,Brunei DarussalamThe Gleneagles Jerudong Park Medical Centre,a 75:25 joint venture between <strong>Parkway</strong> andJerudong Park Medical Centre, became a fullfledgednational cardiovascular centre in <strong>2003</strong>.Gleneagles JPMC became fully operational forinvasive and specialised cardiac andcardiothoracic procedures and became the firstmedical centre in Brunei Darussalam to performopen heart surgery.Apollo Gleneagles Hospital,Kolkata<strong>Parkway</strong> officially opened Apollo GleneaglesHospital, Kolkata, in November <strong>2003</strong>. The 51:49joint venture with the Apollo Hospitals Group notonly symbolises the strategic partnership betweentwo healthcare leaders, it also marks <strong>Parkway</strong>’sfirst expansion into India.Epitomising <strong>Parkway</strong>’s and Apollo’s model ofproviding quality healthcare facilities, the 325-bedApollo Gleneagles will play a pivotal role inmeeting medical needs of the region and willshowcase telemedicine.Apollo Gleneagles has the potential to developinto the healthcare hub of the eastern region,covering the North Eastern states of India,Bangladesh, Nepal, Bhutan and Myanmar.22 <strong>Parkway</strong> Holdings Limited <strong>Annual</strong> <strong>Report</strong> <strong>2003</strong>

BUSINESS REVIEW<strong>Parkway</strong> Hospitals in Malaysia<strong>Parkway</strong> owns two hospitals in Malaysia: GleneaglesMedical Centre in Penang (70% equity) and GleneaglesMedical Centre in Kuala Lumpur (30% equity).Both hospitals have grown and contributed to theGroup significantly in the last year. The hospitals havenot only developed into leading medical centres intheir respective states but also regionally as well.Both hospitals are seeing an increasing number ofpatients for common procedures as well as nicheareas such as cardiology and cardiothoracic surgery.The <strong>Parkway</strong> Group is developing strategic alliances with established healthcare playersin the region. This initiative will maintain the Group's position at the forefront ofmedical excellence to benefit patients as well as enable us to grow as a corporationfrom strength to strength to benefit our investors and shareholders.<strong>Parkway</strong> Holdings Limited <strong>Annual</strong> <strong>Report</strong> <strong>2003</strong>23

45,470inpatients treatedin <strong>2003</strong>The <strong>Parkway</strong> Group has consistently won awardsand accolades for superior service quality.In <strong>2003</strong>, Gleneagles and Mount ElizabethHospitals were bestowed the Superbrands Awardfor outstanding branding. Gleneagles Hospital wonthe Asian Hospital Management Award forInternal Service excellence.

QUALITY SERVICEQuality service is one of the cornerstones of our position as a leading provider of totalhealthcare services. By fulfilling, even exceeding, customer expectations we enhanceour corporation’s value.COMMITMENT TO SERVICE EXCELLENCE<strong>Parkway</strong> is fully committed to international standardsof service. Our hospitals and healthcare servicesuphold service excellence at all levels.Beyond professional competence, the <strong>Parkway</strong> teamprovides service from the heart.Bearing witness to our reputation, internationalpatients from Asia, the Middle East, Australia,Europe, Africa and the United States seek medicalattention at <strong>Parkway</strong>’s facilities each year.Access to quality treatment in comfort and privacy inan exclusive environment, attended by caring,experienced medical and surgical teams is thereason why more than half of the internationalpatients who visit Singapore each year make the<strong>Parkway</strong> Group their top choice.AWARDS AND ACCOLADESExcellence in hospital management and servicequality has won <strong>Parkway</strong>’s premium hospitals awardsand accolades, locally and internationally.For outstanding service, Mount Elizabeth Hospitaland Gleneagles Hospital were bestowed with theSuperbrands Award in 2002/<strong>2003</strong> for scoring highlyin market dominance, goodwill, customer loyalty andoverall market acceptance. This prestigious awardhas enhanced the Hospitals’ brand value.In <strong>2003</strong>, Gleneagles Hospital won the AsianHospital Management Award in the Internal ServiceCategory. Competing against 103 internationalprojects from 25 well-established hospitals acrossseven countries, Gleneagles was a clear winner withits project “Going Beyond Service”.Business Review<strong>Parkway</strong> Holdings Limited <strong>Annual</strong> <strong>Report</strong> <strong>2003</strong>25

