STOCK TO STUDY: T. Rowe Price Group, Inc ... - BetterInvesting

STOCK TO STUDY: T. Rowe Price Group, Inc ... - BetterInvesting

STOCK TO STUDY: T. Rowe Price Group, Inc ... - BetterInvesting

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>S<strong>TO</strong>CK</strong>S | Growth Stocks<br />

Colgate Is Slowing But Won’t Get the Brushoff<br />

Trucking Firm Knight Adds Pickup to Portfolio<br />

by Cy Lynch<br />

Portfolio Overview: Reviewing Historical Returns<br />

Since its start in October 2006, our model portfolio con -<br />

sisting of the stocks featured in this column has a rel ative<br />

return of 2.2 percent based on its annualized return of<br />

7.7 percent compared with 5.5 percent for the stock market<br />

as a whole — represented by the Vanguard VIPERs Total<br />

Market ETF (ticker: VTI) over the same period. Although<br />

that’s solid performance, and significantly better than most<br />

mutual funds, we’d like to be closer to our goal of out -<br />

performing the market by 5 percent over the long haul.<br />

Fourteen of 26 features outperformed<br />

the stock market<br />

for an “accuracy” of 53.8 percent.<br />

That percentage continues<br />

to increase steadily and is within<br />

striking distance of our target<br />

range of between 60 percent and<br />

70 percent.<br />

Reviewing Business Performance<br />

and Projections<br />

All of our 18 current holdings is -<br />

sued new financial reports since<br />

my last column. Virtually all of them<br />

performed generally as projected.<br />

I chose, however, to adjust my<br />

projected sales growth for two of<br />

them.<br />

Aflac (AFL) has continued to per -<br />

form a bit better than expected<br />

since being selected 17 months ago,<br />

with sales growth increasing sub -<br />

stantially during 2012 to 16.2 percent<br />

over the trailing 12 months (compared<br />

with my projected growth<br />

rate of 8 percent). As a result, I in -<br />

creased my projected sales growth<br />

rate to 9 percent.<br />

In contrast, Colgate-Palmolive’s<br />

(CL) sales growth has continued<br />

to slow over the past year, ranging<br />

in the low- to mid-single digits.<br />

There fore, I’ve lowered my projected<br />

growth rate for the com -<br />

pany to 5 percent from 6 percent.<br />

Although slow, that rate is still a<br />

bit faster than the economy and<br />

isn’t overly alarming for a stalwart<br />

company such as Colgate.<br />

32 | <strong>BetterInvesting</strong> | March 2013<br />

Teva Pharmaceutical<br />

(purchased 12/1/10)<br />

Teva Pharmaceutical<br />

(purchased 6/30/11)<br />

On the other hand, we’ll con tinue to monitor the<br />

company going forward to assure that growth stabilizes<br />

at a lower rate rather than continuing to decline.<br />

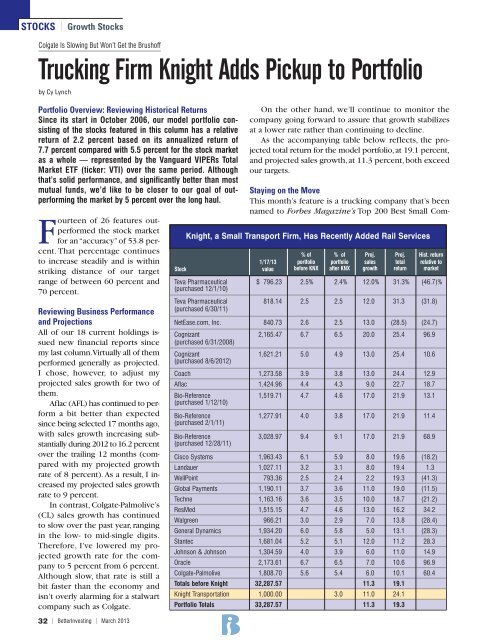

As the accompanying table below reflects, the projected<br />

total return for the model portfolio, at 19.1 percent,<br />

and projected sales growth, at 11.3 percent, both exceed<br />

our targets.<br />

Staying on the Move<br />

This month’s feature is a trucking company that’s been<br />

named to Forbes Magazine’s Top 200 Best Small Com -<br />

Knight, a Small Transport Firm, Has Recently Added Rail Services<br />

% of % of Proj. Proj. Hist. return<br />

1/17/13 portfolio portfolio sales total relative to<br />

Stock value before KNX after KNX growth return market<br />

$ 796.23 2.5% 2.4% 12.0% 31.3% (46.7)%<br />

818.14 2.5 2.5 12.0 31.3 (31.8)<br />

NetEase.com, <strong>Inc</strong>. 840.73 2.6 2.5 13.0 (28.5) (24.7)<br />

Cognizant<br />

(purchased 6/31/2008)<br />

Cognizant<br />

(purchased 8/6/2012)<br />

2,165.47 6.7 6.5 20.0 25.4 96.9<br />

1,621.21 5.0 4.9 13.0 25.4 10.6<br />

Coach 1,273.58 3.9 3.8 13.0 24.4 12.9<br />

Aflac 1,424.96 4.4 4.3 9.0 22.7 18.7<br />

Bio-Reference<br />

(purchased 1/12/10)<br />

1,519.71 4.7 4.6 17.0 21.9 13.1<br />

Bio-Reference<br />

(purchased 2/1/11)<br />

Bio-Reference<br />

(purchased 12/28/11)<br />

1,277.91 4.0 3.8 17.0 21.9 11.4<br />

3,028.97 9.4 9.1 17.0 21.9 68.9<br />

Cisco Systems 1,963.43 6.1 5.9 8.0 19.6 (18.2)<br />

Landauer 1,027.11 3.2 3.1 8.0 19.4 1.3<br />

WellPoint 793.36 2.5 2.4 2.2 19.3 (41.3)<br />

Global Payments 1,190.11 3.7 3.6 11.0 19.0 (11.5)<br />

Techne 1,163.16 3.6 3.5 10.0 18.7 (21.2)<br />

ResMed 1,515.15 4.7 4.6 13.0 16.2 34.2<br />

Walgreen 966.21 3.0 2.9 7.0 13.8 (28.4)<br />

General Dynamics 1,934.20 6.0 5.8 5.0 13.1 (28.3)<br />

Stantec 1,681.04 5.2 5.1 12.0 11.2 28.3<br />

Johnson & Johnson 1,304.59 4.0 3.9 6.0 11.0 14.9<br />

Oracle 2,173.61 6.7 6.5 7.0 10.6 96.9<br />

Colgate-Palmolive 1,808.70 5.6 5.4 6.0 10.1 60.4<br />

Totals before Knight 32,287.57 11.3 19.1<br />

Knight Transportation 1,000.00 3.0 11.0 24.1<br />

Portfolio Totals 33,287.57 11.3 19.3