Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

30<br />

<strong>Deutsche</strong> bahn group<br />

The cash outflow for capital expenditures was also lower during the first half of 2010, decreasing by<br />

€ 83 million to € 810 million. Increased gross capital expenditures were more than offset by increasing<br />

investment grants (€ + 184 million), that, in particular, resulted from the economic stimulus programs.<br />

The cash flow from financing activities increased slightly by € 48 million to € 746 million. The<br />

reason for this is the increased utilization of our commercial paper program (€ + 1.5 billion) and the net<br />

redemption of bond debt (€ – 0.5 billion) after having issued a corporate bond (€ 1.0 billion) in the first<br />

half of 2009. Additionally, the payments for redemption of Federal loans increased slightly.<br />

As of June 30, 2010, DB Group had a higher amount of cash and cash equivalents available than it<br />

did on December 31, 2009 as this figure increased by € 536 million to € 2,747 million. This increase stems<br />

from anticipated financial obligations resulting from the acquisition of Arriva.<br />

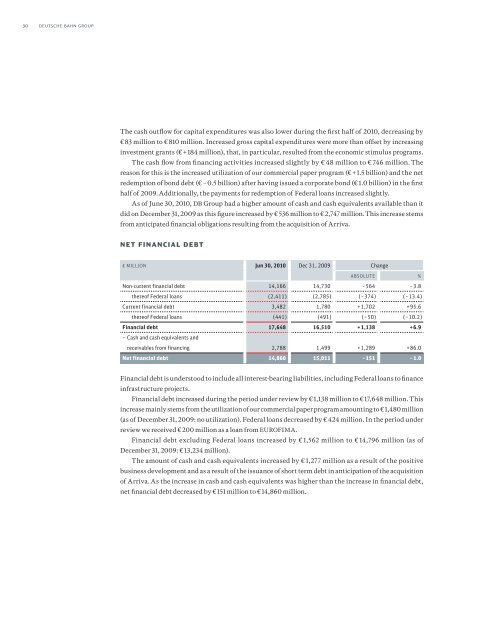

NET FINANCIAL DEBT<br />

€ million Jun 30, 2010 Dec 31, 2009 Change<br />

absolute %<br />

Non-current financial debt 14,166 14,730 – 564 – 3.8<br />

thereof Federal loans (2,411) (2,785) (– 374) (– 13.4)<br />

Current financial debt 3,482 1,780 + 1,702 + 95.6<br />

thereof Federal loans (441) (491) (– 50) (– 10.2)<br />

Financial debt 17,648 16,510 + 1,138 + 6.9<br />

– Cash and cash equivalents and<br />

receivables from financing 2,788 1,499 + 1,289 + 86.0<br />

Net financial debt 14,860 15,011 – 151 – 1.0<br />

Financial debt is understood to include all interest-bearing liabilities, including Federal loans to finance<br />

infrastructure projects.<br />

Financial debt increased during the period under review by € 1,138 million to € 17,648 million. This<br />

increase mainly stems from the utilization of our commercial paper program amounting to € 1,480 million<br />

(as of December 31, 2009: no utilization). Federal loans decreased by € 424 million. In the period under<br />

review we received € 200 million as a loan from EUROFIMA.<br />

Financial debt excluding Federal loans increased by € 1,562 million to € 14,796 million (as of<br />

December 31, 2009: € 13,234 million).<br />

The amount of cash and cash equivalents increased by € 1,277 million as a result of the positive<br />

business development and as a result of the issuance of short term debt in anticipation of the acquisition<br />

of Arriva. As the increase in cash and cash equivalents was higher than the increase in financial debt,<br />

net financial debt decreased by € 151 million to € 14,860 million.