The Jupiter Global Fund - Jupiter Asset Management

The Jupiter Global Fund - Jupiter Asset Management

The Jupiter Global Fund - Jupiter Asset Management

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

the jupiter global fund<br />

Statement of Net <strong>Asset</strong>s<br />

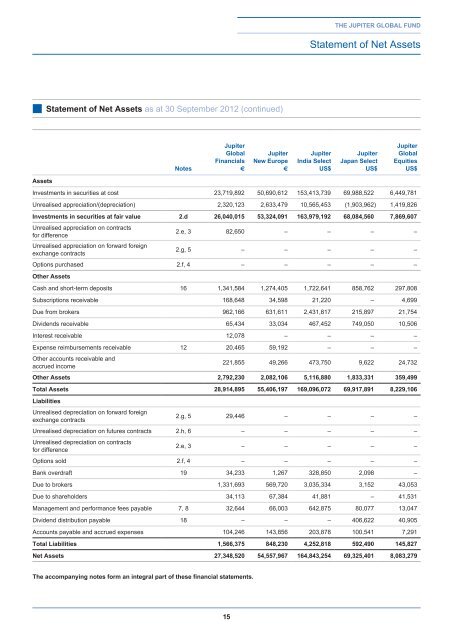

■■Statement of Net <strong>Asset</strong>s as at 30 September 2012 (continued)<br />

Notes<br />

<strong>Jupiter</strong><br />

<strong>Global</strong><br />

Financials<br />

€<br />

<strong>Jupiter</strong><br />

New Europe<br />

€<br />

<strong>Jupiter</strong><br />

India Select<br />

US$<br />

<strong>Jupiter</strong><br />

Japan Select<br />

US$<br />

<strong>Jupiter</strong><br />

<strong>Global</strong><br />

Equities<br />

US$<br />

<strong>Asset</strong>s<br />

Investments in securities at cost 23,719,892 50,690,612 153,413,739 69,988,522 6,449,781<br />

Unrealised appreciation/(depreciation) 2,320,123 2,633,479 10,565,453 (1,903,962) 1,419,826<br />

Investments in securities at fair value 2.d 26,040,015 53,324,091 163,979,192 68,084,560 7,869,607<br />

Unrealised appreciation on contracts<br />

for difference<br />

2.e, 3 82,650 – – – –<br />

Unrealised appreciation on forward foreign<br />

exchange contracts<br />

2.g, 5 – – – – –<br />

Options purchased 2.f, 4 – – – – –<br />

Other <strong>Asset</strong>s<br />

Cash and short-term deposits 16 1,341,584 1,274,405 1,722,641 858,762 297,808<br />

Subscriptions receivable 168,648 34,598 21,220 – 4,699<br />

Due from brokers 962,166 631,611 2,431,817 215,897 21,754<br />

Dividends receivable 65,434 33,034 467,452 749,050 10,506<br />

Interest receivable 12,078 – – – –<br />

Expense reimbursements receivable 12 20,465 59,192 – – –<br />

Other accounts receivable and<br />

accrued income<br />

221,855 49,266 473,750 9,622 24,732<br />

Other <strong>Asset</strong>s 2,792,230 2,082,106 5,116,880 1,833,331 359,499<br />

Total <strong>Asset</strong>s 28,914,895 55,406,197 169,096,072 69,917,891 8,229,106<br />

Liabilities<br />

Unrealised depreciation on forward foreign<br />

exchange contracts<br />

2.g, 5 29,446 – – – –<br />

Unrealised depreciation on futures contracts 2.h, 6 – – – – –<br />

Unrealised depreciation on contracts<br />

for difference<br />

2.e, 3 – – – – –<br />

Options sold 2.f, 4 – – – – –<br />

Bank overdraft 19 34,233 1,267 328,850 2,098 –<br />

Due to brokers 1,331,693 569,720 3,035,334 3,152 43,053<br />

Due to shareholders 34,113 67,384 41,881 – 41,531<br />

<strong>Management</strong> and performance fees payable 7, 8 32,644 66,003 642,875 80,077 13,047<br />

Dividend distribution payable 18 – – – 406,622 40,905<br />

Accounts payable and accrued expenses 104,246 143,856 203,878 100,541 7,291<br />

Total Liabilities 1,566,375 848,230 4,252,818 592,490 145,827<br />

Net <strong>Asset</strong>s 27,348,520 54,557,967 164,843,254 69,325,401 8,083,279<br />

<strong>The</strong> accompanying notes form an integral part of these financial statements.<br />

15