Rolf Group International Financial Reporting ... - Irish Stock Exchange

Rolf Group International Financial Reporting ... - Irish Stock Exchange

Rolf Group International Financial Reporting ... - Irish Stock Exchange

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

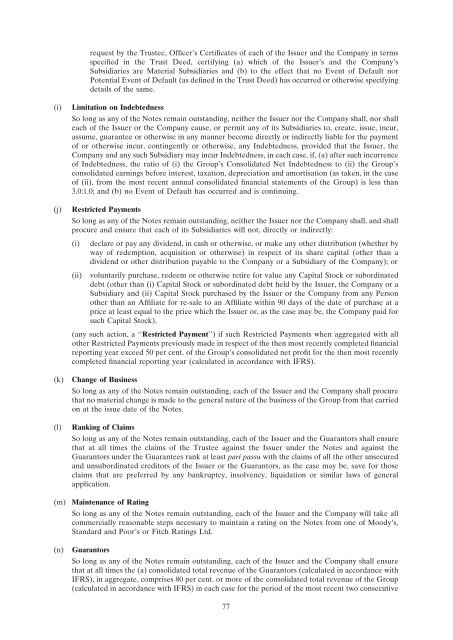

equest by the Trustee, Officer’s Certificates of each of the Issuer and the Company in terms<br />

specified in the Trust Deed, certifying (a) which of the Issuer’s and the Company’s<br />

Subsidiaries are Material Subsidiaries and (b) to the effect that no Event of Default nor<br />

Potential Event of Default (as defined in the Trust Deed) has occurred or otherwise specifying<br />

details of the same.<br />

(i) Limitation on Indebtedness<br />

So long as any of the Notes remain outstanding, neither the Issuer nor the Company shall, nor shall<br />

each of the Issuer or the Company cause, or permit any of its Subsidiaries to, create, issue, incur,<br />

assume, guarantee or otherwise in any manner become directly or indirectly liable for the payment<br />

of or otherwise incur, contingently or otherwise, any Indebtedness, provided that the Issuer, the<br />

Company and any such Subsidiary may incur Indebtedness, in each case, if, (a) after such incurrence<br />

of Indebtedness, the ratio of (i) the <strong>Group</strong>’s Consolidated Net Indebtedness to (ii) the <strong>Group</strong>’s<br />

consolidated earnings before interest, taxation, depreciation and amortisation (as taken, in the case<br />

of (ii), from the most recent annual consolidated financial statements of the <strong>Group</strong>) is less than<br />

3.0:1.0; and (b) no Event of Default has occurred and is continuing.<br />

(j) Restricted Payments<br />

So long as any of the Notes remain outstanding, neither the Issuer nor the Company shall, and shall<br />

procure and ensure that each of its Subsidiaries will not, directly or indirectly:<br />

(i) declare or pay any dividend, in cash or otherwise, or make any other distribution (whether by<br />

way of redemption, acquisition or otherwise) in respect of its share capital (other than a<br />

dividend or other distribution payable to the Company or a Subsidiary of the Company); or<br />

(ii) voluntarily purchase, redeem or otherwise retire for value any Capital <strong>Stock</strong> or subordinated<br />

debt (other than (i) Capital <strong>Stock</strong> or subordinated debt held by the Issuer, the Company or a<br />

Subsidiary and (ii) Capital <strong>Stock</strong> purchased by the Issuer or the Company from any Person<br />

other than an Affiliate for re-sale to an Affiliate within 90 days of the date of purchase at a<br />

price at least equal to the price which the Issuer or, as the case may be, the Company paid for<br />

such Capital <strong>Stock</strong>),<br />

(any such action, a ‘‘Restricted Payment’’) if such Restricted Payments when aggregated with all<br />

other Restricted Payments previously made in respect of the then most recently completed financial<br />

reporting year exceed 50 per cent. of the <strong>Group</strong>’s consolidated net profit for the then most recently<br />

completed financial reporting year (calculated in accordance with IFRS).<br />

(k) Change of Business<br />

So long as any of the Notes remain outstanding, each of the Issuer and the Company shall procure<br />

that no material change is made to the general nature of the business of the <strong>Group</strong> from that carried<br />

on at the issue date of the Notes.<br />

(l) Ranking of Claims<br />

So long as any of the Notes remain outstanding, each of the Issuer and the Guarantors shall ensure<br />

that at all times the claims of the Trustee against the Issuer under the Notes and against the<br />

Guarantors under the Guarantees rank at least pari passu with the claims of all the other unsecured<br />

and unsubordinated creditors of the Issuer or the Guarantors, as the case may be, save for those<br />

claims that are preferred by any bankruptcy, insolvency, liquidation or similar laws of general<br />

application.<br />

(m) Maintenance of Rating<br />

So long as any of the Notes remain outstanding, each of the Issuer and the Company will take all<br />

commercially reasonable steps necessary to maintain a rating on the Notes from one of Moody’s,<br />

Standard and Poor’s or Fitch Ratings Ltd.<br />

(n) Guarantors<br />

So long as any of the Notes remain outstanding, each of the Issuer and the Company shall ensure<br />

that at all times the (a) consolidated total revenue of the Guarantors (calculated in accordance with<br />

IFRS), in aggregate, comprises 80 per cent. or more of the consolidated total revenue of the <strong>Group</strong><br />

(calculated in accordance with IFRS) in each case for the period of the most recent two consecutive<br />

77