Towards Operational Excellence and Financial Sustainability

Towards Operational Excellence and Financial Sustainability

Towards Operational Excellence and Financial Sustainability

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

These consolidated fi nancial statements are originally issued in Indonesian language.<br />

PT INDOCEMENT TUNGGAL PRAKARSA Tbk. AND SUBSIDIARIES<br />

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS<br />

Years ended December 31, 2004 <strong>and</strong> 2003<br />

(Expressed in rupiah, unless otherwise stated)<br />

s. Segment Reporting<br />

The Company <strong>and</strong> Subsidiaries’ businesses are grouped into three major operating businesses: cement, ready mix<br />

concrete <strong>and</strong> other businesses. <strong>Financial</strong> information on business segments is presented in Note 17.<br />

A business segment is a distinguishable component based on the industry or group of products or services <strong>and</strong> is subject<br />

to risks <strong>and</strong> returns that are different from those of other segments.<br />

t. Stock Issuance Cost<br />

Based on the decision letter No. KEP-06/PM/2000 dated March 13, 2000 of the Chairman of Bapepam, all expenses<br />

related to the issuance of equity securities should be offset against additional paid-in capital.<br />

u. Net Earnings per Share<br />

Basic earnings per share is computed by dividing net earnings by the weighted average number of shares outst<strong>and</strong>ing<br />

during the year, which is 3,681,231,699 shares in 2004 <strong>and</strong> 3,681,229,010 shares in 2003.<br />

In accordance with PSAK No. 56, “Earnings per Share”, the Company did not consider the dilutive effects of its outst<strong>and</strong>ing<br />

warrants issued in computing earnings per share since the exercise price of the outst<strong>and</strong>ing warrants is higher than the<br />

market price of the Company’s shares listed on the stock exchange.<br />

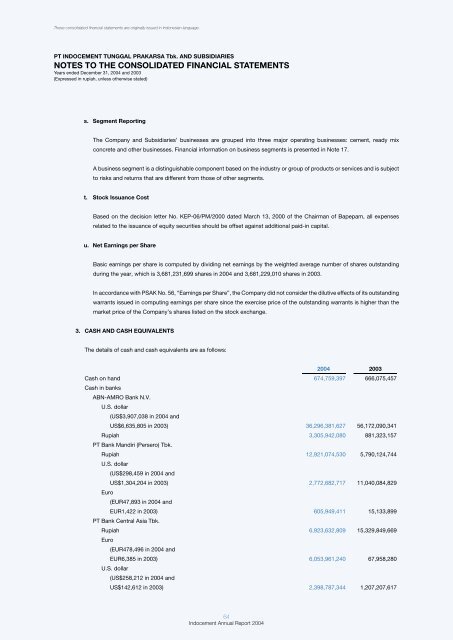

3. CASH AND CASH EQUIVALENTS<br />

The details of cash <strong>and</strong> cash equivalents are as follows:<br />

2004 2003<br />

Cash on h<strong>and</strong> 674,759,397 666,075,457<br />

Cash in banks<br />

ABN-AMRO Bank N.V.<br />

U.S. dollar<br />

(US$3,907,038 in 2004 <strong>and</strong><br />

US$6,635,805 in 2003) 36,296,381,627 56,172,090,341<br />

Rupiah 3,305,942,080 881,323,157<br />

PT Bank M<strong>and</strong>iri (Persero) Tbk.<br />

Rupiah 12,921,074,530 5,790,124,744<br />

U.S. dollar<br />

(US$298,459 in 2004 <strong>and</strong><br />

US$1,304,204 in 2003) 2,772,682,717 11,040,084,829<br />

Euro<br />

(EUR47,893 in 2004 <strong>and</strong><br />

EUR1,422 in 2003) 605,949,411 15,133,899<br />

PT Bank Central Asia Tbk.<br />

Rupiah 6,923,632,809 15,329,849,669<br />

Euro<br />

(EUR478,496 in 2004 <strong>and</strong><br />

EUR6,385 in 2003) 6,053,961,240 67,958,280<br />

U.S. dollar<br />

(US$258,212 in 2004 <strong>and</strong><br />

US$142,612 in 2003) 2,398,787,344 1,207,207,617<br />

64<br />

Indocement Annual Report 2004