Front Cover Page - Tata Mutual Fund

Front Cover Page - Tata Mutual Fund

Front Cover Page - Tata Mutual Fund

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

TATA FLOATER FUND<br />

For further details on taxation please refer the clause on taxation in SAI.<br />

C. COMPUTATION OF NAV<br />

Net Asset Value (“NAV”) of the Units shall be determined daily as of the close of each Business Day.<br />

NAV shall be calculated in accordance with the following formula:<br />

Market Value of Scheme’s Investments + Accrued Income + Receivables + Other Assets – Accrued Expenses - Payables - Other Liabilities<br />

NAV= ——————————————————————————————————————————————————————————————<br />

Number of Units Outstanding<br />

The computation of Net Asset Value, valuation of Assets, computation of applicable Net Asset Value (related price) for ongoing Sale, Redemption,<br />

Switch and their frequency of disclosure shall be based upon a formula in accordance with the Regulations and as amended from time to time<br />

including by way of Circulars, Press Releases, or Notifications issued by SEBI or the Government of India to regulate the activities and growth of<br />

<strong>Mutual</strong> <strong>Fund</strong>s. The NAVs of the fund shall be rounded off upto four decimals.<br />

The valuation of investments shall be based on the principles of fair valuation specified in the Schedule VIII of the SEBI (<strong>Mutual</strong> <strong>Fund</strong>s) Regulations,<br />

1996 and guidelines issued by SEBI /AMFI from time to time.* Please refer Para V. of SAI on ‘Investment valuation norms for securities & other<br />

assets’ for details.<br />

Each option of the Direct Plan will have a separate NAV.<br />

IV. FEES AND EXPENSES<br />

A. NEW FUND OFFER (NFO) EXPENSES<br />

The scheme was launched on 23 rd August, 2005. During the New <strong>Fund</strong> Offer Period i.e. from 23 rd August, 2005 to 5 th September, 2005, the new<br />

fund offer expenses were borne by the scheme. However, being an existing scheme provision of NFO expenses are not applicable for this scheme.<br />

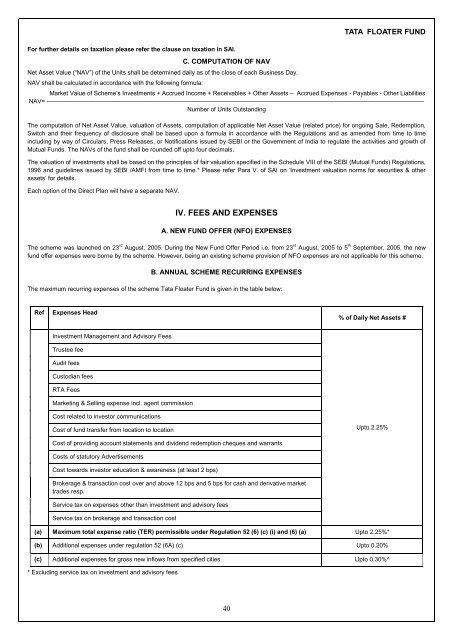

B. ANNUAL SCHEME RECURRING EXPENSES<br />

The maximum recurring expenses of the scheme <strong>Tata</strong> Floater <strong>Fund</strong> is given in the table below:<br />

Ref<br />

Expenses Head<br />

% of Daily Net Assets #<br />

Investment Management and Advisory Fees<br />

Trustee fee<br />

Audit fees<br />

Custodian fees<br />

RTA Fees<br />

Marketing & Selling expense incl. agent commission<br />

Cost related to investor communications<br />

Cost of fund transfer from location to location<br />

Cost of providing account statements and dividend redemption cheques and warrants<br />

Costs of statutory Advertisements<br />

Cost towards investor education & awareness (at least 2 bps)<br />

Brokerage & transaction cost over and above 12 bps and 5 bps for cash and derivative market<br />

trades resp.<br />

Service tax on expenses other than investment and advisory fees<br />

Service tax on brokerage and transaction cost<br />

Upto 2.25%<br />

(a) Maximum total expense ratio (TER) permissible under Regulation 52 (6) (c) (i) and (6) (a) Upto 2.25%*<br />

(b) Additional expenses under regulation 52 (6A) (c) Upto 0.20%<br />

(c) Additional expenses for gross new inflows from specified cities Upto 0.30%^<br />

* Excluding service tax on investment and advisory fees<br />

40