Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Chairmanʼs letter<br />

31<br />

Major events<br />

Interim Group management report<br />

Consolidated interim financial statements<br />

As of June 30, 2010 there was a slight shift in the structure of maturities to short-term financial debt<br />

as its share of total financial debt increased from 11 to 20 %. The composition of financial debt has<br />

changed as a result of the significant utilization of the commercial paper program (as of June 30, 2010:<br />

8 %, as of December 31, 2009: 0 %). The financial debt continues to consist primarily of bonds (56 %)<br />

and Federal loans (16 %).<br />

Capital Expenditures<br />

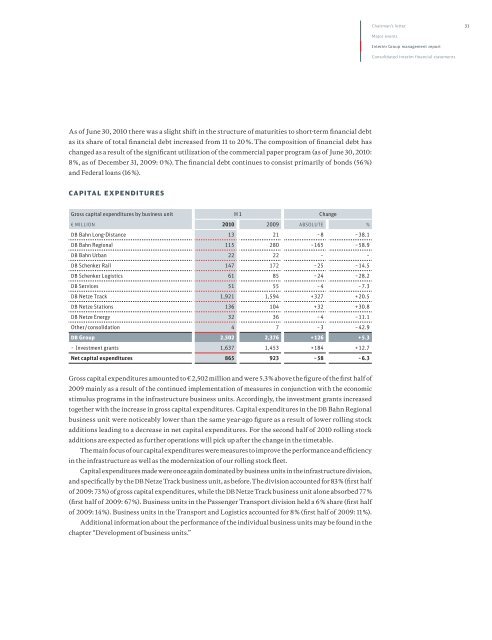

Gross capital expenditures by business unit<br />

H 1<br />

Change<br />

€ million<br />

2010 2009 absolute %<br />

DB <strong>Bahn</strong> Long-Distance 13 21 – 8 – 38.1<br />

DB <strong>Bahn</strong> Regional 115 280 – 165 – 58.9<br />

DB <strong>Bahn</strong> Urban 22 22 – –<br />

DB Schenker Rail 147 172 – 25 – 14.5<br />

DB Schenker Logistics 61 85 – 24 – 28.2<br />

DB Services 51 55 – 4 – 7.3<br />

DB Netze Track 1,921 1,594 + 327 + 20.5<br />

DB Netze Stations 136 104 + 32 + 30.8<br />

DB Netze Energy 32 36 – 4 – 11.1<br />

Other / consolidation 4 7 – 3 – 42.9<br />

DB Group 2,502 2,376 + 126 + 5.3<br />

– Investment grants 1,637 1,453 + 184 + 12.7<br />

Net capital expenditures 865 923 – 58 – 6.3<br />

Gross capital expenditures amounted to € 2,502 million and were 5.3 % above the figure of the first half of<br />

2009 mainly as a result of the continued implementation of measures in conjunction with the economic<br />

stimulus programs in the infrastructure business units. Accordingly, the investment grants increased<br />

together with the increase in gross capital expenditures. Capital expenditures in the DB <strong>Bahn</strong> Regional<br />

business unit were noticeably lower than the same year-ago figure as a result of lower rolling stock<br />

additions leading to a decrease in net capital expenditures. For the second half of 2010 rolling stock<br />

additions are expected as further operations will pick up after the change in the timetable.<br />

The main focus of our capital expenditures were measures to improve the performance and efficiency<br />

in the infrastructure as well as the modernization of our rolling stock fleet.<br />

Capital expenditures made were once again dominated by business units in the infrastructure division,<br />

and specifically by the DB Netze Track business unit, as before. The division accounted for 83 % (first half<br />

of 2009: 73 %) of gross capital expenditures, while the DB Netze Track business unit alone absorbed 77 %<br />

(first half of 2009: 67 %). Business units in the Passenger Transport division held a 6 % share (first half<br />

of 2009: 14 %). Business units in the Transport and Logistics accounted for 8 % (first half of 2009: 11 %).<br />

Additional information about the performance of the individual business units may be found in the<br />

chapter “Development of business units.”