BUSINESS REVIEWSERVICE ENHANCEMENT<strong>Parkway</strong> ShentonIn the first quarter of <strong>2003</strong>, <strong>Parkway</strong> Shenton openedits flagship outpatient clinic at Republic Plaza.Strategically located in the Central BusinessDistrict, it is well-positioned to serve its expandingcorporate client business. The 10,000 sq ft one-stopcentre provides GP services, health screening,dental, aviation medicine as well as laboratory andradiology services.Forefront of Infection ControlIn the interest of patient safety, <strong>Parkway</strong>’s Hospitalstook proactive steps to protect patients andhealthcare professionals, and maintain its SARS-freestatus. Mount Elizabeth Hospital became the firsthospital in Singapore to install a thermal scanner.<strong>Parkway</strong> also became the first in Singapore to adoptcutting-edge bio-decontamination technology.We engaged UK-based biodecontamination experts,BIOQUELL, to deploy their Room Bio-DeactivationService at our hospitals, for greater assurance.SERVICE FROM THE HEARTOur group-wide Customer Service Standardsinitiative ensures service consistency at all levels. Allour personnel undergo our Customer Service andQuality Training programme and are motivated toprovide service from the heart.East Shore Hospital’s WOW philosophy, which standsfor “We aim to wow our patients with our winningways”, has led to higher customer satisfaction.Gleneagles Hospital’s Going Beyond Service withCARE programme inspires exceptional service,resulting in greater customer satisfaction andcustomer loyalty.Mount Elizabeth Hospital’s “We EXCEL” programmehas led to greater consciousness of service qualityamong personnel, leading to finer service towardspatients as well as internal customers.26 <strong>Parkway</strong> Holdings Limited <strong>Annual</strong> <strong>Report</strong> <strong>2003</strong>

BUSINESS REVIEWREGIONAL MEDICAL REFERRAL CENTRESTo uphold medical excellence, <strong>Parkway</strong> has set upMedical Referral Centres (MRC) as an integral aspectof the Group’s regional patient outreach network. MRCprovide international patients referrals to ourSingapore and International Hospitals.The MRC is a one-stop service designed to helppatients access the right channel of specialistexpertise, personalised patient care and cutting-edgetechnology available at all our hospitals.Access to quality treatment in comfort andprivacy in an exclusive environment,attended by caring, experienced medicaland surgical teams is the reason why morethan half of the international patients whovisit Singapore each year make the <strong>Parkway</strong>Group their top choice.The experienced teams of professionals manningthe MRCs connect patients to relevant medicalservices in real time. This free service is extended toanyone who seeks professional medical referrals andconsultation.In <strong>2003</strong>, six new MRCs were set up in Chennai,Delhi, Kolkata,Manado,Medan and Shanghai,bringing the total number of MRCs to 14. Ourpresence in these cities will further extend <strong>Parkway</strong>’sreach across Asia.Plans are underway to increase the number of MRCsto satisfy growing regional demand for the Group’stertiary and quaternary services.<strong>Parkway</strong> Holdings Limited <strong>Annual</strong> <strong>Report</strong> <strong>2003</strong>27

More than half of200,000 *internationalpatientsyearlyMaking substantial investment into expertise andtraining, the <strong>Parkway</strong> Group has created adynamic, stimulating environment in whichdoctors and nurses keep pace with internationalmedical advances to provide the best patient care.

INVESTMENT IN EXPERTISEOur healthcare professionals are our most valuable assets. <strong>Parkway</strong> is dedicated tosecuring top specialised expertise as well as engaging in people development to upholdhigh standards of professionalism in private healthcare provision.DEDICATION TO PEOPLE DEVELOPMENTIn an increasingly complex healthcare environmentwhere patients have become discerning and a widechoice of services are available, <strong>Parkway</strong> recognisesthat our doctors and nurses are challenged to go theextra mile in delivering service quality.<strong>Parkway</strong> is a people developer centre withcomprehensive training and incentive schemes,conducive to the development of disciplined,selfmotivatedhealthcare professionals. Our SingaporeHospitals have won the People Developer Standardfor their commitment to education and training.To meet nursing manpower needs, <strong>Parkway</strong> providesquality nursing education at the Gleneagles IntanCollege of Nursing. In 2004, under a joint-venturecompany formed by <strong>Parkway</strong>, Gleneagles Penangand Gleneagles Kuala Lumpur, the College will berenamed Gleneagles-<strong>Parkway</strong> College of Nursing.It will offer a nursing diploma course and specialtytraining courses for the Group’s personnel.For our medical professionals, the Group facilitatesongoing exchanges of expertise with renownedspecialists by tapping into our links with reputablehospitals.With this dynamic, stimulating environment at<strong>Parkway</strong>, world class doctors, specialists andsurgeons are attracted to set up at our MedicalCentres, and, in turn, contribute their expertise to ourHospitals and Healthcare Services.Business ReviewCentre for Minimally Invasive SurgeryA pioneer in recognising the increasing importanceof minimally invasive surgery (MIS), the Groupactively imparts knowledge of advancements in MISto medical professionals within and outside the Group.A highlight of the <strong>2003</strong> course series organised byGleneagles MIS Centre was New Approach to theRepair of Pelvic Floor Dysfunction, a live telesurgeryfor regional obstetricians, gynaecologists andurology specialists.<strong>Parkway</strong> Centre for Medical SimulationTo improve clinical quality and patient safety, theS$1 million hi-tech <strong>Parkway</strong> Centre for MedicalSimulation (PCMS) was launched. As the region’smost advanced interactive facility for medicalsimulation training, this initiative will enable <strong>Parkway</strong>to take the lead in the education and training ofhealthcare professionals by creating a dynamiclearning environment in the region.Simulation-based training combines technology withquality interactive courses. Medical conditions aresimulated by practising on patient simulators, METIand SimMan,which have realistic computergeneratedsensory feedback.With PCMS as a training resource for healthcareprofessionals in Asia, <strong>Parkway</strong> has set its sights onthe regional healthcare training market. The <strong>Parkway</strong>Group is continually primed to provide strongleadership in Asia’s healthcare industry.<strong>Parkway</strong> Holdings Limited <strong>Annual</strong> <strong>Report</strong> <strong>2003</strong>29

