Annual report financial statements - Meridian Energy

Annual report financial statements - Meridian Energy

Annual report financial statements - Meridian Energy

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Notes to the Financial Statements FOR THE YEAR ENDED 30 JUNE 2011<br />

22. Deferred Tax (continued)<br />

Some Group carried forward tax losses<br />

have not been recognised as deferred tax<br />

assets as Management have assessed that<br />

it is not probable that future taxable profits<br />

will be available against which the benefit<br />

of the losses can be utilised. These total<br />

$11.5 million (2010: $7.3 million). For tax<br />

purposes these losses begin to expire<br />

in 2029.<br />

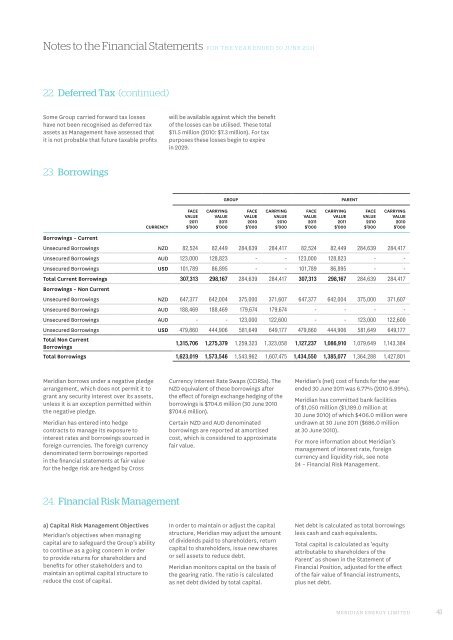

23. Borrowings<br />

GROUP<br />

PARENT<br />

CURRENCY<br />

FACE<br />

VALUE<br />

2011<br />

$’000<br />

CARRYING<br />

VALUE<br />

2011<br />

$’000<br />

FACE<br />

VALUE<br />

2010<br />

$’000<br />

CARRYING<br />

VALUE<br />

2010<br />

$’000<br />

FACE<br />

VALUE<br />

2011<br />

$’000<br />

CARRYING<br />

VALUE<br />

2011<br />

$’000<br />

FACE<br />

VALUE<br />

2010<br />

$’000<br />

CARRYING<br />

VALUE<br />

2010<br />

$’000<br />

Borrowings – Current<br />

Unsecured Borrowings NZD 82,524 82,449 284,639 284,417 82,524 82,449 284,639 284,417<br />

Unsecured Borrowings AUD 123,000 128,823 - - 123,000 128,823 - -<br />

Unsecured Borrowings USD 101,789 86,895 - - 101,789 86,895 - -<br />

Total Current Borrowings 307,313 298,167 284,639 284,417 307,313 298,167 284,639 284,417<br />

Borrowings – Non Current<br />

Unsecured Borrowings NZD 647,377 642,004 375,000 371,607 647,377 642,004 375,000 371,607<br />

Unsecured Borrowings AUD 188,469 188,469 179,674 179,674 - - - -<br />

Unsecured Borrowings AUD - - 123,000 122,600 - - 123,000 122,600<br />

Unsecured Borrowings USD 479,860 444,906 581,649 649,177 479,860 444,906 581,649 649,177<br />

Total Non Current<br />

Borrowings<br />

1,315,706 1,275,379 1,259,323 1,323,058 1,127,237 1,086,910 1,079,649 1,143,384<br />

Total Borrowings 1,623,019 1,573,546 1,543,962 1,607,475 1,434,550 1,385,077 1,364,288 1,427,801<br />

<strong>Meridian</strong> borrows under a negative pledge<br />

arrangement, which does not permit it to<br />

grant any security interest over its assets,<br />

unless it is an exception permitted within<br />

the negative pledge.<br />

<strong>Meridian</strong> has entered into hedge<br />

contracts to manage its exposure to<br />

interest rates and borrowings sourced in<br />

foreign currencies. The foreign currency<br />

denominated term borrowings <strong>report</strong>ed<br />

in the <strong>financial</strong> <strong>statements</strong> at fair value<br />

for the hedge risk are hedged by Cross<br />

Currency Interest Rate Swaps (CCIRSs). The<br />

NZD equivalent of these borrowings after<br />

the effect of foreign exchange hedging of the<br />

borrowings is $704.6 million (30 June 2010<br />

$704.6 million).<br />

Certain NZD and AUD denominated<br />

borrowings are <strong>report</strong>ed at amortised<br />

cost, which is considered to approximate<br />

fair value.<br />

<strong>Meridian</strong>’s (net) cost of funds for the year<br />

ended 30 June 2011 was 6.77% (2010 6.99%).<br />

<strong>Meridian</strong> has committed bank facilities<br />

of $1,050 million ($1,189.0 million at<br />

30 June 2010) of which $406.0 million were<br />

undrawn at 30 June 2011 ($686.0 million<br />

at 30 June 2010).<br />

For more information about <strong>Meridian</strong>’s<br />

management of interest rate, foreign<br />

currency and liquidity risk, see note<br />

24 – Financial Risk Management.<br />

24. Financial Risk Management<br />

a) Capital Risk Management Objectives<br />

<strong>Meridian</strong>’s objectives when managing<br />

capital are to safeguard the Group’s ability<br />

to continue as a going concern in order<br />

to provide returns for shareholders and<br />

benefits for other stakeholders and to<br />

maintain an optimal capital structure to<br />

reduce the cost of capital.<br />

In order to maintain or adjust the capital<br />

structure, <strong>Meridian</strong> may adjust the amount<br />

of dividends paid to shareholders, return<br />

capital to shareholders, issue new shares<br />

or sell assets to reduce debt.<br />

<strong>Meridian</strong> monitors capital on the basis of<br />

the gearing ratio. The ratio is calculated<br />

as net debt divided by total capital.<br />

Net debt is calculated as total borrowings<br />

less cash and cash equivalents.<br />

Total capital is calculated as ‘equity<br />

attributable to shareholders of the<br />

Parent’ as shown in the Statement of<br />

Financial Position, adjusted for the effect<br />

of the fair value of <strong>financial</strong> instruments,<br />

plus net debt.<br />

MERIDIAN ENERGY LIMITED<br />

41