Annual report financial statements - Meridian Energy

Annual report financial statements - Meridian Energy

Annual report financial statements - Meridian Energy

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Notes to the Financial Statements FOR THE YEAR ENDED 30 JUNE 2011<br />

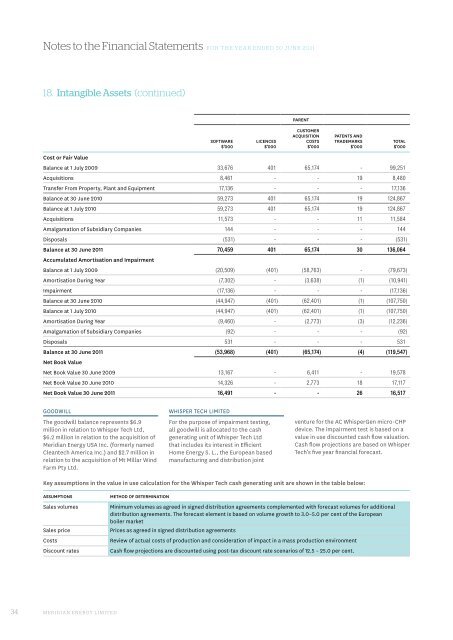

18. Intangible Assets (continued)<br />

PARENT<br />

SOFTWARE<br />

$’000<br />

LICENCES<br />

$’000<br />

CUSTOMER<br />

ACQUISITION<br />

COSTS<br />

$’000<br />

PATENTS AND<br />

TRADEMARKS<br />

$’000<br />

TOTAL<br />

$’000<br />

Cost or Fair Value<br />

Balance at 1 July 2009 33,676 401 65,174 - 99,251<br />

Acquisitions 8,461 - - 19 8,480<br />

Transfer From Property, Plant and Equipment 17,136 - - - 17,136<br />

Balance at 30 June 2010 59,273 401 65,174 19 124,867<br />

Balance at 1 July 2010 59,273 401 65,174 19 124,867<br />

Acquisitions 11,573 - - 11 11,584<br />

Amalgamation of Subsidiary Companies 144 - - - 144<br />

Disposals (531) - - - (531)<br />

Balance at 30 June 2011 70,459 401 65,174 30 136,064<br />

Accumulated Amortisation and Impairment<br />

Balance at 1 July 2009 (20,509) (401) (58,763) - (79,673)<br />

Amortisation During Year (7,302) - (3,638) (1) (10,941)<br />

Impairment (17,136) - - - (17,136)<br />

Balance at 30 June 2010 (44,947) (401) (62,401) (1) (107,750)<br />

Balance at 1 July 2010 (44,947) (401) (62,401) (1) (107,750)<br />

Amortisation During Year (9,460) - (2,773) (3) (12,236)<br />

Amalgamation of Subsidiary Companies (92) - - - (92)<br />

Disposals 531 - - - 531<br />

Balance at 30 June 2011 (53,968) (401) (65,174) (4) (119,547)<br />

Net Book Value<br />

Net Book Value 30 June 2009 13,167 - 6,411 - 19,578<br />

Net Book Value 30 June 2010 14,326 - 2,773 18 17,117<br />

Net Book Value 30 June 2011 16,491 - - 26 16,517<br />

Goodwill<br />

The goodwill balance represents $6.9<br />

million in relation to Whisper Tech Ltd,<br />

$6.2 million in relation to the acquisition of<br />

<strong>Meridian</strong> <strong>Energy</strong> USA Inc. (formerly named<br />

Cleantech America Inc.) and $2.7 million in<br />

relation to the acquisition of Mt Millar Wind<br />

Farm Pty Ltd.<br />

Whisper Tech LIMITED<br />

For the purpose of impairment testing,<br />

all goodwill is allocated to the cash<br />

generating unit of Whisper Tech Ltd<br />

that includes its interest in Efficient<br />

Home <strong>Energy</strong> S. L., the European based<br />

manufacturing and distribution joint<br />

venture for the AC WhisperGen micro-CHP<br />

device. The impairment test is based on a<br />

value in use discounted cash flow valuation.<br />

Cash flow projections are based on Whisper<br />

Tech’s five year <strong>financial</strong> forecast.<br />

Key assumptions in the value in use calculation for the Whisper Tech cash generating unit are shown in the table below:<br />

ASSUMPTIONS<br />

Sales volumes<br />

Sales price<br />

Costs<br />

Discount rates<br />

METHOD OF DETERMINATION<br />

Minimum volumes as agreed in signed distribution agreements complemented with forecast volumes for additional<br />

distribution agreements. The forecast element is based on volume growth to 3.0–5.0 per cent of the European<br />

boiler market<br />

Prices as agreed in signed distribution agreements<br />

Review of actual costs of production and consideration of impact in a mass production environment<br />

Cash flow projections are discounted using post-tax discount rate scenarios of 12.5 – 25.0 per cent.<br />

34 MERIDIAN ENERGY LIMITED