full_annual_report_2014

full_annual_report_2014

full_annual_report_2014

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Overview<br />

Strategy<br />

review Performance Governance Financials<br />

Additional<br />

information<br />

113<br />

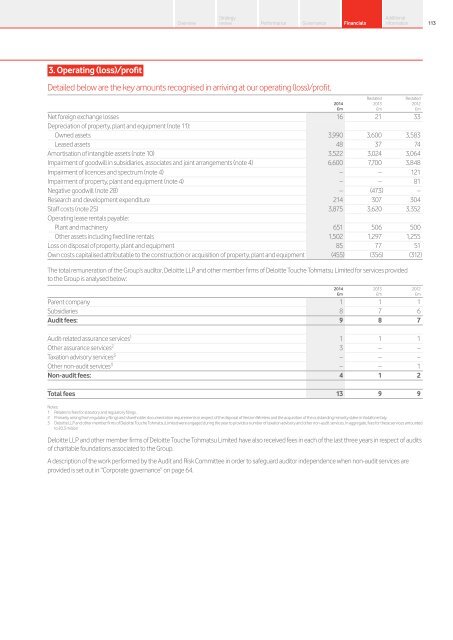

3. Operating (loss)/profit<br />

Detailed below are the key amounts recognised in arriving at our operating (loss)/profit.<br />

£m £m £m<br />

Net foreign exchange losses 16 21 33<br />

Depreciation of property, plant and equipment (note 11):<br />

Owned assets 3,990 3,600 3,583<br />

Leased assets 48 37 74<br />

Amortisation of intangible assets (note 10) 3,522 3,024 3,064<br />

Impairment of goodwill in subsidiaries, associates and joint arrangements (note 4) 6,600 7,700 3,848<br />

Impairment of licences and spectrum (note 4) – – 121<br />

Impairment of property, plant and equipment (note 4) – – 81<br />

Negative goodwill (note 28) – (473) –<br />

Research and development expenditure 214 307 304<br />

Staff costs (note 25) 3,875 3,620 3,352<br />

Operating lease rentals payable:<br />

Plant and machinery 651 506 500<br />

Other assets including fixed line rentals 1,502 1,297 1,255<br />

Loss on disposal of property, plant and equipment 85 77 51<br />

Own costs capitalised attributable to the construction or acquisition of property, plant and equipment (455) (356) (312)<br />

<strong>2014</strong><br />

Restated<br />

2013<br />

The total remuneration of the Group’s auditor, Deloitte LLP and other member firms of Deloitte Touche Tohmatsu Limited for services provided<br />

to the Group is analysed below:<br />

<strong>2014</strong> 2013 2012<br />

£m £m £m<br />

Parent company 1 1 1<br />

Subsidiaries 8 7 6<br />

Audit fees: 9 8 7<br />

Audit-related assurance services 1 1 1 1<br />

Other assurance services 2 3 – –<br />

Taxation advisory services 3 – – –<br />

Other non-audit services 3 – – 1<br />

Non-audit fees: 4 1 2<br />

Total fees 13 9 9<br />

Notes:<br />

1 Relates to fees for statutory and regulatory filings.<br />

2 Primarily arising from regulatory filings and shareholder documentation requirements in respect of the disposal of Verizon Wireless and the acquisition of the outstanding minority stake in Vodafone Italy.<br />

3 Deloitte LLP and other member firms of Deloitte Touche Tohmatsu Limited were engaged during the year to provide a number of taxation advisory and other non-audit services. In aggregate, fees for these services amounted<br />

to £0.3 million<br />

Deloitte LLP and other member firms of Deloitte Touche Tohmatsu Limited have also received fees in each of the last three years in respect of audits<br />

of charitable foundations associated to the Group.<br />

A description of the work performed by the Audit and Risk Committee in order to safeguard auditor independence when non-audit services are<br />

provided is set out in “Corporate governance” on page 64.<br />

Restated<br />

2012