BOARD OF DIRECTORSMr Anil ThadaniChairmanMr Thadani is the Chairman of <strong>Parkway</strong> Holdings and chairs the Group’s Executive,Remuneration and Nominating Committees. Mr Thadani is the Founder andChairman of Schroder Capital Partners Limited, a private investment advisory firmadvising institutional funds focused on direct investment, development capital andbuy-outs in the Asia-Pacific.Mr Tony Tan Choon KeatDeputy ChairmanMr Tan was appointed Deputy Chairman of <strong>Parkway</strong> Holdings in 2002. He has helddirectorships in the Group since 1985 and he was Managing Director of <strong>Parkway</strong>Holdings until June 2000.Dr Lim Cheok PengManaging DirectorDr Lim is the Managing Director of <strong>Parkway</strong> Holdings and he sits on theExecutive Committee. Dr Lim has been steering the Group’s healthcare effortssince 1987. He is also a cardiologist by profession.Mr Tan Kai SengExecutive DirectorMr Tan is the Finance Director of <strong>Parkway</strong> Holdings and a member of theExecutive Committee and other committees. He has been with the Group since1980. He is a CPA and a Fellow Member of the Association of Chartered CertifiedAccountants, UK.Mr Alain Ahkong Chuen FahNon-executive DirectorMr Ahkong is Chairman of the Audit Committee of <strong>Parkway</strong> Holdings.Currently Director of Pioneer Management Services Pte Ltd, he also holdsdirectorships in several companies, including listed company, TwinwoodEngineering Ltd.30 <strong>Parkway</strong> Holdings Limited <strong>Annual</strong> <strong>Report</strong> <strong>2003</strong>

Mr Ang Guan SengNon-executive DirectorMr Ang has been a director of <strong>Parkway</strong> Holdings since 1985 and is a member ofvarious committees. He is also the Managing Director of Malaysia-listed PetalingGarden Berhad.Mr Sunil ChandiramaniNon-executive DirectorMr Chandiramani is a member of the Executive Committee and various othercommittees. Director and Partner of Schroder Capital Partners Limited, aninvestment advisory firm specialising in development capital and buy-outs,Mr Chandiramani also sits on the boards of several private and public-listedcompanies.Mr Chang See HiangNon-executive DirectorMr Chang sits on various committees of <strong>Parkway</strong> Holdings. An Advocate andSolicitor of the Supreme Court of Singapore, he is Senior Partner of his ownlaw firm, M/s Chang See Hiang and Partners. He holds directorships in threepublic-listed companies and is also the Honorary Secretary of the Singapore TurfClub.Mr Ho Kian GuanNon-executive DirectorMr Ho has been a director of <strong>Parkway</strong> Holdings since 1985. He is also theChairman of publicly-listed Keck Seng (Malaysia) Bhd whose principal activitiesinclude palm oil cultivation, the processing and refining of palm oil and real estatedevelopment.Dr Prathap C ReddyNon-executive DirectorDr Reddy is the Founder and Chairman of the India-based Apollo Hospitals Group.He has received several awards from the Indian Government and internationalagencies in recognition of his contributions to India’s healthcare services sector.Mr Ho Kian Hock(alternate director to Mr Ho Kian Guan)<strong>Parkway</strong> Holdings Limited <strong>Annual</strong> <strong>Report</strong> <strong>2003</strong>31

