Annual report financial statements - Meridian Energy

Annual report financial statements - Meridian Energy

Annual report financial statements - Meridian Energy

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Notes to the Financial Statements FOR THE YEAR ENDED 30 JUNE 2011<br />

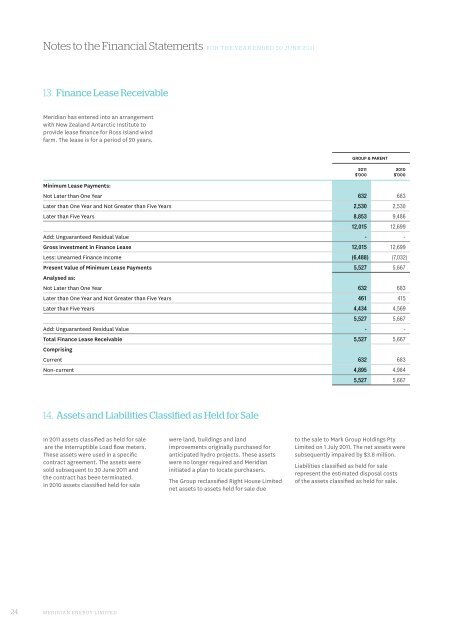

13. Finance Lease Receivable<br />

<strong>Meridian</strong> has entered into an arrangement<br />

with New Zealand Antarctic Institute to<br />

provide lease finance for Ross Island wind<br />

farm. The lease is for a period of 20 years.<br />

GROUP & PARENT<br />

Minimum Lease Payments:<br />

Not Later than One Year 632 683<br />

Later than One Year and Not Greater than Five Years 2,530 2,530<br />

Later than Five Years 8,853 9,486<br />

12,015 12,699<br />

Add: Unguaranteed Residual Value - -<br />

Gross Investment in Finance Lease 12,015 12,699<br />

Less: Unearned Finance Income (6,488) (7,032)<br />

Present Value of Minimum Lease Payments 5,527 5,667<br />

Analysed as:<br />

Not Later than One Year 632 683<br />

Later than One Year and Not Greater than Five Years 461 415<br />

Later than Five Years 4,434 4,569<br />

5,527 5,667<br />

Add: Unguaranteed Residual Value - -<br />

Total Finance Lease Receivable 5,527 5,667<br />

Comprising<br />

Current 632 683<br />

Non-current 4,895 4,984<br />

5,527 5,667<br />

2011<br />

$’000<br />

2010<br />

$’000<br />

14. Assets and Liabilities Classified as Held for Sale<br />

In 2011 assets classified as held for sale<br />

are the Interruptible Load flow meters.<br />

These assets were used in a specific<br />

contract agreement. The assets were<br />

sold subsequent to 30 June 2011 and<br />

the contract has been terminated.<br />

In 2010 assets classified held for sale<br />

were land, buildings and land<br />

improvements originally purchased for<br />

anticipated hydro projects. These assets<br />

were no longer required and <strong>Meridian</strong><br />

initiated a plan to locate purchasers.<br />

The Group reclassified Right House Limited<br />

net assets to assets held for sale due<br />

to the sale to Mark Group Holdings Pty<br />

Limited on 1 July 2011. The net assets were<br />

subsequently impaired by $3.8 million.<br />

Liabilities classified as held for sale<br />

represent the estimated disposal costs<br />

of the assets classified as held for sale.<br />

24 MERIDIAN ENERGY LIMITED