Rolf Group International Financial Reporting ... - Irish Stock Exchange

Rolf Group International Financial Reporting ... - Irish Stock Exchange

Rolf Group International Financial Reporting ... - Irish Stock Exchange

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Rolf</strong> <strong>Group</strong><br />

Notes to the Consolidated <strong>Financial</strong> Statements � 31 December 2006<br />

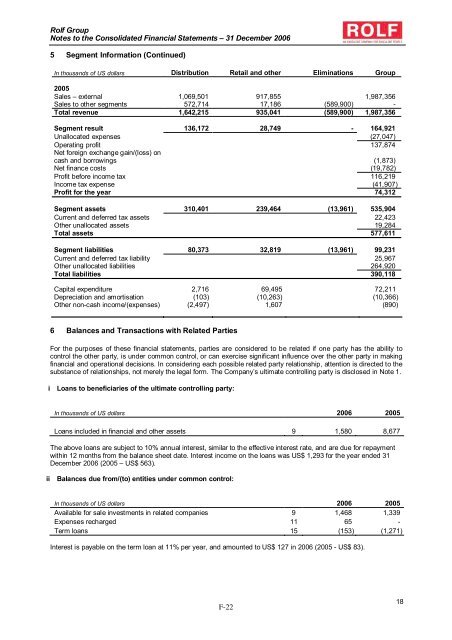

5 Segment Information (Continued)<br />

In thousands of US dollars Distribution Retail and other Eliminations <strong>Group</strong><br />

2005<br />

Sales – external 1,069,501 917,855 1,987,356<br />

Sales to other segments 572,714 17,186 (589,900) -<br />

Total revenue 1,642,215 935,041 (589,900) 1,987,356<br />

Segment result 136,172 28,749 - 164,921<br />

Unallocated expenses (27,047)<br />

Operating profit 137,874<br />

Net foreign exchange gain/(loss) on<br />

cash and borrowings (1,873)<br />

Net finance costs (19,782)<br />

Profit before income tax 116,219<br />

Income tax expense (41,907)<br />

Profit for the year 74,312<br />

Segment assets 310,401 239,464 (13,961) 535,904<br />

Current and deferred tax assets 22,423<br />

Other unallocated assets 19,284<br />

Total assets 577,611<br />

Segment liabilities 80,373 32,819 (13,961) 99,231<br />

Current and deferred tax liability 25,967<br />

Other unallocated liabilities 264,920<br />

Total liabilities 390,118<br />

Capital expenditure 2,716 69,495 72,211<br />

Depreciation and amortisation (103) (10,263) (10,366)<br />

Other non-cash income/(expenses) (2,497) 1,607 (890)<br />

6 Balances and Transactions with Related Parties<br />

For the purposes of these financial statements, parties are considered to be related if one party has the ability to<br />

control the other party, is under common control, or can exercise significant influence over the other party in making<br />

financial and operational decisions. In considering each possible related party relationship, attention is directed to the<br />

substance of relationships, not merely the legal form. The Company’s ultimate controlling party is disclosed in Note 1.<br />

i Loans to beneficiaries of the ultimate controlling party:<br />

In thousands of US dollars 2006 2005<br />

Loans included in financial and other assets 9 1,580 8,677<br />

The above loans are subject to 10% annual interest, similar to the effective interest rate, and are due for repayment<br />

within 12 months from the balance sheet date. Interest income on the loans was US$ 1,293 for the year ended 31<br />

December 2006 (2005 – US$ 563).<br />

ii Balances due from/(to) entities under common control:<br />

In thousands of US dollars 2006 2005<br />

Available for sale investments in related companies 9 1,468 1,339<br />

Expenses recharged 11 65 -<br />

Term loans 15 (153) (1,271)<br />

Interest is payable on the term loan at 11% per year, and amounted to US$ 127 in 2006 (2005 - US$ 83).<br />

F-22<br />

18