CORPORATE INFORMATIONBOARD OF DIRECTORSAnil ThadaniChairmanTony Tan Choon KeatDeputy ChairmanDr Lim Cheok PengManaging DirectorAlain Ahkong Chuen FahNon-executive DirectorAng Guan SengNon-executive DirectorSunil ChandiramaniNon-executive DirectorChang See HiangNon-executive DirectorHo Kian GuanNon-executive DirectorDr Prathap C ReddyNon-executive DirectorTan Kai SengExecutive DirectorHo Kian Hock(alternate directorto Mr Ho Kian Guan)EXECUTIVE COMMITTEEAnil ThadaniChairmanSunil ChandiramaniDr Lim Cheok PengTony Tan Choon KeatTan Kai SengAUDIT COMMITTEEAlain Ahkong Chuen FahChairmanAng Guan SengChang See HiangSHARE OPTION SCHEMECOMMITTEEAnil ThadaniAng Guan SengSunil ChandiramaniREMUNERATION COMMITTEEAnil ThadaniChairmanAng Guan SengSunil ChandiramaniNOMINATING COMMITTEEAnil ThadaniChairmanAlain Ahkong Chuen FahAng Guan SengChang See HiangTony Tan Choon KeatSHARE PURCHASECOMMITTEEAnil ThadaniChang See HiangTony Tan Choon KeatTan Kai SengREGISTERED OFFICE1 Grange Road #11-01Orchard BuildingSingapore 239693Tel : (65) 6796 0600www.parkwayholdings.comCOMPANY SECRETARYJune Tay Kwok FungSHARE REGISTRARM&C Services Private Limited138 Robinson Road #17-00The Corporate OfficeSingapore 068906Tel : (65) 6227 6660AUDITORSKPMGCertified Public Accountants SingaporePartner-In-Charge since the financialyear ended 31 December 1999:Chay Fook YuenPRINCIPAL BANKERSABN AMRO Bank N.V.BNP Paribas, Singapore BranchCitibank N.A, Singapore BranchCrédit Agricole IndosuezDBS Bank LtdThe Hongkong and Shanghai BankingCorporation LimitedOversea-Chinese Banking CorporationLimitedUnited Overseas Bank Limited32 <strong>Parkway</strong> Holdings Limited <strong>Annual</strong> <strong>Report</strong> <strong>2003</strong>

SENIOR MANAGEMENTDr Lim Cheok PengManaging Director(Refer to page 30 for profile)Mr Tan Kai SengExecutive Director(Refer to page 30 for profile)Vivek JetleySenior Vice President/Head, International Business DevelopmentVivek Jetley, 46, joined <strong>Parkway</strong> on 16 January 2004.Prior to joining <strong>Parkway</strong>, Mr Jetley was the Managing Director of Max India Ltd from 1989 to <strong>2003</strong>.Mr Jetley holds a Master in Business Management from Banaras Hindu University and is a Fellow Memberof the Institute of Cost and Works Accountants of India and a Licenciate Member of the Institute of CompanySecretaries of India.Molly Foo Moh LeeChief Financial OfficerMolly Foo, 44, was appointed as Chief Financial Officer on 1 April <strong>2003</strong>.Ms Foo started with Mount Elizabeth Hospital in August 1993 and was the General Manager, Finance.Prior to this, Ms Foo was the Financial Controller for Mount Alvernia Hospital from 1990 to 1993.Ms Foo graduated with a Bachelor in Accountancy from the National University of Singapore.Dr Timothy LowGeneral Manager, Gleneagles HospitalDr Timothy Low, 41, joined <strong>Parkway</strong> as General Manager of Gleneagles Hospital on 1 August 2000 andis responsible for the general management and operations of the Hospital.Prior to joining <strong>Parkway</strong>, Dr Low was the Senior Regional Director of Covance (ASIA) Pte Ltd from 1995 to 2000and Regional Medical Advisor with Glaxo Wellcome Singapore Pte Ltd from 1993 to 1995. Dr Low graduatedwith a MBBS from the National University of Singapore.Dr Ronnie TanGeneral Manager, East Shore HospitalDr Ronnie Tan, 49, was appointed as General Manager of East Shore Hospital on 5 August 2002 and isresponsible for the general management and operations of the Hospital.Prior to joining <strong>Parkway</strong>, Dr Tan was the President & Director of Healthwho.com Pte Ltd from 2000 andChief Executive Officer & Director of AsiaMedic Ltd from 1998 to 2000. Dr Tan graduated with a MBBS from theUniversity of Melbourne and holds a Master of Health Administration from Loma Linda University.<strong>Parkway</strong> Holdings Limited <strong>Annual</strong> <strong>Report</strong> <strong>2003</strong>33

