STOCK TO STUDY: T. Rowe Price Group, Inc ... - BetterInvesting

STOCK TO STUDY: T. Rowe Price Group, Inc ... - BetterInvesting

STOCK TO STUDY: T. Rowe Price Group, Inc ... - BetterInvesting

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

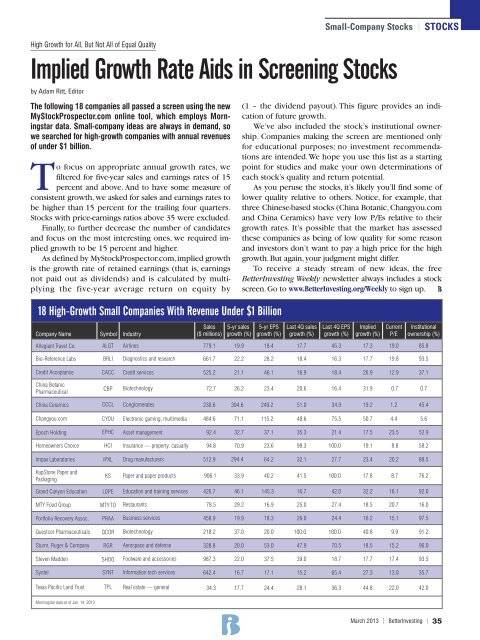

The following 18 companies all passed a screen using the new<br />

MyStockProspector.com online tool, which employs Morn -<br />

ingstar data. Small-company ideas are always in demand, so<br />

we searched for high-growth companies with annual revenues<br />

of under $1 billion.<br />

To focus on appropriate annual growth rates, we<br />

filtered for five-year sales and earnings rates of 15<br />

percent and above. And to have some measure of<br />

consistent growth, we asked for sales and earnings rates to<br />

be higher than 15 percent for the trailing four quarters.<br />

Stocks with price-earnings ratios above 35 were excluded.<br />

Finally, to further decrease the number of candidates<br />

and focus on the most interesting ones, we required im -<br />

plied growth to be 15 percent and higher.<br />

As defined by MyStockPros pector.com, implied growth<br />

is the growth rate of retained earnings (that is, earnings<br />

not paid out as dividends) and is calculated by mul ti -<br />

plying the five-year average return on equity by<br />

Small-Company Stocks | <strong>S<strong>TO</strong>CK</strong>S<br />

High Growth for All, But Not All of Equal Quality<br />

Implied Growth Rate Aids in Screening Stocks<br />

by Adam Ritt, Editor<br />

18 High-Growth Small Companies With Revenue Under $1 Billion<br />

(1 – the dividend payout). This figure provides an indi -<br />

cation of future growth.<br />

We’ve also included the stock’s institutional ownership.<br />

Companies making the screen are mentioned only<br />

for educational purposes; no investment recommendations<br />

are intended. We hope you use this list as a starting<br />

point for studies and make your own determinations of<br />

each stock’s quality and return potential.<br />

As you peruse the stocks, it’s likely you’ll find some of<br />

lower quality relative to others. Notice, for example, that<br />

three Chinese-based stocks (China Botanic, Changyou.com<br />

and China Ceramics) have very low P/Es relative to their<br />

growth rates. It’s possible that the market has assessed<br />

these com panies as being of low quality for some reason<br />

and investors don’t want to pay a high price for the high<br />

growth. But again, your judgment might differ.<br />

To receive a steady stream of new ideas, the free<br />

<strong>BetterInvesting</strong> Weekly newsletter always includes a stock<br />

screen. Go to www.<strong>BetterInvesting</strong>.org/Weekly to sign up.<br />

Company Name<br />

Symbol<br />

Industry<br />

Sales<br />

($ millions)<br />

5-yr sales<br />

growth (%)<br />

5-yr EPS<br />

growth (%)<br />

Last 4Q sales<br />

growth (%)<br />

Last 4Q EPS<br />

growth (%)<br />

Implied<br />

growth (%)<br />

Current<br />

