Front Cover Page - Tata Mutual Fund

Front Cover Page - Tata Mutual Fund

Front Cover Page - Tata Mutual Fund

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

TATA FLOATER FUND<br />

II. INFORMATION ABOUT THE SCHEME<br />

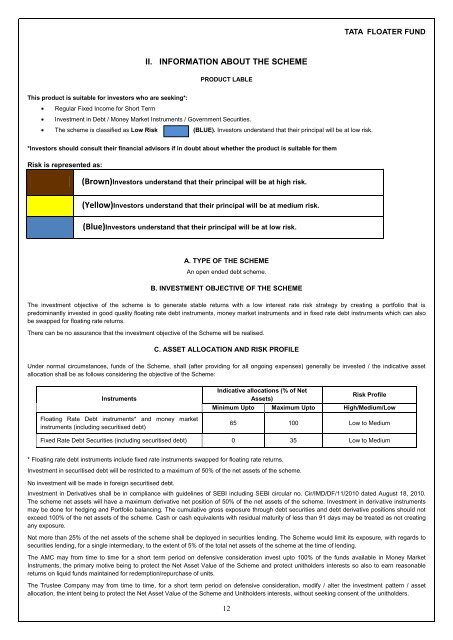

PRODUCT LABLE<br />

This product is suitable for investors who are seeking*:<br />

Regular Fixed Income for Short Term<br />

Investment in Debt / Money Market Instruments / Government Securities.<br />

The scheme is classified as Low Risk<br />

(BLUE). Investors understand that their principal will be at low risk.<br />

*Investors should consult their financial advisors if in doubt about whether the product is suitable for them<br />

Risk is represented as:<br />

(Brown)Investors understand that their principal will be at high risk.<br />

(Yellow)Investors understand that their principal will be at medium risk.<br />

B(Blue)Investors understand that their principal will be at low risk.<br />

A. TYPE OF THE SCHEME<br />

An open ended debt scheme.<br />

B. INVESTMENT OBJECTIVE OF THE SCHEME<br />

The investment objective of the scheme is to generate stable returns with a low interest rate risk strategy by creating a portfolio that is<br />

predominantly invested in good quality floating rate debt instruments, money market instruments and in fixed rate debt instruments which can also<br />

be swapped for floating rate returns.<br />

There can be no assurance that the investment objective of the Scheme will be realised.<br />

C. ASSET ALLOCATION AND RISK PROFILE<br />

Under normal circumstances, funds of the Scheme, shall (after providing for all ongoing expenses) generally be invested / the indicative asset<br />

allocation shall be as follows considering the objective of the Scheme:<br />

Instruments<br />

Floating Rate Debt instruments* and money market<br />

instruments (including securitised debt)<br />

Indicative allocations (% of Net<br />

Assets)<br />

Risk Profile<br />

Minimum Upto Maximum Upto High/Medium/Low<br />

65 100 Low to Medium<br />

Fixed Rate Debt Securities (including securitised debt) 0 35 Low to Medium<br />

* Floating rate debt instruments include fixed rate instruments swapped for floating rate returns.<br />

Investment in securitised debt will be restricted to a maximum of 50% of the net assets of the scheme.<br />

No investment will be made in foreign securitised debt.<br />

Investment in Derivatives shall be in compliance with guidelines of SEBI including SEBI circular no. Cir/IMD/DF/11/2010 dated August 18, 2010.<br />

The scheme net assets will have a maximum derivative net position of 50% of the net assets of the scheme. Investment in derivative instruments<br />

may be done for hedging and Portfolio balancing. The cumulative gross exposure through debt securities and debt derivative positions should not<br />

exceed 100% of the net assets of the scheme. Cash or cash equivalents with residual maturity of less than 91 days may be treated as not creating<br />

any exposure.<br />

Not more than 25% of the net assets of the scheme shall be deployed in securities lending. The Scheme would limit its exposure, with regards to<br />

securities lending, for a single intermediary, to the extent of 5% of the total net assets of the scheme at the time of lending.<br />

The AMC may from time to time for a short term period on defensive consideration invest upto 100% of the funds available in Money Market<br />

Instruments, the primary motive being to protect the Net Asset Value of the Scheme and protect unitholders interests so also to earn reasonable<br />

returns on liquid funds maintained for redemption/repurchase of units.<br />

The Trustee Company may from time to time, for a short term period on defensive consideration, modify / alter the investment pattern / asset<br />

allocation, the intent being to protect the Net Asset Value of the Scheme and Unitholders interests, without seeking consent of the unitholders.<br />

12