Annual report financial statements - Meridian Energy

Annual report financial statements - Meridian Energy

Annual report financial statements - Meridian Energy

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Notes to the Financial Statements FOR THE YEAR ENDED 30 JUNE 2011<br />

25. Financial Instruments (continued)<br />

c) Cash Flow Hedging<br />

Cash Flow Hedges – CFDs<br />

<strong>Meridian</strong> currently sells and purchases<br />

electricity at spot prices from the market<br />

exposing it to changes in the price of<br />

electricity. As described in note 24 –<br />

Financial Risk Management, it is Group<br />

policy to manage this risk on a net basis<br />

by entering into CFDs which swap receipt<br />

(payment) of spot electricity prices based<br />

on a specified volume of electricity with<br />

fixed electricity payments (receipts) for<br />

an equivalent volume. Cash settlements<br />

are made on these instruments on a<br />

monthly basis and impact income on an<br />

accrual basis. As discussed in Note 24 –<br />

Financial Risk Management, for accounting<br />

purposes, from 1 January 2009 all of the<br />

CFDs are classified as held for trading with<br />

movements in fair value recognised in<br />

the income statement. Upon cessation of<br />

hedge accounting the balance in the cash<br />

flow hedge reserve is amortised as contract<br />

volumes expire over the remaining life of<br />

the respective contracts.<br />

Cash Flow Hedges – FECs<br />

<strong>Meridian</strong> hedges highly probable forecast<br />

capital expenditures through a combination<br />

of forward exchange contracts and<br />

foreign currency options. The cash flows<br />

associated with these contracts are timed<br />

to mature when payment for the capital<br />

expenditure is made. The contracts<br />

range in maturity from 0 to 36 months.<br />

For contracts designated as hedges for<br />

accounting purposes, when the cash flows<br />

occur <strong>Meridian</strong> adjusts the carrying value<br />

of the asset acquired.<br />

Cash Flow Hedges – CCIRSs<br />

<strong>Meridian</strong> hedges its foreign currency<br />

exposure on foreign currency denominated<br />

debt using CCIRSs in a combination of<br />

cash flow and fair value hedges. The cash<br />

flow hedge component represents the<br />

expected foreign currency cash flows on<br />

the debt relating to the credit margin paid<br />

by <strong>Meridian</strong> on the borrowings. Cash flows<br />

relating to the debt and the CCIRSs are<br />

settled quarterly for the NZ cash flows and<br />

semi-annually for the foreign currency<br />

(US and Australian dollars). Income is<br />

affected by these settlements on an<br />

accrual basis.<br />

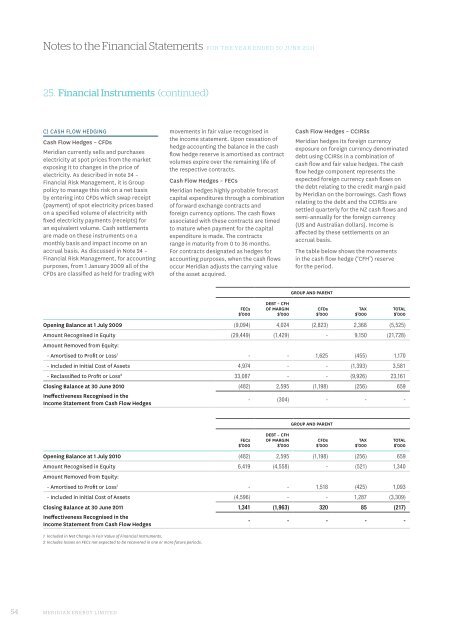

The table below shows the movements<br />

in the cash flow hedge (‘CFH’) reserve<br />

for the period.<br />

GROUP AND PARENT<br />

FECs<br />

$’000<br />

DEBT – CFH<br />

OF MARGIN<br />

$’000<br />

CFDs<br />

$’000<br />

TAX<br />

$’000<br />

TOTAL<br />

$’000<br />

Opening Balance at 1 July 2009 (9,094) 4,024 (2,823) 2,368 (5,525)<br />

Amount Recognised in Equity (29,449) (1,429) - 9,150 (21,728)<br />

Amount Removed from Equity:<br />

- Amortised to Profit or Loss 1 - - 1,625 (455) 1,170<br />

- Included in Initial Cost of Assets 4,974 - - (1,393) 3,581<br />

- Reclassified to Profit or Loss 2 33,087 - - (9,926) 23,161<br />

Closing Balance at 30 June 2010 (482) 2,595 (1,198) (256) 659<br />

Ineffectiveness Recognised in the<br />

Income Statement from Cash Flow Hedges<br />

- (304) - - -<br />

GROUP AND PARENT<br />

FECs<br />

$’000<br />

DEBT – CFH<br />

OF MARGIN<br />

$’000<br />

CFDs<br />

$’000<br />

TAX<br />

$’000<br />

TOTAL<br />

$’000<br />

Opening Balance at 1 July 2010 (482) 2,595 (1,198) (256) 659<br />

Amount Recognised in Equity 6,419 (4,558) - (521) 1,340<br />

Amount Removed from Equity:<br />

- Amortised to Profit or Loss 1 - - 1,518 (425) 1,093<br />

- Included in Initial Cost of Assets (4,596) - - 1,287 (3,309)<br />

Closing Balance at 30 June 2011 1,341 (1,963) 320 85 (217)<br />

Ineffectiveness Recognised in the<br />

Income Statement from Cash Flow Hedges<br />

- - - - -<br />

1 Included in Net Change in Fair Value of Financial Instruments.<br />

2 Includes losses on FECs not expected to be recovered in one or more future periods.<br />

54 MERIDIAN ENERGY LIMITED