STOCK TO STUDY: T. Rowe Price Group, Inc ... - BetterInvesting

STOCK TO STUDY: T. Rowe Price Group, Inc ... - BetterInvesting

STOCK TO STUDY: T. Rowe Price Group, Inc ... - BetterInvesting

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

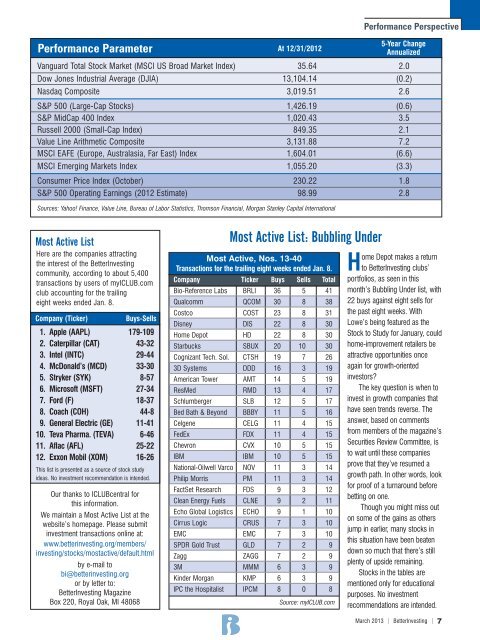

Performance Parameter At 12/31/2012<br />

Performance Perspective<br />

5-Year Change<br />

Annualized<br />

Vanguard Total Stock Market (MSCI US Broad Market Index) 35.64 2.0<br />

Dow Jones Industrial Average (DJIA) 13,104.14 (0.2)<br />

Nasdaq Composite 3,019.51 2.6<br />

S&P 500 (Large-Cap Stocks) 1,426.19 (0.6)<br />

S&P MidCap 400 Index 1,020.43 3.5<br />

Russell 2000 (Small-Cap Index) 849.35 2.1<br />

Value Line Arithmetic Composite 3,131.88 7.2<br />

MSCI EAFE (Europe, Australasia, Far East) Index 1,604.01 (6.6)<br />

MSCI Emerging Markets Index 1,055.20 (3.3)<br />

Consumer <strong>Price</strong> Index (October) 230.22 1.8<br />

S&P 500 Operating Earnings (2012 Estimate) 98.99 2.8<br />

Sources: Yahoo! Finance, Value Line, Bureau of Labor Statistics, Thomson Financial, Morgan Stanley Capital International<br />

Most Active List<br />

Here are the companies attracting<br />

the interest of the <strong>BetterInvesting</strong><br />

community, according to about 5,400<br />

transactions by users of myICLUB.com<br />

club accounting for the trailing<br />

eight weeks ended Jan. 8.<br />

Company (Ticker)<br />

Buys-Sells<br />

1. Apple (AAPL) 179-109<br />

2. Caterpillar (CAT) 43-32<br />

3. Intel (INTC) 29-44<br />

4. McDonald’s (MCD) 33-30<br />

5. Stryker (SYK) 8-57<br />

6. Microsoft (MSFT) 27-34<br />

7. Ford (F) 18-37<br />

8. Coach (COH) 44-8<br />

9. General Electric (GE) 11-41<br />

10. Teva Pharma. (TEVA) 6-46<br />

11. Aflac (AFL) 25-22<br />

12. Exxon Mobil (XOM) 16-26<br />

This list is presented as a source of stock study<br />

ideas. No investment recommendation is intended.<br />

Our thanks to ICLUBcentral for<br />

this information.<br />

We maintain a Most Active List at the<br />

website’s homepage. Please submit<br />

investment transactions online at:<br />

www.betterinvesting.org/members/<br />

investing/stocks/mostactive/default.html<br />

by e-mail to<br />

bi@betterinvesting.org<br />

or by letter to:<br />

<strong>BetterInvesting</strong> Magazine<br />

Box 220, Royal Oak, MI 48068<br />

Most Active List: Bubbling Under<br />

Most Active, Nos. 13-40<br />

Transactions for the trailing eight weeks ended Jan. 8.<br />

Company Ticker Buys Sells Total<br />

Bio-Reference Labs BRLI 36 5 41<br />

Qualcomm QCOM 30 8 38<br />

Costco COST 23 8 31<br />

Disney DIS 22 8 30<br />

Home Depot HD 22 8 30<br />

Starbucks SBUX 20 10 30<br />

Cognizant Tech. Sol. CTSH 19 7 26<br />

3D Systems DDD 16 3 19<br />

American Tower AMT 14 5 19<br />

ResMed RMD 13 4 17<br />

Schlumberger SLB 12 5 17<br />

Bed Bath & Beyond BBBY 11 5 16<br />

Celgene CELG 11 4 15<br />

FedEx FDX 11 4 15<br />

Chevron CVX 10 5 15<br />

IBM IBM 10 5 15<br />

National-Oilwell Varco NOV 11 3 14<br />

Philip Morris PM 11 3 14<br />

FactSet Research FDS 9 3 12<br />

Clean Energy Fuels CLNE 9 2 11<br />

Echo Global Logistics ECHO 9 1 10<br />

Cirrus Logic CRUS 7 3 10<br />

EMC EMC 7 3 10<br />

SPDR Gold Trust GLD 7 2 9<br />

Zagg ZAGG 7 2 9<br />

3M MMM 6 3 9<br />

Kinder Morgan KMP 6 3 9<br />

IPC the Hospitalist IPCM 8 0 8<br />

Source: myICLUB.com<br />

Home Depot makes a return<br />

to <strong>BetterInvesting</strong> clubs’<br />

portfolios, as seen in this<br />

month’s Bubbling Under list, with<br />

22 buys against eight sells for<br />

the past eight weeks. With<br />

Lowe’s being featured as the<br />

Stock to Study for January, could<br />

home-improvement retailers be<br />

attractive opportunities once<br />

again for growth-oriented<br />

investors?<br />

The key question is when to<br />

invest in growth companies that<br />

have seen trends reverse. The<br />

answer, based on comments<br />

from members of the magazine’s<br />

Securities Review Committee, is<br />

to wait until these companies<br />

prove that they’ve resumed a<br />

growth path. In other words, look<br />

for proof of a turnaround before<br />

betting on one.<br />

Though you might miss out<br />

on some of the gains as others<br />

jump in earlier, many stocks in<br />

this situation have been beaten<br />

down so much that there’s still<br />

plenty of upside remaining.<br />

Stocks in the tables are<br />

mentioned only for educational<br />

purposes. No investment<br />

recommendations are intended.<br />

March 2013 | <strong>BetterInvesting</strong> | 7