Rolf Group International Financial Reporting ... - Irish Stock Exchange

Rolf Group International Financial Reporting ... - Irish Stock Exchange

Rolf Group International Financial Reporting ... - Irish Stock Exchange

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Rolf</strong> <strong>Group</strong><br />

Notes to the Consolidated <strong>Financial</strong> Statements � 31 December 2006<br />

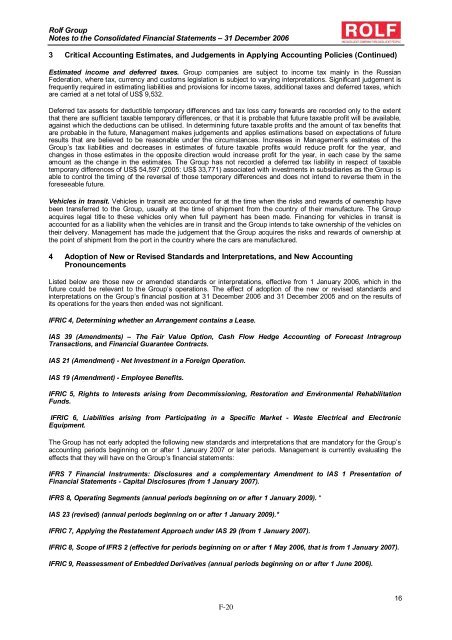

3 Critical Accounting Estimates, and Judgements in Applying Accounting Policies (Continued)<br />

Estimated income and deferred taxes. <strong>Group</strong> companies are subject to income tax mainly in the Russian<br />

Federation, where tax, currency and customs legislation is subject to varying interpretations. Significant judgement is<br />

frequently required in estimating liabilities and provisions for income taxes, additional taxes and deferred taxes, which<br />

are carried at a net total of US$ 9,532.<br />

Deferred tax assets for deductible temporary differences and tax loss carry forwards are recorded only to the extent<br />

that there are sufficient taxable temporary differences, or that it is probable that future taxable profit will be available,<br />

against which the deductions can be utilised. In determining future taxable profits and the amount of tax benefits that<br />

are probable in the future, Management makes judgements and applies estimations based on expectations of future<br />

results that are believed to be reasonable under the circumstances. Increases in Management‘s estimates of the<br />

<strong>Group</strong>’s tax liabilities and decreases in estimates of future taxable profits would reduce profit for the year, and<br />

changes in those estimates in the opposite direction would increase profit for the year, in each case by the same<br />

amount as the change in the estimates. The <strong>Group</strong> has not recorded a deferred tax liability in respect of taxable<br />

temporary differences of US$ 54,597 (2005: US$ 33,771) associated with investments in subsidiaries as the <strong>Group</strong> is<br />

able to control the timing of the reversal of those temporary differences and does not intend to reverse them in the<br />

foreseeable future.<br />

Vehicles in transit. Vehicles in transit are accounted for at the time when the risks and rewards of ownership have<br />

been transferred to the <strong>Group</strong>, usually at the time of shipment from the country of their manufacture. The <strong>Group</strong><br />

acquires legal title to these vehicles only when full payment has been made. Financing for vehicles in transit is<br />

accounted for as a liability when the vehicles are in transit and the <strong>Group</strong> intends to take ownership of the vehicles on<br />

their delivery. Management has made the judgement that the <strong>Group</strong> acquires the risks and rewards of ownership at<br />

the point of shipment from the port in the country where the cars are manufactured.<br />

4 Adoption of New or Revised Standards and Interpretations, and New Accounting<br />

Pronouncements<br />

Listed below are those new or amended standards or interpretations, effective from 1 January 2006, which in the<br />

future could be relevant to the <strong>Group</strong>’s operations. The effect of adoption of the new or revised standards and<br />

interpretations on the <strong>Group</strong>’s financial position at 31 December 2006 and 31 December 2005 and on the results of<br />

its operations for the years then ended was not significant.<br />

IFRIC 4, Determining whether an Arrangement contains a Lease.<br />

IAS 39 (Amendments) � The Fair Value Option, Cash Flow Hedge Accounting of Forecast Intragroup<br />

Transactions, and <strong>Financial</strong> Guarantee Contracts.<br />

IAS 21 (Amendment) - Net Investment in a Foreign Operation.<br />

IAS 19 (Amendment) - Employee Benefits.<br />

IFRIC 5, Rights to Interests arising from Decommissioning, Restoration and Environmental Rehabilitation<br />

Funds.<br />

IFRIC 6, Liabilities arising from Participating in a Specific Market - Waste Electrical and Electronic<br />

Equipment.<br />

The <strong>Group</strong> has not early adopted the following new standards and interpretations that are mandatory for the <strong>Group</strong>’s<br />

accounting periods beginning on or after 1 January 2007 or later periods. Management is currently evaluating the<br />

effects that they will have on the <strong>Group</strong>’s financial statements:<br />

IFRS 7 <strong>Financial</strong> Instruments: Disclosures and a complementary Amendment to IAS 1 Presentation of<br />

<strong>Financial</strong> Statements - Capital Disclosures (from 1 January 2007).<br />

IFRS 8, Operating Segments (annual periods beginning on or after 1 January 2009). *<br />

IAS 23 (revised) (annual periods beginning on or after 1 January 2009).*<br />

IFRIC 7, Applying the Restatement Approach under IAS 29 (from 1 January 2007).<br />

IFRIC 8, Scope of IFRS 2 (effective for periods beginning on or after 1 May 2006, that is from 1 January 2007).<br />

IFRIC 9, Reassessment of Embedded Derivatives (annual periods beginning on or after 1 June 2006).<br />

F-20<br />

16