P/E<br />

Institutional<br />

ownership (%)<br />

Allegiant Travel Co. ALGT Airlines 779.1<br />

19.9<br />

18.4<br />

17.7<br />

45.3<br />

17.3<br />

19.0<br />

85.8<br />

Bio-Reference Labs<br />

BRLI<br />

Diagnostics and research<br />

661.7<br />

22.2<br />

28.2<br />

18.4<br />

16.3<br />

17.7<br />

19.8<br />

93.5<br />

Credit Acceptance<br />

CACC<br />

Credit services<br />

525.2<br />

21.1<br />

46.1<br />

16.9<br />

18.4<br />

26.9<br />

12.9<br />

37.1<br />

China Botanic<br />

Pharmaceutical<br />

CBP<br />

Biotechnology<br />

72.7<br />

26.2<br />

23.4<br />

20.6<br />

16.4<br />

31.9<br />

0.7<br />

0.7<br />

China Ceramics<br />

CCCL<br />

Conglomerates<br />

230.6<br />

394.6<br />

249.2<br />

51.0<br />

34.9<br />

19.2<br />

1.2<br />

45.4<br />

Changyou.com<br />

CYOU<br />

Electronic gaming, multimedia<br />

484.6<br />

71.1<br />

115.2<br />

48.6<br />

75.5<br />

50.7<br />

4.4<br />

5.6<br />

Epoch Holding<br />

EPHC<br />

Asset management<br />

92.4<br />

32.7<br />

37.1<br />

35.3<br />

21.4<br />

17.5<br />

23.5<br />

52.9<br />

Homeowners Choice<br />

HCI<br />

Insurance — property, casualty<br />

94.8<br />

70.9<br />

23.6<br />

98.3<br />

100.0<br />

19.1<br />

8.8<br />

58.2<br />

Impax Laboratories<br />

IPXL<br />

Drug manufacturers<br />

512.9<br />

294.4<br />

64.2<br />

32.1<br />

27.7<br />

23.4<br />

20.2<br />

88.5<br />

KapStone Paper and<br />

Packaging<br />

KS<br />

Paper and paper products<br />

906.1<br />

33.9<br />

40.2<br />

41.5<br />

100.0<br />

17.8<br />

8.7<br />

76.2<br />

Grand Canyon Education<br />

LOPE<br />

Education and training services<br />

426.7<br />

46.1<br />

145.3<br />

16.7<br />

42.0<br />

32.2<br />

16.1<br />

92.0<br />

MTY Food <strong>Group</strong><br />

MTY.<strong>TO</strong><br />

Restaurants<br />

78.5<br />

29.2<br />

16.9<br />

25.0<br />

27.4<br />

18.5<br />

20.7<br />

16.0<br />

Portfolio Recovery Assoc.<br />

PRAA<br />

Business services<br />

458.9<br />

19.9<br />

18.3<br />

26.0<br />

24.4<br />

16.2<br />

15.1<br />

97.5<br />

Questcor Pharmaceuticals<br />

QCOR<br />

Biotechnology<br />

218.2<br />

37.0<br />

20.0<br />

100.0<br />

100.0<br />

40.8<br />

9.9<br />

91.2<br />

Sturm, Ruger & Company<br />

RGR<br />

Aerospace and defense<br />

328.8<br />

20.0<br />

53.0<br />

47.9<br />

70.5<br />

18.5<br />

15.2<br />

96.0<br />

Steven Madden<br />

SHOO<br />

Footware and accessories<br />

987.3<br />

22.0<br />

37.5<br />

39.0<br />

18.7<br />

17.7<br />

17.4<br />

93.5<br />

Syntel<br />

SYNT<br />

Information tech services<br />

642.4<br />

16.7<br />

17.1<br />

15.2<br />

65.4<br />

27.3<br />

13.0<br />

35.7<br />

Texas Pacific Land Trust<br />

TPL<br />

Real estate — general<br />

34.3<br />

17.7<br />

24.4<br />

28.1<br />

36.3<br />

44.8<br />

22.0<br />

42.0<br />

Morningstar data as of Jan. 14, 2013<br />

March 2013 | <strong>BetterInvesting</strong> | 35