Front Cover Page - Tata Mutual Fund

Front Cover Page - Tata Mutual Fund

Front Cover Page - Tata Mutual Fund

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

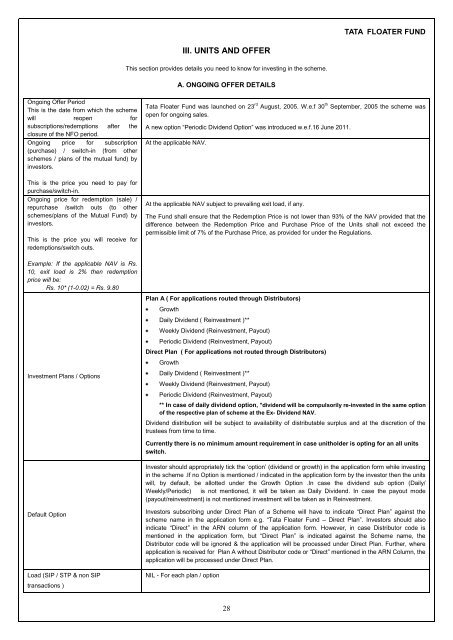

TATA FLOATER FUND<br />

III. UNITS AND OFFER<br />

This section provides details you need to know for investing in the scheme.<br />

A. ONGOING OFFER DETAILS<br />

Ongoing Offer Period<br />

This is the date from which the scheme<br />

will reopen for<br />

subscriptions/redemptions after the<br />

closure of the NFO period.<br />

Ongoing price for subscription<br />

(purchase) / switch-in (from other<br />

schemes / plans of the mutual fund) by<br />

investors.<br />

This is the price you need to pay for<br />

purchase/switch-in.<br />

Ongoing price for redemption (sale) /<br />

repurchase /switch outs (to other<br />

schemes/plans of the <strong>Mutual</strong> <strong>Fund</strong>) by<br />

investors.<br />

This is the price you will receive for<br />

redemptions/switch outs.<br />

Example: If the applicable NAV is Rs.<br />

10, exit load is 2% then redemption<br />

price will be:<br />

Rs. 10* (1-0.02) = Rs. 9.80<br />

Investment Plans / Options<br />

<strong>Tata</strong> Floater <strong>Fund</strong> was launched on 23 rd August, 2005. W.e.f 30 th September, 2005 the scheme was<br />

open for ongoing sales.<br />

A new option “Periodic Dividend Option” was introduced w.e.f.16 June 2011.<br />

At the applicable NAV.<br />

At the applicable NAV subject to prevailing exit load, if any.<br />

The <strong>Fund</strong> shall ensure that the Redemption Price is not lower than 93% of the NAV provided that the<br />

difference between the Redemption Price and Purchase Price of the Units shall not exceed the<br />

permissible limit of 7% of the Purchase Price, as provided for under the Regulations.<br />

Plan A ( For applications routed through Distributors)<br />

Growth<br />

Daily Dividend ( Reinvestment )**<br />

Weekly Dividend (Reinvestment, Payout)<br />

Periodic Dividend (Reinvestment, Payout)<br />

Direct Plan ( For applications not routed through Distributors)<br />

Growth<br />

Daily Dividend ( Reinvestment )**<br />

Weekly Dividend (Reinvestment, Payout)<br />

Periodic Dividend (Reinvestment, Payout)<br />

** In case of daily dividend option, *dividend will be compulsorily re-invested in the same option<br />

of the respective plan of scheme at the Ex- Dividend NAV.<br />

Dividend distribution will be subject to availability of distributable surplus and at the discretion of the<br />

trustees from time to time.<br />

Currently there is no minimum amount requirement in case unitholder is opting for an all units<br />

switch.<br />

Investor should appropriately tick the ‘option’ (dividend or growth) in the application form while investing<br />

in the scheme .If no Option is mentioned / indicated in the application form by the investor then the units<br />

will, by default, be allotted under the Growth Option .In case the dividend sub option (Daily/<br />

Weekly/Periodic) is not mentioned, it will be taken as Daily Dividend. In case the payout mode<br />

(payout/reinvestment) is not mentioned investment will be taken as in Reinvestment.<br />

Default Option<br />

Load (SIP / STP & non SIP<br />

transactions )<br />

Investors subscribing under Direct Plan of a Scheme will have to indicate “Direct Plan” against the<br />

scheme name in the application form e.g. “<strong>Tata</strong> Floater <strong>Fund</strong> – Direct Plan”. Investors should also<br />

indicate “Direct” in the ARN column of the application form. However, in case Distributor code is<br />

mentioned in the application form, but “Direct Plan” is indicated against the Scheme name, the<br />

Distributor code will be ignored & the application will be processed under Direct Plan. Further, where<br />

application is received for Plan A without Distributor code or “Direct” mentioned in the ARN Column, the<br />

application will be processed under Direct Plan.<br />

NIL - For each plan / option<br />

28