Rolf Group International Financial Reporting ... - Irish Stock Exchange

Rolf Group International Financial Reporting ... - Irish Stock Exchange

Rolf Group International Financial Reporting ... - Irish Stock Exchange

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Rolf</strong> <strong>Group</strong><br />

Notes to the Consolidated <strong>Financial</strong> Statements � 31 December 2006<br />

4 Adoption of New or Revised Standards and Interpretations, and New Accounting<br />

Pronouncements (Continued)<br />

IFRIC 10, Interim <strong>Financial</strong> <strong>Reporting</strong> and Impairment (annual periods beginning on or after 1 November<br />

2006).<br />

IFRIC 11, IFRS 2�<strong>Group</strong> and Treasury Share Transactions (effective for annual periods beginning on or after<br />

1 March 2007).<br />

IFRIC 12, Service Concession Arrangements (annual periods beginning on or after 1 January 2008).*<br />

(* not adopted by the European Union at the date of issuing these financial statements).<br />

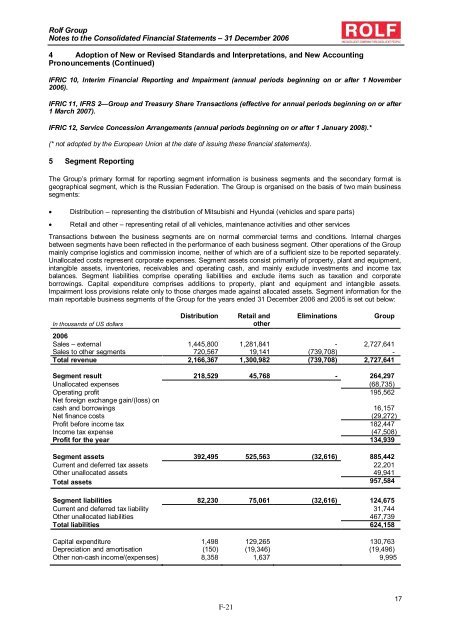

5 Segment <strong>Reporting</strong><br />

The <strong>Group</strong>’s primary format for reporting segment information is business segments and the secondary format is<br />

geographical segment, which is the Russian Federation. The <strong>Group</strong> is organised on the basis of two main business<br />

segments:<br />

• Distribution – representing the distribution of Mitsubishi and Hyundai (vehicles and spare parts)<br />

• Retail and other – representing retail of all vehicles, maintenance activities and other services<br />

Transactions between the business segments are on normal commercial terms and conditions. Internal charges<br />

between segments have been reflected in the performance of each business segment. Other operations of the <strong>Group</strong><br />

mainly comprise logistics and commission income, neither of which are of a sufficient size to be reported separately.<br />

Unallocated costs represent corporate expenses. Segment assets consist primarily of property, plant and equipment,<br />

intangible assets, inventories, receivables and operating cash, and mainly exclude investments and income tax<br />

balances. Segment liabilities comprise operating liabilities and exclude items such as taxation and corporate<br />

borrowings. Capital expenditure comprises additions to property, plant and equipment and intangible assets.<br />

Impairment loss provisions relate only to those charges made against allocated assets. Segment information for the<br />

main reportable business segments of the <strong>Group</strong> for the years ended 31 December 2006 and 2005 is set out below:<br />

In thousands of US dollars<br />

Distribution Retail and<br />

other<br />

Eliminations <strong>Group</strong><br />

2006<br />

Sales – external 1,445,800 1,281,841 - 2,727,641<br />

Sales to other segments 720,567 19,141 (739,708) -<br />

Total revenue 2,166,367 1,300,982 (739,708) 2,727,641<br />

Segment result 218,529 45,768 - 264,297<br />

Unallocated expenses (68,735)<br />

Operating profit 195,562<br />

Net foreign exchange gain/(loss) on<br />

cash and borrowings 16,157<br />

Net finance costs (29,272)<br />

Profit before income tax 182,447<br />

Income tax expense (47,508)<br />

Profit for the year 134,939<br />

Segment assets 392,495 525,563 (32,616) 885,442<br />

Current and deferred tax assets 22,201<br />

Other unallocated assets 49,941<br />

Total assets 957,584<br />

Segment liabilities 82,230 75,061 (32,616) 124,675<br />

Current and deferred tax liability 31,744<br />

Other unallocated liabilities 467,739<br />

Total liabilities 624,158<br />

Capital expenditure 1,498 129,265 130,763<br />

Depreciation and amortisation (150) (19,346) (19,496)<br />

Other non-cash income/(expenses) 8,358 1,637 9,995<br />

F-21<br />

17