Towards Operational Excellence and Financial Sustainability

Towards Operational Excellence and Financial Sustainability

Towards Operational Excellence and Financial Sustainability

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

These consolidated fi nancial statements are originally issued in Indonesian language.<br />

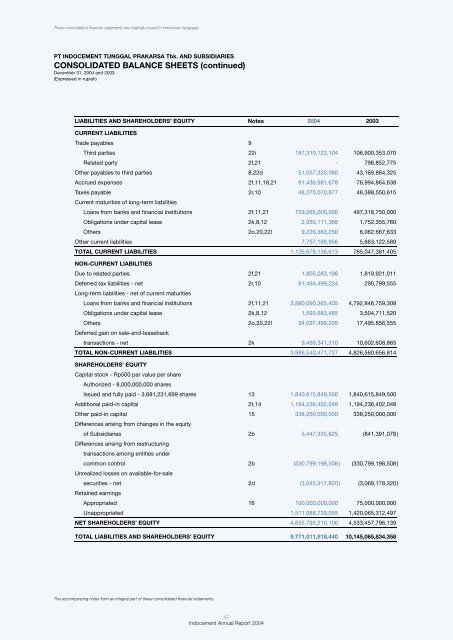

PT INDOCEMENT TUNGGAL PRAKARSA Tbk. AND SUBSIDIARIES<br />

CONSOLIDATED BALANCE SHEETS (continued)<br />

December 31, 2004 <strong>and</strong> 2003<br />

(Expressed in rupiah)<br />

LIABILITIES AND SHAREHOLDERS’ EQUITY Notes 2004 2003<br />

CURRENT LIABILITIES<br />

Trade payables 9<br />

Third parties 22i 187,310,122,104 106,900,353,070<br />

Related party 2f,21 - 796,852,775<br />

Other payables to third parties 8,22d 51,057,320,380 43,169,864,325<br />

Accrued expenses 2f,11,18,21 91,436,981,678 76,994,864,638<br />

Taxes payable 2r,10 48,275,070,877 46,388,550,615<br />

Current maturities of long-term liabilities<br />

Loans from banks <strong>and</strong> financial institutions 2f,11,21 729,265,000,000 497,318,750,000<br />

Obligations under capital lease 2k,8,12 2,350,111,368 1,752,355,760<br />

Others 2o,20,22l 9,226,363,250 6,062,667,633<br />

Other current liabilities 7,757,166,956 5,663,122,589<br />

TOTAL CURRENT LIABILITIES 1,126,678,136,613 785,047,381,405<br />

NON-CURRENT LIABILITIES<br />

Due to related parties 2f,21 1,805,083,198 1,819,921,011<br />

Deferred tax liabilities - net 2r,10 61,494,499,224 290,799,555<br />

Long-term liabilities - net of current maturities<br />

Loans from banks <strong>and</strong> financial institutions 2f,11,21 3,880,090,365,405 4,792,846,759,308<br />

Obligations under capital lease 2k,8,12 1,593,683,485 3,504,711,520<br />

Others 2o,20,22l 34,097,499,205 17,495,856,555<br />

Deferred gain on sale-<strong>and</strong>-leaseback<br />

transactions - net 2k 9,459,341,210 10,602,608,865<br />

TOTAL NON-CURRENT LIABILITIES 3,988,540,471,727 4,826,560,656,814<br />

SHAREHOLDERS’ EQUITY<br />

Capital stock - Rp500 par value per share<br />

Authorized - 8,000,000,000 shares<br />

Issued <strong>and</strong> fully paid - 3,681,231,699 shares 13 1,840,615,849,500 1,840,615,849,500<br />

Additional paid-in capital 2t,14 1,194,236,402,048 1,194,236,402,048<br />

Other paid-in capital 15 338,250,000,000 338,250,000,000<br />

Differences arising from changes in the equity<br />

of Subsidiaries 2b 5,447,335,825 (841,391,078)<br />

Differences arising from restructuring<br />

transactions among entities under<br />

common control 2b (330,799,198,508) (330,799,198,508)<br />

Unrealized losses on available-for-sale<br />

securities - net 2d (3,045,917,820) (3,069,178,320)<br />

Retained earnings<br />

Appropriated 16 100,000,000,000 75,000,000,000<br />

Unappropriated 1,511,088,739,055 1,420,065,312,497<br />

NET SHAREHOLDERS’ EQUITY 4,655,793,210,100 4,533,457,796,139<br />

TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY 9,771,011,818,440 10,145,065,834,358<br />

The accompanying notes form an integral part of these consolidated fi nancial statements.<br />

49<br />

Indocement Annual Report 2004