SENIOR MANAGEMENTNellie TangGeneral Manager, Mount Elizabeth HospitalNellie Tang, 59, was appointed as General Manager of Mount Elizabeth Hospital on 1 July 1998 andis responsible for the general management and operations of the Hospital.Mrs Tang started with Mount Elizabeth Hospital in May 1981 and was Director of Nursing prior to herappointment as General Manager, Patient Care Services in 1998. Mrs Tang holds a Master of Science inHealthcare Management from the University of Wales, UK.Dr Goh Jin HianExecutive Director, <strong>Parkway</strong> Shenton Pte LtdDr Goh Jin Hian, 35, was appointed as Executive Director of <strong>Parkway</strong> Shenton on 1 April 1999. Dr Goh isresponsible for the general management of all the primary care services under <strong>Parkway</strong> Shenton whichincludes, Shenton Family Clinics, Executive Health Screeners, Nippon Medical Care and Maritime Medical.Prior to joining <strong>Parkway</strong>, Dr Goh was with the Ministry of Health. Dr Goh graduated with a MBBS from theNational University of Singapore.Lim Poh SuanGeneral Manager, Medi-Rad Associates LtdLim Poh Suan, 51, was appointed as General Manager of Medi-Rad on 1 March 2002, and is responsible for thegeneral management and operations of the Group’s radiology services.Ms Lim started with Mount Elizabeth Hospital in July 1984 and was Head of Radiology with the Hospital prior toher appointment with Medi-Rad. Ms Lim graduated with a Bachelor of Science in Economics from the Universityof London and holds a Diploma of the College of Radiographers.George PusavatGeneral Manager, <strong>Parkway</strong> Laboratory Services LtdGeorge Pusavat, 51, was appointed as General Manager of <strong>Parkway</strong> Laboratory Services on 1 July 1997 andis responsible for the general management and operations of the Group’s laboratory services.Prior to joining <strong>Parkway</strong> Laboratory, Mr Pusavat was the Systems/Project Manager for the San JoaquinCommunity Hospital from 1992 to 1994 and Laboratory System Manager with Kern Medical Centre, USA from1989 to 1991. Mr Pusavat graduated with a Bachelor of Science in Medical Technology from California StateUniversity Bakersfield and holds a Master of Business Administration from the University of SouthernCalifornia.34 <strong>Parkway</strong> Holdings Limited <strong>Annual</strong> <strong>Report</strong> <strong>2003</strong>

CORPORATE OFFICEPARKWAY HOLDINGS LIMITED1 Grange Road, #11-01 Orchard BuildingSingapore 239693Tel: (65) 6796 0600Fax: (65) 6796 0634www.parkwayholdings.comHOSPITALSEAST SHORE HOSPITAL321 Joo Chiat Place, Singapore 427990Tel: (65) 6344 7588 Fax: (65) 6345 4966www.eastshore.com.sgGLENEAGLES HOSPITAL6A Napier Road, Singapore 258500Tel: (65) 6473 7222 Fax: (65) 6472 5816www.gleneagles.com.sgMOUNT ELIZABETH HOSPITAL3 Mount Elizabeth, Singapore 228510Tel: (65) 6737 2666 Fax: (65) 6737 1189www.mountelizabeth.com.sgGLENEAGLES INTAN MEDICAL CENTRE,KUALA LUMPUR282 & 286 Jln Ampang, 50450 Kuala LumpurTel: (60-3) 4257 1300 Fax: (60-3) 4257 9233www.gimc.com.myGLENEAGLES MEDICAL CENTRE, PENANG1 Jln Pangkor, 10050 Penang, MalaysiaTel: (60-4) 227 6111 Fax: (60-4) 226 2994www.gleneagles-penang.comAPOLLO GLENEAGLES HOSPITAL, KOLKATA58 Canal Circular Road, Kolkata 700 054,India, West BengalTel: (91-33) 2358 5217 Fax: (91-33) 2358 5198www.apollogleneagles.comGLENEAGLES JPMC, BRUNEIJerudong Park, BG 3122Brunei DarussalamTel: (673-2) 261 1883 Fax: Tel: (673-2) 261 1886KEY HEALTHCARE SERVICESGLENEAGLES CLINICAL RESEARCH CENTRE *6A Napier Road, Singapore 258500Tel: (65) 6470 5726 Fax: (65) 6471 3642www.gleneaglescrc.comPARKWAY LABORATORY SERVICES*28 Ayer Rajah Crescent #03-08Singapore 139959Tel: (65) 6248 5829 Fax: (65) 6248 5878www.parkwaylab.com.sgMEDI-RAD ASSOCIATES *3 Mount Elizabeth,Mount Elizabeth Medical Centre #01-01/02/06Singapore 228510Tel: (65) 6736 3538 Fax: (65) 6732 7776www.medirad.com.sgPARKWAY SHENTON*Cyberhub Building20 Bendemeer Road #03-11/14Singapore 339914Tel: (65) 6227 7777 Fax: (65) 6225 3735www.parkwayshenton.comMEDICAL REFERRAL CENTRES (MRCs)SINGAPORETel: (65) 6735 5000 (24-hour hotline)Fax: (65) 6732 6733www.imrc.com.sgBANGLADESHDhakaBRUNEI DARUSSALAMCHINAShanghaiHONG KONGINDIAChennaiKolkataNew DelhiINDONESIABalikpapanJakartaMedanManadoPalembangSurabayaMYANMARYangonRUSSIAVladivostokSRI LANKAColomboVIETNAMHanoi* Corporate officeCONCEPT, DESIGN & PRODUCTION BY GK CONSULTANCY PRIVATE LIMITED

