The Jupiter Global Fund - Jupiter Asset Management

The Jupiter Global Fund - Jupiter Asset Management

The Jupiter Global Fund - Jupiter Asset Management

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

the jupiter global fund<br />

<strong>Jupiter</strong> <strong>Global</strong> Financials<br />

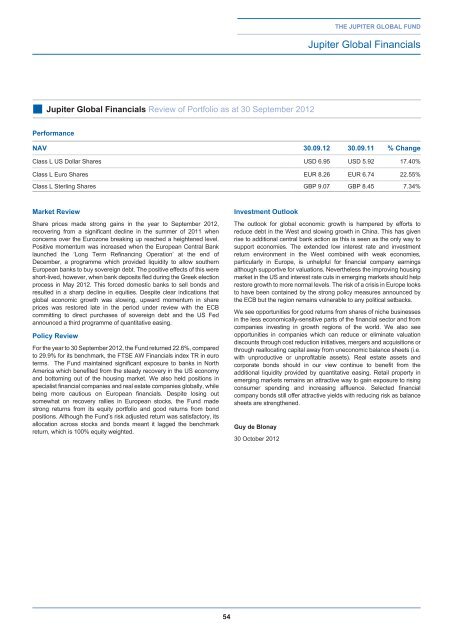

■■<strong>Jupiter</strong> <strong>Global</strong> Financials Review of Portfolio as at 30 September 2012<br />

Performance<br />

NAV 30.09.12 30.09.11 % Change<br />

Class L US Dollar Shares USD 6.95 USD 5.92 17.40%<br />

Class L Euro Shares EUR 8.26 EUR 6.74 22.55%<br />

Class L Sterling Shares GBP 9.07 GBP 8.45 7.34%<br />

Market Review<br />

Share prices made strong gains in the year to September 2012,<br />

recovering from a significant decline in the summer of 2011 when<br />

concerns over the Eurozone breaking up reached a heightened level.<br />

Positive momentum was increased when the European Central Bank<br />

launched the ‘Long Term Refinancing Operation’ at the end of<br />

December, a programme which provided liquidity to allow southern<br />

European banks to buy sovereign debt. <strong>The</strong> positive effects of this were<br />

short-lived, however, when bank deposits fled during the Greek election<br />

process in May 2012. This forced domestic banks to sell bonds and<br />

resulted in a sharp decline in equities. Despite clear indications that<br />

global economic growth was slowing, upward momentum in share<br />

prices was restored late in the period under review with the ECB<br />

committing to direct purchases of sovereign debt and the US Fed<br />

announced a third programme of quantitative easing.<br />

Policy Review<br />

For the year to 30 September 2012, the <strong>Fund</strong> returned 22.6%, compared<br />

to 29.9% for its benchmark, the FTSE AW Financials index TR in euro<br />

terms. <strong>The</strong> <strong>Fund</strong> maintained significant exposure to banks in North<br />

America which benefited from the steady recovery in the US economy<br />

and bottoming out of the housing market. We also held positions in<br />

specialist financial companies and real estate companies globally, while<br />

being more cautious on European financials. Despite losing out<br />

somewhat on recovery rallies in European stocks, the <strong>Fund</strong> made<br />

strong returns from its equity portfolio and good returns from bond<br />

positions. Although the <strong>Fund</strong>’s risk adjusted return was satisfactory, its<br />

allocation across stocks and bonds meant it lagged the benchmark<br />

return, which is 100% equity weighted.<br />

Investment Outlook<br />

<strong>The</strong> outlook for global economic growth is hampered by efforts to<br />

reduce debt in the West and slowing growth in China. This has given<br />

rise to additional central bank action as this is seen as the only way to<br />

support economies. <strong>The</strong> extended low interest rate and investment<br />

return environment in the West combined with weak economies,<br />

particularly in Europe, is unhelpful for financial company earnings<br />

although supportive for valuations. Nevertheless the improving housing<br />

market in the US and interest rate cuts in emerging markets should help<br />

restore growth to more normal levels. <strong>The</strong> risk of a crisis in Europe looks<br />

to have been contained by the strong policy measures announced by<br />

the ECB but the region remains vulnerable to any political setbacks.<br />

We see opportunities for good returns from shares of niche businesses<br />

in the less economically-sensitive parts of the financial sector and from<br />

companies investing in growth regions of the world. We also see<br />

opportunities in companies which can reduce or eliminate valuation<br />

discounts through cost reduction initiatives, mergers and acquisitions or<br />

through reallocating capital away from uneconomic balance sheets (i.e.<br />

with unproductive or unprofitable assets). Real estate assets and<br />

corporate bonds should in our view continue to benefit from the<br />

additional liquidity provided by quantitative easing. Retail property in<br />

emerging markets remains an attractive way to gain exposure to rising<br />

consumer spending and increasing affluence. Selected financial<br />

company bonds still offer attractive yields with reducing risk as balance<br />

sheets are strengthened.<br />

Guy de Blonay<br />

30 October 2012<br />

54