The Jupiter Global Fund - Jupiter Asset Management

The Jupiter Global Fund - Jupiter Asset Management

The Jupiter Global Fund - Jupiter Asset Management

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

the jupiter global fund<br />

Statement of Net <strong>Asset</strong>s<br />

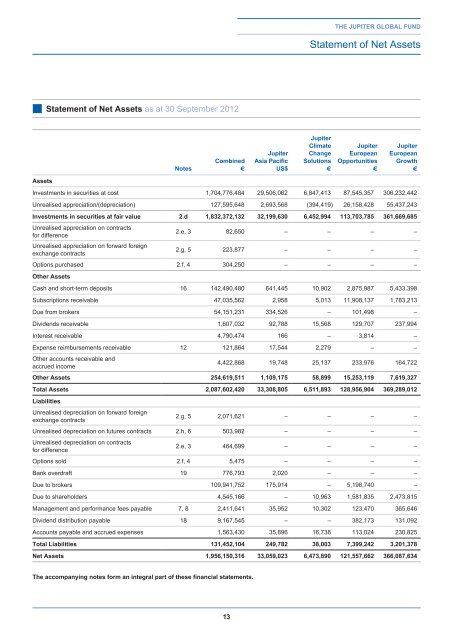

■■Statement of Net <strong>Asset</strong>s as at 30 September 2012<br />

Notes<br />

Combined<br />

€<br />

<strong>Jupiter</strong><br />

Asia Pacific<br />

US$<br />

<strong>Jupiter</strong><br />

Climate<br />

Change<br />

Solutions<br />

€<br />

<strong>Jupiter</strong><br />

European<br />

Opportunities<br />

€<br />

<strong>Jupiter</strong><br />

European<br />

Growth<br />

€<br />

<strong>Asset</strong>s<br />

Investments in securities at cost 1,704,776,484 29,506,062 6,847,413 87,545,357 306,232,442<br />

Unrealised appreciation/(depreciation) 127,595,648 2,693,568 (394,419) 26,158,428 55,437,243<br />

Investments in securities at fair value 2.d 1,832,372,132 32,199,630 6,452,994 113,703,785 361,669,685<br />

Unrealised appreciation on contracts<br />

for difference<br />

2.e, 3 82,650 – – – –<br />

Unrealised appreciation on forward foreign<br />

exchange contracts<br />

2.g, 5 223,877 – – – –<br />

Options purchased 2.f, 4 304,250 – – – –<br />

Other <strong>Asset</strong>s<br />

Cash and short-term deposits 16 142,490,480 641,445 10,902 2,875,987 5,433,398<br />

Subscriptions receivable 47,035,562 2,958 5,013 11,908,137 1,783,213<br />

Due from brokers 54,151,231 334,526 – 101,498 –<br />

Dividends receivable 1,607,032 92,788 15,568 129,707 237,994<br />

Interest receivable 4,790,474 166 – 3,814 –<br />

Expense reimbursements receivable 12 121,864 17,544 2,279 – –<br />

Other accounts receivable and<br />

accrued income<br />

4,422,868 19,748 25,137 233,976 164,722<br />

Other <strong>Asset</strong>s 254,619,511 1,109,175 58,899 15,253,119 7,619,327<br />

Total <strong>Asset</strong>s 2,087,602,420 33,308,805 6,511,893 128,956,904 369,289,012<br />

Liabilities<br />

Unrealised depreciation on forward foreign<br />

exchange contracts<br />

2.g, 5 2,071,621 – – – –<br />

Unrealised depreciation on futures contracts 2.h, 6 503,982 – – – –<br />

Unrealised depreciation on contracts<br />

for difference<br />

2.e, 3 464,699 – – – –<br />

Options sold 2.f, 4 5,475 – – – –<br />

Bank overdraft 19 776,793 2,020 – – –<br />

Due to brokers 109,941,752 175,914 – 5,198,740 –<br />

Due to shareholders 4,545,166 – 10,963 1,581,835 2,473,815<br />

<strong>Management</strong> and performance fees payable 7, 8 2,411,641 35,952 10,302 123,470 365,646<br />

Dividend distribution payable 18 9,167,545 – – 382,173 131,092<br />

Accounts payable and accrued expenses 1,563,430 35,896 16,738 113,024 230,825<br />

Total Liabilities 131,452,104 249,782 38,003 7,399,242 3,201,378<br />

Net <strong>Asset</strong>s 1,956,150,316 33,059,023 6,473,890 121,557,662 366,087,634<br />

<strong>The</strong> accompanying notes form an integral part of these financial statements.<br />

13