B/C 1PARKWAY HOLDINGS LIMITED1 Grange Road#11-01 Orchard BuildingSingapore 239693Tel: (65) 6796 0600www.parkwayholdings.com

FINANCIALS <strong>2003</strong>Directors’ <strong>Report</strong> 36Statement by Directors 43<strong>Report</strong> of the Auditors 44Balance Sheets 45Consolidated Profit and Loss Account 46Consolidated Statement of Changes in Equity 47Statement of Changes in Equity 48Consolidated Statement of Cash Flows 49Notes to the Financial Statements 51Supplementary Information -SGX-ST Listing Manual Requirements 100Analysis of Shareholdings 115Notice of <strong>Annual</strong> General Meeting 116Proxy Form 119

DIRECTORS’ REPORTYear ended 31 December <strong>2003</strong>We are pleased to submit this annual report to the members of the Company together with the audited financial statementsfor the financial year ended 31 December <strong>2003</strong>.DirectorsThe directors in office at the date of this report are as follows:Anil ThadaniTony Tan Choon KeatDr Lim Cheok PengAlain Ahkong Chuen FahAng Guan SengSunil ChandiramaniChang See HiangHo Kian GuanDr Prathap C ReddyTan Kai SengHo Kian Hock(Chairman)(Deputy Chairman)(Managing Director)(alternate to Ho Kian Guan)Directors’ InterestsAccording to the register kept by the Company for the purposes of Section 164 of the Companies Act, Chapter 50(the “Act”), particulars of interests of directors who held office at the end of the financial year (including those held by theirspouses and infant children) in shares, debentures, warrants and share options in the Company and in related corporations(other than wholly-owned subsidiaries) are as follows:Holdings in the nameof the director,spouse or infant childrenOther holdings in whichthe director is deemedto have an interestAt beginningof the yearAt endof the yearAt beginningof the yearAt endof the yearThe CompanyOrdinary Shares of S$0.25 each fully paidAnil ThadaniTony Tan Choon KeatDr Lim Cheok PengSunil ChandiramaniTan Kai SengHo Kian Guan1,200,00014,426,776202,00050,0001,100,000500,0001,200,00014,426,776202,00050,0001,100,000500,000-19,953,764-----20,073,764----<strong>Parkway</strong> Employee Share Option SchemeOptions to subscribe for Ordinary Shares of S$0.25 each(exercise price at S$1.33 per share and exercisablebetween 20/4/1999 and 19/2/<strong>2003</strong>)Dr Lim Cheok Peng150,000 - - -36<strong>Parkway</strong> Holdings Limited <strong>Annual</strong> <strong>Report</strong> <strong>2003</strong>

Directors’ Interests (Cont’d)Holdings in the nameof the director,spouse or infant childrenOther holdings in whichthe director is deemedto have an interestAt beginningof the yearAt endof the yearAt beginningof the yearAt endof the year<strong>Parkway</strong> Share Option Scheme 2001The Company (Cont’d)Options to subscribe for Ordinary Shares of S$0.25 each(exercise price at S$0.865 per share and exercisablebetween 10/4/2002 and 9/4/2006)Dr Lim Cheok PengTan Kai Seng500,000250,000500,000250,000----Options to subscribe for Ordinary Shares of S$0.25 each(exercise price at S$0.94 per share and exercisablebetween 20/9/2002 and 19/9/2006)Anil ThadaniTony Tan Choon KeatAlain Ahkong Chuen FahAng Guan SengChang See HiangHo Kian GuanDr Prathap C ReddySunil ChandiramaniHo Kian Hock240,000100,000150,000150,000100,000100,000100,000200,000100,000240,000100,000150,000150,000100,000100,000100,000200,000100,000------------------Options to subscribe for Ordinary Shares of S$0.25 each(exercise price at S$0.835 per share and exercisablebetween 20/4/<strong>2003</strong> and 19/4/2007)Anil ThadaniTony Tan Choon KeatDr Lim Cheok PengAlain Ahkong Chuen FahAng Guan SengChang See HiangHo Kian GuanDr Prathap C ReddySunil ChandiramaniTan Kai Seng240,000200,000500,000150,000150,000100,000100,000100,000200,000250,000240,000200,000500,000150,000150,000100,000100,000100,000200,000250,000--------------------SubsidiaryPulau Pinang Clinic Sdn. Bhd.Ordinary Shares of RM1.00 each fully paidTony Tan Choon Keat - - 394,352 394,352Except as disclosed in this report, no director who held office at the end of the financial year had interests in shares,debentures, warrants or share options of the Company or of related corporations either at the beginning or at the end of thefinancial year.<strong>Parkway</strong> Holdings Limited <strong>Annual</strong> <strong>Report</strong> <strong>2003</strong> 37

