Front Cover Page - Tata Mutual Fund

Front Cover Page - Tata Mutual Fund

Front Cover Page - Tata Mutual Fund

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

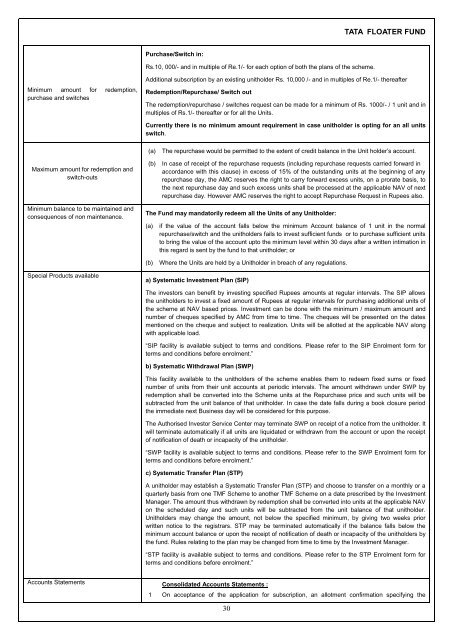

TATA FLOATER FUND<br />

Purchase/Switch in:<br />

Rs.10, 000/- and in multiple of Re.1/- for each option of both the plans of the scheme.<br />

Minimum amount for redemption,<br />

purchase and switches<br />

Additional subscription by an existing unitholder Rs. 10,000 /- and in multiples of Re.1/- thereafter<br />

Redemption/Repurchase/ Switch out<br />

The redemption/repurchase / switches request can be made for a minimum of Rs. 1000/- / 1 unit and in<br />

multiples of Rs.1/- thereafter or for all the Units.<br />

Currently there is no minimum amount requirement in case unitholder is opting for an all units<br />

switch.<br />

Maximum amount for redemption and<br />

switch-outs<br />

(a)<br />

(b)<br />

The repurchase would be permitted to the extent of credit balance in the Unit holder’s account.<br />

In case of receipt of the repurchase requests (including repurchase requests carried forward in<br />

accordance with this clause) in excess of 15% of the outstanding units at the beginning of any<br />

repurchase day, the AMC reserves the right to carry forward excess units, on a prorate basis, to<br />

the next repurchase day and such excess units shall be processed at the applicable NAV of next<br />

repurchase day. However AMC reserves the right to accept Repurchase Request in Rupees also.<br />

Minimum balance to be maintained and<br />

consequences of non maintenance.<br />

The <strong>Fund</strong> may mandatorily redeem all the Units of any Unitholder:<br />

(a)<br />

if the value of the account falls below the minimum Account balance of 1 unit in the normal<br />

repurchase/switch and the unitholders fails to invest sufficient funds or to purchase sufficient units<br />

to bring the value of the account upto the minimum level within 30 days after a written intimation in<br />

this regard is sent by the fund to that unitholder; or<br />

(b)<br />

Where the Units are held by a Unitholder in breach of any regulations.<br />

Special Products available<br />

a) Systematic Investment Plan (SIP)<br />

The investors can benefit by investing specified Rupees amounts at regular intervals. The SIP allows<br />

the unitholders to invest a fixed amount of Rupees at regular intervals for purchasing additional units of<br />

the scheme at NAV based prices. Investment can be done with the minimum / maximum amount and<br />

number of cheques specified by AMC from time to time. The cheques will be presented on the dates<br />

mentioned on the cheque and subject to realization. Units will be allotted at the applicable NAV along<br />

with applicable load.<br />

“SIP facility is available subject to terms and conditions. Please refer to the SIP Enrolment form for<br />

terms and conditions before enrolment.”<br />

b) Systematic Withdrawal Plan (SWP)<br />

This facility available to the unitholders of the scheme enables them to redeem fixed sums or fixed<br />

number of units from their unit accounts at periodic intervals. The amount withdrawn under SWP by<br />

redemption shall be converted into the Scheme units at the Repurchase price and such units will be<br />

subtracted from the unit balance of that unitholder. In case the date falls during a book closure period<br />

the immediate next Business day will be considered for this purpose.<br />

The Authorised Investor Service Center may terminate SWP on receipt of a notice from the unitholder. It<br />

will terminate automatically if all units are liquidated or withdrawn from the account or upon the receipt<br />

of notification of death or incapacity of the unitholder.<br />

“SWP facility is available subject to terms and conditions. Please refer to the SWP Enrolment form for<br />

terms and conditions before enrolment.”<br />

c) Systematic Transfer Plan (STP)<br />

A unitholder may establish a Systematic Transfer Plan (STP) and choose to transfer on a monthly or a<br />

quarterly basis from one TMF Scheme to another TMF Scheme on a date prescribed by the Investment<br />

Manager. The amount thus withdrawn by redemption shall be converted into units at the applicable NAV<br />

on the scheduled day and such units will be subtracted from the unit balance of that unitholder.<br />

Unitholders may change the amount, not below the specified minimum, by giving two weeks prior<br />

written notice to the registrars. STP may be terminated automatically if the balance falls below the<br />

minimum account balance or upon the receipt of notification of death or incapacity of the unitholders by<br />

the fund. Rules relating to the plan may be changed from time to time by the Investment Manager.<br />

“STP facility is available subject to terms and conditions. Please refer to the STP Enrolment form for<br />

terms and conditions before enrolment.”<br />

Accounts Statements Consolidated Accounts Statements :<br />

1 On acceptance of the application for subscription, an allotment confirmation specifying the<br />

30