full_annual_report_2014

full_annual_report_2014

full_annual_report_2014

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Overview<br />

Strategy<br />

review Performance Governance Financials<br />

Additional<br />

information<br />

181<br />

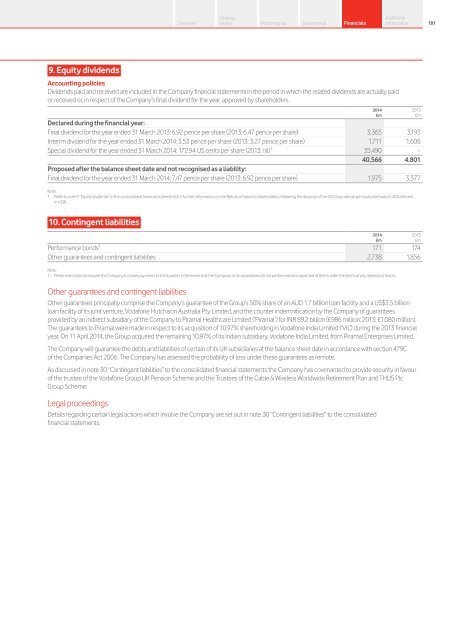

9. Equity dividends<br />

Accounting policies<br />

Dividends paid and received are included in the Company financial statements in the period in which the related dividends are actually paid<br />

or received or, in respect of the Company’s final dividend for the year, approved by shareholders.<br />

<strong>2014</strong> 2013<br />

£m £m<br />

Declared during the financial year:<br />

Final dividend for the year ended 31 March 2013: 6.92 pence per share (2013: 6.47 pence per share) 3,365 3,193<br />

Interim dividend for the year ended 31 March <strong>2014</strong>: 3.53 pence per share (2013: 3.27 pence per share) 1,711 1,608<br />

Special dividend for the year ended 31 March <strong>2014</strong>: 172.94 US cents per share (2013: nil) 1 35,490 –<br />

40,566 4,801<br />

Proposed after the balance sheet date and not recognised as a liability:<br />

Final dividend for the year ended 31 March <strong>2014</strong>: 7.47 pence per share (2013: 6.92 pence per share) 1,975 3,377<br />

Note:<br />

1 Refer to note 9 “Equity dividends” in the consolidated financial statements for further information on the Return of Value to shareholders, following the disposal of the US Group whose principal asset was its 45% interest<br />

in VZW.<br />

10. Contingent liabilities<br />

<strong>2014</strong> 2013<br />

£m £m<br />

Performance bonds 1 171 174<br />

Other guarantees and contingent liabilities 2,738 1,856<br />

Note:<br />

1 Performance bonds require the Company to make payments to third parties in the event that the Company or its subsidiaries do not perform what is expected of them under the terms of any related contracts.<br />

Other guarantees and contingent liabilities<br />

Other guarantees principally comprise the Company’s guarantee of the Group’s 50% share of an AUD 1.7 billion loan facility and a US$3.5 billion<br />

loan facility of its joint venture, Vodafone Hutchison Australia Pty Limited, and the counter indemnification by the Company of guarantees<br />

provided by an indirect subsidiary of the Company to Piramal Healthcare Limited (‘Piramal’) for INR 89.2 billion (£986 million; 2013: £1,080 million).<br />

The guarantees to Piramal were made in respect to its acquisition of 10.97% shareholding in Vodafone India Limited (‘VIL’) during the 2013 financial<br />

year. On 11 April <strong>2014</strong>, the Group acquired the remaining 10.97% of its Indian subsidiary, Vodafone India Limited, from Piramal Enterprises Limited.<br />

The Company will guarantee the debts and liabilities of certain of its UK subsidiaries at the balance sheet date in accordance with section 479C<br />

of the Companies Act 2006. The Company has assessed the probability of loss under these guarantees as remote.<br />

As discussed in note 30 “Contingent liabilities” to the consolidated financial statements the Company has covenanted to provide security in favour<br />

of the trustee of the Vodafone Group UK Pension Scheme and the Trustees of the Cable & Wireless Worldwide Retirement Plan and THUS Plc<br />

Group Scheme.<br />

Legal proceedings<br />

Details regarding certain legal actions which involve the Company are set out in note 30 “Contingent liabilities” to the consolidated<br />

financial statements.