DIRECTORS’ REPORTYear ended 31 December <strong>2003</strong>Directors’ Interests (Cont’d)Except as disclosed in this report, there were no changes in any of the above-mentioned interests in the Company betweenthe end of the financial year and 21 January 2004.Except as disclosed under the “Share Options” section of this report, neither at the end of nor at any time during the financialyear was the Company a party to any arrangement whose objects are, or one of whose objects is, to enable the directors ofthe Company to acquire benefits by means of the acquisition of shares in or debentures of the Company or any other bodycorporate.During the year, certain transactions were made between the Company and/or its subsidiaries and its directors, or thesubsidiaries’ directors or a firm in which one of the directors is deemed to have a substantial financial interest or companiesin which the directors of the Company or its subsidiaries have substantial financial interest in the ordinary course of business.However, these directors have neither received nor will they become entitled to receive any benefit from these transactionsother than as suppliers, directors and members of these firms/companies.Except as disclosed in this report and in note 31 to the financial statements, since the end of the last financial year, nodirector has received or become entitled to receive a benefit by reason of a contract made by the Company or a relatedcorporation with the director or with a firm of which he is a member or with a company in which he has a substantial financialinterest.Share Options<strong>Parkway</strong> Employee Share Option Scheme (“<strong>Parkway</strong> Scheme”)Details of the <strong>Parkway</strong> Scheme were set out in the Directors’ <strong>Report</strong> for the year ended 31 December 1988, and amendmentswere effected by a resolution passed at the Extraordinary General Meeting of the Company held on 22 August 1994 andwhich were set out in the Directors’ <strong>Report</strong> for the year ended 31 December 1994.At the Extraordinary General Meeting held on 18 January 2001, the shareholders of the Company approved the terminationof the <strong>Parkway</strong> Scheme. Existing options granted under the <strong>Parkway</strong> Scheme but not exercised will not be prejudiced as therules of the scheme state that the termination of the <strong>Parkway</strong> Scheme shall not affect options which have been grantedunder the scheme, whether such options have been exercised (fully or partially) or not.Other statutory information regarding the <strong>Parkway</strong> Scheme is set out below:(i)(ii)(iii)The exercise price of the option is determined at the average of the middle market quotation computed from thehighest and lowest transacted prices of the Company’s shares on the Singapore Exchange Securities TradingLimited (“SGX-ST”) prevailing on the five business days immediately preceding the date of grant of such options.The options vest one year after the grant date.The options granted expire after 46 months from the vesting date unless they have been cancelled or have lapsedprior to that date.At the end of the financial year, details of the options granted under the <strong>Parkway</strong> Scheme on the unissued ordinary sharesof S$0.25 each of the Company are as follows:Date ofgrant ofoptionsExercisepriceper shareOptionsoutstandingat1 Jan <strong>2003</strong>OptionsgrantedOptionsexercisedOptionslapsedOptionsoutstandingat31 Dec <strong>2003</strong>Number ofoptionholders at31 Dec <strong>2003</strong>Exerciseperiod20/4/1998 S$1.33 940,000--(940,000)--20/4/1999 to19/2/<strong>2003</strong>940,000--(940,000)-38<strong>Parkway</strong> Holdings Limited <strong>Annual</strong> <strong>Report</strong> <strong>2003</strong>

