STOCK TO STUDY: T. Rowe Price Group, Inc ... - BetterInvesting

STOCK TO STUDY: T. Rowe Price Group, Inc ... - BetterInvesting

STOCK TO STUDY: T. Rowe Price Group, Inc ... - BetterInvesting

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

The basic question everyone facing retirement asks is: How<br />

much can I withdraw safely and not run out of money before I<br />

die? Of course, this question would be a lot easier to answer if<br />

we knew how long we were going to live and how much our living<br />

costs would be.<br />

Thirty years ago, when retirement planning was in<br />

its infancy, financial planners would just assume<br />

that your assets would grow at 8 percent indef -<br />

initely and that if you were withdrawing 5 percent, you’d<br />

be OK. But as we’ve seen over the years, most dramatically<br />

in the 2008 to 2009 market, making projections like this<br />

is unrealistic. What if you had retired in fall 2008 relying on<br />

these simplistic projections? You’d have had a rude awakening<br />

as your principal declined.<br />

Various approaches have been developed to better<br />

simulate real life. The most common approach used today<br />

is one using a fixed rate of return, a constant level of ex -<br />

penses only changing with inflation and a constant inflation<br />

rate. This is often referred to as “deterministic” and<br />

doesn’t take any changes into account for the variables of<br />

returns, expenses and inflation.<br />

This more simple projection doesn’t address the pos -<br />

sible varia bility in any of the assumptions. Also, be aware<br />

that the longer-term financial projections are the more<br />

likely errors will be present. This is why financial plans<br />

need to be updated regularly.<br />

$10,000,000<br />

Financial Planner | PERSONAL FINANCE<br />

Will Your Money Last as Long as You Do?<br />

Projecting Retirement <strong>Inc</strong>ome<br />

by Alexandra Armstrong, CFP, and Kelly Wright, CFP<br />

Withdrawal Rate of Assets<br />

Another tool used is examining forecasted withdrawal rates<br />

of assets. Cash flow is the most critical financial measurement<br />

since you need sufficient cash flow to meet ongoing<br />

expenses. Often in retirement, cash flow from earnings<br />

must be replaced with cash flow from other sources.<br />

These other sources for cash flow may include pensions<br />

and Social Security income. Usually these sources of re tire -<br />

ment income are insufficient to meet expenses, so in come<br />

from investments must also be used to meet ongoing<br />

expenses.<br />

The income from investments is often not just dividend<br />

and interest income, but gradual withdrawals from prin -<br />

cipal as well. The dollar amount needed to be re moved<br />

from invested assets divided by the original principal<br />

amount is the withdrawal rate.<br />

Many studies suggest a withdrawal rate of 4 percent<br />

will allow a portfolio to survive intact even with the ups<br />

and downs of the market. Other studies suggest the em pir -<br />

ical safe zone is in the 4 percent to 6 percent withdrawal<br />

range.<br />

If a financial projection shows you need to withdraw<br />

6 percent or more, a prudent financial planner will rec om -<br />

mend you reduce your expenses, often easier said than<br />

done, so that the assets will not be depleted too quickly.<br />

We find that the biggest expense in later years is health<br />

care costs. This added to the fact that many people are<br />

living longer than they ever have makes retirement planning<br />

more difficult.<br />

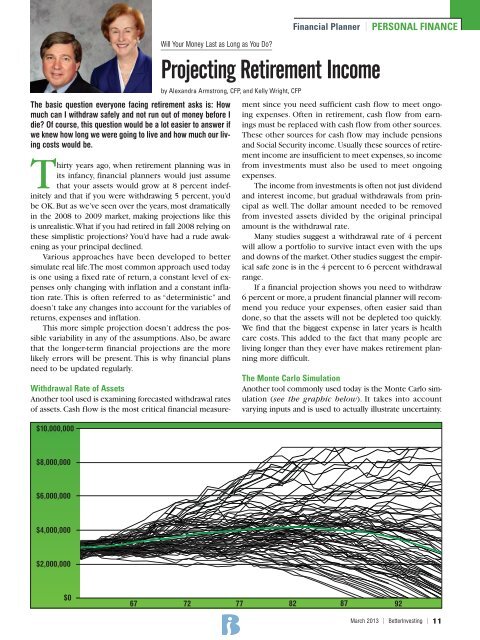

The Monte Carlo Simulation<br />

Another tool commonly used today is the Monte Carlo sim -<br />

u lation (see the graphic below). It takes into account<br />

varying inputs and is used to actually illustrate uncertainty.<br />

$8,000,000<br />

$6,000,000<br />

$4,000,000<br />

$2,000,000<br />

$0<br />

67 72 77 82 87 92<br />

March 2013 | <strong>BetterInvesting</strong> | 11