The Jupiter Global Fund - Jupiter Asset Management

The Jupiter Global Fund - Jupiter Asset Management

The Jupiter Global Fund - Jupiter Asset Management

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

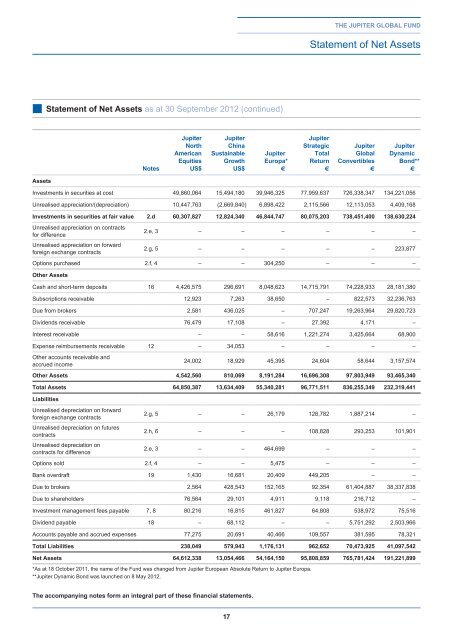

the jupiter global fund<br />

Statement of Net <strong>Asset</strong>s<br />

■■Statement of Net <strong>Asset</strong>s as at 30 September 2012 (continued)<br />

Notes<br />

<strong>Jupiter</strong><br />

North<br />

American<br />

Equities<br />

US$<br />

<strong>Jupiter</strong><br />

China<br />

Sustainable<br />

Growth<br />

US$<br />

<strong>Jupiter</strong><br />

Europa*<br />

€<br />

<strong>Jupiter</strong><br />

Strategic<br />

Total<br />

Return<br />

€<br />

<strong>Jupiter</strong><br />

<strong>Global</strong><br />

Convertibles<br />

€<br />

<strong>Jupiter</strong><br />

Dynamic<br />

Bond**<br />

€<br />

<strong>Asset</strong>s<br />

Investments in securities at cost 49,860,064 15,494,180 39,946,325 77,959,637 726,338,347 134,221,056<br />

Unrealised appreciation/(depreciation) 10,447,763 (2,669,840) 6,898,422 2,115,566 12,113,053 4,409,168<br />

Investments in securities at fair value 2.d 60,307,827 12,824,340 46,844,747 80,075,203 738,451,400 138,630,224<br />

Unrealised appreciation on contracts<br />

for difference<br />

2.e, 3 – – – – – –<br />

Unrealised appreciation on forward<br />

foreign exchange contracts<br />

2.g, 5 – – – – – 223,877<br />

Options purchased 2.f, 4 – – 304,250 – – –<br />

Other <strong>Asset</strong>s<br />

Cash and short-term deposits 16 4,426,575 296,691 8,048,623 14,715,791 74,228,933 28,181,380<br />

Subscriptions receivable 12,923 7,263 38,650 – 822,573 32,236,763<br />

Due from brokers 2,581 436,025 – 707,247 19,263,964 29,820,723<br />

Dividends receivable 76,479 17,108 – 27,392 4,171 –<br />

Interest receivable – – 58,616 1,221,274 3,425,664 68,900<br />

Expense reimbursements receivable 12 – 34,053 – – – –<br />

Other accounts receivable and<br />

accrued income<br />

24,002 18,929 45,395 24,604 58,644 3,157,574<br />

Other <strong>Asset</strong>s 4,542,560 810,069 8,191,284 16,696,308 97,803,949 93,465,340<br />

Total <strong>Asset</strong>s 64,850,387 13,634,409 55,340,281 96,771,511 836,255,349 232,319,441<br />

Liabilities<br />

Unrealised depreciation on forward<br />

foreign exchange contracts<br />

Unrealised depreciation on futures<br />

contracts<br />

Unrealised depreciation on<br />

contracts for difference<br />

2.g, 5 – – 26,179 128,782 1,887,214 –<br />

2.h, 6 – – – 108,828 293,253 101,901<br />

2.e, 3 – – 464,699 – – –<br />

Options sold 2.f, 4 – – 5,475 – – –<br />

Bank overdraft 19 1,430 16,681 20,409 449,205 – –<br />

Due to brokers 2,564 428,543 152,165 92,354 61,404,887 38,337,838<br />

Due to shareholders 76,564 29,101 4,911 9,118 216,712 –<br />

Investment management fees payable 7, 8 80,216 16,815 461,827 64,808 538,972 75,516<br />

Dividend payable 18 – 68,112 – – 5,751,292 2,503,966<br />

Accounts payable and accrued expenses 77,275 20,691 40,466 109,557 381,595 78,321<br />

Total Liabilities 238,049 579,943 1,176,131 962,652 70,473,925 41,097,542<br />

Net <strong>Asset</strong>s 64,612,338 13,054,466 54,164,150 95,808,859 765,781,424 191,221,899<br />

*As at 18 October 2011, the name of the <strong>Fund</strong> was changed from <strong>Jupiter</strong> European Absolute Return to <strong>Jupiter</strong> Europa.<br />

**<strong>Jupiter</strong> Dynamic Bond was launched on 8 May 2012.<br />

<strong>The</strong> accompanying notes form an integral part of these financial statements.<br />

17