Share Options (Cont’d)<strong>Parkway</strong> Employee Share Option Scheme (“<strong>Parkway</strong> Scheme”) (Cont’d)Details of options granted to directors of the Company under the scheme are as follows:Name of directorOptions grantedfor financialyear ended31 Dec <strong>2003</strong>Aggregateoptions grantedsincecommencementof scheme to31 Dec <strong>2003</strong>Aggregateoptions exercisedsincecommencementof scheme to31 Dec <strong>2003</strong>Aggregateoptions lapsedsincecommencementof scheme to31 Dec <strong>2003</strong>Aggregateoptionsoutstanding asat 31 Dec <strong>2003</strong>Dr Lim Cheok PengTan Kai Seng--300,000600,000-(400,000)(300,000)(200,000)--In view that the <strong>Parkway</strong> Scheme was terminated in 2001, no options have been granted during the year. The last batch ofunexercised options under the <strong>Parkway</strong> Scheme has lapsed during the financial year.<strong>Parkway</strong> Share Option Scheme 2001 (“<strong>Parkway</strong> Scheme 2001”)The <strong>Parkway</strong> Scheme 2001 was approved by the shareholders of the Company at an Extraordinary General Meeting heldon 18 January 2001. Details of the <strong>Parkway</strong> Scheme 2001 and amendments effected by a resolution passed at theExtraordinary General Meeting of the Company held on 4 July 2001 were set out in the Directors’ <strong>Report</strong> for the years ended31 December 2001 and 31 December 2002. The <strong>Parkway</strong> Scheme 2001 is administered by the Company’s Share OptionScheme Committee, comprising 3 directors, Anil Thadani, Ang Guan Seng and Sunil Chandiramani.Other statutory information regarding the <strong>Parkway</strong> Scheme 2001 is set out below:(i)(ii)The exercise price of the option is determined at the average of the last dealt price of the Company’s shares on theSGX-ST prevailing on the three consecutive trading days immediately preceding the date of grant of such options.The options vest one year after the grant date in accordance with the vesting schedule set out below:Vesting ScheduleOn or before the first anniversary of the grant dateAfter the first anniversary, and on or before the secondanniversary of the grant dateAfter the second anniversary, and on or before the thirdanniversary of the grant dateAfter the third anniversary, and on or before the fourthanniversary of the grant dateAfter the fourth anniversary, and on or before the fifthanniversary of the grant datePercentage of shares over which theoptions are exercisableNil25%50%75%100%(iii)The options granted expire on the fifth anniversary of the grant date unless they have been cancelled or have lapsedprior to that date.<strong>Parkway</strong> Holdings Limited <strong>Annual</strong> <strong>Report</strong> <strong>2003</strong> 39

DIRECTORS’ REPORTYear ended 31 December <strong>2003</strong>Share Options (Cont’d)<strong>Parkway</strong> Share Option Scheme 2001 (“<strong>Parkway</strong> Scheme 2001”) (Cont’d)At the end of the financial year, details of the options granted under the <strong>Parkway</strong> Scheme 2001 on the unissued ordinaryshares of S$0.25 each of the Company are as follows:Date ofgrant ofoptionsExercisepriceper shareOptionsoutstandingat1 Jan <strong>2003</strong>OptionsgrantedOptionsexercisedOptionscancelledOptionsoutstandingat31 Dec <strong>2003</strong>Number ofoptionholders at31 Dec <strong>2003</strong>Exerciseperiod9/4/20018/5/200119/9/200119/4/2002S$0.865S$0.993S$0.940S$0.8353,195,000400,0001,240,0007,005,000----(15,000)--(4,500)(110,000)--(290,000)3,070,000400,0001,240,0006,710,500592922110/4/2002 to9/4/20069/5/2002 to8/5/200620/9/2002 to19/9/200620/4/<strong>2003</strong> to19/4/200711,840,000-(19,500)(400,000)11,420,500Except as disclosed above, there were no unissued shares of the Company or its subsidiaries under options granted by theCompany or its subsidiaries as at the end of the financial year.Details of options granted to directors of the Company under the <strong>Parkway</strong> Scheme 2001 are as follows:Name of directorOptions grantedfor financialyear ended31 Dec <strong>2003</strong>Aggregateoptions grantedsincecommencementof scheme to31 Dec <strong>2003</strong>Aggregateoptions exercisedsincecommencementof scheme to31 Dec <strong>2003</strong>Aggregateoptions lapsedsincecommencementof scheme to31 Dec <strong>2003</strong>Aggregateoptionsoutstandingas at31 Dec <strong>2003</strong>Anil ThadaniTony Tan Choon KeatDr Lim Cheok PengAlain Ahkong Chuen FahAng Guan SengChang See HiangHo Kian GuanDr Prathap C ReddySunil ChandiramaniTan Kai SengHo Kian Hock-----------480,000300,0001,000,000300,000300,000200,000200,000200,000400,000500,000100,000----------------------480,000300,0001,000,000300,000300,000200,000200,000200,000400,000500,000100,000Since the commencement of the scheme, no options have been granted to the controlling shareholders of the Company ortheir associates.Except as disclosed above, no participant under the scheme has been granted 5% or more of the total options availableunder the scheme.40<strong>Parkway</strong> Holdings Limited <strong>Annual</strong> <strong>Report</strong> <strong>2003</strong>