Annual report financial statements - Meridian Energy

Annual report financial statements - Meridian Energy

Annual report financial statements - Meridian Energy

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

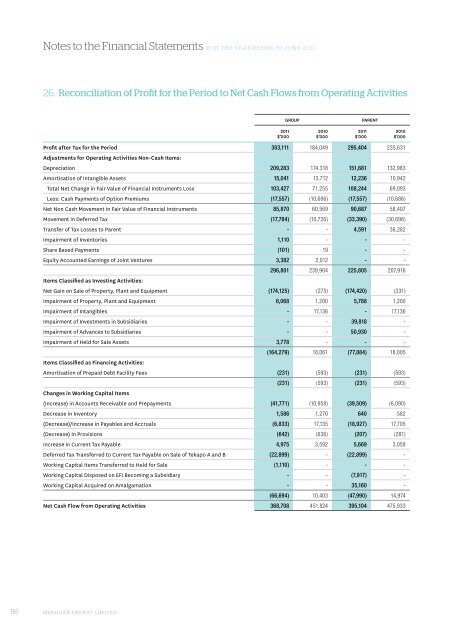

Notes to the Financial Statements FOR THE YEAR ENDED 30 JUNE 2011<br />

26. Reconciliation of Profit for the Period to Net Cash Flows from Operating Activities<br />

GROUP<br />

PARENT<br />

Profit after Tax for the Period 303,111 184,049 295,404 235,631<br />

Adjustments for Operating Activities Non-Cash Items:<br />

Depreciation 209,283 174,318 151,681 132,983<br />

Amortisation of Intangible Assets 15,041 13,712 12,236 10,942<br />

Total Net Change in Fair Value of Financial Instruments Loss 103,427 71,255 108,244 69,093<br />

Less: Cash Payments of Option Premiums (17,557) (10,686) (17,557) (10,686)<br />

Net Non Cash Movement in Fair Value of Financial Instruments 85,870 60,569 90,687 58,407<br />

Movement in Deferred Tax (17,784) (10,726) (33,390) (30,698)<br />

Transfer of Tax Losses to Parent - - 4,591 36,282<br />

Impairment of Inventories 1,110 - - -<br />

Share Based Payments (101) 19 - -<br />

Equity Accounted Earnings of Joint Ventures 3,382 2,012 - -<br />

296,801 239,904 225,805 207,916<br />

Items Classified as Investing Activities:<br />

Net Gain on Sale of Property, Plant and Equipment (174,125) (275) (174,420) (331)<br />

Impairment of Property, Plant and Equipment 6,068 1,200 5,788 1,200<br />

Impairment of Intangibles - 17,136 - 17,136<br />

Impairment of Investments in Subsidiaries - - 39,818 -<br />

Impairment of Advances to Subsidiaries - - 50,930 -<br />

Impairment of Held for Sale Assets 3,778 - - -<br />

(164,279) 18,061 (77,884) 18,005<br />

Items Classified as Financing Activities:<br />

Amortisation of Prepaid Debt Facility Fees (231) (593) (231) (593)<br />

(231) (593) (231) (593)<br />

Changes in Working Capital Items<br />

(Increase) in Accounts Receivable and Prepayments (41,771) (10,958) (39,509) (6,090)<br />

Decrease in Inventory 1,586 1,270 640 582<br />

(Decrease)/Increase in Payables and Accruals (6,833) 17,135 (18,927) 17,705<br />

(Decrease) in Provisions (642) (636) (207) (281)<br />

Increase in Current Tax Payable 4,975 3,592 5,669 3,058<br />

Deferred Tax Transferred to Current Tax Payable on Sale of Tekapo A and B (22,899) - (22,899) -<br />

Working Capital Items Transferred to Held for Sale (1,110) - - -<br />

Working Capital Disposed on EFI Becoming a Subsidiary - - (7,917) -<br />

Working Capital Acquired on Amalgamation - - 35,160 -<br />

(66,694) 10,403 (47,990) 14,974<br />

Net Cash Flow from Operating Activities 368,708 451,824 395,104 475,933<br />

2011<br />

$’000<br />

2010<br />

$’000<br />

2011<br />

$’000<br />

2010<br />

$’000<br />

56 MERIDIAN ENERGY LIMITED